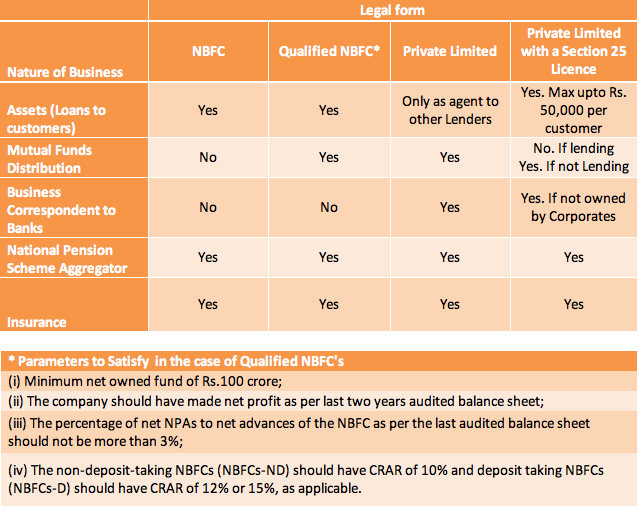

The best of intentions get thwarted ever so often, simply because the co-ordination and communication required are absent. Nowhere is this more evident than in the regulations governing delivery of financial services, given that there are multiple regulators to regulate various aspects. Given the important role played by financial services in the economy, even minor variations in regulations have amplified implications for the service providers and originators and consequently even customers. Take the case of various regulations governing distribution of financial services products as depicted in the table below:

As evident, there is no one legal form that allows an entity to freely intermediate all products with the customer, with the result that the customer is unable to access all services from a single originator. These complications are not however an attempt to deter the originators but spring out of the regulators desire to ensure that there is an orderly and stable market place. This objective, it is felt, could also be achieved by putting in performance specific, legal form agnostic regulations such as governance, vintage, net worth, technology thresholds etc., and align such requirements across regulators. At least for distribution channels for financial services there is a strong case for such an approach in order to ensure universal and omnipresent access. It is heartening to note that the new pension fund regulator PFRDA has chosen such an approach. Hopefully more will follow.