[This article is the third in a series of posts on the theme “Regulatory architecture of India’s financial system”. IFMR Blog will continue to feature this theme through the next two weeks.]

As discussed in the introductory post of this series, and as Dr. Ajay Shah highlighted in an extensive interview, the Indian regulatory architecture needs significant changes to ensure the development of a modern financial system that can serve the economy of India. In this article, we look at Australia’s financial regulatory architecture to bring out insights that may be useful for thinking about reforming the regulatory architecture of India’s financial system.

Why look at the Australian regulatory architecture?

There is great diversity in the financial regulatory architectures across countries. While some countries have a highly consolidated architecture with only one agency responsible for regulating and supervising the financial system, there are countries like India with a range of regulatory agencies responsible for different parts of the financial system. Most countries are somewhere along this spectrum. Among the developed economies, the financial regulatory architecture in Australia, though not without its share of critics, is widely perceived as successful in terms of its ability to allow and adjust to financial innovations without compromising stability of the financial system. The Australian financial regulatory architecture is also a pioneer in consolidating the regulatory agencies based on functions. This can at least partially be attributed to the continuous and timely reforms of the regulatory architecture and approach. The Australian regulatory framework has undergone fundamental changes in the architecture itself.

Tracing the background of reform

Up until the 1960s the Australian regulatory system tried to implement its monetary and supervision policies through the direct control of banks. As a result they put restraints on the interest rates on deposits, as well as lending restrictions on banks as they were asked to put a majority of their funds in cash, government securities or as deposits with the central bank. This affected their operational flexibility and ability to compete. As a result, new Non Banking Financial Institutions emerged to fill the gap caused by the restraints on banks. Over a period of time, market share of commercial banks declined. The Australian government took a number of small steps towards banking deregulation, which were done mostly on an ad hoc basis.

In this context, the Australian Government appointed the Campbell Committee in 1979, to bring about the first major wave of financial sector reforms. The Inquiry recommended deregulation and removal of regulations, such as interest rate controls and lending restrictions. Deregulation also led to lowering the entry barriers and paved the way for entry of foreign firms, resulting in increased competition. This facilitated technological innovation and greater choice for customers. Deregulation also opened the financial markets to the world and they became more integrated with global financial markets.

However, deregulation introduced its own set of challenges for the regulators. Efficiency and competition increased but seemingly at the expense of stability. Deregulation enabled banks to take on high risk credit borrowers without putting in place efficient risk assessment procedures. As a result the credit quality deteriorated, leading to very high level of NPAs, recapitalization of govt owned banks etc, affecting the overall stability of the system. Also, with regulation still largely following an institutional basis, it was difficult to regulate the provision of similar products offered by different institutions.

The Wallis Inquiry

In 1996, Australian Government appointed the Wallis committee to recommend changes to the regulatory system to ensure an ‘efficient, responsive, competitive and flexible financial system to underpin stronger economic performance, consistent with financial stability, prudence, integrity and fairness.

Wallis committee’s proposals were guided by the approach that to address market failures (caused by anti competitive behaviour, market misconduct, information asymmetry and systemic instability), there need to be different regulatory tools. The Wallis enquiry put forward three main regulatory options– a mega regulator, a lead regulator and a ‘twin peaks’ regulatory model.

While under the mega regulator model, a single regulator would regulate financial markets, consumer protection and prudential regulation, the lead regulatory model envisaged a single agency responsible for gathering and providing information about financial groups to various regulatory agencies.

Considering the pros and cons of the various models and the status of existing Australian regulatory structure, the ‘twin peaks’ model of financial regulation was adopted by the Australian Government. The rationale was that though a single regulator would create regulatory consistency and remove regulatory arbitrage, the agency would be very powerful and may have a “one size fits all” approach to regulation. The lead regulator, on the other hand, would retain the already existing regulatory agencies and have a coordinated approach towards financial groups, but may not work because of the competition and different objectives of the various regulators being coordinated.

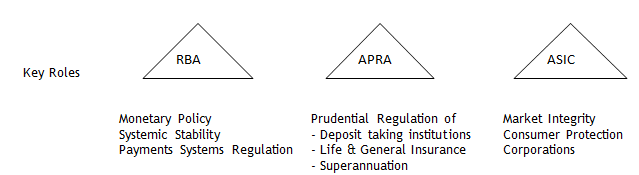

The twin peaks model involved the creation of two new regulators: Australian Securities and Investments Commission (ASIC) ) and the Australian Prudential Regulatory Authority (APRA). Under the Wallis reforms, the key regulatory agencies and their functions are

This architecture brought about a clear distinction between regulations appropriate for ‘conduct and disclosure’ aspects of the financial system, and those appropriate for ‘prudential’ aspects of the financial system. The Wallis Inquiry highlighted the importance of moving away from the concept of entity based financial regulation to this functional based approach.

The committee also proposed separation of the central bank (monetary policy) and prudential regulator. This ensured that the Reserve Bank of Australia (RBA) would help in maintaining systemic stability and would not be burdened by the implicit guarantee to protect the financial institutions at the time of insolvency. At the same time all prudentially regulated entities in the financial system would come under the jurisdiction of a single agency, APRA.

If the function-based approach of regulation is introduced in India, the space for regulatory arbitrage and overlaps should diminish. A single APRA-type prudential regulator would bring regulatory consistency in prudential regulation across products like savings, insurance, investment and pensions. This would also help avoid the regulatory arbitrage across institutions, like the lack of regulatory clarity on cooperative banks. As mentioned in the first post under this series, the conflict of interest arising from RBI functioning as a regulator for monetary policy and as a banking regulator would also be eliminated with this twin peak model approach.

ASIC regulates companies, financial markets, financial services organizations and professionals who deal and advise in investments, superannuation, insurance, deposit taking and credit. It ensures that credit consumer activities, financial markets as well as financial service providers operate efficiently and honestly. This is important for protecting consumers against mis-selling and other unethical practices. In India, with different products regulated by different agencies, no single regulator has a complete understanding of the overall picture, especially on issues regarding product transparency, consumer awareness, financial planning and advice. Due to disparate regulations by different regulators, the existing regulatory architecture in India does not allow any institution-type to provide a complete range of financial services at the front-end. An ASIC-type agency could help overcome this problem by providing consistency in regulation of client-facing activities across products. It would also help in regulation and supervision of large complex financial institutions that cover a wide range of financial services. Presently, they are forced to organize themselves through various financial firms that meet the requirements of respective regulations.

There is potential for India to learn from some countries, and Australia seems to be near the top of that list. Even though the exact approach India adopts need not be the same, we need a shift towards a similar functional approach. Importantly, Australia’s journey of timely, prescient regulatory changes is in itself something Indian policymakers can learn from. Even though there is no perfect regulatory system, the focus should be on selecting the best fit for the country’s fast evolving economy.

One Response

Excellent article! We are linking to this great article on our site.

Keep up the good writing.