Continuing our series of posts on Consumer Protection, this post represents the first part in a two part series that charts out the historical evolution of the various sources of consumers’ rights in India today.

Overview

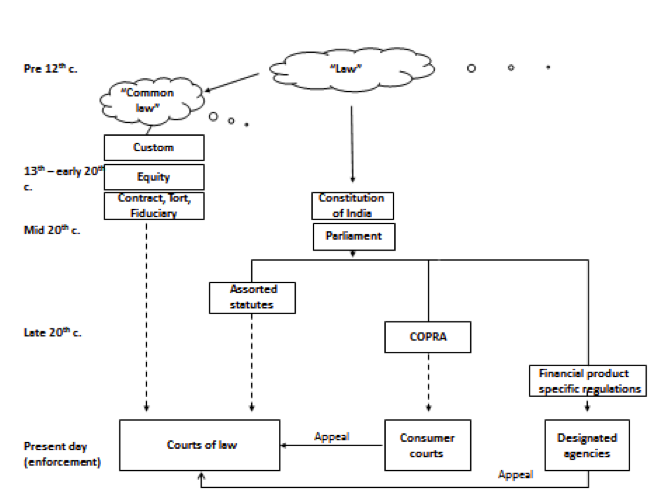

The consumer protection regime in India may be said to rest on four individual “pillars” – namely, (a) the common law; (b) assorted statutes; (c) the Consumer Protection Act, 1986; and (d) financial product specific regulations; each of whose means of enforcement ultimately tie together in the formal courts of law.

An overview of all applicable categories is depicted below, with timelines indicating their development:

Jurisprudence

Before delving into the concrete pillars of the consumer protection legal regime, it is worth noting that certain principles underlie all aspects of consumer protection by virtue of India’s legal system having its historical basis in the “common law” – an organically built up body of legal rules and principles in England from the 12th century onwards. Specifically these are:

a. Caveat emptor

Age-old principle of law where buyers in commercial transactions are “to beware” ie. the onus lies upon them to ascertain the sanctity of the product. This rule has, over the years, become subject to disclosure requirements imposed on sellers, as well as to any other warranties / guarantees the seller may provide

b. “Justice, equity and good conscience”

In the words of one legal commentator, “its meaning is obscure and is as variable as the colour of a chameleon. It is the convenient phrase to put into a statute to fill the gaps in the law. Thus, if, in deciding cases, the courts can obtain no help or guidance from legislative enactments or religious law books or other authorities, the Judges are expected to act in accordance with justice, equity and good conscience. This usually means what each judge thinks best to do in the particular case.”

However, as of this writing, there is no “white paper” or “state of the sector position paper” or any such analogous document authored by any of the wings of government in India summarising the existing legal position on the applicability of these generic legal principles to specific questions of consumer protection.

Historical Evolution

It is useful to disaggregate the study of the evolution of the different sources of consumer protection laws into four timeframes:

a. pre – 1950

b. 1950 – 1986

c. 1986

d. 1986 – present

Pre-1950

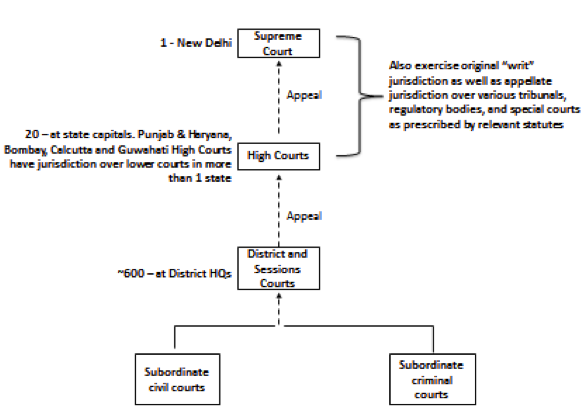

Prior to 1950, issues of consumer protection (albeit not dealt with as “consumer protection” but under the relevant legal heads) were dealt with under the technical rules built up in the English common law. The common law evolved at least three distinct heads of law that are relevant to consumer protection in India even today: (a) tort; (b) contract; and (c) fiduciary laws. Enforcement takes place through suits filed in courts of law.

Torts are “civil wrongs”. There exists several types of torts, each with a “test” laid down and refined by courts of law in England (and subsequently in India) over the years. Torts typically open to aggrieved customers include “deceit”, “fraud”, “misrepresentation” and “negligence”, depending upon the facts of the matter. Any individual may sue a provider under these heads in trial court, with relief granted usually in the form of restitution or monetary damages. A customer may also potentially sue the manufacturer or main service provider himself under the vicarious liability rule (“master servant” rule).

Contracts are agreements between two or more parties, setting out their respective rights and obligations in exchange for “consideration” (ie. payment or such). Contracts may be written or verbal, and include express as well as “implied” terms (including the commercial principle of caveat emptor). Consumers aggrieved during the purchase of any goods or services may seek redress in trial court, with relief granted usually in the form of monetary damages. A customer may also potentially sue the manufacturer or main service provider himself under the vicarious liability rule (“principal agent” rule).

Fiduciary responsibilities arise in specific situations where sellers are deemed to be in a position of trust with respect to consumers (for instance, wealth management advisors and consumers), consequently becoming answerable to a higher set of responsibilities. Consumers may sue sellers who owe them a fiduciary responsibility in trial court.

The structure of the system of courts is as follows:

1950 – 1986

In the years since its creation in 1950 by the Constitution of India, the Union Parliament has passed several legislations that include consumer protection provisions in their body. The ambit of these provisions is restricted to the subject matter of these statutes, and they are enforceable through the trial courts. Failure on the part of any customer to show the statute was applicable meant that he had to then resort to tort / contract / fiduciary law for relief.

An illustrative list of product specific legislations with consumer protection components is as below:

a. Drugs Control Act, 1950

b. Prevention of Food Adulteration Act, 1954

c. Essential Commodities Act, 1955

1986

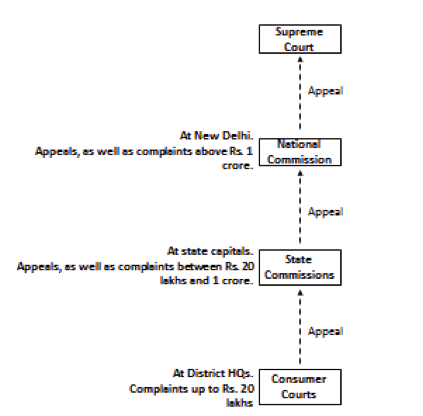

In 1986, the Union Parliament passed the landmark Consumer Protection Act [“COPRA”] which not only was the first generic customer protection law enacted in India covering goods and services falling under all categories (as opposed to the earlier set of individual statutes covering specific products) but also set up a separate chain of courts specifically for their enforcement.

The structure of the system of consumer courts is as follows:

The proceedings at these courts are summary in nature and statutorily applicable penalties includes punitive damages. Further, they decide the case within 3 months from the date of receipt of notice by opposite party. Amendments made to the COPRA in 1991, 1993 and most importantly in 2002 have strengthened the powers of these courts – under the last amendment, provision now exists for attachment and sale of property of a person not complying with the order.

Recent developments in the historical evolution of India’s consumer protection regime, specifically the creation of product-specific regimes for regulation of financial products and services, and the attendant consequences for consumers falling in those categories, as well as on going regulatory overhauls shall be considered in the second part of this two-part blog entry.

3 Responses

Is it possible to get back my money where I couldn’t get a better and complete service ?.particularly I joined in a ffitness and slimming centre but the treatment is very painful along with a crash diet that which causes to damage my health as I’ve been suffering from thyroid since 2011. Please give me some advices for file a complaint against the slimming centre and thanks for above information.

It’s possible for you to retrieve your money, as well as ensure that The Fitness Centre would be required to pay heavy punitive damages. Your right herein stems from Section 2(v)(B) of the Consumer Protection Act, which accords liability upon traders and service providers who willingly, and knowingly provide goods and services which can endanger the life and safety of the consumer. If you had made them aware of your thyroid problem, and they continued to put you on this diet, they can be held guilty.

Interesting blog!!! Thanks for sharing this.