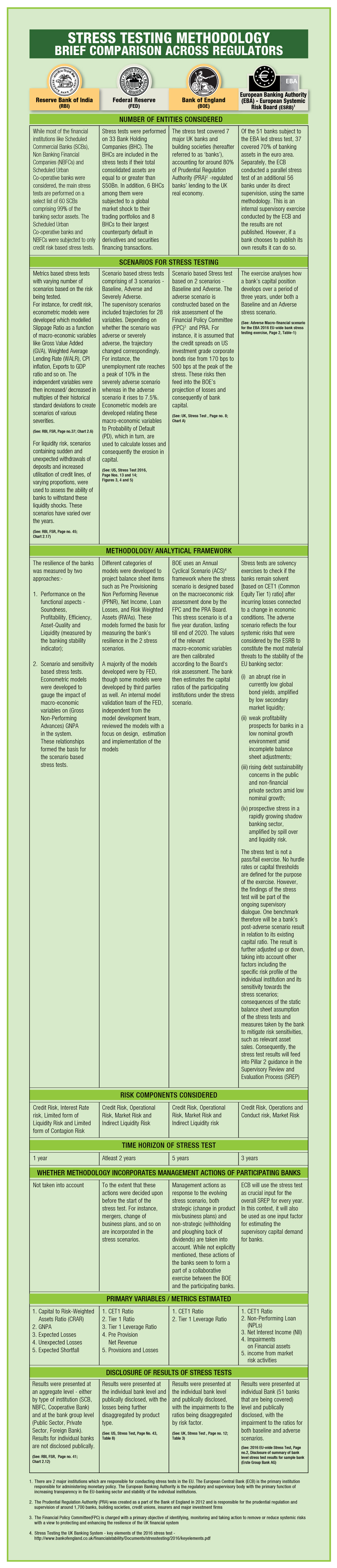

The below table summarises, along some key dimensions, the stress testing methodologies adopted by the central banks in India, US, UK and EU to assess the stability of their banking system. It is to be noted here that the stress tests that individual banks conduct by themselves, as part of their Internal Capital Adequacy and Assessment Process (ICAAP), do not figure in our comparison. Also the below analysis is based on the stability/stress test reports of the respective regulators for the year 2016.

All data for the above comparison was taken from the following references:

- Reserve Bank of India’s Financial Stability Report December 2016 – (RBI, FSR)

- United States’ Federal Reserve’s Guidelines on Stress Testing –

- United States’ Federal Reserve’s Supervisory Stress Test Methodology and Results June 2016 – (US, Stress Test)

- Stress Testing the UK Banking System – 2016 results – (UK, Stress Test)

- Stress Testing the UK Banking System – key elements of the 2016 stress test –

- 2016 EU-Wide Stress Test – Methodological note – (EU-Wide Stress Test)

Click here for PDF of the infographic.