This post marks the beginning of our new blog series on Long Term Debt Markets in the Indian context. In this series we will explore current status of the Indian debt market, importance and issues in relation to these markets, profile select developed debt markets and identify key learnings for the Indian debt market.

By Rajeswari Sengupta, IFMR B-School & Vaibhav Anand, IFMR Capital

At the current time, when India is endeavouring to sustain its high growth rate, it is imperative that financing constraints in any form be removed and alternative financing channels be developed in a systematic manner for supplementing traditional bank credit. In this context, the development of long-term debt markets – corporate debt and municipal debt – is critical in the mobilisation of the huge magnitude of funding required to finance potential business expansion and infrastructure development.

Before we discuss the evolution and current state of the Indian corporate debt market, it maybe useful to discuss the rationale and need for long-term debt markets, in general as well as in context of the Indian economy. The objective of this post is thus to analyze the critical role played by long-term debt markets in supporting economic development, especially in emerging economies.

a) Ensuring financial system stability:

A liquid corporate bond market can play a critical role because it supplements the banking system to meet the requirements of the corporate sector for long-term capital investment and asset creation. Banking systems cannot be the sole source of long-term investment capital without making an economy vulnerable to external shocks. Historical and cross-sectional experience has shown that systemic problems in the banking sector can interrupt the flow of funds from savers to investors for a dangerously long period of time.

Indeed, one of the lessons from the 1997 Asian financial crisis has been the importance of having non-bank funding channels open. In the aftermath of this crisis, a number of countries in the region, including Korea, Malaysia, Singapore and Hong Kong, have made progress in building their own corporate debt markets. Spreading credit risk from banks balance sheets more broadly through the financial system would lower the risks to financial stability. Bond financing reduces macroeconomic vulnerability to shocks and systemic risk through diversification of credit and investment risk.

b) Enabling meaningful coverage of real sector needs:

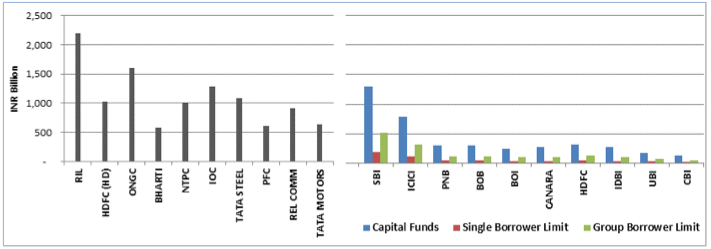

The financial sector in India is much too small to cater to the needs of the real economy. A comparison of the asset size of the top ten corporates and that of the top ten banks (as shown in Figure 1 below) reveals that banks in India are unable to meet the scale or sophistication of the needs of corporate India. Needless to say, the financial system is not big enough to meet the needs of small and medium-sized enterprises either. While these are pointers to the fact that the banking sector in India needs to be larger than its current size, they are also clear indicators that debt markets need to grow manifold to ensure that the financial sector becomes adequate for an economy as large and as ambitious as India’s.

Panel A: Assets of top 10 corporates (2011) Panel B: Capital funds and exposure limits of top 10 banks (2011)

Figure 1: A comparison of the asset size of the top ten corporates and exposure limits of the top ten banks above reveals the disparity in credit demand and supply.

c) Creating new classes of investors:

Commercial banks face asset-liability mismatch issues in providing longer-maturity credit. Development of a corporate debt market will enable participation from institutions that have the capacity as well as aptitude for longer maturity exposures. Financial institutions like insurance companies and provident funds have long-term liabilities and do not have access to adequate high quality long-term assets to match them. Creation of a deep corporate bond market can enable them to invest in long-term corporate debt, thus serving the twin goals of diversifying corporate risk across the financial sector and enabling these institutions to access high quality long-term assets. Thus, access to long-term debt opens up the market to new classes of investors with an appetite for longer maturity assets and thereby helps prevent maturity mismatches.

d) Reduced currency mismatches:

The development of local currency bond markets has been seen as a way to avoid crisis, not only by supplementing bank credit but also because these markets help reduce potential currency mismatches in the financial system. Currency mismatches can be avoided by issuing local currency bonds.

Thus, well-developed and liquid bond markets can help firms reduce their overall cost of capital by allowing them to tailor their asset and liability profiles to reduce the risk of both maturity and currency mismatches.

e) Term structure and effective transmission of monetary policy:

The creation of long-term debt markets will also enable the generation of market interest rates at the long end of the yield curve – thus facilitating the development of a more complete term structure of interest rates. A deeper, more responsive interest rate market would in turn provide the central bank with a mechanism for effective transmission of monetary policy.

5 Responses

A great topic to pick. Thanks.

As an investor, a functional debt market allows me some upside into corporate performance without the inherent risks in equity.

Debt markets are bigger than the equity markets in at least some of the countries where they are well functional. A comparison of the top 5 or 10 countries would be very helpful as part of a follow up post.

Also, requirements of infrastructure may never be fulfilled without debt. How much does the revised needs for $800 Bn in the current 5 yr plan of India, translate into debt requirements, may also be a part of further investigation.

Look forward to more.

Thanks again.

Thanks Suvikasb. In future posts we will try to look at the status and

evolution of long term debt market in other economies and will look for lessons

for the Indian debt markets.

Dear Professor Sengupta and Vaibhav,

This is an excellent blog post and I look forward to reading more posts in the series. In

addition to the list of good reasons to have a long-term debt market already

included in the blog post I want to add a few more thoughts of my own:

1. It allows much better price discovery and therefore setting of both long-term risk free

rates (and yield curve) as well as credit spreads (and credit yield curves). In

an environment like India where banks are the principal lenders and there is a

backward looking policy (based on actual experience of default) to assess

non-performing assets it is possible that banks are systematically either

over-pricing or under-pricing credit risk. Long-term bonds markets can provide

a strong and an independent benchmark against which such bank assets can be

valued allowing the market to compute their book value more accurately as well

as allocating financial resources much more systematically across the system.

2. Banks tend to impose soft-budget constraints on their borrowers — particularly

larger borrowers in order to continue to keep their existing loans in the performing

category. Bond markets tend to do the opposite allowing a much more dynamic

reallocation of capital which is free of the “first-mover” bias.

3. It would allow insurance companies and pension funds a much wider asset pool to choose

from. Currently it is possible that “excess” demand from insurance

companies for both governments bonds and long-term equities are keeping those

markets mis-priced. A wider pool of assets available to them will allow them to

offer much better returns to their clients as well as potentially make it

possible to reintroduce defined benefit plans for those clients that need them.

4. It would allow the proper development of a credit derivatives market and make it

possible to more easily transfer credit risk between counter-parts both on an

on-balance-sheet basis as well as off-balance-sheet basis.

Sincerely,

Nachiket Mor

Thanks Nachiket for your comment. It provided some great insights as well as

brought up important reasons to have a long term debt market. In future posts we

will try to explore these reasons and substantiate them with examples from other

economies.

Definitely a robust debt market is the need of the hour for an economy like India. It is required for creating moderating effects in the banking system and equity markets as well.