Over the last few years, microfinance has attracted a large number of equity and debt investors. The Andhra Pradesh ordinance however has resulted in investors suddenly pulling away from this sector, many having taken to adopting a wait and watch approach at a time when their intervention would be most crucial.

It is a turbulent time for microfinance. IFMR Capital shares the concerns of the sector. We have been carefully monitoring not only our exposures via our portfolio data and field monitoring systems, but also the performance of the microfinance sector as a whole, the debt funding activity and the impact of this crisis on the short term liquidity of MFIs. While clearly some geographies have been affected, our surveillance on-the-ground and our portfolio performance seem to convey a picture that is quite different from what seems to be propagated by media and discussed in investor circles.

We believe sunlight is the best disinfectant and would like to share some information on our portfolio exposures across various geographies and entities.

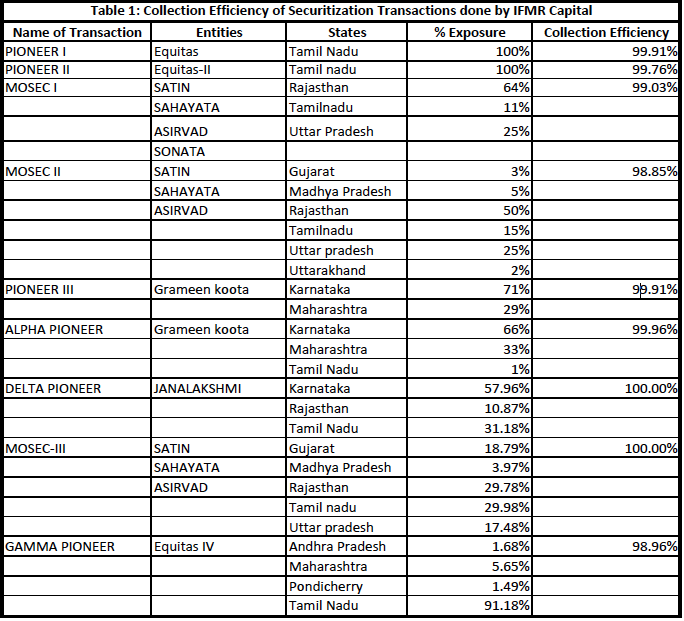

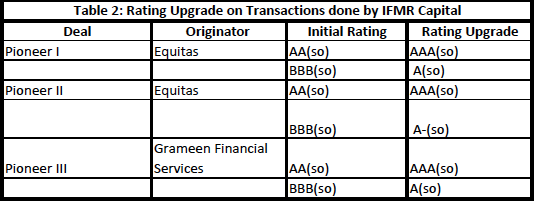

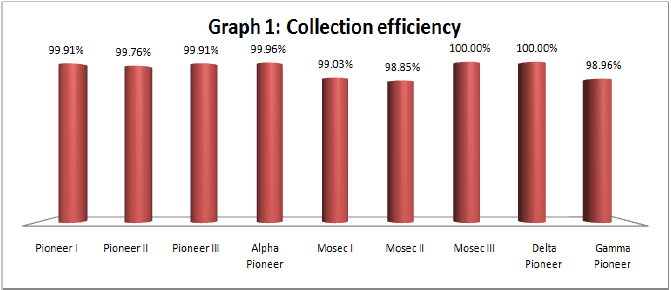

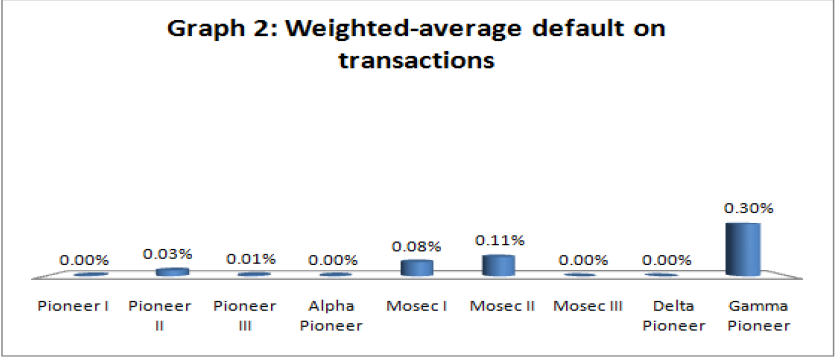

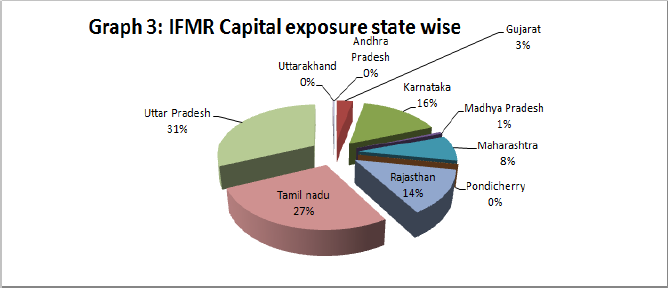

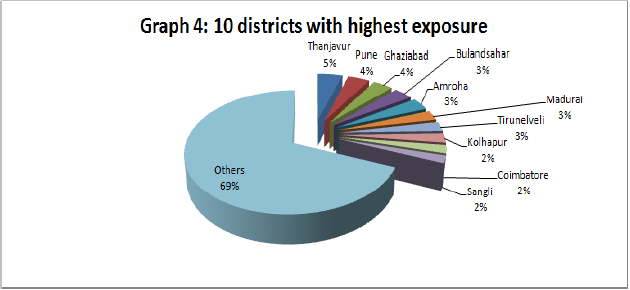

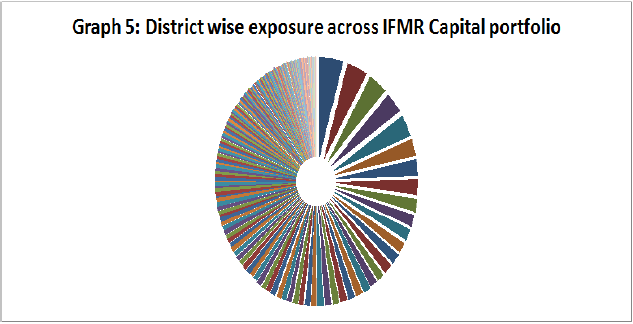

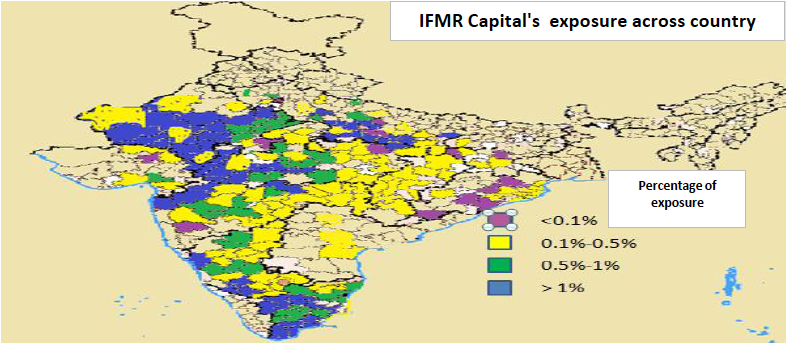

We have put together a snapshot of our microfinance exposures and portfolio performance across the country which gives a clearer sense of the picture as we see it today. To summarise, we have seen no drop in collection efficiencies, either on loans made by us to our MFI partners or on the portfolios underlying the various securitization transactions structured, arranged and invested in by IFMR Capital. Our loans and investments in securitizations show zero over dues. The collection efficiency on the underlying micro-loans securing our assets, stands at close to 99 percent. Our exposures are well diversified over 200 plus districts across various states in the country.

IFMR Capital has partnered with 15 microfinance institutions till date through securitization and through loans made to microfinance institutions. The sector has witnessed capital markets access for MFIs though the development of a rated asset class and a class of new investors such as mutual funds, NBFCs, private wealth and bank treasuries. It has also seen the evolution of a new transparent benchmark of asset class performance. Our MFIs partners have not only delivered in terms of the data and information rigor of capital markets transactions, but have also consistently demonstrated their ability to service the underlying loans effectively.

A picture is worth a thousand words. The tables and charts below give an insight into the performance of the transactions structured, arranged and invested in by IFMR Capital.

18 Responses

Good luck to you Kshama. What’s the month these data had been gathered?

Good luck to you Kshama. What’s the month these data had been gathered?

Thanks, Rajan. These numbers are as of yesterday.

Thanks, Rajan. These numbers are as of yesterday.

Data such as this and the strong message of stakeholders that labelling microfinance as ineffective is unfair (see: http://www.good.is/post/indian-microfinance-confusing-scale-with-impact/ for one view)needs to be disseminated farther and wider.

Denouncing the micro-credit model of MFIs as ineffective has become the favourite of many commentators. The recent spate of articles, almost one every day, proves this. Former RBI Governor Dr. Y.V Reddy has called it a ‘swadeshi vulnerability’.

A former regulator’s opinion that the sector needs intelligent regulation needs to be highlighted and consolidated, formal and unified frameworks need to be established for the sector as a whole. An impartial authority will also be able to assess which mode is better for providing atleast basic access to credit and which structure would be better for other allied financial services. Jumping on the bandwagon to dismiss one methodology of microfinance, such as the MFI route, without investigation of data such as this and beyond might lead to a situation where symptomatic cleansing leads to death of healthy institutions.

Ultimately, the government’s action was allegedly motivated by the ‘people’, so a neutral study of what the people think MFIs have given them or taken away from them can only truly answer the concerns that are brimming over and tainting the sector.

Data such as this and the strong message of stakeholders that labelling microfinance as ineffective is unfair (see: http://www.good.is/post/indian-microfinance-confusing-scale-with-impact/ for one view)needs to be disseminated farther and wider.

Denouncing the micro-credit model of MFIs as ineffective has become the favourite of many commentators. The recent spate of articles, almost one every day, proves this. Former RBI Governor Dr. Y.V Reddy has called it a ‘swadeshi vulnerability’.

A former regulator’s opinion that the sector needs intelligent regulation needs to be highlighted and consolidated, formal and unified frameworks need to be established for the sector as a whole. An impartial authority will also be able to assess which mode is better for providing atleast basic access to credit and which structure would be better for other allied financial services. Jumping on the bandwagon to dismiss one methodology of microfinance, such as the MFI route, without investigation of data such as this and beyond might lead to a situation where symptomatic cleansing leads to death of healthy institutions.

Ultimately, the government’s action was allegedly motivated by the ‘people’, so a neutral study of what the people think MFIs have given them or taken away from them can only truly answer the concerns that are brimming over and tainting the sector.

Thanks Kshama, Do you have any study on current collections of MFIs ( after the recent mfi crisis in AP) ?

Amit, I am not aware of any reliable/robust study on the current collections in the sector as a whole. I only have access to first hand information on the current collections of portfolios/partners of IFMR Cap across the country and thats what I’ve shared here. These are the latest numbers.

Thanks Kshama, Do you have any study on current collections of MFIs ( after the recent mfi crisis in AP) ?

Amit, I am not aware of any reliable/robust study on the current collections in the sector as a whole. I only have access to first hand information on the current collections of portfolios/partners of IFMR Cap across the country and thats what I’ve shared here. These are the latest numbers.

The data gives more cognizance to IFMR portfolio. This would serve IFMR better than give confidence to the Industry. The biggies have been left out of this data and so has A.P. If A.P contributes more than a third of total country’s MFI portfolios, then December would decide the fate of the Industry significantly. There has been a very nasty approach by Banks to the MFIs focussed in areas other than A.P and this has significantly dented plans. It would take a long time before these institutions start full-fledged operations. Banks should understand that such reactive stance would hurt the industry in the same manner as what happened during the recession when factually recession was not supposed to be there in india. Hope this data wakes up the Banks from their selective slumber.

The data gives more cognizance to IFMR portfolio. This would serve IFMR better than give confidence to the Industry. The biggies have been left out of this data and so has A.P. If A.P contributes more than a third of total country’s MFI portfolios, then December would decide the fate of the Industry significantly. There has been a very nasty approach by Banks to the MFIs focussed in areas other than A.P and this has significantly dented plans. It would take a long time before these institutions start full-fledged operations. Banks should understand that such reactive stance would hurt the industry in the same manner as what happened during the recession when factually recession was not supposed to be there in india. Hope this data wakes up the Banks from their selective slumber.

A quick clarification required: when you say that you get collections of 99 odd percent or so in the collections, is this still being done on a weekly basis? Particularly for the AP portfolio, since the ordinance stated that only monthly collections are allowed, is the efficiency number the collections done at monthly frequency?

IFMR Capital has negligible exposure to AP. MFI collections in states other than AP continue to be weekly. The efficiency numbers are for weekly collections.

A quick clarification required: when you say that you get collections of 99 odd percent or so in the collections, is this still being done on a weekly basis? Particularly for the AP portfolio, since the ordinance stated that only monthly collections are allowed, is the efficiency number the collections done at monthly frequency?

IFMR Capital has negligible exposure to AP. MFI collections in states other than AP continue to be weekly. The efficiency numbers are for weekly collections.

Kshama, thanks for this update. I had a few queries and observations. I hope you would bear with me.

1. The table seems to mention Sonata as one of the entities to which IFMR Capital has an exposure, but there are no figures mentioned against the entity. As I understand under your MOSEC transaction you club smaller MFIs together and securitise the loans. If that is the case, then why has Sonata been left out from your subsequent MOSEC transactions. Is it just a typographical error or have you consciously stopped working with Sonata?

2. As I notice, IFMR Capital has a negligible exposure to AP. Was it a conscious choice that IFMR Capital made? Did you see the crisis coming? It seems like a conscious choice as you have limited exposure to states like Orissa, WB, AP and MP, and have a great deal of exposure to “new territories” like UP and Rajasthan and “safe territories” like TN. If you did see it coming your foresight would have been very constructive for the sector.

3. As is evident from Table 2, all the rating upgrades are limited to individual MFI securitisations and not the “MOSEC” securitisations. Is there any particular reason behind that?

4. From Graph 3, it is noticable that IFMR Capital has very high exposure to states like UP and TN. Do you recommend a prudential limit that a financial institution should adhere to at every given point in time in order to control its exposure to a particular geography?

5. When IFMR Capital invests in securitisations does it look at its districtwise exposure or statewise exposure? Which do you think is the better methodology–district/ division/ state?

6. Could you please elaborate how IFMR Capital calculates “efficiency ratios”? Is it possible to share some detailed illustrations with the public at large?

7. I have read numerous articles about IFMR Capital’s success in securitising MFI loans. Would be great to know about the specific role of IFMR Capital. Is IFMR Capital the sole investor in these transactions or does it, like any investment bank, help MFIs place securities with others?

8. Lastly, to me it seems IFMR Capital had great foresight in restricting its exposure to states like AP, Orissa and MP and hence, avoided the impending rough weather (that’s how I view it and I believe the overall climate will not change.) How did IFMR Capital go about doing this? May be you can detail your analysis and the foresight relating to the situation.

9. Also, considering IFMR Capital’s focus on a few large states and not the other smaller ones, will it be safe to state that IFMR Capital’s work relating to the big/ upcoming MFIs only and not so much about others.

I look forward to your responses.

Kshama, thanks for this update. I had a few queries and observations. I hope you would bear with me.

1. The table seems to mention Sonata as one of the entities to which IFMR Capital has an exposure, but there are no figures mentioned against the entity. As I understand under your MOSEC transaction you club smaller MFIs together and securitise the loans. If that is the case, then why has Sonata been left out from your subsequent MOSEC transactions. Is it just a typographical error or have you consciously stopped working with Sonata?

2. As I notice, IFMR Capital has a negligible exposure to AP. Was it a conscious choice that IFMR Capital made? Did you see the crisis coming? It seems like a conscious choice as you have limited exposure to states like Orissa, WB, AP and MP, and have a great deal of exposure to “new territories” like UP and Rajasthan and “safe territories” like TN. If you did see it coming your foresight would have been very constructive for the sector.

3. As is evident from Table 2, all the rating upgrades are limited to individual MFI securitisations and not the “MOSEC” securitisations. Is there any particular reason behind that?

4. From Graph 3, it is noticable that IFMR Capital has very high exposure to states like UP and TN. Do you recommend a prudential limit that a financial institution should adhere to at every given point in time in order to control its exposure to a particular geography?

5. When IFMR Capital invests in securitisations does it look at its districtwise exposure or statewise exposure? Which do you think is the better methodology–district/ division/ state?

6. Could you please elaborate how IFMR Capital calculates “efficiency ratios”? Is it possible to share some detailed illustrations with the public at large?

7. I have read numerous articles about IFMR Capital’s success in securitising MFI loans. Would be great to know about the specific role of IFMR Capital. Is IFMR Capital the sole investor in these transactions or does it, like any investment bank, help MFIs place securities with others?

8. Lastly, to me it seems IFMR Capital had great foresight in restricting its exposure to states like AP, Orissa and MP and hence, avoided the impending rough weather (that’s how I view it and I believe the overall climate will not change.) How did IFMR Capital go about doing this? May be you can detail your analysis and the foresight relating to the situation.

9. Also, considering IFMR Capital’s focus on a few large states and not the other smaller ones, will it be safe to state that IFMR Capital’s work relating to the big/ upcoming MFIs only and not so much about others.

I look forward to your responses.