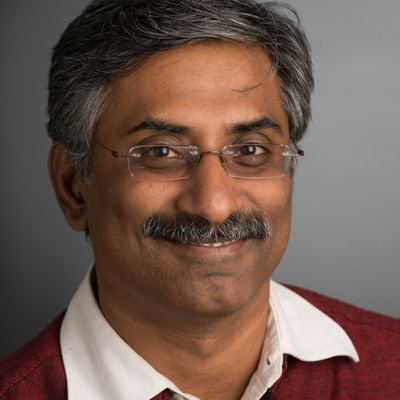

Gabriel Pieter Davel

International Consultant

SME finance

Gabriel is a Chartered Accountant and has a Master’s Degree in Economics. He was part of the team that established the Small Enterprise Foundation (the leading MFI in South Africa); a partner at Deloitte & Touche’s Financial Institutions team (1995 – 2000); the founding CEO of the Micro Finance Regulatory Council (2000 – 2006) and the founding CEO of the National Credit Regulator in South Africa (2006 – 2010). Over the last 10 years he has been doing international consulting in the areas of financial regulation, consumer protection and SME finance (specialising in credit guarantee funds).

In 2000 Gabriel was appointed to establish the Micro Finance Regulatory Council, which was responsible for the regulation of both bank and non-bank micro-lending. In June 2006 Gabriel became the first CEO of the National Credit Regulator (NCR) and responsible for the implementation of the National Credit Act in South Africa. The NCR is responsible for all areas of credit regulation in South Africa, with a mandate which includes banks, NBFIs, credit bureaus and debt counsellors.

Since 2011 Gabriel has been doing international consulting and advisory projects in financial regulation, development finance and consumer protection. He specialise in credit market development (with SME finance as major area of focus), financial regulation, credit information and credit risk management. Gabriel has been working for clients in these areas in different countries in Africa, Asia, Central Asia, and the Caribbean Islands. His clients include the World Bank, International Finance Corporation, international donor organisations, central banks, private sector credit bureaus and banks. He acted as Director: Credit Market Development for FSD Africa from 2015 to 2019, leading FSDA’a credit market projects across Africa.

Over the last four years Gabriel’s primary focus has been on credit guarantee funds and in particular on digital origination and the application of Fintech in the commercialisation of credit insurance and credit guarantees in SME lending. The focus is on introducing credit guarantees through commercial insurance and reinsurance partners, in order to mitigate bank risk in lending to the SME sector and encourage greater bank and non-bank lending to small and medium businesses.

Gabriel currently lives between Johannesburg in South Africa and Maputo in Mozambique.