The Andhra Pradesh government while promulgating the MFI Ordinance also stated that it has a mandate to disburse INR 100,000 crores bank loans to SHG women members by 2014 to bring 10 million families out of poverty indicating government’s strong belief in serving the needs of the poor through Self Help Group (SHG) model.

The SHG model has been regarded as an instrument for the empowerment of poor and marginalized sectors as SHGs enable women to their savings and to access the credit which banks are willing to lend. Andhra Pradesh has been proactive about taking an initiative of total financial inclusion through SHGs. Recently, the groups had been given large loans up to INR 0.75 million in order to help them discharge all their other loan liabilities and replace it with the low cost loans from the banking system. Study found that even though SHG members discharged other loans taken at higher rates of interest immediately, however, after 9-15 months, these members had incurred new debts outside the SHGs. The more alarming concern has been the increased levels of default. SOS 2010 report indicates that AP banks typically mentioned recovery levels of between 80-85 percent of loans. On an outstanding loan level of more than Rs 100 billion in the state of AP, a 15% default is highly significant.

While there has been an extensive discussion on the Ordinance and its impact on the Microfinance Industry itself on this blog and on the India Development Blog, we thought it would be interesting to observe if the SHG bank linkage programme has actually kept pace with increased after the MFI industry came to a grinding halt in the state.

The Centre of Microfinance at IFMR Research conducted a study under the Microfinance Researchers Alliance Program (MRAP) to understand how SHG Bank Linkage Programme is performing in Andhra Pradesh and to understand if the SHG model is meeting the demand of the clients especially after AP crisis.

We present below some of our findings from the study.

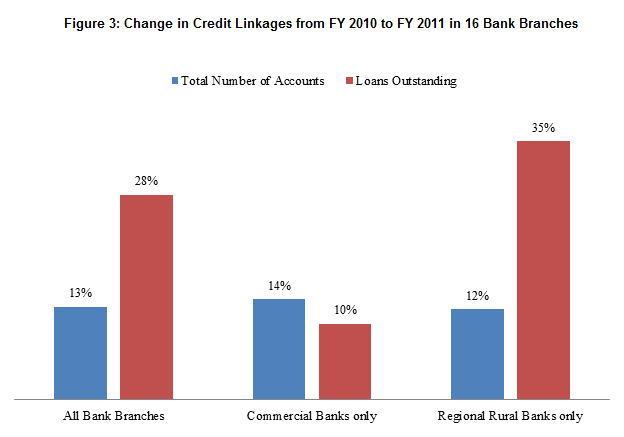

This study involves interviews with 20 bank branch managers (both commercial and regional rural banks) in 3 randomly-chosen districts of AP (Medak, Mahabubnagar, and Kadapa) with the client base of not less than 50 SHG groups. We have directly visited and collected data from 20 bank branches of the following 8 banks.

Data collection

We collected data from the abovementioned 20 branches focusing on the following topics:

- Monthly SHG loan outstanding and the number of SHGs in FY 2010-2011

- Annual SHG savings and the number of SHGs in FY 2009-2010 and FY 2010-2011

- Total loan outstanding and number of SHGs as of March 2010

- Total loan outstanding and number of SHGs as of March 2011

- Irregular balance (Reschedule and NPA) and number of SHGs as of March 2010

- Irregular balance (Reschedule and NPA) and number of SHGs as of March 2011

The biggest limitation of this study is not able to collect data on all of the abovementioned topics from 20 bank branches due to the difficulties reaching some data at some bank branches. Hence, some of the sections in the report are analyzed based on data collected from less than 20 bank branches.

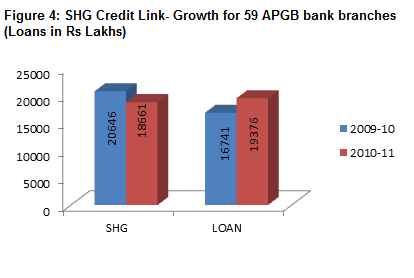

We also collected data from 59 branches of Andhra Pragathi Grameena Bank (APGB) in Kadapa district. For this report, we analyzed that data seperately to understand how this particular Regional Rural Bank is performing in Kadapa district.

Data Findings

Savings

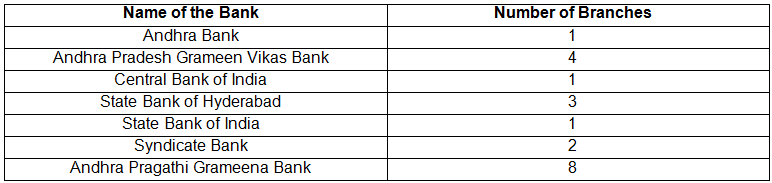

We collected annual two years (FY 2009-10 and FY 2010-11 ) data on total number of SHGs that are saving with the bank branches and their total savings amount from 13 branches of five banks (State Bank of Hyderabad-2 branches, Andhra Pradesh Grameen Vikas Bank-4 branches, Andhra Bank-2 branches, Canara Bank-1 branch, Andhra Pragati Grameen Bank-4 branches. Out of 13 bank branches, 8 are Regional Rural Banks (RRBs) and 5 are Commercial Banks.

Figure 1 below shows that compared to the FY 2009-10, there is a moderate increase in both SHG savings amount and the number of SHG saving accounts in FY 2010-11. Even though there is an increase of 7.6% in the total number of SHG accounts in FY 2010-11, when it comes to savings amount, there is an insignificant increase of 0.3% only.

The data also shows that the average savings amount per group has improved for Commercial Banks compared to Regional Rural Banks.

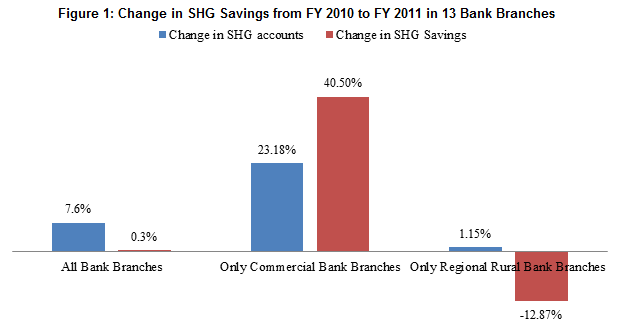

From annual savings data of 59 bank branches of a Regional Rural Bank in Kadapa district, we found that there is an increase of 34% in savings amount even though the number of SHG account holders has decreased by 10% in FY 2010-11. The average savings amount per group has increased by almost by 49%.

Credit Linkage

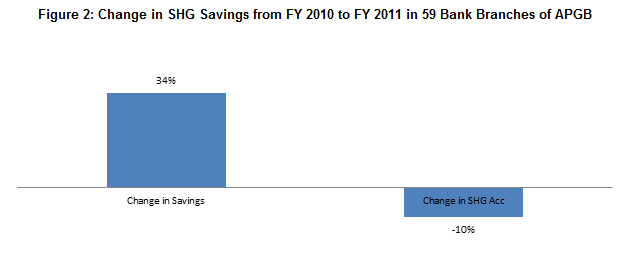

In order to understand the growth in SHG credit linkage from FY 2009-10 to FY 2010-11, we collected data on loans outstanding and the number of SHGs provided with loans from 16 branches out of which 6 are Commercial Banks (Canara Bank, Syndicate Bank, State Bank of Hyderabad and Andhra Bank) and 10 are Regional Rural Banks (Andhra Pradesh Grameen Vikas Bank and Andhra Pragati Grameen Bank).

When we analyzed data from 6 Commercial Bank branches and 16 Regional Rural Bank branches separately, we found that even though the margin of increase in the number of SHG accounts is similar for both types of bank branches, there is a huge difference in the margin of increase in SHG loan outstanding between commercial and Regional Rural Bank branches. When there is an increase of 10% in SHG loan outstanding for Commercial Bank branches, Regional Rural Bank branches have substantially increased its loan disbursement as there is an increase of 35%.

Similar analysis of 59 bank branches of a Regional Rural Bank in Kadapa district shows that even though the cumulative number of SHGs linked with the branches of this particular Regional Rural Bank has decreased by 10%, the total outstanding loan has increased by 16% in FY 2010-1. The average loan size has also increased from Rs. 81,085 to Rs 103,832 in FY 2010-11.

Seasonal Difference in Loan Disbursement

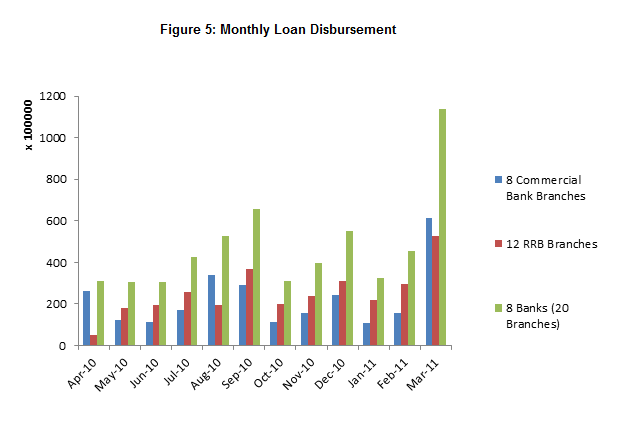

We collected month wise loan disbursement data from 20 bank branches out of which 12 are Regional Rural Bank branches (Andhra Pradesh Grameen Vikas Bank, Andhra Pragati Grameena Bank) and 8 are Commercial Bank branches (State Bank of Hyderabad, State Bank of India, Andhra Bank, Canara Bank, Syndicate Bank, Central Bank of India).

Figure 5 shows the seasonal trend in loan disbursement from 20 bank branches. The spike in March might explain that in order to receive priority sector lending commitment, banks increase the loan disbursement towards the end of the year to meet the specific target. The other spike can be observed in the period between July and September. Most of agricultural activities seem to flourish during monsoon season, which is usually from July to September. This might show that SHG loans from these bank branches might be helping farmers meet the seasonal difference in their demand for finance.

Irregular Balance Data

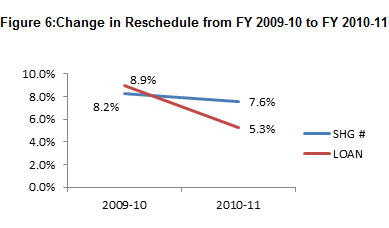

13 bank branches provided data on irregular balance (both Reschedule and Non Performing Asset (NPA)) data for the last two fiscal years. Out of these bank branches, 9 are Regional Rural Bank branches and 4 are Commercial Bank branches. For this report, we first analysed Rescheduled and Non Performing Asset (NPA) data separately, and then we combined data and compared the performance of the branches in the last two years.

Reschedule Data:

As seen in Figure 6, in the FY 2009-10, 8.9% of the total SHG loan outstanding amount was rescheduled. This payment was delayed by 8.2% of the total SHG borrowers. The data shows that the situation improved in FY 2010-11 as only 5.3% of total loan outstanding was delayed in payment by 7.6% of the total number of SHG borrowers.

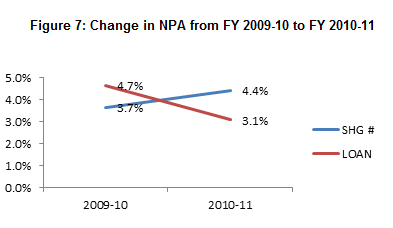

NPA Data:

As seen in Figure 7, in FY 2009-10, 4.7% of the total loan outstanding was considered Non Performing Asset and almost 3.7% of the total number of SHG borrowers defaulted this amount. Interestingly, the margin on the total number of SHG defaulters increased from 3.7% to 4.4% in FY 2010-11, even though the total loan outstanding amount drastically decreased from 4.7% to 3.1%

Reschedule and NPA Data together:

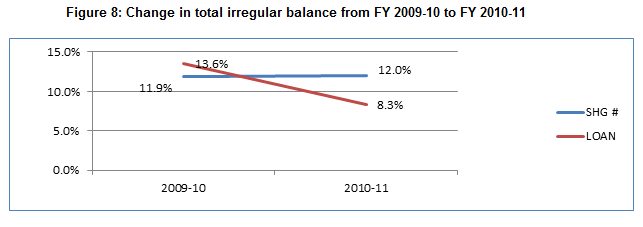

While combining both NPA and reschedule data together, we found that even though there is a slight increase from 11.9% to 12% of the total SHG borrowers that have been defaulting or delaying the payment from FY 2009-2010 to FY 2010-11, there is a significant drop in irregular balance amount from 13.6% to 8.3%.

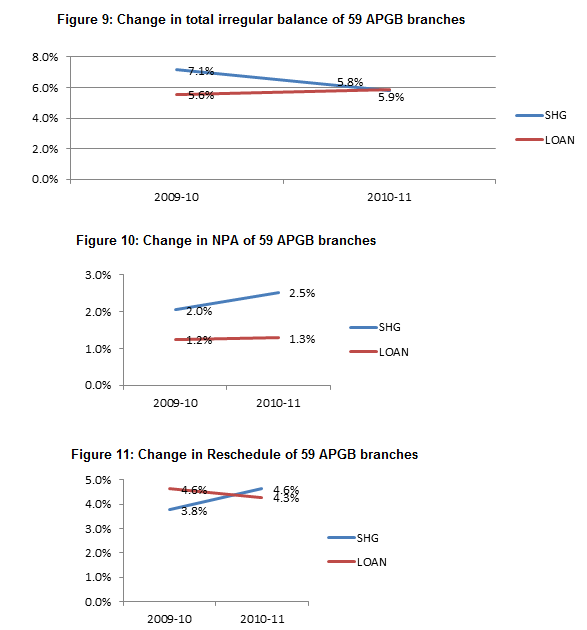

When we looked at the irregular balance data of 59 bank branches of APGB , we found that the overall the irregular balance has increased this year from 5.6% of the total SHG loan outstanding in FY 2009-10 to 5.9% of the total SHG loan outstanding in FY 2010-11 as can be seen in Figure 9.

The interesting fact is that even though there is an increase in irregular balance, the total number of SHGs that have delayed or defaulted has drastically gone down from 7.1% to 5.8%. When we looked at NPA and reschedule data separately, we found that the situation has slightly worsen in FY 2010-11 compared to FY 2009-10 when it comes to NPA as the percentages of both the SHG defaulters and the total amount have slightly increased as seen in Figure 10.

When it comes to reschedule amount, even though the percentage of the total number of SHG has increased, the percentage of the total rescheduled amount has decreased as seen in Figure 11.

4 Responses

For a state like AP, the study sample is very small. One cannot infer any conclusions from the study. However, the analysis of data shows that Savings as reported in Fig 1 is not in conformity with the findings of the study as given in Fig 2. Both are contradictory.

As for NPAs, it is well known that defaults in all categories of mF loans -both MFI funded and SHG linked bank progs were hit badly post Ordinance. SOS 2010 report also vouch for that with default rate of 15%. Then findings with a single digit default and NPAs under the study is intriguing.

It is mentioned that the three districts were randomly chosen ones. Not sure, if random sample techniques were used to select these districts. Dr S Santhanam Ph.D (Eco)

Thank you for your comment. This study was carried out with a small sample size to understand how bank branches are performing specially after AP crisis. As mentioned in the blog, Figure 1 applies to randomly selected 20 bank branches (both Commercial

and Regional Rural Banks) from 3 districts Medak, Mahabubnagar and Kadapa districts

and Figure 2 applies to 59 bank branches of one particular Regional Rural Bank in Kadapa District. We analyzed data from 59 branches seperately to understand how this

particular Regional Rural Bank is performing in Kadapa district.That is why results are different.

We acknowledge that it is very difficult to conclude anything from this study as the sample size is small. Here, we are only trying to outline our findings without making any conclusion. We are encouraging readers to share with us what inferences they would make from the graphs above.

Did not get much hang

of anything from this data presented …yes, 1) saving accounts have increased, ( if its savings in the

bank that is tracked then it should be ie; net of intra group lending) 2) the

lending has also increased 3) seasonal spikes are common , not sure of the

agri-use conclusion. 4) Rescheduled- can this be explained !!…looks like sub

teek hai !!

Thank you for sharing your comments. My colleague Deepti has already

clarified in her previous respond that it is very difficult to conclude

anything from such a small set of sample. I think seasonal difference in loan disbursement

mostly reflects results of periodic target of the banks to meet priority sector

obligation. The rescheduled section is trying to present the number of SHG loan

agreements those are readjusted during the reporting period/s and the

outstanding loan amount that factors into it.