The evolution of South African debt market can be divided in four phases. Debt market reforms under phase 1 and 2 were covered in the earlier post as part of our series on Long Term Debt Markets (LTDM). In this post, we shall cover phase 3 and 4 reforms.

Phase 3: This phase began in 1996 when Bond Market Association (BMA) received the exchange license. BMA was soon transformed to Bond Exchange of South Africa (BESA), a self-regulated organization (SRO), that would operate within the rules and directives set by Financial Services Board (FSB) . The establishment of a formal bond exchange was one of the recommendations of the Jacobs committee. BESA adopted the G-30 recommendations on clearing and settlement and established UNEXcor as a recognized clearing house . During the same period, South Africa decided to follow the widely accepted regular auctions practice as a method of selling primary issues of the government securities. In 1998, South African Reserve Bank (SARB) was made responsible for conducting auctions of benchmark bonds on behalf of the National Treasury. A formal system of market making was put in place and primary dealers were appointed to quote bid-ask prices and to provide liquidity in the secondary market for government bonds.

During the early 1990s, the South African economy was grappling with high fiscal deficit (4-7% of GDP), soaring government debt (around 45% of GDP) and high interest rates (16-18%). In 1996, the government decided to review its entire debt management policy. The following initiatives constituted some of the most important components of economic reforms in South Africa.

A framework for managing government debt, cash and risk was put in place. The framework identified certain gaps in the debt management and monetary policy of the government. Some of the identified areas of concern were the incoherent funding activities among state owned enterprises and the lack of coordination between the national treasury’s liability management and SARB’s monetary operations. In order to address the latter, a detailed work plan was developed for the public debt management committee . The reform initiatives also resulted in the Public Finance Management Act (PFMA) of 1999 and the Municipal Finance Management Act (MFMA) of 2003.

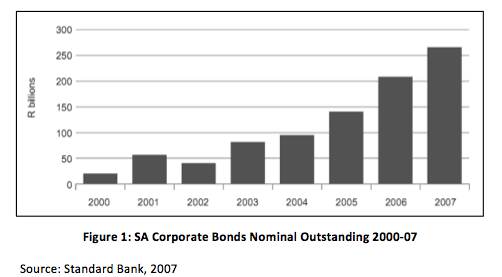

Phase 4: This phase began in 2001 and witnessed a remarkable increase in the issuance of corporate bonds. In 2000, the outstanding nominal corporate debt was less than R25 billion. By 2007, there were more than 800 outstanding corporate debt issues resulting in a nominal outstanding amount of R265 billion, which accounted for 34% of the total outstanding listed debt in South Africa. The period was characterized by lower interest rates, underleveraged corporatesv, reduction in fiscal deficit resulting in low supply of new government debt, and implementation of BASEL-II norms leading to migration of corporate loans from bank balance sheets to capital markets as a result of pressure on banks to price corporate loans correctly.

India & South Africa: Post reforms

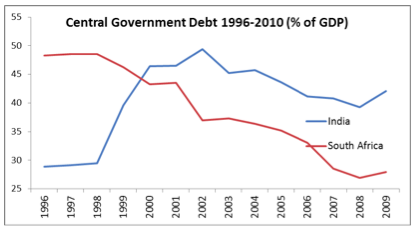

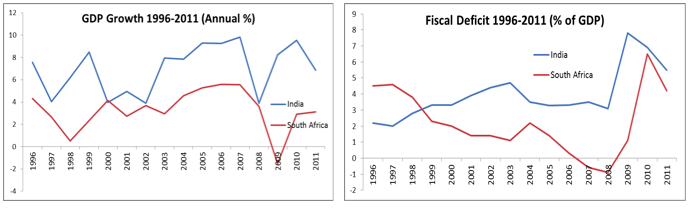

The economic and debt market reforms in South Africa, which were initiated in 1996 and lasted for nearly two decades, resulted in significant improvements in various economic and market indicators. In particular, the diverging trends of fiscal deficit-to-GDP and government debt-to-GDP ratios in South Africa and India provide strong evidence of the efficacy of reform measures adopted by South Africa.

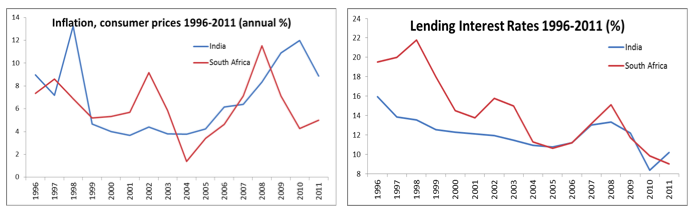

During 2000-2008, South African economy grew at an average rate of 4 to 5% , fiscal deficit as a percenatge of GDP declined from 5% in 1997 to less than 0% in 2007 , consumer price inflation remained less than 9% and interest rates declined from 22% in 1998 to 12% in 2005. During the same period, Indian economy displayed significant growth (6 to 8%), inflation remained low and varied in the range of 4 to 6%, and interest rates declined from 14% in 1997 to less than 12% in 2006. However, fiscal deficit in Indian economy remained high in the range of 3 to 5% of GDP throughout the period.

Moreover, during 2000-08, as a result of prudent public debt management, South Africa witnessed a decline in government debt-to-GDP ratio from nearly 50% in late 1990s to less than 30% in 2008. In India however, the debt-to-GDP ratio rose sharply during the late 1990s from less than 30% to around 45% during 2000-08.

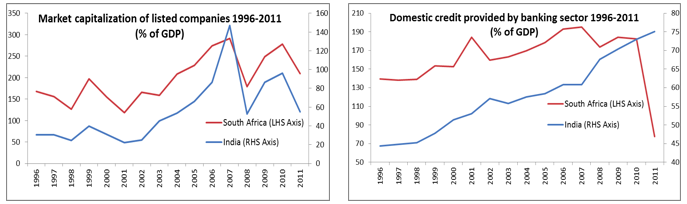

Capital markets in both economies achieved greater depths during 2000s till the 2007 crisis. The market capitalisation of listed companies as percentage of GDP reached close to 300% in South Africa and 140% in India by 2007 from 150% and 50% respectively in 2000. Domestic credit provided by banking sector as a share of GDP witnessed a growth of 30% and 50% in South Africa and India respectively during 2000-07.

Key lessons for India

During 1980-90s South African debt market was facing issues which were not much different from what the Indian debt market is facing today. These include large fiscal deficit, a debt market dominated by government bonds, high interest rates and restrictive investment mandates imposed on financial institutions. The market and policy level reforms adopted by South Africa addressed these issues and resulted in the emergence of an efficient debt market.

Against this background, the following are a few potential lessons that may be relevant to the Indian context:

- Regulatory and policy level reforms may prove to be more effective when designed and implemented in coordination with market participants. Further, self-regulation by market players may be more effective than any enforced control.

- Restrictive investment mandates tend to limit participation of financial institutions in primary as well as secondary debt market. Further, such norms may result in long term holding of government debt in skewed proportions, illiquidity as well as lack of pricing information. Relevance of such investment mandates may need to be revisited from time to time.

- Issues such as crowding of debt markets by government securities cannot be addressed by market participants and regulators alone-better management of public debt and cash could result in a reduction in the debt requirements of the government, which in turn would provide more market space and create greater demand for corporate debt securities.

- High fiscal deficit and high interest rates may keep corporate borrowers away from debt markets. Better coordination of public debt management and monetary operations is essential to deal with these issues. Further, an effective legal framework ought to be in place to ensure proper public debt and cash management.

3 Responses

Compliments to the authors of this note. I missed the first two parts, but will look it up. Just an observation, its likely you may have touched upon this elsewhere, to complete this picture. In India through till the early 90s, the regulatory seperation of working capital / short term lending (commercial banks) and long term capital (financial institutions) was an aspect that affected interest rates in term so of keeping them high. Commercial banks that received deposits had a high proportion of capital in SLR / CRR resulting in high lending rates while FIs, that didn’t have this restriction, lent at lower rates – often subsidized by govt through its deficits for target sectors. The pooling in of resources by collapsing these two segments equalized interest rates, linked them more to risk and tenure (shorter loans with quasi-cash backing had higher interest rates earlier), plus an accompanying reduction in the pre=emptive SLR rates (if I recollect it went down from a high of nearly 60% to below 30%).

Dear Pras, thank you for sharing this interesting observation. We have not covered this in our analysis, however we will certainly look into this.

My own instinct is that Crowding Out was / is less of a concern than is

the manner in which financial institutions are governed in India. Crowding Out

assumes a fixed pot of money from which both government and private sector are

seeking to access whereas the reality is that much of this is locked inside

non-financial assets such as gold and real-estate which have no multiplier,

bank loan books, over-priced stocks, and the very small quantum of AAA rated

bonds.

Within banks, there is a strong regulatory preference for loans over

bonds and originating-and-holding-to-maturity versus participating in financial

markets both to create risks and sell off risks — it almost appears as if the

notion of liquidity itself is frowned upon. The entire provisioning policy is

backward looking (number of days of observed default) and the notion of

marking-to-model or marking-to-market of the entire portfolio is not a

requirement for financial institutions. Notions such as RAROC have not yet made

their presence felt within Indian banks which is why loans tend to be heavily

under-priced and CASA rather than actual lending as a business tends to be the

principal source of profitability.

Amongst the insurance companies there is a great deal of

micro-management of the investment portfolio which, strangely, allows for

aggressive participation in equity markets which are much higher risk, but not

in either securitised instruments or lower rated bonds. This once again drives

borrowers towards banks as the sole source of funds. And even here notions such

as RAROC and marking-to-market or market-to-model of the entire balance sheet

are completely foreign.

I feel that much as it happened for mutual funds when absolutely

transparency was insisted upon and a concept like NAV was introduced, unless

something similar happens to large financial institutions who are then

propelled to actively manage their balance sheet and risk exposures and the

regulators trust each financial institution to choose its own destiny rather

than forcing each one into narrow frames designed by the regulator, we are not

going to see much change. Every financial institution is being forced to become

a clone of the other because of the “one-right-path” perspective

being imposed on them thus increasing covariance risk and systemic risk and

preventing the development of the diversity needed to build both systemic stability

as well as bond markets.

In our system the regulator and other

stake holders such as investors, depositors, and the insured, are not really

aware of the consolidated risk status of the financial institution but rather

take comfort in the belief since they micromanage the manner in which each financial

institution is (or should be) run, the outcomes must, of necessity, be good. It would be very

useful to see if in other systems where bond and fixed income derivative

markets have become deeper, if the regulatory perspectives are very different.

My prior would be that this difference in perspective would be the relevant

differentiator and not the size of the fiscal deficit.