This is the third post in our blog series on Long Term Debt Markets (LTDM) in the Indian context. In this post (and the next one) we discuss the evolution of LTDM in South Africa and identify key lessons for the Indian debt markets.

By Rajeswari Sengupta, IFMR B-School & Vaibhav Anand, IFMR Capital

Large fiscal deficit, high interest rates, inadequate market infrastructure, lack of transparency, excessive regulatory restrictions on the investment mandate of financial institutions, and distortionary tax and stamp duty regime are some of the key issues that may potentially hamper the development of a well-functioning corporate debt market in an emerging economy. Not all of these concerns can be addressed by regulators and market participants alone. Some of these issues also need the political will to bring about legislative, regulatory and fiscal reforms. In order to gain insight into the required reforms, it may be useful to look at an economy that implemented not only the regulatory but also the policy level reforms in debt markets.

South Africa is one such economy where the long term debt market (LTDM) reforms lasted nearly two decades starting from early 1980s. In this post, and the following one, we shall briefly discuss the evolution of LTDM in South Africa so as to draw some key lessons for the corresponding Indian scenario.

India and South Africa- A quick comparison

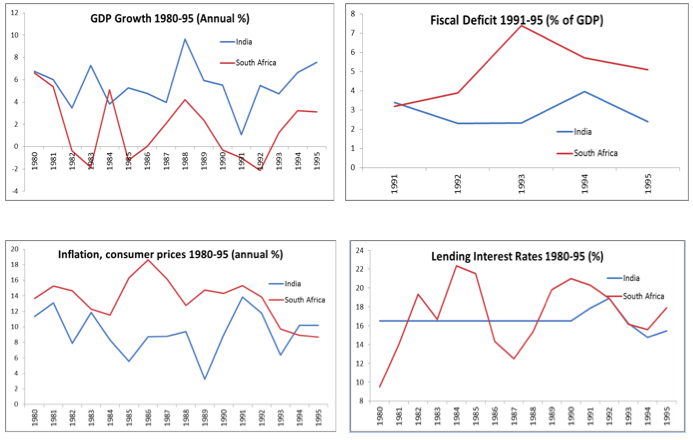

During the 1980s and leading up to the 1990s, the South African economy (SA) witnessed low GDP growth (-2% during 1991-92)i , high fiscal deficit (4-7% of GDP during 1991-94)ii , high inflation (13-15% during 1991-92), and high lending interest rates (16-18% during 1991-93). During the same period, the Indian economy also experienced low growth rates (3-4%), reasonably high fiscal deficit (3-4% of GDP), high inflation (11-13%), and high interest rates (15-18%), as seen in the charts below.

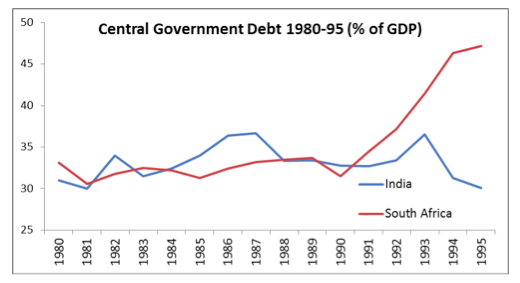

During early 1990s, both countries had outstanding government debt-to-GDP ratio of around 35-40%iii and almost had no market for corporate bonds.

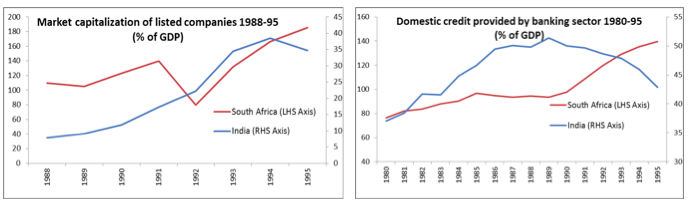

However, SA has traditionally had more depth in its capital market. The market capitalization of listed companies (as % of GDP) in SA was nearly 150% even during the early 1990s as compared to less than 50% in India. Also, the domestic credit provided by banking sector was close to 150% of GDP in SA as compared to 50% in India during this period.

Throughout 1990s both economies had a long term debt market dominated by government securities. Corporate debt market was insignificant in both countries during 1990s. The first corporate debt in SA was issued by South African Breweries in 1992. In 1996, the corporate debt issuance in India was only 0.56% of GDP.

The early 1990s’ liberalization and privatization reforms in India coincided with a major economic transformation in SA. The policy reforms that began in early 1980s in SA and continued till late 1990s resulted in a remarkable improvement in the overall macroeconomic environment thereby providing a strong fillip to the emergence of a well-developed corporate LTDM.

South Africa: Debt market reforms

The evolution of SA debt market can be divided in four phases. Debt market reforms under phase 1 and 2 are covered in the current post. We shall discuss phase 3 and 4 reforms in the next post.

Phase 1: This phase started at the end of 1970s and continued till 1989. The SA government started issuing bonds at a discount on an open-ended tap basis after the Electricity and Supply Commission’s (ESKOM) first discounted bond issue in 1981iv. South African Reserve Bank (SARB) acted as the principal underwriter and the major issuers were the National Treasury, the Landbank, and public utilitiesv.

During 1980s the government also appointed various committees and commissions (the De Kock Commission, the Stals committee, and the Jacobs committee) to provide recommendations for SA capital market reforms. The Jocobs Committee in 1988 suggested that the requirement for holding prescribed assets should be abolished and highlighted the need for market makers in government bondsvi. As per the Prescribed Assets Act, created in 1958 to generate funds for semi-government organizations and the development of South African homelands, the pension funds and the insurance companies were obliged to keep part of their assets as prescribed assets in public sector debtsvii. Until 1989, the pension funds had to invest 53% of their book value assets and long term insurers had to invest 33% of their liabilities in government debt. By late 1980s, the Prescribed Asset act was repealed. The SA government also took the initiative to consolidate smaller issues to create benchmark in different maturitiesviii. As a result a nascent secondary market in government bond started developing.

Phase 2: This phase covered the period from 1989 to 1996. The formation of Bond Market Association or BMA (with no exchange license) comprising bond issuers, intermediaries, banks, brokers, and investors marked the beginning of this phase. The aim of BMA was to formalize the market structure, achieve greater depth and increase transparencyv. The BMA started paper-script based trading through open outcry on Johannesburg Stock Exchange (JSE). Around the same time, SARB started acting as a market maker for government securities and public utilities started quoting bid and ask prices in their bonds.

In 1989 the major clearing and bond settlement banks, along with SARB, created Universal Exchange Corporation Ltd (UNEXCor) in order to develop an electronic settlement system using a central securities depository. In 1994, UNEXCor was appointed as the clearing house for the SA bond market. The secondary market in government and state owned entities was also developed during this period. The first corporate bond was issued in 1992 by South African Breweriesix.

—

– Source: World Bank databank, 2012

– Source: www.tradingeconomics.com

– Source: www.reinhartandrogoff.com

– Source: Guidelines for public debt management, 2003 by IMF & The World Bank

– Source: The challenges facing the South African bond market, 2007 by X P Guma

– Source: A South African Corporate Bond market, 1992. Investment Analyst Journal

– Source: Guidelines for public debt management, 2003 by IMF & The World Bank

– Source: Bond market development in emerging economies: A case study of the BESA, 2008 by Tagara Hove

– Source: Credit Indices Guide, 2007. Standard Bank and BESA