Well regarded academicians have highlighted the importance of financial services in bringing about a transformation in the lives of those that haven’t traditionally had access to those services. The IFMR Trust was an early leader in understanding this need.

In a relatively short span of time, in the three geographies where the Kshetriya Gramin Financial Services (KGFS) initiative has been active, we have already seen a significant difference in the overall well-being of those families that have actively sought to leverage the services of KGFS and those that have not. KGFS was able to provide these families with a sense of financial stability through a portfolio of specially designed products and services and thereby improve their prospects of a brighter and more comfortable future. KGFS excelled in providing its customers products that were competitive and culturally significant to the local territory.

The next important step for KGFS, in affirming its competence in this role, needed to be customer appreciation of its services. Key to making this happen was going to be:

Accessibility, convenience, and usability

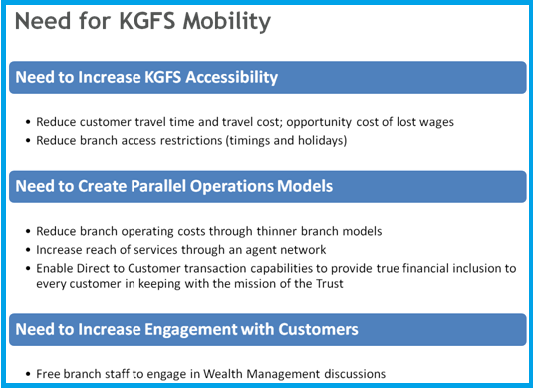

To achieve these, there was a need for KGFS to be closer to its customer, and similarly to bring the customer closer to KGFS. This need for flexibility in delivering services is what made the element of MOBILITY as a new entrant into the operating model so imperative. Mobility was thus a combination of accessibility, convenience and usability delivered using a combination of mobile technologies.

Customer Challenges

Early feedback from the field had indicated two clear challenges facing customers on the ground.

1) In-person Payments

2) Branch Access Restrictions

Several KGFS loan products like the Joint Liability Group (JLG) loan required customers to repay their installments weekly, and in the case of the JLG, the payment had to be in person, with all group members present at repayment. This was a challenge for many customers, some of whom had to forgo daily wages to be present at the branch, often spend on transport to reach the branch and coordinate to ensure that all group members were present at the same time.

The other issue was that, while KGFS branches opened early and shut late – even working all-day on Saturdays; certain customers had expressed their inability to be present within branch timings and had started requesting longer branch hours.

Clearly, distances and immobile infrastructure were hurdles in accessibility, convenience and usability.

Thinner branch front-ends using technology

As KGFS expanded through a growing network of branches, it was reaching ever closer to its customers – typically no more than a 5 kilometer radius away. The distances between customer and branch were being shortened. With a high degree of branch automation using computers and internet access, branches had been optimized to cater to large numbers of customers with minimal operational overheads. Yet, some important questions had to be answered –

Could the branch front-ends be made even thinner and even more nimble?

An important need was that the branch not just be in proximity of, but feel local to every customer it served. This was an interesting challenge. KGFS realized that a network of appointed agents could provide exactly that flexibility.

Could KGFS take its services to the customer’s doorstep?

Roving agents would:

a) Complement the activities of the primary area branch – and often even free up branches from routine activities.

b) Allow the branch to focus on more skilled services such as financial advice in the form of customized wealth management discussions.

For the customer, interactions with the branch needed to be direct when required – such as when discussing wealth management strategies and indirect (through an agent) in less private dealings.

How was this going to be possible?

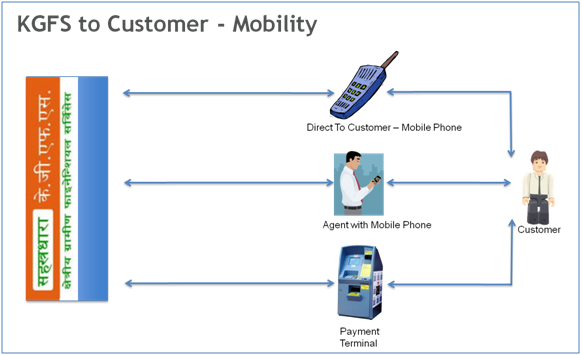

Technology was no doubt the answer. A combination of devices and access points was going to be necessary. For example:

– Automated cash deposit machines – possibly located at a main market or in a prominent store could do away with agent intervention while handling cash.

– An agent equipped with a portable access device would be free to transact from a fixed location or at the customer’s doorstep.

– Customers with access to a connected device would have the convenience of performing certain operations in the privacy of their home at a time convenient to them.

KGFS had already tested Point of Sale (POS) machines as transaction points at branches. While these had worked fine at the branch:

– Costs were relatively high

– Technology was dated

– Functionality and the ability to add new features were complex and limited.

So what else could be used?

The ubiquitous mobile phone

Mobile phones on the other hand are an impressive alternative. With over 500 million mobile phone connections across India today, even in rural markets most extended families have access to a mobile phone. Importantly people are comfortable using them. The social challenge of people having to accept a new technology does not exist. The technology has been around for a while. It is stable, easily available and connectivity across the country has been getting better and less expensive.

Through special applications the mobile phone can replicate almost all branch functions. KGFS appointed agents that already own mobile phones could be up and running access points within days with minimal additional hardware costs. Using biometric authentication, and encrypted data sessions, applications can be made secure and robust. Newly available security solutions even allow remote erasing of data in the event the phone is misplaced or compromised.

Mobile phones do hold a tremendous opportunity for KGFS to expand its reach. In areas like the remote hills of Tehri Garhwal, where Sahastradhara KGFS operates, the challenges of physical access make the case for mobility very strong. No doubt in areas like Sahastradhara mobility will be the key to accessibility!

4 Responses

Thanks for a great post. Two questions:

1. How will you do biometrics if the agent is transacting on a mobile?

2. How will the transaction executed on the agent's phone be sync-ed with the kgfs server?

Biometric authentication would be an integral part of the mobile transaction. Fingerprint biometrics are a mature authentication technology and the system would use a portable finger print scanner synced with the mobile phone.

Synchronization with the server could be real-time or delayed depending on connectivity. Mixed connectivity options that use a combination of data (GPRS), text messages (SMS) and other connection options would need to be used.

nice write-up, Adi.

vishwa

http://theerthamforeveryone.wordpress.com is about getting *everybody* a drink of clean water

Thanks for the timely and relevant post. The global proliferation of mobile technology and it's overall user friendliness has indeed made it the alternative of choice and the future direction of financial services institutions. This however raises the delicate question of security and a fraudsters ability to cloak their identity using prepaid mobile devices. I work with a company called TeleSign, whose unique ability to identify, trace and block such attempts at breaching security has made them the vendor of choice among financial institutions. You may want to inquire and determine if there mobile phone authentication solution would fit your security model. http://www.telesign.com

Respectfully.

TeleSign Matt