SPOTLIGHT PROJECTS

SEEKING THE CUSTOMER'S CONSENT

CAN BEHAVIOURAL SCIENCE HELP DESIGN CUSTOMER-FRIENDLY CONSENT FORMS?

A consent artefact is a digital document that records a user’s consent to share their personal data with a provider, or via the provider, to a third party. Obtaining informed, prior, and explicit consent is often seen as an important tool for customers to establish control over their personal data. However, evidence suggests that customers do not actively peruse or understand consent artefacts, falling short of the regulatory standard of free, informed, explicit, and revocable consent.

This project employs behavioural science tools to ask why customers do not engage with consent artefacts and how that can be reversed. The specific use case we took up for the study is digital lending and (therefore) the consent screens presented by RBI-licensed account aggregators. We discover that the macro- context of a borrowing journey is characterised among low- income borrowers by financial desperation, the urgency of time and an acute awareness

that they may be denied formal credit for no proper reason. This macro-context shapes individuals’ micro-decision of consent, immediately placing them on the defensive. Furthermore, the shrink-wrap design of consent artefacts offers little scope for negotiation or challenge, affording customers little real choice or control. As a consequence, customers feel resigned to passively comply.

that they may be denied formal credit for no proper reason. This macro-context shapes individuals’ micro-decision of consent, immediately placing them on the defensive. Furthermore, the shrink-wrap design of consent artefacts offers little scope for negotiation or challenge, affording customers little real choice or control. As a consequence, customers feel resigned to passively comply.

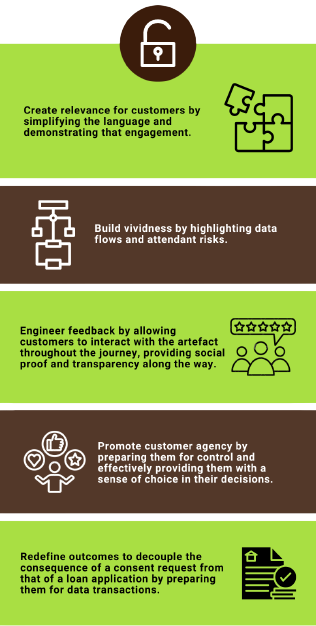

A customer-friendly consent artefact would assuage the negative emotions triggered by prospects of borrowing, empower customers during the process and be easy for the customer to comprehend. For this to happen, the consent form should have the elements as shown in Illustration 1.4

At the time of this publication, the team is translating these principles into specific design recommendations which will be piloted with customers of a lender and account aggregator to test their effectiveness.

Read all our writings under Customer’s Consent here.

ADDRESSING DEBT DISTRESS

HOW CAN LENDERS DETECT AND ALLEVIATE BORROWERS' DISTRESS?

In India, signs of borrower distress have appeared in many states over the past decades, often exacerbated by natural disasters and political events, making many borrowers unable or unwilling to repay. The presence of such distress has adverse consequences not just for the borrower but also for financial service providers, and the larger financial system.

The customer protection concern is firstly one of improper credit decisioning. Here, regulations are in place but are not adequately reflected in the decisioning procedures that financial service providers actually employ. Even if the credit decision properly identified a worthy borrower, distress may set in for one reason or another, but default remains the only signal of distress available to the lender. This is especially true because low-income households often hide distress by using various desperate measures to repay loans, such as postponing necessary medical care or pulling children out of school.

We have partnered with the Robert Bosch Center for Data Science and Artificial Intelligence (RBCDSAI) at IIT Madras to develop a machine learning model that will use the borrower’s past repayment behaviour, demographic characteristics, and economic activities to determine whether the borrower is in distress.

Our approach is to design a tool that will detect distress after a loan has been made. This is not a trivial problem because it means uncovering something that is unobserved from analysing what is observed, which is repayment behaviour. We have partnered with the Robert Bosch Center for Data Science and Artificial Intelligence (RBCDSAI) at IIT Madras to develop a machine learning model that will do precisely this, i.e., use the borrower’s past repayment behaviour, demographic characteristics, and economic activities to determine whether the borrower is in distress. In our work thus far, we have completed the development of the machine learning model and deployed it across the borrower base of a non-bank lender with over 1.5 million customers. We are in the process of validating the model’s result using field surveys.

Once distress is confirmed, we propose to test various solutions (or protocols) to alleviate it. In such solutioning, we will strive to remain within the scope of the credit contract while also deploying behavioural interventions at the end of the project, we expect to have a robust distress prediction model as well as a set of field-tested protocols for financial services providers to use, to detect and address distress among customers.

Read all our writings under Debt Distress here.

REDUCING INFORMATION ASYMMETRY

CAN INFORMATION DISCLOSURES HELP CUSTOMERS MAKE BETTER LIFE INSURANCE PURCHASE DECISIONS?

Information asymmetry is a situation where one party to a transaction has more or better information than the other. In financial markets, it is often the case that the provider has more information than the poor customer about a product, but does not disclose this information accurately in order to make an unsuitable sale. Life insurance is a good use-case to study in this regard.

If poor customers buy life insurance at all, they usually buy endowment plans, but these are not typically suitable for them. Relative to term life policies, endowment products require high premiums, offer inadequate death cover, and penalise policyholders heavily for premature surrender or closure. Despite these shortcomings, insurance agents, often embedded within customer communities, are incentivised to sell endowment policies as if they offer safe and assured investment options, i.e., without accurately disclosing the returns or surrender terms.

We proposed to solve this problem by focusing on the disclosure aspect (there are many other intervention points, but this is the one that truly tackles the information asymmetry problem). Accordingly, we employed behavioural science to first understand the drivers of life insurance purchases among low-income households, and then experimental methods to test the effectiveness of diverse disclosure formats in influencing the purchase decision. We discovered that disclosures that merely provide accurate information about endowment plans are not enough to change habits. Rather, a superior alternative option should also be offered, and accurate information about its advantages over endowment plans needs to be clearly presented. Then switching behaviour follows.

We employed behavioural science to first understand the drivers of life insurance purchases among low-income households, and then experimental methods to test the effectiveness of diverse disclosure formats in influencing the purchase decision.

In our study, this alternative was a combination of the Pradhan Mantri Jeevan Jyoti Bima Yojana (a term life insurance plan) and a post office recurring deposit. This specific bundle was chosen because it mimics an endowment plan while offering features better attuned to the needs of low-income customers, such as committed savings with fair returns, a low penalty for premature exit and affordable life cover. Currently, we are in the second phase of the project, wherein the behavioural insights from the study are being disseminated to targeted stakeholders in the life insurance industry, with a view to identifying a provider partner that will be enthusiastic about operationalising our preferred solution bundle.

REDUCING DIGITAL FRAUDS

ARE FRAUD-AWARENESS CAMPAIGNS EFFECTIVE IN RAISING CUSTOMERS' AWARENESS?

Social engineering ploys, where unsuspecting customers are manipulated into authorising fraudulent transactions, are a serious customer protection concern. Regulators and financial institutions are investing efforts in designing awareness campaigns in the form of TV commercials (TVCs). In this project, we design an outcome-based survey (OBS) to evaluate the effectiveness of UPI-fraud-awareness campaigns in reducing individuals’ propensity to engage with fraudulent communication. Leaning on behavioural science and market research literature, the OBS measures effectiveness along the four dimensions of recall, appeal, comprehension and impact.

To recreate the hot state that individuals encounter when faced with fraudulent messages, the OBS simulates common frauds in a lab-in-the-field setting. Respondents’ willingness to engage with such messages is recorded as their baseline disposition. Next, the respondents are presented with a short film (unrelated to the topic), interspersed with a clutter of ads, comprising TVCs of interest. They are asked to summarise the visual content without any probes directed at the TVC. The readiness and clarity with which respondents recall the TVC from amongst the clutter is treated as a proxy for its appeal and comprehension. The researchers next meet with the respondents after seven days, presenting them with the same fraudulent situations again. A decline in their propensity to engage with the simulations is treated as proxies for both recall and impact. Finally, focus group discussions are organised to understand why respondents prefer certain TVCs over others.

As proof of concept, this OBS was piloted with 80 low-income and new-to-UPI users from four Tier I and Tier II cities, to test the effectiveness of three TVCs. We discovered that TVCs with relatable characters and simple messages in a storytelling format fare better on recall, appeal, and comprehension. Further, we learned that TVC-driven awareness campaigns only operate at the cognitive level and cannot change attitudes or behaviour which are driven rather by habit, emotional make-up, and vulnerability to biases. This is the reason that fraudsters continue to use ‘hot state’ scenarios (e.g., fake emergencies, enticing rewards) to make customers feel panicked or elated so that they do not think clearly.

In this project, we design an outcome-based survey (OBS) to evaluate the effectiveness of UPI-fraud-awareness campaigns in reducing individuals’ propensity to engage with fraudulent communication.

Our work so far provides the foundation for the next step, which will be to develop interventions that go beyond raising awareness to initiating actual behavioural change. We are also able to identify system-level interventions that would create a cohesive frauds-database which would double up as a supervisory as well as an enforcement tool.

Read our writings under Digital Frauds here.

DESIGNING EFFECTIVE GRIEVANCE REDRESS

DO IN-APP GRMS WORK FOR CONSTRAINED USERS OF UPI?

Effective grievance redress is integral to customer protection. Unfortunately, grievance redress in the financial sector is exclusionary, time-consuming, and opaque for low-income customers.[9] Regulators and financial service providers are aware of this and are using digital approaches to address these challenges.[10] For instance, in the Unified Payments Interface (UPI) space, providers are deploying Grievance Redress Mechanisms (GRM) where users can seek redress through the UPI app (In-App grievance redress). But these GRMs also fall short of meeting the needs of low-literate, low-income and digital immigrant users who we define as constrained users.

Our research project on UPI In-App GRMs uses Human-Centered Design (HCD) techniques to develop design inputs that make In-App GRMs more constrained-user friendly. The project proceeds in three phases.

First, we gauge the bottlenecks that constrained users face in the In-App UPI redress journey. We do this by personally using those GRMs, talking to stakeholders, conducting dipstick user surveys and undertaking desk research. We discover that In-App GRM functionalities are not intuitive for customers because they are difficult to find, or do not use vernacular languages, or separately locate payment-related from non-payment related grievance recording, or do not easily provide information about the status of grievance resolution, or otherwise increase the frictions for customers seeking redress.

Our research project on UPI In-App GRMs uses Human-Centered Design (HCD) techniques to develop design inputs that make In-App GRMs more constrained-user friendly.

Second, we use HCD techniques to rethink the design of In-App GRMs considering the above problems. HCD is a problem-solving technique that puts real people at the centre of the development process, enabling one to create products and services that resonate with and are tailored to a specific audience’s needs. The goal is to keep users’ wants, pain points, and preferences in front of mind during every phase of design.

Third, we partner with providers to create and test prototypes of the solutions with live users to test their efficacy and scalability.

The above three phases proceed iteratively, and we have already completed one iteration of the first and second phases and presented our ideas to select providers. Working with specific providers may cause us to revisit the earlier phases and slightly tweak our solutioning ideas basis the providers’ specific requirements and offerings. In the end, however, because UPI is such a foundational aspect of digital finance, we hope to improve the baseline for accessibility and usability that digital financial service providers can aim for in their GRMs.

Read all our writings under Designing Effective Grievance Redress here.

PROTECTING CUSTOMERS’ DATA

HOW CAN INDIA'S DIGITAL PERSONAL DATA PROTECTION BILL BE STRENGTHENED?

India is contemplating a Digital Personal Data Protection Bill[11] to safeguard customers’ personal data and uphold their right to privacy. This has significant implications for financial customer protection. Extensive digitisation of finance promises expanded inclusion and better tailored financial services but also occasions, by that very measure, a greater collection of personal data and therefore a greater likelihood of adverse customer outcomes when personal data is breached, misused, or wrongly processed. Many such instances have occurred in recent times, amounting to identity theft, monetary loss, predatory recovery practices, and unfair denial of services.

A law would improve personal data protection practices in two ways. First, it would bring under its fold those financial intermediaries that may reside outside of the perimeter of financial sector regulators. Second, it would set a minimum baseline for personal data protection even where financial sector regulators may not have provided active guidance. For these reasons, engagement with the Bill is critical, and we note the action items in Illustration 1.5 for strengthening its customer protection impact.

Read all our writings under Data Protection here.