How can we design a financial product for a farmer that is exactly suited to his requirement? The answer lies in understanding the utilisation of the product. So, it became clear to us that if we were to design a crop loan for a farmer, we had to understand the exact utilisation of the loan. This also meant we had to understand everything about the crop for which the loan would be utilised for. Which is exactly what we did.

Instead of designing a generic crop loan that any farmer could avail, we designed a very specific loan that only paddy farmers could avail. Here’s what we did:

First we studied the paddy farming cycles in Tamil Nadu, which included the seasonality, varieties and duration of the cropping cycle. Then we mapped the entire supply chain for the paddy farming activity, keeping the farmer as the focal point. This included:

- Identifying the inputs and sources (Seeds, fertilisers, pesticides)

- Costs associated with each of them

- Costs associated with infrastructure such as electricity and water

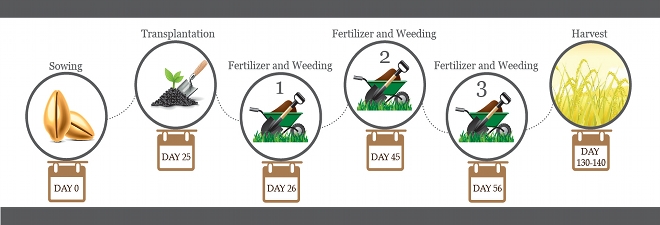

We then mapped out the different activities of paddy farming over a timeline. Here’s what a typical paddy farming cycle looks like:

Based on a combination of our own primary research and various secondary data, we developed our own template to calculate the financing requirement to cultivate paddy. The inputs for the template are:

- Size of land holding

- Nature of electricity (free or paid)

- Source of water (Borewell/bought/free)

- Extent of mechanisation (Partial/complete)

Based on the combination of inputs, the template recommends an approximate cost of cultivation and a recommended loan amount. The template also recommends the disbursement to be made in multiple tranches (ideally 2).

The first tranche (60% of the sanctioned loan) is disbursed on Day 15 and the second tranche (remaining 40%) is disbursed on Day 45. The days were decided based on our interaction with farmers. The farmer could use the first disbursement to pay wage labourers for transplantation, purchase of fertiliser for first round application.

The second disbursement will help the farmer to meet the expenses he will incur during purchase of fertiliser for subsequent applications, pesticides, and will also take care of harvesting expenses (manual or mechanised).

As is usual in loans, the farmer is expected to bring in equity. This equity is deployed in the first few days of the cycle to meet the sowing expenses (seeds + labour).

The farmer will repay the loan (principal + interest) post harvest and sales.

We believe it is important to offer a credit product that is structured around the cash flows of the customer, making credit available exactly when needed and repayment when cash is available at the household. The exact timing helps in reducing the interest cost and also eliminates the uncertainty surrounding the credit availability.

This pilot is a step in that direction. Our pilot is underway in four branches of Pudhuaaru KGFS. We also aim to roll out customised loans for farmers growing other crops.

Track our progress and findings from the pilot on our Facebook page or via Twitter.

27 Responses

Though known for generations, diagrammatic representation of paddy cultivation cycle is refreshing. Hope labour, insurance costs are taken into account while arriving at the unit cost. In thanjavur delta, some farmers go for three cycles of paddy cultivation viz, kuruvai, samba and thaladi. unit costs would differ for each of them as sowing to harvest time, agri practices differ.

Dear Santhanam,

Thanks a lot for sharing your observations. The Paddy template is designed taking into consideration the changes in unit cost from one season to the other and the related agricultural practices as well. Having said this, factors such as type of crop (short, medium and long), extent of mechanization and availability of irrigation facilities affects the cost of cultivation than the season.

This is truly sophisticated product development, congratulations!

A few questions,

– Are we planning to extend to other crops as well?

– What proportion is effectively equity financed in the paddy loan?

– Is some insurance (against fire, floods) etc) also recommended along with the loan?

– How is the loan priced for different farmers taking paddy loans (clearly the proportion of equity will be a parameter, what are the others, also the ones relating to the household’s capacity to pay + credit history)?

Do provide updates on the performance of the paddy loan pilot on the blog

Best,

Sucharita

Dear Sucharita,

Thanks a lot for this. Though we have started with paddy in Thanjavur, the plan is to design such templates for other crops too. This we believe will help us to understand the cash flows and the risks involved in order to take informed lending decisions.

So far as the paddy financing product is concerned, a minimum of 20% of the total cost of cultivation should be equity and the rest can be given as loan. On pricing, though our long term plan is to have differential pricing based on factors such as proportion of equity, debt servicing capacity and credit history, we have kept the lending rates uniform during the pilot phase.

For the pilot we are not recommending any insurance as such but the team is already working on weather and portfolio cover for crops. We expect to pilot these products during the next crop cycle. We will keep you updated about the progress in this.

Thanks,

Arun

Excellent stuff. A few observations and queries, however,

1. Are these disbursement dates flexible given the nature of agricultural crops? e g weeding may advance or get delayed, just like harvesting is in a window of time.

2. Does the loan tie-in with the supplier? To explain, the farmer can go to the store and pick up his fertilizer, pesticide and the shop owner is aware that he’s got the cash to pay. Is the process of disbursement as streamlined as possible, as often this could be the glitch.

3. Is the repayment a balloon payment on the sale of harvest?

Also, the harvest time is when you can step in to offer investment options.

I’m sure you’ve thought of many of these points, so forgive me if the queries are redundant!

Dear Prassana,

Thanks a lot for your observations. These are all relevant questions and are very important to our design work. Please find our response below in bold.

1. Are these disbursement dates flexible given the nature of agricultural crops? e g weeding may advance or get delayed, just like harvesting is in a window of time.

Yes, they are flexible within a particular time period. For instance clients can avail of the first tranche at anytime between the 15th and 30th day and the 2nd tranche can be availed of between the 45th and 65th day from the date of nursery preparation. Disbursements in both these tranches cannot happen beyond the disbursement window as expenses are incurred during the above mentioned days taking into account changes such as the date of application of fertilizers and pesticides.

2. Does the loan tie-in with the supplier? To explain, the farmer can go to the store and pick up his fertilizer, pesticide and the shop owner is aware that he’s got the cash to pay. Is the process of disbursement as streamlined as possible, as often this could be the glitch.

This is definitely the way forward in our work and we are exploring ways to connect the various parts of the supply chain and address the gaps pertaining to finance. For the moment, loan is given to the farmer directly in tranches and the disbursement is linked to expenses incurred for a set of activities as explained above.

3. Is the repayment a balloon payment on the sale of harvest?

Yes, it is a bullet repayment wherein the clients are expected to repay the loan in a single payment on the sale of the harvest.

Also it is a very good idea to discuss about the client’s investment options at the time of harvest and provide them with flexible options. we have started to think about such product designs. Please follow this space for further updates on them.

Thanks,

Arun

Dear Arun, Many thanks for making the time to respond. I wish you and the team the very best in making this happen, and will keep track of things through this site. Kind regards

Since this is in pilot stage, am I right the spread of farmers is limited to a particular region ( a few villages may be)? In this case, it would actually make sense to tie the supplier link too which makes the disbursement that much more cost effective. And if the supplier is also a micro-business, it might make sense to include this as part of the microfinance ecosystem.

Impressive, a banker to spend time and understand crop cycle. If you could get in a collateral management/warehousing system, you have almost a commodity backed product. Best wishes and will try a form of it in my areas of operation

Thank you Gagan. That is the direction we are headed. Would be great if you could share results from your experience.

This is an excellent blog post and I can see that a very good discussion is already in progress. I want to add a few of my questions into the mix as well.

1. The product description appeared to me to be exclusively input oriented and does not seem to explicitly acknowledge or take into account the fact that repayment is a function of outputs — crop yield, rainfall, post-harvest sale-price of paddy, farmer level moral hazard, diversion of funds, etc. I am keen to hear your thoughts on this — in particular how do you propose to deal with each risk.

2. To me one of the values of multiple disbursements which are input linked is that each one offers an opportunity for pre-disbursement review and cancellation of further disbursements if the review is not satisfactory. I feel also that it also not sufficient to take farmer feedback and say 15 days and 45 days. If the manner in which we propose to deal with moral hazard relating to diversion of funds is to directly disburse to suppliers and to ensure that the farmer does not hold surplus cash, then why can the disbursement not be on a much more continuous expense related basis — daily even. You could agree to pay his workers directly for example or his seed supplier, or his electricity bill.

3. Not clear to me what the logic of 20% equity was? How has that been computed and what role does it play? And, what is the base on which it is computed? Small farmers would generally be expending a great deal of human capital on this work — would that be counted?

These are the points that occur to me at the moment. I would be eager to hear from the authors as well as the others that participate in this blog.

1. Thank you Nachiket. We agree that this is mostly based on inputs. We are working on weather insurance and portfolio cover for crops to deal with risks arising out of yield-related issues such as rainfall, diseases.

Farmers choose the higher of the government price (Minimum Support Price – MSP) and traders’ price. While the traders price tend to fluctuate depending on the market, MSP is fixed for the season and it is fixed in such a way that the farmer makes a nominal profit. What we could definitely explore is tying up with the local traders to ensure that the payment is routed through us. This will also mitigate the risk of diversion of funds.

For the farmer level moral hazard, we propose to deal with this at multiple stages of the cropping. The insistence of the farmer investing for the initial sowing is a way on ensuring the farmer has a stake in the process. At a due-diligence level, the wealth managers will monitor the crops at regular intervals. We have even proposed to take photographs of the crop frequently to monitor the progress.

2. Thank you for this idea. This is exactly what we had thought of initially. The 15 and 45-day logic was based on the days on which the farmer incurs a bulky expense. To explain, the farmer initially incurs expense for land preparation, nursery preparation and tilling – this is taken care by his equity.

The next expense comes approximately on Day 25 when he has to pay the labourers for transplantion and purchase fertilisers. We intended to give the farmer the first tranche in time for him to arrange for the labour (which currently is a big challenge to find) beforehand and to purchase fertilizers.

The second tranche is ideally for purchase of fertilisers and pesticides for the second and third applications between Days 45 and 60.

Though it might also be worthwhile to explore the possibility of disbursing a tranche just before the third fertiliser application, we also think this might not be effective as the farmers tend to procure them in bulk.

Ideally we should be disbursing another tranche just before harvesting to meet his harvesting expenses (The only other time the farmer incurs an expenditure). We will try and incorporate this in our product. Parallely we would also explore plotting the supply chain and making direct payments to the suppliers/labourers as a risk mitigation strategy.

3. The 20% equity was arrived based on the time and money that a farmer has to spend so as to not go back on his words ie. if the farmer has prepared the land, tilled, sowed and kept the nursery ready, there is very little incentive for him to stop cultivating and is more profitable to complete the cultivation rather than abandon the process. This in a sense eliminates the moral hazard. On an average, the amount spent by the farmer till the preparation of nursery was about 20% of the total expenses.

The template is designed taking into account the number of man hours spent on a particular activity (say transplantation or weeding). So whether the farmer works on his own farm or hires laborers to work on his farm, it is assumed that he has to incur the expenses.

– Balajee and Arun Kumar

I wonder if it makes sense to build master table at the IRF level which has two axes: crop and district and gives two pieces of information: crop price volatility and rainfall volatility. These inputs could potentially help fix the quantum of equity required as well as the need for rainfall insurance as well as commodity derivatives.

Thank you Nachiket, this is a great idea. This will actually help us come up with very specific equity requirements. Will try to build one.

I think this is a very interesting experiment and am keen on following the progress of this pilot. Please continue to post updates on this. Thanks.

1. Is this credit being offered to individual farmers or is there a community (JLG) approach to this.

2. It would be interesting to see if this pilot can expand to an entire microfinance ecosystem – which would include small / marginal farmers, micropreneurs offering services for harvest / threshing, delivering the harvest to the local cooperative mandi, etc.

3. Is the loan also being tied into some kind of “best practices” for paddy cultivation? For example, for a given season, the sowing has to happen within a small window of 5-7 days, else it is quite likely that the yield is going to be affected. Other factors like quality of seeds, timely weeding also play a major role. How is the relationship of credit being tied into these factors?

1. This is an individual loan.

2. While this pilot has been designed specifically for farmer and farming activity, we are sure can design products that address the specific purposes that you mention.

3. Right now, we are not involving ourselves in paddy farming advice per se as we believe the farmer knows/is at liberty to choose what he thinks is best. However, the template definitely has certain minimum conditions such as timely transplantation and application of fertilisers. These things are monitored by the staff and if at any time found unsatisfactory, it will affect the subsequent disbursment.

1. One, if the loan is to be tied to supplier, is supplier

assessment going to be a service and options for choosing a supplier be available to farmers?

We are working towards tying up with suppliers so that farmers can buy inputs from them and we can make payments directly to the suppliers. In such a case, farmers would be given the option of choosing the supplier and we will leave that decision to the farmer.

2. What if an alternative or preferred source of credit is available and the farmer only requires a top up?

Top-up can be given depending on the specific activity for which the farmer requires the top-up for and the expense incurred for that activity alone. For instance if the top-up is to meet the harvest expense, then we can lend to that extent alone. Though we do not have this option for pilot, it is a very good idea and we will certainly explore ways of including it in our product offering.

Right now, the template we have designed recommends a maximum loan amount. The customer is at liberty to opt for a loan amount lesser than the sanctioned amount.

Thanks a lot for yours observations and valuable feedback. We are already working on tying up with suppliers and making direct payments to them. This we believe will reduce the risks surrounding diversion of funds.

To mitigate exigencies arising out of other loans of the farmer, we have designed the household debt servicing capacity (follow this blog for updates about this approach) that will be arrived at after accounting for the loan repayments and other expenses of the household. The loan amount will be within the debt servicing capacity of the household. This is done to ensure that the household has enough cashflows to repay its loans.

We have proposed a bullet repayment as the product is structured in such a way that loan repayments are linked to cash inflows on the sale of the crop post harvest. Given the fact that farmers do not have any cash inflows before crop harvest, it is very difficult from the farmer’s perspective to repay in equated instalments.

-Balajee and Arun Kumar

Thanks a lot for sharing your views. We have replied to your questions below.

1. Yes, the template is designed for each specific season. Though the total number of days of cultivation varies from season to season, about 60% of the expense is incurred by day 50 across all seasons. This 60% accounts for sowing, transplantation and first application of fertilizers that happen before day 50 for all seasons. The actual difference across seasons lies in the application of fertizers after day 50 and the harvest date.

What we have depicted as a timeline here is only an indicative one. Ideally the input should also take into the variety of crop (long/medium/short) and indicate a repayment date based on the harvesting day for that variety.

2. The equity amount was based on our direct feedback from the farmers specifically in the locations where the pilot was rolled out. However, we do agree that this amount varies from Rs. 2500 to Rs. 3500 across different places depending on farming practices. We hope to finetune this amount as we progress.

3. Interest rates are purely based on the cost of funds and operating expenses of the lending entity. While the intention is not to compete with any existing government schemes, we believe the design of the product is compelling to the farmer, taking into account the exact need for cash at the right time.

Thank you Prakash.

Thank you Vivek. You have raised some good points. This sure provides us with food for thought for improving our offerings to the customer.

Thank you Shekar.

Thank you Sudha. You have raised a valid point. Repayment date is something we are trying to zero in as closely to the harvest date as possible. Right now we have taken an approximate duration of one week post harvesting as the repayment date. However, we had feedback that sometimes the farmer has to wait in queue for the government to procure his produce and this may delay the repayment. We are working on this.

As mentioned in another comment below, working with suppliers and labourers directly is a good idea but involves mapping them first. This is definitely in our radar.

-Balajee and Arun

is there any significant expenses of hiring irrigation pumpsets by paddy farmers. In areas of Dhanei KGFS though there is canal irrigation … farmers do hire around 5 -8 instances for critical crop periods like nursery, transplanting, panicle formation etc..

In the event of this is pumpset financing is a good loan product for farmers especially small, marginal farmers including share cropper, leased in farmers. It is seen that they are not able t participate in the subsidy system and even in subsidy system they do not have the 50% amount to pay afront. They also remain out of normal bank loan process because of abscence of any land collateral. The situation will be critical for other crops especially Vegetables.

any data points or thoughts around it

Thank you Sahu. It was great meeting you. As we had told you, we are yet to initiate work in Dhanei KGFS for our paddy product.

Looking at irrigation in general for the paddy crop, we find that we can make an impact if we understand the economics of irrigation better. One such option we are exploring is to finance pumpsets and gensets. However, this needs better research and we hope to be in touch with you to share our data and learn from your experience as well.

Hello Arun Kumar,

Thanks for the blog post.

Do you think it would be possible to repackage the proceeds from such financing arrangements in to some ABS via SPV, that could be sold to the goverments (local and central) or to cooperative or holding firms or released in secondary markets.

The pooling of the proceeds could be done via region or by crop.

Please consider this and share your commentary on the same.

Cheers …