By Satya Srinivasan, Mohammed Irfan, IFMR Capital & Rajeswari Sengupta, IFMR B-School

This post is part of our series of posts on Long Term Debt Markets in the Indian context.

This post takes off from where our article on the current status of Indian debt markets ended. The peculiar issue with the Indian corporate debt market is not that it faces challenges due to a lack of adequate infrastructure. In fact, as our previous articles mentioned, India is fairly well-placed insofar as the pre-requisites for the development of a corporate debt market are concerned. Inspite of this, Indian corporate debt markets are yet to witness the level of activity that an organised financial market should. In this post and over the next couple of posts that will follow in this series, we pin down and discuss in detail some of the specific challenges corporate debt markets in India face, which in turn have contributed to the lack of activity in these markets as compared to the equity and Government debt bourses.

Some of the issues are structural and a few are regulatory road-blocks. We have systematically categorised these issues into supply-side, demand-side, secondary-market issues and risk & hedging related issues. This post will focus on supply-side issues in the Indian corporate debt market.

The total corporate bond issuance in India is highly fragmented because bulk of debt raised is through private placements. The private placement route requires that the issuer makes an offer to select a group of investors, no more than 50, to invest in the debt securities for issue1. However, corporates are known to circumvent the 49 investor cap in private issuances by making multiple bond issuances for many groups of 49 investors or satisfying the greater demand through immediate secondary market transfers upon the completion of the primary issue, thus diffusing the issue among a greater number of subscribers. Therefore there is a clear need to remove impediments that hinder the development of the institutional side of the market.

The dominance of private placements has been attributed to several factors, including ease of issuance, cost efficiency and primarily institutional demand. Furthermore, trading is concentrated in few securities, with the top five to ten traded issues accounting for bulk of the total turnover. The SEBI Issue and Listing of Debt Securities Regulations 2008, in Ch III, Sec 20 lays out conditions for private placement2 which include, requiring compliance with The Companies Act of 1956, obtaining credit rating, listing of securities, mandating disclosure standards as per Sec 21 that stipulates the documentation and disclosure requirements (detailed in Schedule I of the Regulations3 ).

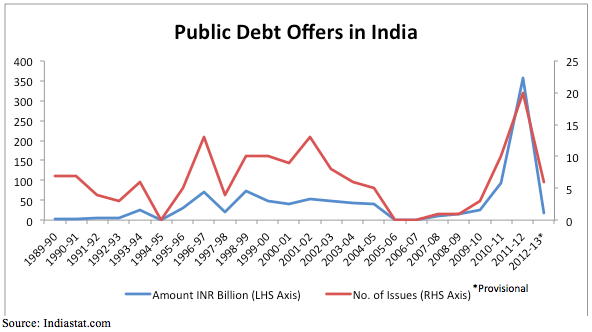

The private placement disclosure and documentation requirements are viewed by the market to be comprehensive yet not being too onerous in terms of compliance. On the other hand, the disclosure and documentation requirements for public placement of securities are viewed by the market as being extremely onerous and difficult to comply with. In addition to the Schedule I requirements for private placements, public placements also have to comply with additional disclosure requirements , as specified in Schedule II of The Companies Act of 1956. These are an exhaustive set of disclosures in three parts. The first part contains general information, capital structure information, terms and issue particulars, information on company, management and project as well as information on all companies under the same management, and finally management perception of risk factors. The second part contains additional general, financial, statutory and other informational disclosures.

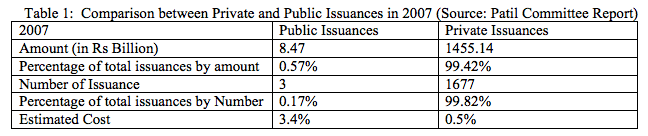

With such an extensive set of disclosure requirements4 for public issues, it seems to us that the market has been avoiding this route for issuing bonds. For instance, The Patil Committee Report lays out the following statistic that highlights corporates’ preference for the private placement route as against the public:

The figures above are consistent with findings of the Patil Committee.

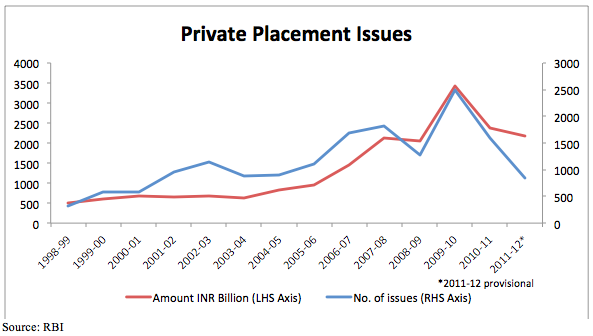

Analysis of the Private Placement Market

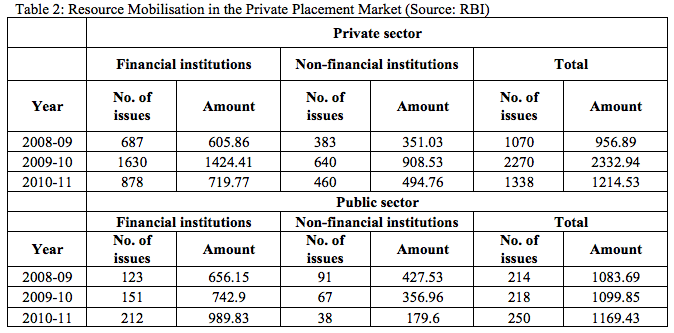

Table 2 above indicates that over the years, number of issuances by the private sector has been much more than that of the public sector. However, the volumes of the private sector have been lower than public sector. This indicates that the average size of issue by private sector corporations has been close to INR 1 billion as against the larger size of public sector issuances amounting to INR 4 to 5.5 billion over the years. As shown in Table 2, resources mobilised through private placements in private sector spiked in 2009-10 but came down in 2010-11. There was close to 120% hike in issues placed during 2009-10 by the private sector. Comparatively, public sector issues increased marginally by around 1% during the same period. What is also evident from Table 2, is the tremendous cost differential, with public issuances on average seven times as expensive as private issuances. This could have further driven market participants to favour the private route.

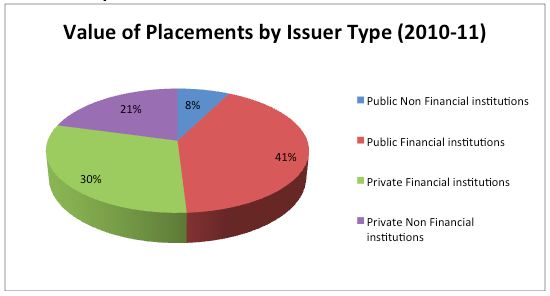

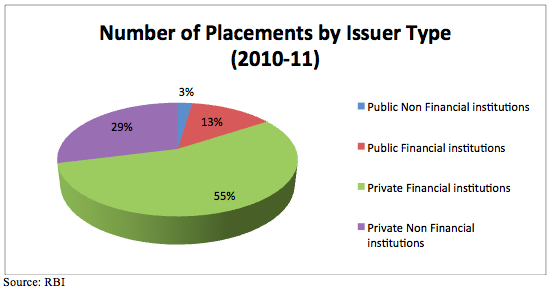

Analysis of issues and volumes of private placements by financial and non-financial corporates reveals that the financial corporates dominate. However, in terms of growth, volumes placed by financial institutions grew by 71% while the same by non-financial institutions grew by 62% from 2008-09 to 2009-10.

The pie chart below corroborates the finding that financial institutions have dominated the number and volume of issues over the years.

In the winter of 2005, the High Powered Expert Committee (HPEC) on Corporate Bonds & Securitisation led by Dr. R.H. Patil made a variety of recommendations to address the prevailing issues in the corporate bond market. The recommendations were spread across three broad areas – (i) Primary Market, (ii) Secondary Market and (iii) Securitisation. One of the primary recommendations to address supply-side issues, was enhancement of the issuer base.

The Patil Committee recommended that in order to reduce the time and cost of public issuance, the disclosure norms and listing requirements be reduced. The Committee also recommended that in the case of issuers that are already listed, these requirements be reduced even further.

In December 2007, SEBI vide circular dated December 03, 2007 amended the provisions pertaining to issuances of Corporate Bonds under the SEBI (Disclosure and Investor Protection) Guidelines, 2000. The changes to the guidelines were as below:

- (a) For public issues of debt instruments, issuers now need to obtain rating from only one credit rating agency instead of from two. This was done with a view to reduce the cost of issuances.

- (b) In order to facilitate issuance of below-investment grade bonds to suit the risk appetite of investors, the stipulation that debt instruments issued publicly shall be of at least investment grade has been removed.

- (c) Further, in order to provide issuers with desired flexibility in structuring of debt instruments, structural restrictions such as those on maturity, put/call option, conversion, etc have been done away with.

In May 2009, SEBI issued a Listing Agreement for Debt Securities that provided for a simplified regulatory framework for the issuance and listing of Non-Convertible Debentures (NCDs). The circular released by SEBI was split in two parts. The first part prescribed incremental disclosures for issuers that were already listed and the second part pertained to issuers who were unlisted and prescribed detailed disclosures for them.

To conclude, the supply-side issues in the Indian corporate debt market remain primarily cost related and to some extent related to heavy disclosure norms, some of which have recently been simplified through regulatory changes. Hopefully the steps taken by regulators to address these issues will help deepen the bond market development further, by promoting more public issuances in multiple categories. Having discussed supply-side issues that have been constraining the development of Indian corporate bond markets, our next blog post will cover demand-side and secondary market issues that pose additional challenges for this crucial market.

—

1 – As per definition of private issue in the SEBI Issue and Listing of Debt securities Regulations, 2008. The nature of making an offer to specific investors and therefore constituting a private issue is dealt with in Sec 67 of the Companies Act, 1956.

2 – (1) An issuer may list its debt securities issued on private placement basis on a recognized stock exchange subject to the following conditions:

(a) the issuer has issued such debt securities in compliance with the provisions of the Companies Act,1956, rules prescribed there under and other applicable laws;

(b) credit rating has been obtained in respect of such debt securities from at least one credit rating agency registered with the Board;

(c) the debt securities proposed to be listed are in dematerialized form ;

(d) the disclosures as provided in regulation 21 have been made.

(2) The issuer shall comply with conditions of listing of such debt securities as specified in the Listing Agreement with the stock exchange where such debt securities are sought to be listed.

3 – The details of Schedule I of the Annexure 1 of the SEBI Issue and Listing if Debt Securities Regulations, 2008 are reproduced in Annexure 1

4 – These disclosure requirements for public placement are laid out in Ch II, Sec 5 of the SEBI Issue and Listing if Debt Securities Regulations, 2008

2 Responses

This is an excellent series, thanks for putting it together. A few thoughts:

a. I suppose it is instructive to note that the relaxed SEBI guidelines have not – in any significant sense – increased issues or secondary trading in corporate debt markets. Does this hint that the difficulty/cost of the process is not a key reason?

b. Would be interesting to study the ratio of bank borrowings vs. bonds in the balance sheets of Indian companies vis-a-vis other emerging markets. Indian companies seem to be willing to pay the (intangible and tangible) costs of reducing information asymmetry with lending banks, but not willing to do the same while issuing bonds. (The possibly subtler view here is that lending banks are willing to look the other way just to further their large corporate business, while SEBI is a more careful watchdog?)

c. My sense is that if bonds could be issued at reasonable rates, they would be (irrespective of how “painful” the process is). Is there any pricing data that compares implied yields with long term bank lending rates for similar tenors? If issued bonds are priced at much higher rates (take into account liquidity premia), what does this tell us about the faith placed by the market on our rating agencies?

d. What is the state of the corporate loan securitisation market in India? Is it growing? Given that there’s likely to be a glut of corporate loans on banks’ books, would it not make sense to securitise them (if only to make more loans)?

It would seem to me that the reforms required in the debt markets to solve the chicken-and-egg problem (low liquidity leads to low issuance leads to further low liquidity) are “discontinuous”, in the sense that we need to jump from the current equilibrium to a better one, not move progressively. I don’t see it happening.

Dear Rahul,

Thank you for your insightful comments.

1. While we tried to analyse the issuances of non-convertible

debentures post the revised SEBI guidelines in 2009, we couldn’t establish

causality in the relationship.

2. We would definitely consider analysing the balance sheets of

companies from India and other emerging markets. However, I would like to draw

your attention to an interesting comment by Dr. Nachiket Mor on the first blog

post of this series. He touched upon the rationale of banks to prefer holding

loans on their balance sheets to a bond. The scenario of a bank’s incentive to

continue to keep their existing loans in performing category drives the

preference. (https://dvararesearch.com/why-do-we-need-a-long-term-debt-market/)

3. We haven’t compared the pricing date of corporate bonds and bank

lending rates for same tenor. However, we believe that comparing the pricing

data would indeed reveal interesting insights into the expectations of the

borrowers as well as the lenders.

As Dr. Mor commented, lenders’ (banks) preference for loans to bonds would also to some extent impact the pricing when credit risk is under or overpriced.

Thanks,