“Absence of evidence is not evidence of absence” – Carl Sagan[1]

A comprehensive body of research evidence can powerfully help policy-makers assess the situation and needs of households, inform market practices, and design financial sector policies that aid to deliver holistic financial services for all individuals, households and enterprises. The Household Finance Research Initiative at Dvara Research exists with the objective to catalyse insightful and rigorous research on household finance for India (for an introduction to Household Finance, see our blog posts) that is customer-centric while also relevant and responsive to the Indian policy context and financial landscape (see our Strategy Note for more details). In making progress towards this objective, we have identified three broad types of constraints to high-quality research in India today: these relate to motive to study households, various dimensions of research capacity and an effective feedback mechanism that loops in all consumers of the research.

Household Finance research is an emerging field in India, and we are at a formative stage to understand its’ scope, theory and methods. Researchers do not have adequate tools to study the different dimensions of household finance. A starting point for conducting sound research in this field begins with the accessibility to and the availability of relevant and context specific evidence. To enable this, the Household Finance Research Initiative team have focused on the theme of Financial Well-Being and built a repository of existing evidence in relation to it. Through this blog post, we launch a visual tool for showcasing and accessing this evidence, called the Financial Well-Being Evidence Gap Map, with the intention of updating it semi-annually in order to have it reflect the latest evidence available on the theme.

What is the Financial Well-being Evidence Gap Map (FWB-EGM)?

An Evidence Gap Map (EGM) is a visual tool that aims to map existing research or lack thereof, across the different dimensions of household finance. It is essentially a matrix that maps evidence at the intersection of a row and a column. Taking inspiration from the 3ie Evidence Gap Maps[2], we have adapted this concept to develop an EGM on research related to the financial well-being of individuals and households and created a visual tool called the Financial Well-being Evidence Gap Map.

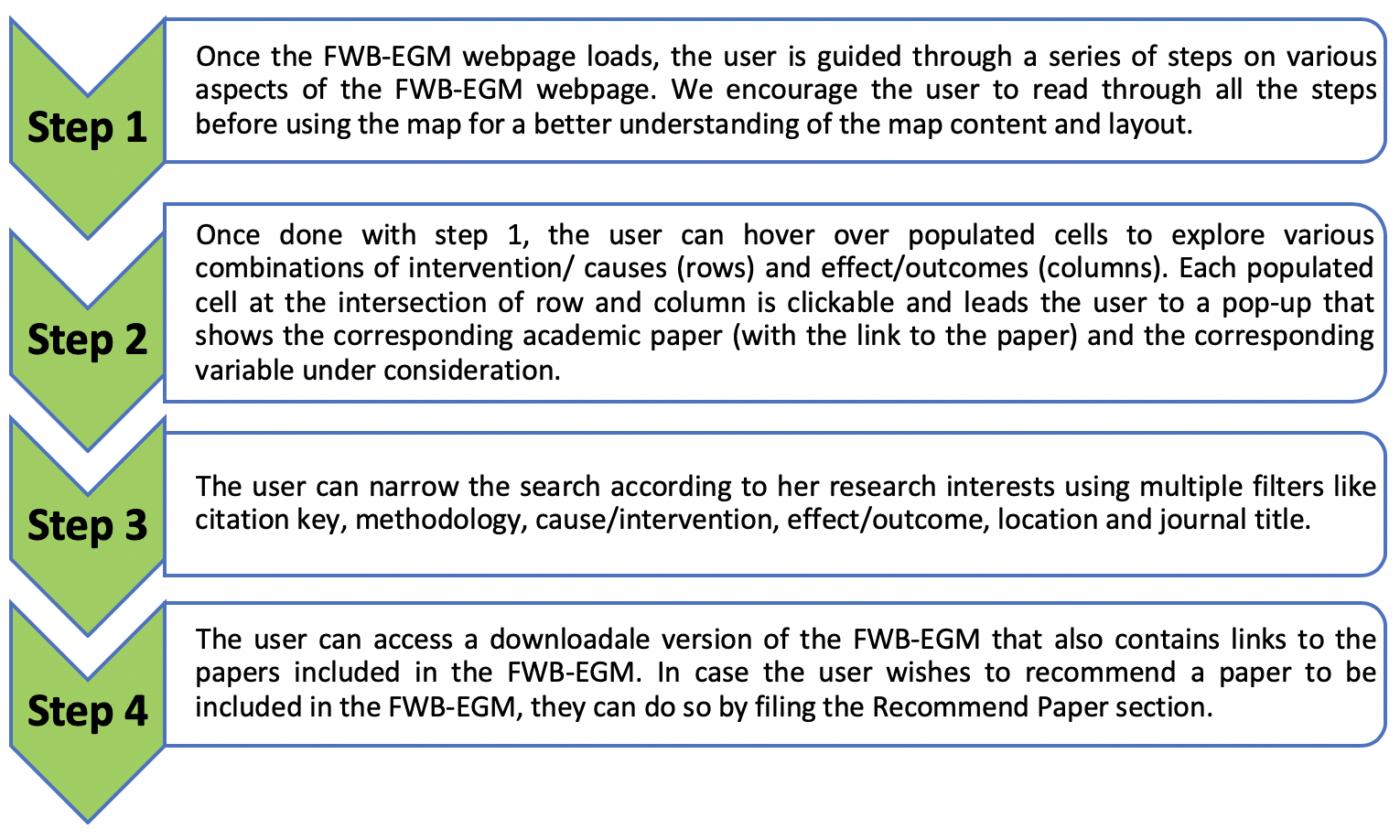

The Financial Well-Being EGM is an interactive online webpage that allows users to explore evidence on various dimensions of Financial Well-Being of individuals and households as well as to detect gaps that reflect the lack of any existing evidence. The FWB-EGM was created after reviewing and systematically organising academic literature (we chose 100 academic papers for this launch) from multiple areas of financial well-being that are discussed below.

What are the components of the Financial Well-being Evidence Gap Map?

Based on the findings from the 100 academic papers, we identified three interventions/ causes (shown as rows) that were mapped to four effects/ outcomes (shown as columns). For the rows, we considered institutional interventions, policy interventions and causes driven by household characteristics. Based on the outcomes/effects of the interventions or characteristics present in the literature, we divided the columns into four broad categories such as –

- Functional – The functional feature involves the movement of resources across time, space and states of the world. Broadly the subcategories include all outcomes that are related to the core functions of finance as well as the real-world effects of finance.

- Informational – The informational feature of financial well-being includes product literacy and financial literacy aspects of finance. As an extension, it also includes information related to the local economy that can indirectly impact users of finance.

- Emotional – Beyond the core functional and informational features of financial well-being, there are multiple factors that contribute to financial outcomes of consumers. This category aims to capture some of the subjective aspects related to the use of finance.

- Economic Well-being (EWB) – In addition to the evidence on above features which are directly related to aspects of Financial Well-being, we observed that academic readings often measured the impact of an intervention on the economic well-being of the end user. These outcomes do not fit into the functional, informational, or emotional aspects of financial well-being but are broadly related to the overall well-being of the subject under study.

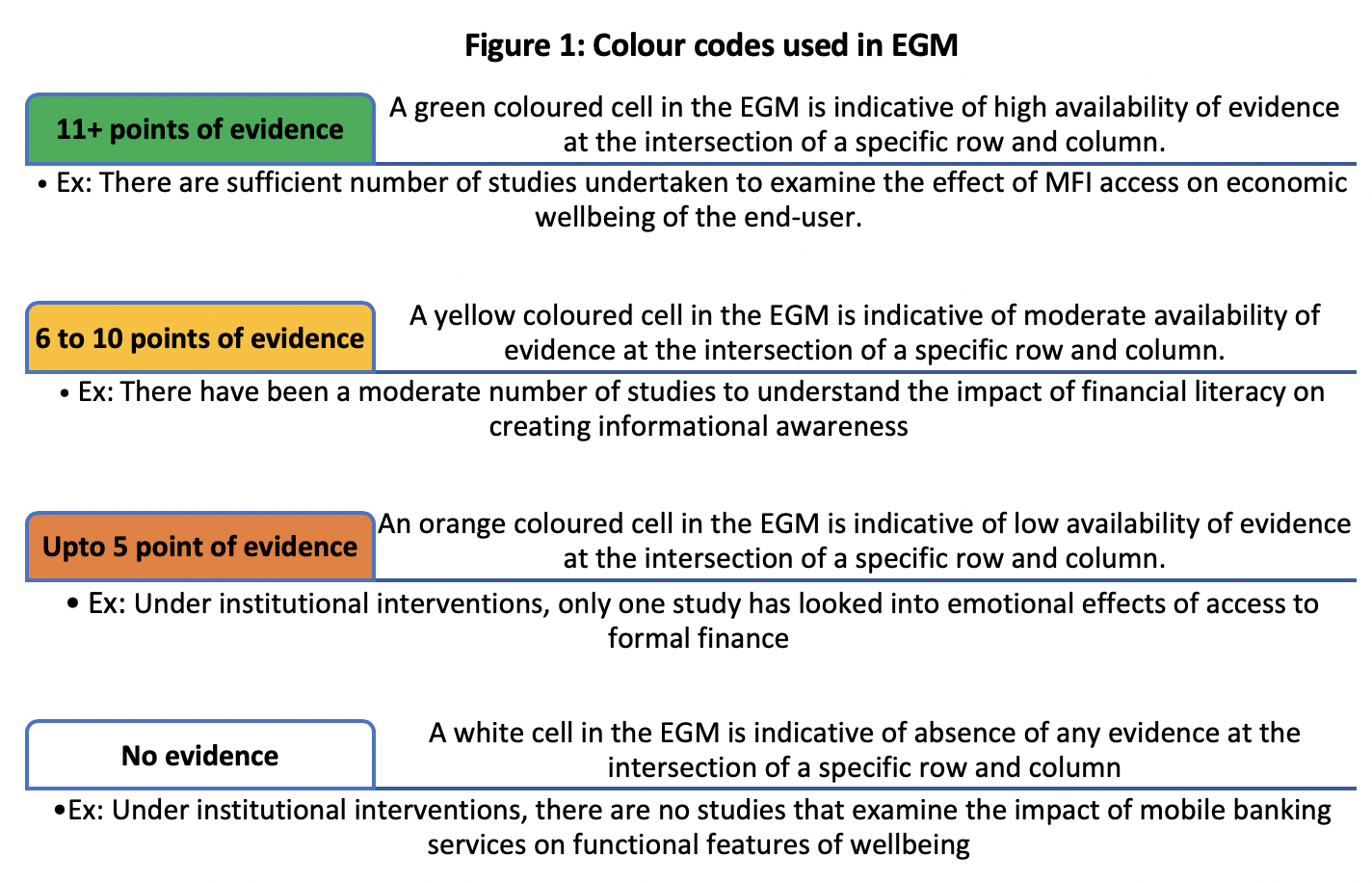

Each of these rows and columns is further divided into multiple context-relevant sub-categories. The FWB-EGM is colour-coded (See Figure 1) where the colour indicates the volume of evidence available at the intersection of a specific cause/intervention (row) and outcomes (columns).

What is the methodology used to create the FWB-EGM?

We followed two systematic approaches to identifying papers for the purposes of including in the FWB-EGM. In the first method, we shortlisted papers using Advanced Search on Google Scholar that satisfied a combination of keywords + India + research methodologies + 2000 (as the year). Our list of keywords consists of indicators that have contextual relevance to financial well-being. In the second method, we referred to the scholarly work of a carefully curated list of academicians across diverse disciplines (but having a thematic reference to Financial Well-Being). These researchers belonged to diverse fields like household finance, development and growth theory, public policy, financial market research and behavioural economics.

In the process of selecting the papers, we included studies that were based on low- and middle-income households or individuals and excluded papers that discussed the financial well-being of high-income households.

For each paper, we captured the objective of the study, details of the ‘cause’ or ‘intervention’ under evaluation, the ‘effects of the cause’ or the ‘effect of the intervention’, and the underlying variables under study. To create the FWB-EGM we populated the rows with Interventions/ Causes analysed in the papers and the columns with the Outcomes / Effects found in the study. We grouped similar Intervention/ Causes and Outcomes/ Effects thematically. The rows have been grouped into three categories: i) household characteristics, ii) institutional interventions and iii) policy interventions. The columns have been grouped into four categories: i) Functional, ii) Informational iii) Emotional and iv) Economic Well-being.

How does a user read the FWB-EGM?

Identifying a gap from the FWB-EGM

EGMs are useful for identifying gaps in existing research, and this can aid in deciding future research priorities. In the FWB-EGM, gaps can be in the form of an absence of or low points of evidence available from academic literature for a specific dimension of financial well-being Through our project, we observed that most of the evidence clustered within Functional dimensions (78 points of evidence). This was followed by the Emotional dimension[3] (44 points of evidence). Even within the Functional dimension, we found a concentration of evidence in outcomes related to loan, delinquency and household borrowing. However, some of the noteworthy gaps within the Functional dimension are –

- Lack of evidence for management of risk by low-income households across contingent states of the world. Risk management, as a core function of finance, is a dimension that requires more attention from the perspective of poor families with uncertain and volatile cashflows and suboptimal portfolios.

- On social security and participation in financial markets, we found limited papers that assess the role of, the willingness to purchase, and the need for old-age liquidity. This is of particular research interest as recent literature points out that Indian households tend to accumulate debt as they approach retirement and there is no reduction in their holding of physical assets (such as property and land) as they pass into retirement, and neither is there a rise in the mortgage of property[4].

- There is limited evidence on outcomes relating to household spending behavior. As of now, this dimension has been analysed in the context of impact on household spending due to access to microfinance loans but not in the context of access to a whole range of other financial products and services.

- As interventions, we found low evidence on the effect of cash credit loans as well as low-cost savings products on the Functional financial outcomes of low-income households with household enterprises.

Users are encouraged to use this evidence gap map to detect gaps in the research pertaining to various dimensions of financial well-being. This EGM can serve to familiarise research students and academicians with various sub-themes under Financial Well-Being and in doing so, in Household Finance. It can significantly ease the search for research evidence for anyone interested in questions around the financial well-being of individuals and households. The EGM can bolster the efforts of researchers and students who are shaping up their areas of research and the questions of interest.

To view the map please click here and to read the Financial Well-being Evidence Gap Map Report, please click here. We welcome any feedback or comments that you may have on the map and the report.

—

[1] Sagan, C. (1997), “The demon-haunted world: Science as a candle in the dark”. Original quote by Sir Martin Rees

[2] Evidence Gap Map, International Initiative for Impact Evaluation. Available at: http://www.3ieimpact.org/evidence-hub/evidence-gap-maps

[3] This is apart from evidence under the Economic Well-being dimension, which we do not consider to be first-order outcomes of Finance

[4] Page 4, Report of the Household Finance Committee, Reserve Bank of India, 2017