We started Kshetriya Gramin Financial Services (KGFS) ten years ago with the objective of re-defining the way financial services are delivered to the rural poor. The analogy that inspired us in those early days was – how can finance be more like noise-cancelling headphones for customers, absorbing the volatilities and excess “noise” in their lives and delivering a smooth experience of having money when they needed it?

It has been the experience of a lifetime for all of us on the team to execute against this goal. This journey has taken us into remote villages in India where we have become deeply embedded in the local economy. It has taught us how enterprising and resilient these economies & households are and of course, given us an opportunity to partner with a variety of like-minded institutions and mentors. In this post, I will briefly share results of an impact evaluation of the KGFS in Tamil Nadu as well as some reflections on the execution of the model.

To recap, the KGFS operating model had three distinct elements[1]:

- A wealth management approach to customer acquisition and servicing that starts with the customer and her unique needs (rather than a product sales-led approach). Following from this, KGFS did not “own” any product but primarily was focused on customer experience

- Ability to offer the customer financial services that go beyond small-value credit, particularly insurance

- A high-saturation approach to geographical expansion that lets us keep operating costs low even while serving a micro-market in a more complete manner.

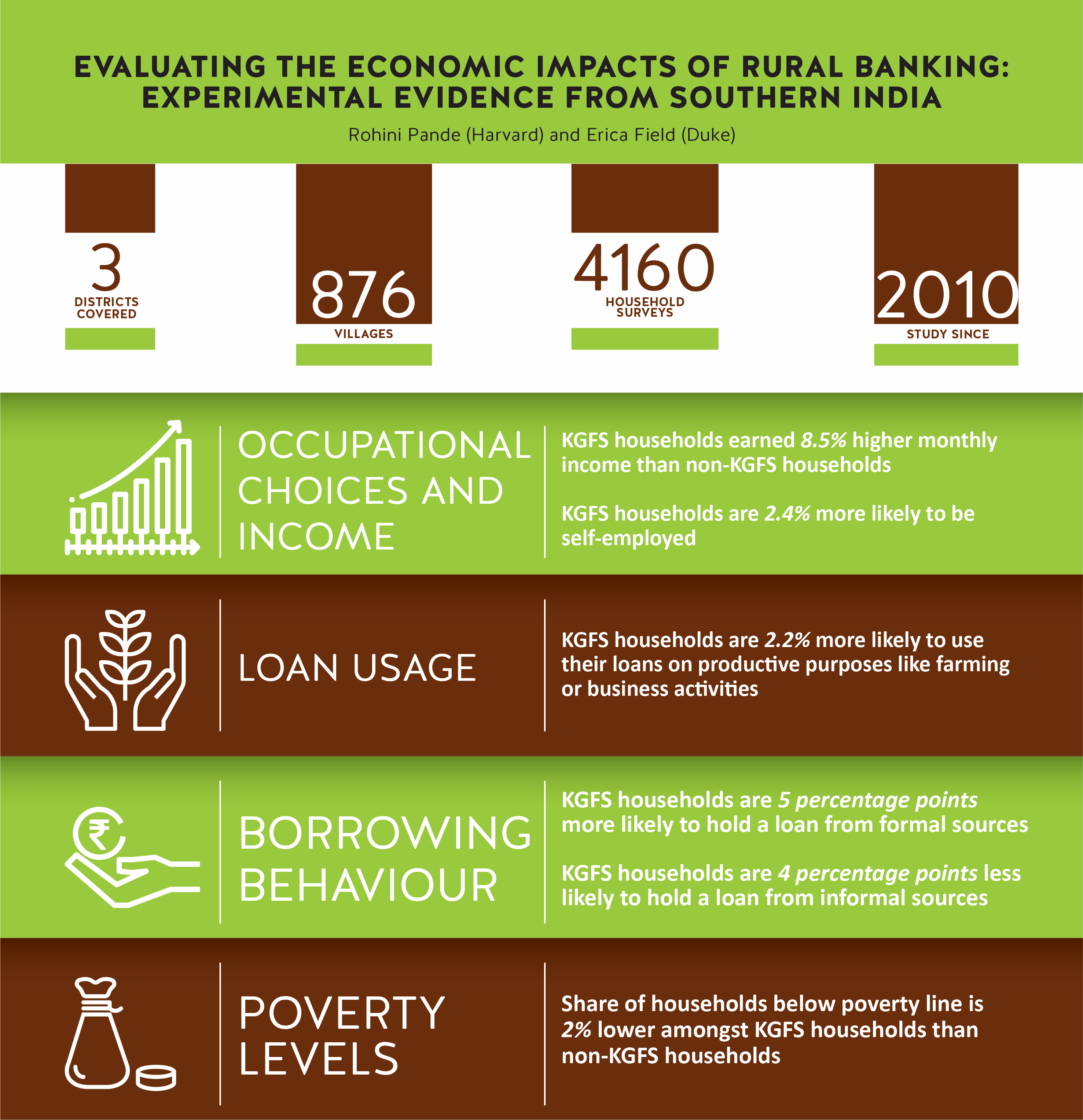

Firstly, on impact, the graphic below is based on a forthcoming paper by Rohini Pande (Harvard) and Erica Field (Duke) who conducted an independent impact evaluation of the KGFS model since 2010. In the days to come, we hope to deeply reflect on model innovations needed to further improve these outcomes.

While some of the improvements in customer outcomes will come from iterating the model itself, this is also a great moment to reflect on the execution journey itself.

Going back to the three distinct elements of the operating model, we were most successful in the dense expansion approach. Early branches have a market penetration/take-up of 45% while the average is 25%[2]. Average micro finance market penetration is typically in the low teens. I think this is the reason why we see local economy effects in the impact evaluation. From a cost structure perspective, this also results in a very healthy operating cost to income ratio of 25% for early branches. However, this only works well in markets with relatively high population density. Unit economics at the branch level continues to be challenging in the hilly markets of Uttarakhand where we are iterating the distribution strategy for these environments. We remain convinced that the physical branch (with digitized processes) and well-trained employees are essential for a complete financial inclusion approach in these markets.

On the multi-product delivery goal, we have experimented extensively and stabilized with a narrower product portfolio than originally planned. We offer through KGFS branches the standard group loan, a micro-enterprise loan, individual consumption loans backed by gold or salary slips, a savings account linked to a bank partner, personal accident insurance, and life insurance – to my understanding, the broadest product suite among financial institutions focused on this market segment. The impacts attributable to this are in terms of increased risk-taking capacity by KGFS customers evidenced in diversification to self-employment and more investments towards business activities. Products that we tried and failed to scale include cattle insurance, money market mutual funds, medical insurance, unsecured crop loans, education loans and a working capital line for households. As I think about these product experiments, I remain convinced that customer demand is certainly not the issue. However, we over-estimated the capacity of the front-line wealth managers to handle and sell these products. It produced too much complexity in operations. We have become more mindful now of front-line capacity constraints and sequencing of product launches. As the cash handling demands on the branch and front-line decrease with greater agent proliferation and digital up-take, we believe that the capacity of the front-line also greatly improves. We are also working on mapping customer segments to distinct product portfolios to make the sales process more suitability-driven.

Finally, on the execution of the wealth management approach. The success for us here has been developing a cadre of about 1000 wealth managers that are very knowledgeable and empathetic about their customers (one of my proudest moments personally was when Shikha Sharma, MD & CEO of Axis Bank interacted with one of our wealth managers and remarked that she wished she had a wealth manager like that!) and also developing a detailed process for capturing customer details and mapping customer profile to a recommended portfolio. My colleague and I co-edited a book, Financial Engineering for Low-Income Households, that captures our thinking on this and forms the basis of our training. Our wealth managers have been deeply trained to understand the context of households, their capacity for growth and debt and also to detect high-risk customers for whom insurance is essential. We have been proud to share our training material and approaches with other institutions in the industry. The ongoing challenge is to convert all this customer know-how & soft information into sharply defined business differentiators. While we are profitable and have competitive ROEs, the true test going forward would be if our approach produces above-market ROEs to reflect this unique customer strategy.

Looking ahead, we continue to strongly believe in the need for financial institutions that are obsessively focused on customers and customer outcomes and act as an interface between them and the rest of the financial system that is configured along product lines. Relative to 2008, we have very powerful identity management, payments, and analytics tools available to us that lets us redefine what it means to be a wealth manager to the village. The last decade has been a fantastic start in this direction and I wish our teams the very best for the next decade of our work here!

—

[1] See this paper for a more complete description of the KGFS operating model and building blocks.

2 Calculations based on KGFS Administrative Data, Census (2011), NSSO AIDIS (2012) and Credit Bureau data

3 Responses

Congratulations Bindu and entire team. Such a remarkable journey. It was my great honor to support and guide the KGFS customer focus efforts in the early days. Your early commitment to move the original design team to Thanjavur for more than six months in order to articulate key elements of the model laid the foundation for success. It is one thing to have a grand vision and quite another to realize it on the ground. There were thousands of details to be finalized: the look, feel and physical design of the branch, the training protocols for the wealth managers, the daily operational guidelines of the branch team, the ease of use of the technology platform.

There was a clear understanding of the mission and values in the founding team and a commitment and real joy in the iterative process of creation on the ground. I remember many ‘mission review’ sessions with early groups of wealth managers sitting in a circle shyly describing how they approach the clients and making suggestions on how to improve that interaction. The feedback was heard and suggestions were integrated and rolled out across the branches in record time. This flexibility and focus allowed for a solid foundation to be laid for future growth. Many of problems you and the team were wrestling with in those days have been solved or simplified, such as client identification and enrollment , KYC, bandwidth and technology, mobile platform availability. No doubt the time is right to see an updated even more robust version of KGFS emerge for the next ten years of growth. Bravo to all! Deidra Wager.

Congratulations to you too Deidra. We have been so lucky to have such an incredible board member, mentor and friend in you. Much of the details of the branch model, the uniforms, the training, the supervision structure and the review processes have your unmistakeable imprint. We look forward to your continued support & guidance.

I was fortunate to have got the opportunity to get a closer look at the bottom of pyramid. Do remember my visit to IFMR & being fascinated by the KGFS model; to incorporate the learnings for UMANG, the consumer services division of FINO, which finally had to be shut down.

Am really delighted to read the success journey; would love to see it scale up to exemplify the hidden Fortune.