A checklist of design choices for effective consent artefacts of Account Aggregators[i]

A. Account Aggregators: An Introduction

Account Aggregators (AAs) are gaining significant traction in India’s policy landscape for their crucial role in transforming consent-based financial data sharing and facilitating access to financial services including credit. AAs are data-blind consent managers that help customers move their data among financial institutions. Essentially, they enable an alternative to relationship finance by allowing financial service providers to obtain relevant information from other providers. This undoes the monopoly position that legacy service providers come to have in relation to the customer by having access to their financial behaviour and information. It promises to widen the pool of providers that could serve the customer and tip the balance in favour of the customer. This dismantling of data siloes is expected to unlock access to low-cost, low-ticket-size credit, leveraging the digital trail of consented transactional data.

B. Consent artefacts: The USP of the AA Paradigm

AAs, designed as a practical application of Data Empowerment Protection Architecture in the financial sector, put customers in control of sharing their personal data across various financial institutions. They retrieve, share or transfer information with a prospective financial institution only with the customer’s explicit consent i.e., free, informed, specific and revocable consent. This information is collected by AAs in a standardised electronic format called the consent artefact. As of 15th August 2024, the AA ecosystem has recorded over 100 million successful consents, a number speculated to continue rising. This consensual flow of data is the USP of the AA ecosystem which allows it to improve access to financial services while protecting the customers’ personal, financial information. It is crucial to get consent right for the AA to retain its niche.

Our previous work highlights the barriers that customers face in engaging with consent artefacts offered by several AAs in the market. Our behavioural study, ‘Designing for Informed Consent: A prototype for AA Framework’, reveals that the artefacts continue to be binding, incomprehensible and not intuitive for the customers. These issues are further exacerbated when customers are faced with financial decisions, that are predisposed to biases. For instance, in a digital loan application context, customers tend to be in a hot state to achieve the loan to satisfy their financial needs, overshadowing the consent routine and the attendant data sharing that it permits. Motivated to obtain a loan, customers are highly unlikely to engage with the artefact meaningfully. These concerns may be more pronounced for the lower-income, less educated, first-generation formal and digital financial users, a group we refer to as the vulnerable customer.

C. The Tool: A Self-assessment Checklist

This blog presents a self-assessment checklist targeted at UI/UX designers and AA product managers, enabling them to surface gaps in the design of their consent artefacts especially in relation to the vulnerable customer. The checklist lays out design choices that would make a consent artefact relevant for the vulnerable user. Every affirmative response signals the presence of a desirable feature in the consent artefact, and, therefore, positively affects its effectiveness. A negative response illuminates a gap in the design that providers may consider addressing. Used as such, this checklist serves as a diagnostic instrument, i.e., to surface gaps and as a prognostic instrument i.e., to identify features that may make the consent journey more meaningful and engaging for the vulnerable customer.

The checklist is tailored to a digital loan application context, where bypassing would be most appealing to the customer given the urgent state, they find themselves in. A consent artefact designed to be effective in the case of a loan, which is characterised as a highly stimulating context, would also be illustrative for other financial services.

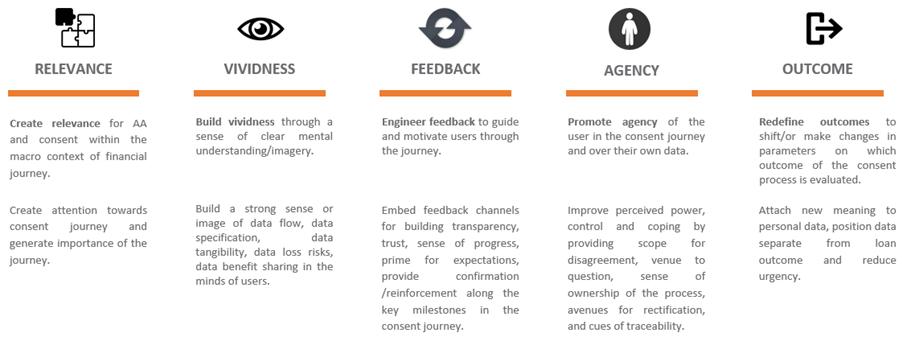

The checklist builds upon the five decision principles, identified in the study, which significantly influence the users’ disposition to consent artefacts. Our lab research suggests that conforming to these principles when designing the consent artefact, could make it more effective:

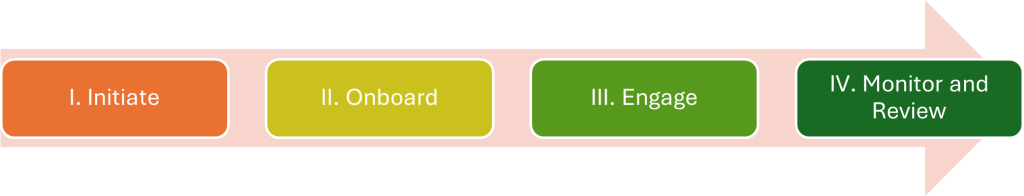

These principles are juxtaposed over the four stages of the consent decision as conceived in the AA workflow (1) Initiate; (2) Onboard; (3) Engage and (4): Monitor and Review. At each stage, these principles prompt distinct and specific design choices that could make the consent journey effective. These design choices operationalise the principle and allay the barriers that the customers face at the particular stage, reducing the risk of drop-off or consent by default. We briefly discuss the stages below.

D. The Checklist

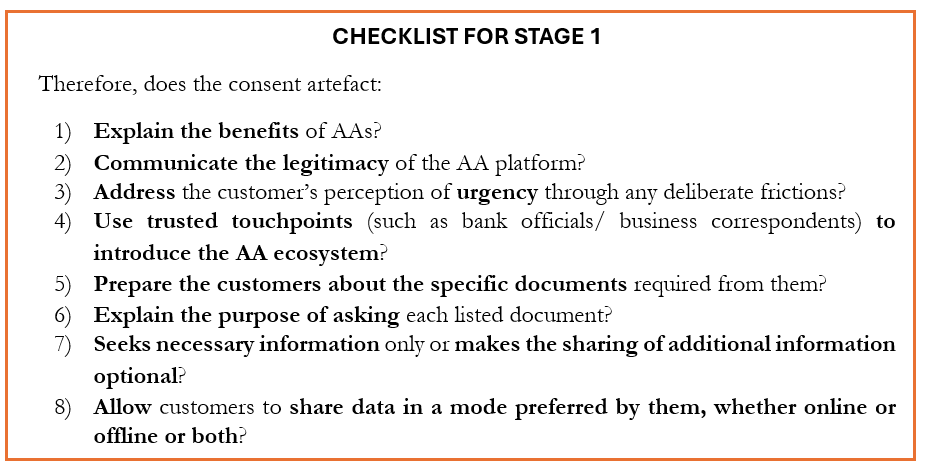

a) Stage 1: Initiate i.e., customer initiates conversations with the bank for the loan application

At this stage, it is important to recognise that various contextual factors, such as an immediate need of money and lack of bandwidth to focus on details, may play on a customer’s mind. Additionally, the customer may have an unfavourable perception towards the AA platform stemming from an unfamiliarity with the process, uncertainty about the ability to contest data sharing or a lack of clarity about the potential consequences of loss of data.

At this stage, the following design choices could provide confidence to the customer, start a healthy engagement pattern, and reduce the risk of drop-off or uninformed consent.

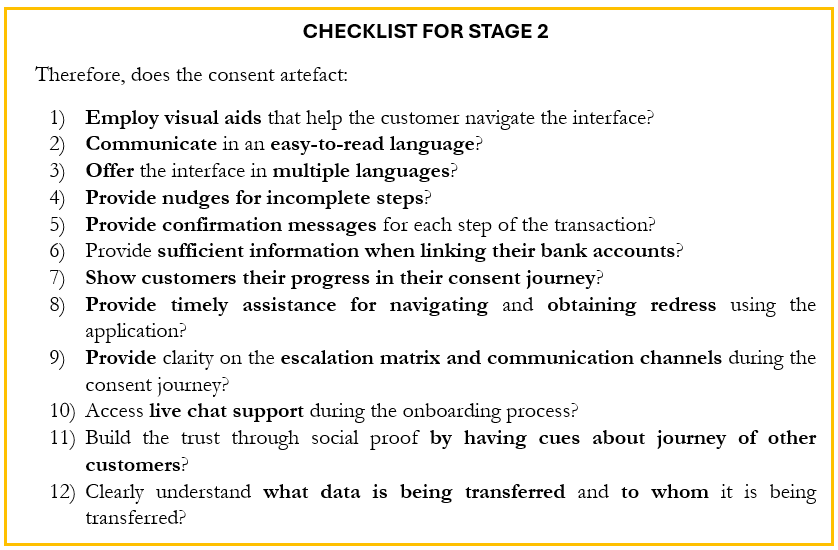

b) Stage 2: Onboard i.e., introduction to and onboarding on to the AA platform

At this stage, passive engagement often stems from customers struggling to locate themselves favorably in the larger context of seeking a loan or lacking visibility into what other customers are doing. Besides, their greater trust in tangible, in-person processes and past experiences of having to comply unquestionably also cause them to disengage with the consent journey.

Ideally, at this stage, customers should find the onboarding process simple, intuitive and meaningful. They should feel secure linking their bank accounts to the AA platform and receive prompt transaction confirmations.

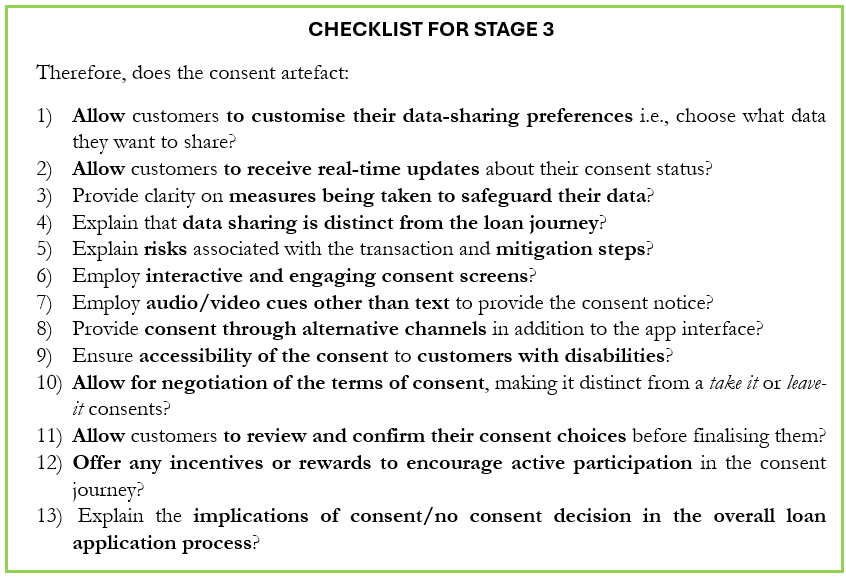

c) Stage 3: Engagement i.e., engagement with the consent request

At this stage, customers may view consent artefact as an unwelcome technicality in the existing loan application process. They see little to no value in spending time with consent artefact, especially if they perceive it to have no impact on the loan outcome. Moreover, the presence of terms and conditions as well as privacy messages are often interpreted as signals of providers being trustworthy, which in turn may make active engagement seem redundant to the customers.

Ideally, at this stage, customers should be making informed decisions, be able to customise what they share, as well as understand the risks involved with such data sharing.

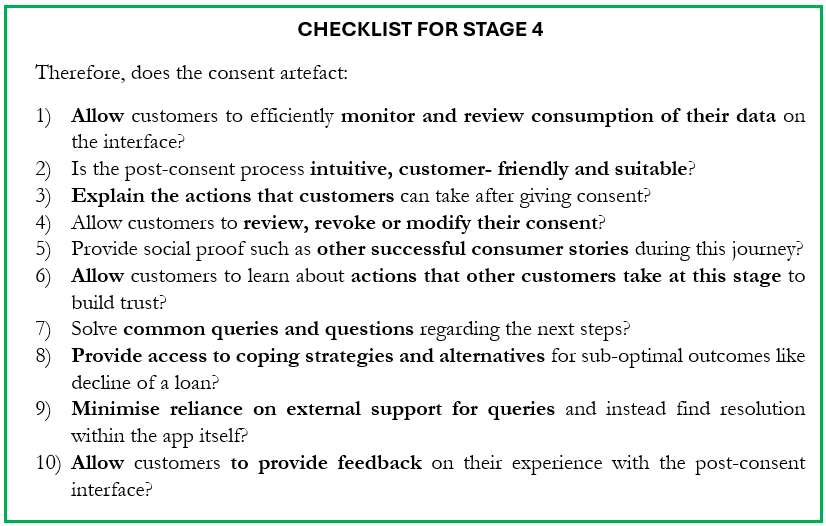

d) Stage 4: Monitor and Review i.e., interaction with post-consent action

At this stage, customers may not see value in actively monitoring and/or reviewing the consent that they have already given. To hold the promise of informed consent, it is imperative to reinforce the importance of mindful data-sharing and provide post-consent agency.

The detailed self-assessment toolkit and study, ‘Designing for Informed Consent: A prototype for AA Framework’ is available here.

———————————————–

[i] Compiled by Manvi Khanna, Beni Chugh based on the work of Beni Chugh, Srikara Prasad, Anubhutie Singh, and The Final Mile.