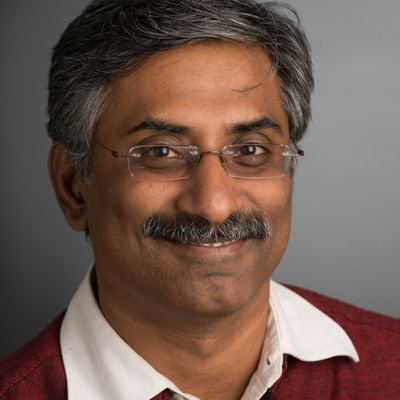

Vinay Kumar Singh

Head (Self-Regulation & Compliance)

Microfinance Institutions Network India

Vinay Kumar Singh is Head (Self-Regulation & Compliance) at Microfinance Institutions Network (www.mfinindia.org).

Vinay is a PhD in Economics and a management professional with nearly two decades of experience in financial services across multinational organizations viz. Citibank NA & Aviva Life Insurance. He has multi-business experience in consumer lending, retail banking and insurance. Vinay has worked across geographies with cross-functional stints in sales, distribution, strategy, credit & risk, learning & development, and wealth management.

Vinay trained to be a Chemical Engineer at IIT Kanpur and then did a dual major in Economics & Finance at IIM Calcutta. He completed his PhD in Economics from Management Development Institute Gurgaon.

Vinay studied the “Dynamics of financial inclusion and economic growth amid demonetization” as the topic for his PhD thesis. He has published his research in top ranking peer reviewed academic journals. His research interests are in impact of financial inclusion policies, adoption of financial products and time-series econometrics. He is a regular contributor of opinion pieces in the leading financial dailies on topics related to financial inclusion.

Microfinance Institutions Network (MFIN) is an RBI (Reserve Bank of India) recognized Self-Regulatory Organization (SRO) for NBFC-MFIs: the first such institution in the country. MFIN works closely with the microfinance providers, regulators, government, and other key stakeholders. It focuses on creating an enabling policy and business environment to facilitate responsible lending with the highest standards of customer protection and corporate governance. MFIN members are a diverse set of institutions that provide microfinance services throughout the length and breadth of the country. These include more than 100 NBFC-MFIs, Banks, Small Finance Banks, NBFCs and Business Correspondents. Put together, MFIN’s primary and associate members reach around 6 crore microfinance clients with a loan portfolio of more than INR 3 lac crores.