India has been distinctly lagging behind other emerging economies in developing its long-term debt market (LTDM), be it corporate or municipal bonds. The equity market has been more active, developed and at the centre of media and investor attention. Traditionally, larger corporates have used bank finance, equity markets and external borrowings to finance their needs. Small and medium enterprises face significant challenges in raising funds for growth.

Comparison with other countries

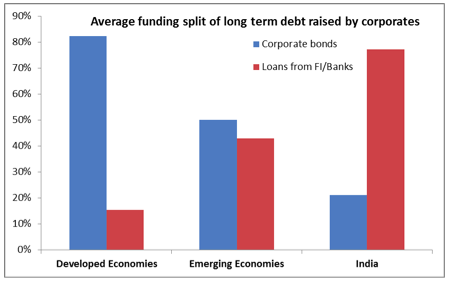

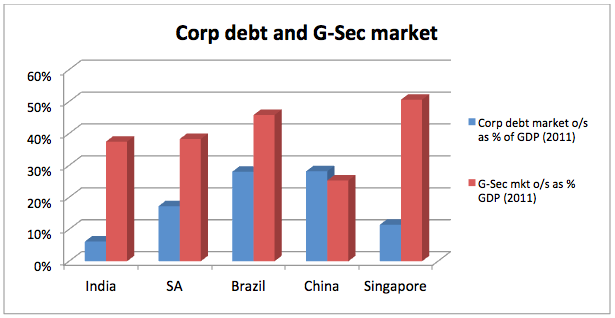

In India, the proportion of bank loans to GDP is approximately 36%, while that of corporate debt to GDP is only 4% or so. In contrast, corporate bond outstanding is 70% of GDP in USA, 147% in Germany, 41% in Japan, & 49% in South Korea. The size of the Indian corporate debt market is very small in comparison to both developed markets, as well as some of the major emerging market economies. For a sample of eight Indian corporates that featured in Forbes 2000, corporate bonds account for only 21% of total long term financing. In contrast, corporate bonds account for nearly 80% of total long term debt financing by corporates in the four developed economies of USA, Germany, Japan and South Korea1. In these countries, the share of corporate bonds is close to 87% for corporates graded above BBB and 66% for the rest. Corresponding figures in major emerging economies such as South Africa, Brazil, China and Singapore, are 57% and 33% for corporates rated above BBB and those rated at BBB or below respectively.

Drawing on the cross sectional experience of G7 countries since the 1970s, it is estimated that the overall capitalization of the Indian debt market (including public-sector debt) could grow nearly four-fold over the next decade. This would bring it from roughly USD 400 billion, or around 45% of GDP, in 2006, to USD 1.5 trillion, or about 55% of GDP, by 2016. This growth, if not crowded out by public sector debt, could result in increased access to debt markets for Indian corporates.

Comparison with the G-Sec Market and Equity Market

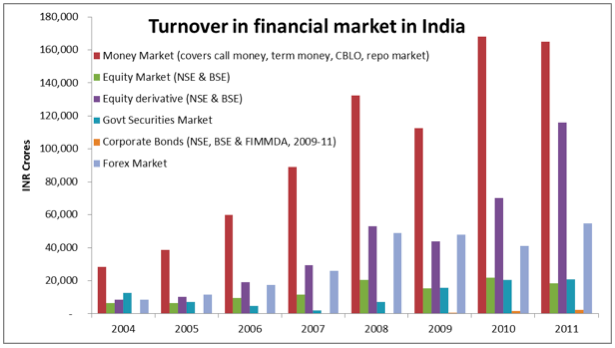

In India the long-term debt market largely consists of government securities. The market for corporate debt papers in India primarily trades in short term instruments such as commercial papers and certificate of deposits issued by Banks and long term instruments such as debentures, bonds, zero coupon bonds, step up bonds etc. In 2011, the outstanding issue size of Government securities (Central and State) was close to Rs. 29 lakh crores (USD 644.31 billion) with a secondary market turnover of around Rs. 53 lakh crores (USD 1.18 trillion). In contrast, the outstanding issue size of corporate bonds was close to Rs. 9 lakh crores (USD 200 billion). Moreover, the turnover in corporate debt in 2011 was roughly Rs. 6 lakh crores (USD 133 billion) whereas in 2011, the Indian equity market turnover was roughly Rs. 47 lakh crores (USD 1.04 trillion.)

Some challenges in the Indian market

The total corporate bond issuance in India is highly fragmented because bulk of the debt raised is through private placements. Small and medium-size enterprises are unable to access the debt markets. Furthermore, trading is concentrated in a few securities, with the top five to ten traded issues accounting for the bulk of total turnover. The secondary market is also minuscule, accounting for only 0.03% of the total trading.

Development of the domestic corporate debt market in India is constrained by a number of factors viz: low issuance leading to illiquidity in the secondary market, narrow investor base, high costs of issuance, lack of transparency in trades and so on. The market suffers from deficiencies in products, participants and institutional framework.

All this is despite the fact that India is fairly well placed insofar as pre-requisites for the development of the corporate debt market are concerned. There is a reasonably well-developed government securities market, which generally precedes the development of the market for corporate debt securities. Another emerging economy, South Africa for instance, witnessed nearly a decade long public sector debt market reform before the market for corporate debt securities began to develop. The major stock exchanges in India have trading platforms for transactions in debt securities. Infrastructure also exists for clearing and settlement in the form of the Clearing Corporation of India Limited (CCIL). Finally, the presence of multiple rating agencies meets the requirement of an assessment framework for bond quality.

In the subsequent blogs in this series, our objective is to analyze the evolution of and developments in the Indian corporate debt market over the last couple of decades, identify the challenges and also discuss possible recommendations to further improve and deepen this critical area of the Indian financial system.

—

1 – Based on data collected for a sample of 72 corporates across 9 countries, including India, for FY 2010-11

6 Responses

This is fascinating! How such meta financial instruments infleunce investment and wealth creation pattarns are so crucial. It will be great if you could also make a comemnt on two, in terms of how this nature and size of corprorate debt, in percentage terms, affects the way in which long trem capital gets invested. Is there a co-relation? for example, if there is skewedness in favour of long trem capital in ‘public’ hand (Govt. securities), does that have direct or indirect implcations on how that capital may be getting invested in socially beneficial infrastructure as opposed to investment in higher end consumer-driven private scetor investment? this sugegsstion of mine is only to provoke thinking and analysis. thanks, anuj

Nice post. Looking forward others in the series. One question, about the data source for the outstanding size of corporate bonds. Also does it include all long term and short term and non-vanilla bonds?

A note on Municipal bond markets that I worked on: http://urbanblog.cprindia.org/2012/06/municipal-bonds.html

Nice read. In fact in Gsec market also we have very few securities which are liquid that too after having many PD’s, who are primarily there to created two way in the market. Also on corporate bond side, very few market making happens. We need SEBI to market make the corporate bonds

Thanks

Jinesh. Liquidity is a major concern for both government as well as

corporate debt market in India. There are issues with supply as well as demand

side. More than 70% of central government debt lies with scheduled banks and

insurance banks. A large part of it is in hold-to-maturity portfolio which may

be resulting in low trading volumes. For corporate bonds, though the trading

volumes are showing an upward trend in last few years, the absolute volume is

still low. We will discuss these issues and potential recommendations in our

future posts.

Bogus analysis. Wrong facts. It’s new issues which account for 4% of GDP- Not the total outstanding corporate bonds! How can you compare new issues % with the outstanding corporate bonds of other countries? The basic minimum expectation from you is to be numerate.

Dear Anonymous, Thank you for reading the blog and providing your feedback.

The outstanding corporate debt as % of GDP in India is 3.3%, 3.9% and 4% based on the following three sources-

Banking & Finance Journal, FICCI, April-2010, Page 6

Banking & Finance Journal, FICCI, April-2010, Page 19

(link: (http://www.ficci.com/sector/3/Add_docs/ficci-finance.pdf)

“Corporate bonds reforms likely on anvil”, Business Standard, Nov 2012 (link: http://www.business-standard.com/article/finance/corporate-bonds-reforms-likely-on-anvil-112111000454_1.html)

The main idea of this figure in the blog was to convey that corporate bond market in India was very small compared to other developing as well as developed economies. We came across different number (as low as 1.6%) in other sources. We went ahead with ‘4% or so’. If you know a data source that could help us improve this blog, please let us know.

I value your feedback. Alas! Bereft, I am left, of the pleasure to know your name and convey my personal thanks.