OUR PERSPECTIVE

ADVOCACY FOR FINANCIAL CUSTOMER PROTECTION

Dvara Research is uniquely positioned to study the state of financial customer protection in India, and to devise solutions that will enhance customer experience and trust. We have over a decade of experience in studying and documenting the financial lives of low-income households. We have developed deep expertise in understanding the structure of the Indian financial system and the regulatory frameworks that govern it. In our thinking, we strive to also maintain a sensitivity towards the imperative for business model sustainability faced by financial service providers.

As such, we occupy a unique vantage point in the financial inclusion ecosystem and possess the ability to identify levers of financial customer protection that can be commercially viable and regulatorily compliant.

Given this background, in December 2021, Dvara Research launched the Customer Protection Program to design, test, and scale customer protection solutions for meaningful financial inclusion in partnership with stakeholders. We are confident that we can become an ideal partner for stakeholders in co-creating solutions that will build customer trust and customer loyalty, thus benefiting both customers and financial service providers. We also look forward to creating significant momentum towards regulatory policies that promote customer protection.

Our past work is a testament to our optimism and confidence. In 2013, Dvara Research proposed a theoretical framework[1] for financial customer protection in India, which called for a significant shift from a disclosure-driven approach where the onus is on the customer to make the right choice, to one that is based on suitability, where the onus is on the financial service provider to ensure that the appropriate advice or product has been provided to customers. The ‘Right to Suitability’ was also articulated as one of the six vision statements in the Mor Committee[2] constituted by the Reserve Bank of India (RBI) in 2013, for which we served as the technical secretariat.

The Right to Suitability was later enshrined in RBI’s ‘Charter of Customer Rights’ released in 2015. We have also made several contributions to the conceptualisation of the Digital Personal Data Protection Bill and its contributions were recognised in the Srikrishna Committee Report (2018).[3] Lastly, Dvara Research has also collaborated with policy think tanks such as NITI Aayog to create customer protection toolkits, and conceptualise mechanisms to simplify redress in the financial sector.

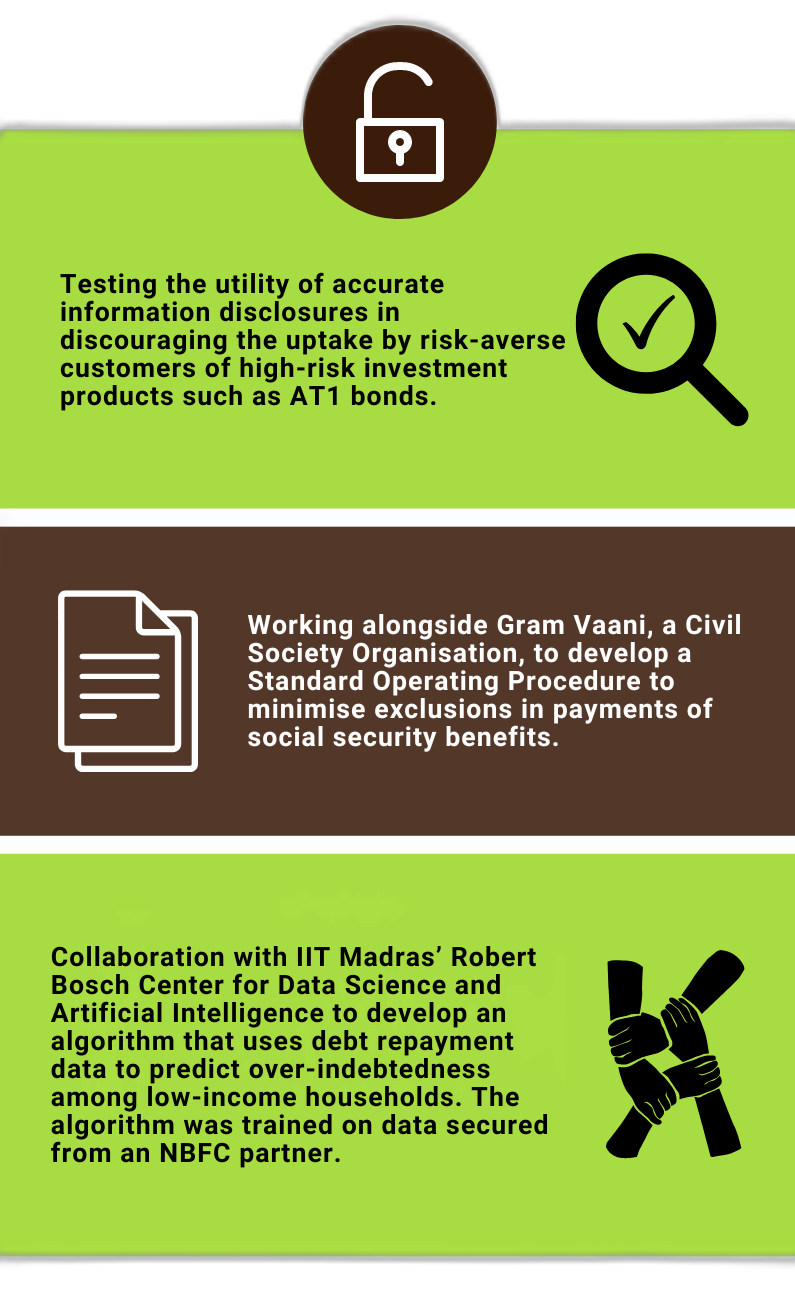

Over the last three years, Dvara Research has been building a portfolio of action research projects, where the goal has been to validate or test the solutions that our theoretical work points to. A few examples are shown in Illustration 1.1.

Dvara Research’s current work under the Customer Protection Program is unfolding in a similar manner and is significantly adding to its existing portfolio of projects.

COMPREHENSIVE CUSTOMER PROTECTION

We believe that customer protection in financial services is fundamentally different from that for non-financial products and services.[4] Unlike in a non-financial product where the outcome of a purchase is immediately visible, in a financial product, that is seldom the case. When saving or investing in a long-term retirement product, the outcome of the strategy becomes visible only in the long run. Similarly, when buying health or life insurance, the assurance of whether the claim will be settled or not, if such a situation arises, becomes known only in the future.

Furthermore, the world of financial products and services is becoming increasingly complex. The rise of digital finance is enabling an unbundling of the value chain or a modularisation of financial products and services. This benefits customers because it allows for increasing product customisation. But it also complicates the problem of choosing a suitable financial product because it greatly expands the range of product types facing a customer. The benefits of unbundling and digitisation are also counterbalanced by new emergent risks[5], most notably data misuse and frauds[6], and a potential worsening of already extant harms such as unfair conduct, inadequate information, poor disclosures and lack of transparency, and inadequate grievance redress channels.

Given these emerging trends, it is quite likely that the principle of ‘caveat emptor’ or ‘buyer beware’ will continue to be insufficient for protecting customers’ interests. Financial literacy campaigns, which are essentially motivated by the same principle, are also likely to be ineffective (as they have proven to be, in the past) in producing desirable financial behaviours among customers.

As stated earlier, Dvara Research has instead consistently championed the principle of suitability, which we see as a process attribute rather than an outcome. The requirement of suitability holds the provider accountable for ensuring that the customer’s context is always carefully attended to in the process of giving advice or selling.[7] We recommend that every financial services provider follow a board-approved suitability policy that adequately protects all retail customers, especially the low-income ones.

In contrast to that desirable standard, the current financial customer protection regime in India may be characterised[8] with four specific concerns as shown in Illustration 1.2.

Clearly, this state of affairs will not make for meaningful financial inclusion insofar as adequate customer protection should be regarded as a constitutive or integral feature of such inclusion. In our view, a reorientation of the system towards meaningful inclusion consists in recognising five attributes to be incorporated into the design and delivery of financial products and services:

We believe that on one front, regulators and policymakers should recognise these attributes of financial products and services as being desirable and be able to tell when they are absent. Therefore, we strive to support regulators and policymakers by (i) providing them with research insights that add to their existing understanding of the financial and household sectors; (ii) developing toolkits that help them monitor markets more effectively; and (iii) making recommendations that help orient existing frameworks and guidelines towards the manifestation of the above attributes.

On the other front, financial customer protection cannot be made a reality without the participation of financial service providers. Therefore, we seek to work with them and co-create new products and processes that will incorporate the above attributes. We believe in a collaborative style of engagement with providers, which most importantly requires us to actively listen to them and remain very open to understanding their priorities and constraints. We appreciate that customer protection is the by-product of a negotiation between customer concerns and provider constraints, and that the pathway to greater customer trust and loyalty can therefore only be dialectical.

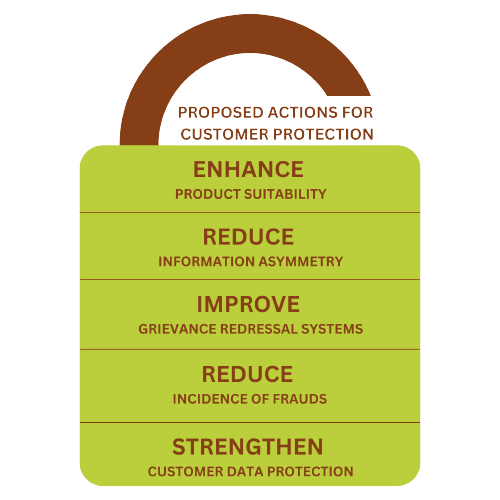

We encourage providers to undertake five actions, while remaining mindful of business model sustainability concerns.

We recommend these five actions(as shown in Illustration 1.3) because we believe that they will help providers design financial products and services that are relevant, affordable, accessible, intuitive, and trustworthy. For instance, when the suitability of a product is enhanced in terms of its design and distribution, customers find the product to be more attuned to their needs and context, and they can access the product/service conveniently and at a price that makes sense for them. Therefore, enhancing product suitability automatically makes the product/service more relevant, accessible, affordable, trustworthy, and intuitive for the customer.