Since 2011, China’s P2P lending market has witnessed unprecedented growth. However, numerous high profile platform failures prompted the Chinese authorities to come out with a host of regulations at the end of 2016. This post is the first in a two-part series and takes a brief look at the explosive rise and the subsequent failures in the Chinese P2P lending industry.

China’s peer-to-peer (P2P) lending sector has emerged as the largest digital alternative finance sector in the world. In China, digital financial services, such as P2P lending, are generally referred to within the broad category of Internet Finance. This taxonomy includes both traditional financial institutions that have moved online and non-traditional financial platforms offering online financial products and/or services.

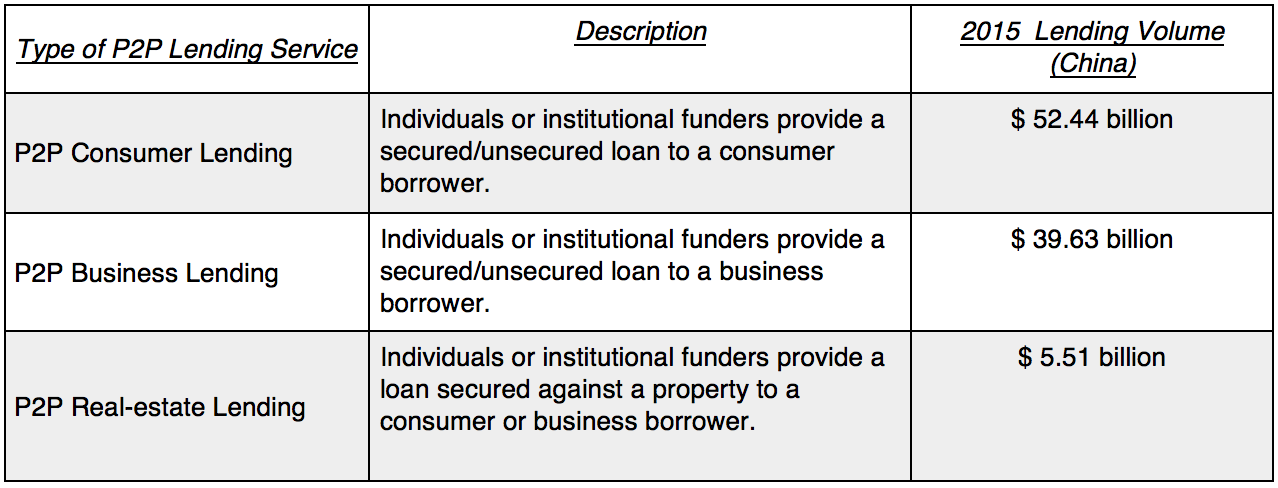

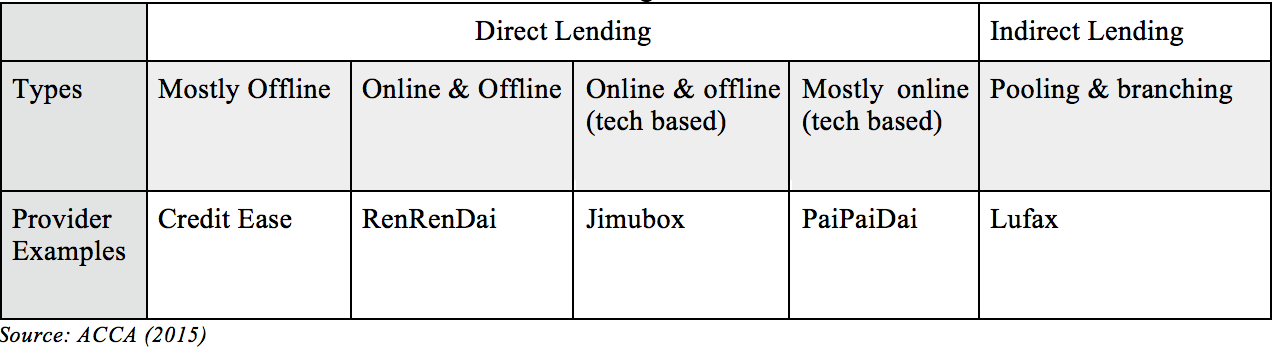

Box 1: Disaggregation of P2P Lending in China[1]

The Initial Boom

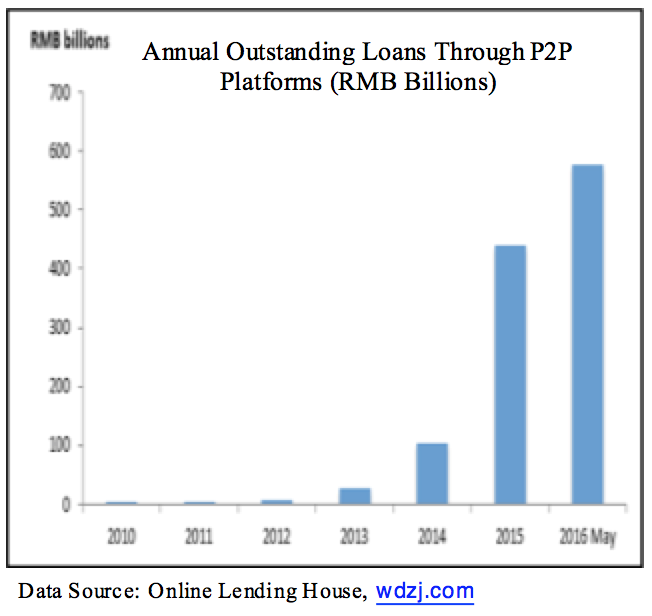

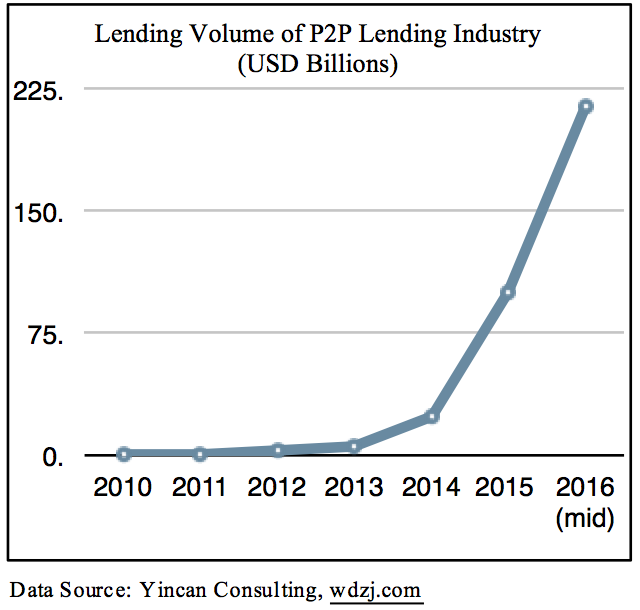

The first online P2P lending platform, ppdai.com, was established in China in August 2007. However, 2013 is widely seen as the watershed year for marketplace/peer-to-peer lending[2] in China.[3] Between 2013 and 2014, the market grew, in terms of lending volume, at a rate of 337% per annum, peer-to-peer (P2P) lending topped USD 100bn in China in 2015, soaring 248.3% versus the previous year. The number of active users of P2P also surpassed 9 million in 2016[4].

Box 2: Annual Outstanding Through P2P Platforms

Box 3: Lending Volume of P2P Industry

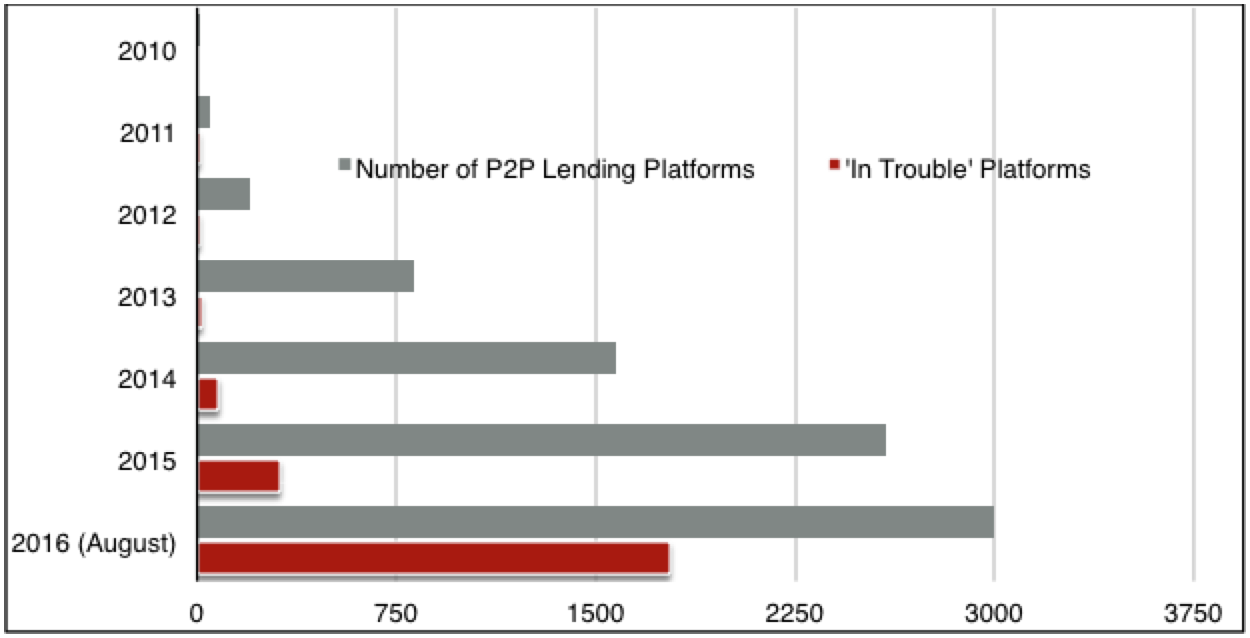

The number of platforms trading between 2013 and 2016 also increased rapidly: 800 platforms were trading at the end of 2013, 1575 by the end of 2014, and 2,364 as of March 2016.[5] [6] In comparison the P2P Lending market has developed much more slowly in UK and US, despite the first platforms in these countries predating China.

The Subsequent Busts and Consolidation

However this explosive growth led to a large number of “incidents” and platform collapses involving cash shortages, defaults, fraud and closures. These incidents have inflicted huge financial losses on lenders and the wider public, and led to instances of social unrest in certain areas of China. For instance Anhui province-based Ezubao, which until January 2016 was one of the top 10 largest P2P lending platforms in China, was shut down in early 2016 and 21 of its executives arrested for scamming 900,000 individual investors out of USD 6.7 billion. An estimated 95% of all borrower listings on Ezubao were fraudulent and the top executives used investor money to enrich themselves.[7] Other cases of fraud saw company bosses launching P2P platforms to fund their own businesses.

Box 4: Number of Operational Platforms vs ‘In Trouble’ Platforms[8]

During the first half of 2016, 515 P2P platforms were shut down.[9] By the end June 2016, there were 1,778 troubled P2P platforms, accounting for 43.1% of the total, according to the China Banking Regulatory Commission (CBRC).[10] Furthermore the number of newly created P2P lending platforms in China had declined at a rate of over 50% in April, compared to a growth rate of nearly 80% back in May 2015.[11] The number of platforms experienced a year-on-year decrease for the first time in the short history of P2P lending in China.

China’s financial authorities had initially enabled the P2P Lending Industry’s growth, and were content to let things develop without any government intervention. However, the increasing number of platform failures forced their hand and 2016 saw the introduction of a whole host of measures to regulate and guide the market. These measures — called the ‘Interim Measures’ — put a stop to some of the predatory and cavalier practices of P2P platforms and introduced provisions to control risks.

Some Determinants of the Chinese P2P Market: 2007 -2016

Four factors were instrumental in driving the growth of China’s Online P2P Lending Industry at an unparalleled speed: an open and supportive regulatory environment, enormous demands for inclusive finance from under-served segments, innovative business models and the entry of mainstream financial institutions in the market. But many of these factors also contributed to the building of customer and systemic risk in the sector which culminated in the series of platform failures.

- The regulatory environment

The Chinese government has been extremely forthcoming in its support for P2P platforms and internet finance in general. In recent years Chinese Premier Li Keqiang made multiple calls of support in the Report on the Work of the Government over 2014/15, stating that “Internet-based finance has swiftly risen to prominence”, with the imperative “to encourage the healthy development of … Internet banking”.[12]

Chinese platforms operated in a regulatory vacuum until 2016. They registered themselves as some variant of “information services” companies with the local Industry and Commerce office, then opened up their websites soliciting borrowers and investors with no official standards for disclosure and no formal regulation from the central bank or banking regulator.[13] It was unclear which watchdog agency should regulate the industry. Consequently, due to the fact that P2P platforms are not subject to any market entry rules, industrial criteria or regulatory monitoring, they had grown extremely fast.

But this loose environment was a double edged sword. While it created room for companies to build new financial products in traditionally underserved areas like consumer finance and small business loans despite the lack of reporting to credit reporting agencies, it made it easy for bad actors to defraud unwary investors. Interest rates were higher than those offered by banks, and returns to retail investors were high too — averaging around 13.29% in 2015.

- Limited financial services available for low income customers

Since the start of the policy era of market ‘reform and opening’ in the 1980s, a few massive State-Owned Commercial Banks (SOCBs) have dominated China’s financial system. These large banks have predominately financed large state-owned enterprises and government-related borrowers. Furthermore, the traditional credit market in China is subject to various restrictions such as interest rate caps and exchange rate caps.[14]

In order to increase the supply of credit SOCBs had initiated many schemes, however there remains a large ‘institutional gap’ when funding smaller enterprises, poorer individuals and household. According to data from People’s Bank of China, only 25.1% of individuals have got personal loan approvals from traditional banking institutions in 2014.[15] This has been largely attributed to the difficulty in accessing traditional banking institutions, complex and cumbersome application process and overtly strict eligibility criteria for wealth management products.

These under-served customers had an eager appetite for online P2P lending to fulfil their needs. Many P2P lending providers had also moved into consumer financing by offering a diversified range of lending services in areas where traditional banks have been too slow to operate – such as car financing, education and training, as well as mortgage financing.[16]

- Entry of mainstream financial institutions and other large enterprises in the market

Since 2014, state owned enterprises, private equity and mainstream financial institutions such as SOCBs gradually became involved in the P2P lending sector by buying equity stakes in the platforms. This swelled the average registered capital of P2P platforms to RMB 27.84 million (~ USD 4 million) in 2014, almost double the 2013 average. This enabled many platforms to take a trial and error approach to expand their customer base by offering low-price or even free services.[17]

- Innovative Business Models

In order to attract enough investors, P2P companies offered various investor-protection plans, and security schemes to guarantee the repayment of the principal and interest. And thus, platforms in China devoted a large pool of money and resources to building up offline risk control teams, thereby forming a so-called online to offline (O2O) business model.

While the Internet was used to obtain funding, offline processes were used to educate and consult with individual investors. Due to the relative lack of comprehensive credit information about borrowers, providers relied on offline modes for soliciting them and for carrying out credit investigations. However, many P2P platforms did not have specialised risk controls and credit check teams.[18]

A survey done by the Association of Chartered Certified Accountants (ACCA) captures the following distinctions amongst P2P lending provider business models in China, explained below[19] :

Box 5: Different P2P Lending Provider Models in China

These measures drastically increase the operational costs of P2P lending, contributing to the relatively higher interest rates compared to the commercial lenders in China.[20]

Box 6: P2P Loans for Home Mortgage Down Payments[21]

| The P2P lending industry has been a source for loans for down payments on homes. These P2P loans typically mature in 90 days and carry interest rates of up to 12%. Speculators applied for multiple mortgages from banks, increasing the overall systemic risks to the Chinese financial system. Many experts are worried that property speculation in China’s four biggest cities — Beijing, Shanghai, Guangzhou and Shenzhen — has reached new highs, largely due to unregulated P2P financing.[21] For instance, Lianjia.com, a Beijing-based real estate company and P2P lender which shut down in mid 2016, had lent up to RMB 3 billion (USD 430 million) alone. |

In the aftermath of these developments, the “Interim Measures” from Chinese authorities were aimed at the controlling the damage from platform failures. In the next post, we will analyse these measures and look at the subsequent lessons for Indian policymakers.

—

About the Future of Finance Initiative:

The Future of Finance Initiative (FFI) is housed within IFMR Finance Foundation and aims to promote policy and regulatory strategies that protect individuals accessing finance given the sweeping changes that are reshaping retail financial services in India – including those driven by Indiastack, Payments Banks, mobile usage and the growing P2P market.

—

[1] Source: https://home.kpmg.com/au/en/home/insights/2016/03/harnessing-potential-asia-pacific-alternative-finance-benchmarking-report.html

[2] Debt crowdfunding is more commonly known as peer-to-peer lending (P2P lending). It is the practice of matching borrowers and lenders through online platforms. The online lending company provides the platform for lending transactions. The borrower’s need for funding is published on the platform after a vetting process, and lenders provide funding. Another commonly used term for debt crowdfunding is market place lending, this is to allay confusion caused due to the increasing presence of institutional lenders on peer-to-peer lending platforms.

[3] See: https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/harnessing-potential.pdf

[4] See: http://www.iresearchchina.com/content/details7_26454.html

[5] See:http://www.globaltimes.cn/content/1003315.shtml

[6] As until recently there was no explicit requirement for P2P lending platforms to make regulatory filings or register with a regulator, the numbers and scale of P2P lending companies in China can only be calculated on the basis of some incomplete data.

[7] See: http://www.lendacademy.com/massive-7-6-billion-fraud-large-chinese-p2p-lending-platform/

[8] Source: WDZJ.com

[9] See: http://www.globaltimes.cn/content/1003315.shtml

[10] See: http://www.globaltimes.cn/content/1003315.shtml

[11] See: https://www.chinamoneynetwork.com/2016/05/26/chinas-p2p-lending-market-is-a-scammers-paradise

[12] See: http://www.mckinsey.com/industries/financial-services/our-insights/whats-next-for-chinas-booming-fintech-sector

[13] See: https://piie.com/blogs/china-economic-watch/p2p-series-part-1-peering-chinas-growing-peer-peer-lending-market#_ftn1

[14] See: https://www.brookings.edu/wp-content/uploads/2016/06/shadow_banking_china_elliott_kroeber_yu.pdf

[15] See: http://www.iresearchchina.com/content/details7_26454.html

[16] See: http://www.accaglobal.com/content/dam/ACCA_Global/Technical/manage/ea-china-p2p-lending.pdf

[17] See: http://www.mckinsey.com/industries/financial-services/our-insights/whats-next-for-chinas-booming-fintech-sector

[18] See: http://blog.lendit.com/wp-content/uploads/2015/04/Lufax-white-paper-Chinese-P2P-Market.pdf

[19] See: http://www.accaglobal.com/content/dam/ACCA_Global/Technical/manage/ea-china-p2p-lending.pdf

[20] See: https://ssrn.com/abstract=2827356

[21] See: https://www.ft.com/content/2cd149d0-e999-11e5-bb79-2303682345c8

2 Responses

I find it quite striking that the highest lending volume is in P2P consumer lending. To what extent do you think this is driven by customers seeking a better return on their funds? Lending to other individuals is after all not a new concept, and is quite prevalent amongst poor customers as well: you would lend to your neighbour in their times of need assuming they would do the same for you. Ignacio Mas calls it liquidity farming. So what is the expectation from lending to a stranger on a platform: the promise of higher returns? Or incorrect marketing by the firms? The former can be addressed through transparency in transactions, the latter becomes a consumer protection issue. So understanding the underlying reasons for adoption is critical.

Thanks for your comment Jayshree!

Indeed,the supply of funds from individual retail investors is a key reason for the growth of P2P lending in China. One of the few surveys done of P2P lenders in China, focusing on the largest Chinese P2P providers, revealed that by lending through the P2P platforms lenders have been able to increase the number of available investment channels and to get returns three to five times higher than the bank deposit rates — most lenders said that they usually bid for loans (median principal amount around RMB 3000) in a three-to-six-month term range and with interest rates in the 12% to 18% range. Another key reason that has attracted lenders was the investment guarantee schemes that many platforms offered. This practice has now been barred by the new regulations — more on this in the next blog. Another distinctive characteristic of the Chinese P2P market is that unlike US and UK, institutional lending has been slow to pick up; most individual retail investors invest on their own behalf or for family and friends.

The new set of regulations (‘the Interim Measures’) have taken to steps to increase transparency of transactions through mandatory public reporting requirements.