Bindu Ananth, President of IFMR Trust, speaks about the year that was and explains how the Trust is participating in the change process towards making universal access to financial services a reality.

In Andipatti village in Thanjavur district, where Pudhuaaru KGFS, one of our investee companies, has a branch, I recently met a woman I cannot stop thinking about. She and her husband are doing everything they can – agricultural labour, odd jobs in the village, even migrating to find work — to ensure that their two girls and two boys are put through college. The girls are close to graduating; the boys are still in high school.

Speaking to the woman, I couldn’t help feeling that the power of finance and financial markets was not being made available to the family when they needed it badly. If the family were “financially included,” they would be able to “move resources across time”. They would be able to benefit from the fact that the two girls may soon have jobs and an income; that future income could be tapped today, through a loan. Instead, the woman and her husband had to earn all the resources required to send their children to college. And despite all their efforts, the numbers were just not adding up!

This family is not an exception. Sadly, they represent a majority of households in our country whom our financial system has failed to reach.

Pudhuaaru KGFS will work with this particular family and offer them a wealth management plan with a suite of customised products. Likewise, it will work with similar families through its branches. But what about the millions of other households in the country?

At IFMR Trust, we strongly believe that the answer lies in well-functioning financial markets. Well-functioning financial markets enable movement of resources across time, through borrowings, savings and investments; and movement of resources across states, through insurance and derivatives. When these two central features of finance combine with the innate desire of people to improve their lives and the lives of their children, the result can be deeply transformative.

But the challenge remains: How do we ensure that every citizen of our country benefits from the two central features of finance? And how do we do this quickly – every day lost is a day in which millions of families have had to make bad, potentially debilitating decisions because this power was not available to them?

We believe financial inclusion can happen quickly if the financial system has three elements:

- A large number of high-quality, local risk originators offering a full range of financial products and wealth management services to their individual, local corporate and local government clients.

- An adequate number of risk transmitters who can isolate systemic components of the risk borne by households and risk originators, and transfer it to financial institutions and markets that are better placed to absorb such risks.

- Risk aggregators in the form of a few well-capitalised and well-managed financial institutions with the ability to hold and diversify all the area-specific risks of the risk originators.

Think of a life insurance policy bought by a customer at her doorstep, or at a branch of a financial institution close to her house. The policy pays out within hours of a need arising, but the actuarial risk embedded in the insurance is held by a national entity with the capital to bear the risk. In simple words, every individual and every enterprise needs to be close to a financial institution that is, in the words of Professor Jonathan Murdoch, reliable, convenient, flexible and continuous. In order to be sustainable, these financial institutions need to transfer risks that are beyond their ability to manage to larger, better equipped financial institutions and capital markets.

All of our work is geared towards making this vision a reality.

How are we going about it?

We realised that for a challenge as daunting as the one we face, we needed to make a big shift from the strategies used so far. Accordingly, we are engaged in a unique brand of advocacy — one that is firmly rooted in the reality of the financial services needs of our country, and engages directly with the existing financial system to bring it closer to the goal of financial inclusion.

We are not sitting on the sidelines or protesting against the status quo. We are participating in the change process, in the following thematic areas:

Deepening our understanding of the financial services needs of under-served segments

Working towards universal access to finance is too important a challenge to be driven by anecdote, however well told. We think it is vital that all our product and channel innovations are rooted in a textured understanding of the financial status and needs of households. To illustrate, one of the issues we are grappling with is the fact that many households in rural India, including rich households, build savings mainly through physical assets — livestock, plots of land, houses. Most of these assets are illiquid, highly correlated to the local economy, and have low total income potential. A good outcome of financial access would be that these households start converting physical assets to more secure financial assets, such that even if households take risks, they will do so in exchange for good long-term returns. And they will be able to adequately diversify their exposure to risks.

How can financial service providers facilitate this transition? Is the mere provision of a high-quality savings account adequate? Are additional “nudges” required, in the form of product design and communication? The fact is, we don’t really know. The only way to know is through a process of careful experimentation and learning.

We do this with the help of our partner research centres.

In the year under review, our partner research centres — Centre for Micro Finance (CMF), Centre for Insurance and Risk Management (CIRM), Centre for Innovations in Financial Design (CIFD), and InnerWorlds — continued to investigate themes that are important to amplify the impact of financial access.

CMF completed the world’s first randomised evaluation of micro credit, in partnership with MIT and Spandana, an MFI based in Hyderabad. The results were widely discussed and have been influential in developing a deeper understanding of the impact of micro credit on households and enterprises. Ongoing analysis of the 2,000 households that were studied under this programme is expected to yield valuable insights for MFIs and their stakeholders. CMF has also completed a series of studies that examined the role of groups and group meetings in strengthening the social capital of joint liability groups and repayment rates. These findings are critical as MFIs contemplate the evolution of their operating models.

In partnership with the Economic Growth Centre at Yale University, CMF is running a large-scale panel survey covering all districts of Tamil Nadu to gather data that will be used to study the pathways through which economic development is getting influenced. The panel survey will also give us granular data about the shape of financial inclusion over time in dynamic settings.

CIFD went ahead in its efforts to develop usable conceptual insights that could improve the design of financial products and channels. For example, it carried out a study to identify and analyse behavioural reasons for sub-optimal allocation of resources in dairy production and irrigation. The insights from this study will help in the design of financing mechanisms for investments in livestock and irrigation — two of the most attractive investment opportunities available to farmers in India. A similar study was conducted to help identify financing opportunities to improve the efficiency of water markets.

CIRM continued to design and test insurance solutions for livestock, agriculture and healthcare.

The research centres also hosted and participated in knowledge-sharing and training events during the course of the year. CIRM partnered with Wharton Business School to hold a training programme for practitioners on micro insurance design in emerging markets. CMF’s partnership with the Reserve Bank of India’s College of Agriculture Banking has continued to deepen. The micro finance summit held in January 2010 brought together leading practitioners, researchers and regulators, to reflect on the theme of translating insights from recent micro finance research projects to better practice.

InnerWorlds continued to map the subjective experience of lives, livelihoods, aspirations and wellbeing of households in rural India, using a participatory dialogic approach. In 2009-10, the team added 411 life stories from Tamil Nadu, Orissa, Uttarakhand and Bihar, to take its respondent database to a total of 592 families spread across India. More families and more states will be covered in the current year to capture high-quality data that reflects the complexities in the financial lives of households. Insight gained from these stories has been taken forward by IFMR entities in various ways, including structuring the dialogue process between KGFS wealth managers and clients.

Directly catalysing the creation of high-quality originators for remote rural India, and addressing performance issues faced by existing originators in both rural and urban India

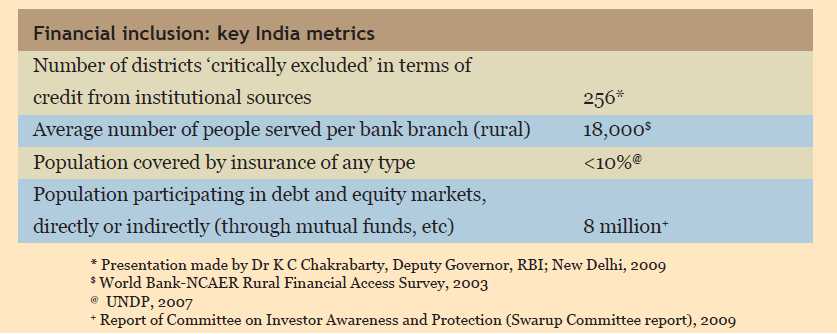

India does not have enough financial institution front-ends. There is, on average, one bank branch for every 11,000 people in the country (18,000 in rural areas). Bank branches provide a narrow range of financial services, and people have to travel several kilometres to effect even a basic transaction. Clearly, there is a need for several hundred well-functioning financial institutions that also serve the remotest villages. In our view, the task of creating the required number of originators is too large for any one entity.

Our approach, therefore, is as follows:

- We are backing the creation of a few large, prototypical high-quality originators in diverse contexts and geographies. The prototypes are expected to offer the full range of services and meet the ideal in a demonstrably impactful, sustainable and profitable manner.

- We are building industry utilities in risk management, technology and training that will enable easy replication of these prototypes.

- We are working hard to persuade other players in the market to proliferate originators.

We are working closely with three financial institutions to develop them as examples of high-quality origination: Pudhuaaru Kshetriya Gramin Financial Services (KGFS) in Thanjavur and Thiruvarur districts of Tamil Nadu; Sahastradhara KGFS in Dehra Dun, Rudra Prayag, Tehri Garhwal, Pauri Garhwal and Uttarkashi districts of Uttarakhand; and Dhanei KGFS in Ganjam and Khurda districts of Orissa. In the year under review, these three institutions achieved an aggregate outreach of over 900 villages and 58,994 customers. Jointly with IFMR Rural Finance, which is building the above-mentioned industry utilities, these institutions offer their clients a suite of products under the integrated wealth management approach.

We are also working with Aajeevika Bureau, Rajasthan, to develop a model of origination for seasonal migrants — a segment that is roughly 100-million strong, yet has been largely ignored by the formal financial system. Aajeevika Bureau has come up with channels and products that meet the unique needs of this segment.

In the current year, we have initiated work with the rapidly growing business correspondent (BC) network of banks, to understand how BCs can be “complete” access points for financial services. We also worked with India’s largest BC network, developed by FINO Fintech Foundation — affiliated to FINO, one of our investee companies — and helped them add a lending product to their channel.

Simultaneously, we are trying to identify and isolate factors that led to some originators performing better than others within a common legal and governance structure. We are gleaning lessons from district cooperative credit banks (DCCBs) in India and community development finance institutions (CDFI) in the United States that have weathered the sub-prime crisis. These lessons will be critical for newer types of originators such as KGFS entities and MFIs.

Some high-quality originators, particularly not-for-profit ones, are unable to scale up due to shortage of risk capital. For these entities we have promoted IFMR Mezzanine, to create a mezzanine finance product. With mezzanine finance, originators get risk capital and the investor is repaid from the company’s balance sheet, without acquiring an equity stake. This levels the playing field for for-profit and not-for-profit entities, as far as the ability to access risk capital is concerned.

IFMR Mezzanine got off to a good start in fiscal 2010; the current year will be its first year of full-fledged operations.

Building mechanisms for orderly risk transfer to risk aggregators

A key threat to regionally focused originators is that they may hold risks in their balance sheets that they are ill-equipped to manage. They do not have the capital to withstand risks such as a failed monsoon, or shocks to the local economy. Hence, mechanisms have to be built for transfer of risk. The US credit crisis has taught us that moral hazard is rampant when risk is traded. The Indian experience of failed development finance institutions, regional rural banks, state finance corporations, and cooperative banks has highlighted the dangers of holding on to concentrated risks within poorly diversified entities. We need a market infrastructure that ensures that risk transfer happens in an orderly manner, and that capital finds its way to disciplined, high-quality originators.

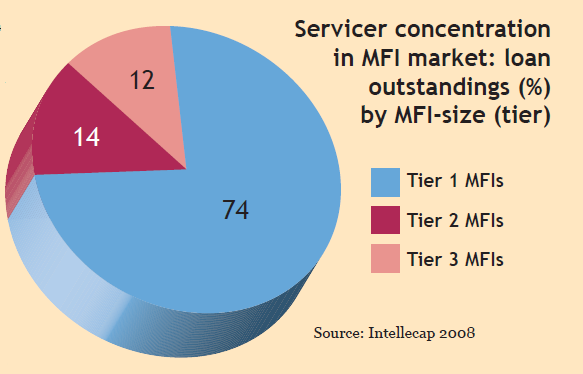

The primary purpose of our investee company, IFMR Capital, is to create just such a market infrastructure, to begin with in micro finance. In the year under review, IFMR Capital securitised micro finance debts of Rs 1.05 billion. In a pathbreaking transaction for the global micro finance market, the company facilitated the participation of a mutual fund investor. In another historic effort, it arranged and co-invested in the world’s first multi-originator securitisation of micro loans. Multi-originator securitisation is significant because it allows an originator to be regionally focused while giving the investor the benefit of diversification through pooling. We also believe that the presence of multiple investor groups promotes greater transparency and price discovery in this rapidly growing and robust asset class.

Debt access through markets will reduce servicer-concentration risks in the industry structure by enabling smaller and newer entities to benefit from access to capital. It will also create conditions for orderly market competition which, in turn, may sharply bring down rates of interest being charged by MFIs; there would be no need for legislation that could stifle access to finance.

Focusing on provider liability for financial wellbeing

At an unforgettable meeting with Professor Robert Merton earlier this year, he told us that financial literacy was like asking a customer who is being wheeled into surgery: “Do you want 14 sutures or 17?” Our view on this issue is similar. We feel complexity in financial product design is necessary, perhaps even desirable, to engineer an optimal solution to a customer’s problems. Financial literacy then becomes an impossible task. Rather than transfer the onus on to the customer, who is expected to be “well-informed” and “literate”, we believe financial providers should be accountable for outcomes arising from the use of financial services and the advice provided.

This shift of accountability places an enormous burden of expertise on the financial provider. We have designed a course called ‘Financial Engineering for Low-Income Households’, in partnership with the faculty at IFMR Business School, to impart a building-blocks understanding of finance to providers of financial services. The course is mandatory for all our staff and those of our investee companies. We are looking forward to making the course and its textbook widely available to other financial institutions.

We are also developing a website (IFMR Wealth Manager) that will feature all the calculators and simulators required to allow the employee of a financial institution to provide her customer with a high-quality financial plan.

Ensuring that providers can offer a full range of well-designed financial products and services

Access to finance is effective only when there is a wide range of financial products and services that meet all the liquidity and risk management needs of individuals and enterprises. Our product development efforts are focused on large segments that currently receive inadequate attention. Examples include working capital finance for small businesses; exchange-linked warehouse receipt finance; livestock insurance; remittances, index funds, and money market mutual funds for rural markets. IFMR Rural Finance and IFMR Ventures are dedicated to this task, in the household and enterprise spaces respectively.

IFMR Ventures has incubated sector-specific companies called network enterprises (NE). In the year under review, these companies improved our understanding of scaleable solutions for supply chain constraints that businesses in rural India face. Some NEs work closely with KGFS entities to develop financing propositions for specific enterprises; others directly address supply chain bottlenecks. The Rural Tourism NE is ready for the next stage of growth in providing reliable access to markets for thousands of properties in remote rural India, after having successfully tested the model with over 250 properties in coastal Maharashtra. The Agricultural Terminal Markets NE deals with improving price discovery and small-lot exchange trading capability among farmers. It has facilitated exchange trade worth about Rs 65 million for castor and groundnut farmers in Kadi (Mehsana) and Maliya (Junagadh), in Gujarat. In the coming months, the Agricultural Terminal Markets NE will look to replicate this infrastructure widely with other regional partners.

The Dairy NE, in partnership with Pudhuaaru KGFS and CIRM, conceptualised and rolled out a livestock insurance product based on radio frequency identification (RFID) tagging; it has also developed a prototype for delivery of animal healthcare services.

These are exciting times for people working towards financial inclusion in India. We are witnessing a wonderful convergence of technology, capital and human resources, which makes me believe that we are going to reach our goal sooner than we thought.

I take this opportunity to thank the Governing Council of IFMR Trust for inspiring and challenging us, and for being generous with their time and guidance. I thank the CEOs of our investee companies and all IFMR Trusters for their unwavering focus in helping us execute the group’s mission. I also thank ICICI Group for its continued mentorship and support of our work.

3 Responses

Congratulations, Bindu, to you and the entire IFMR ecosystem for an eventful – and progressive – year. The strategy of layering risks of financial inclusion across origination, transfer and aggregation is an innovative approach and something that will probably best address the unparalleled diversity (of people, products and needs) in our marketplace. I am sure the next few years will be tremendously exciting as organizations such as yours take this model to scale!

Congratulations on your continued, stellar focus on addressing the entire supply-chain of financial inclusion. Each link is critical and inter-connected, so it is great to see you comprehensively work on all of them. Terrific and inspiring. Keep it up and every best wish for the forthcoming year!

Thanks for your encouragement and support of our work Arun and Vinay.