Keeping in mind the existing state of consumer protection measures in place for India, FSLRC has proposed a consumer protection framework for financial services, with the stated objectives being – to protect and further the interests of consumers of financial products and services; and to promote public awareness in financial matters. It is pertinent to mention here that the Commission has included, in its definition of retail consumer, not just individuals but also enterprises that avail a financial product or service whose value does not exceed a limit as prescribed by the regulator1, or who has less than a specified level of net asset value or turnover, also as prescribed by the regulator . The previous post mentioned the rights and protections that the draft Code sets out. Among these rights are the right against unfair contract terms and the right to redress of complaints.

The right against unfair contract terms

The Draft Code deems an unfair term of a non-negotiated contract2 to be void. A term is unfair if it causes a significant imbalance in the rights and obligations of the parties, to the detriment of the consumer, and is not reasonably necessary to protect the legitimate interests of the provider3. Further, the Draft Code enlists a set of factors that would be considered in determining whether a term is unfair or not – such as the nature of the service, the extent of transparency of the term, the extent to which the term allows comparison with other financial products or services, and the dependency of the term with the remaining contract and with other contracts under question. If a term was found to be unfair, the contract will continue to be enforced with the remaining terms as long as it can do so without the unfair term.

This is very much in line with the laws laid out in Australia, in as late as 2010, through the Competition and Consumer Act 2010. While Australia already had laws in place to protect consumers against unfairness in contractual dealings (ex: prohibition of unconscionable or misleading and deceptive conduct), this Act introduced a new ‘unfair contract terms’ regime to standard form consumer contracts4 under which courts can decide if a term in the contract is found to be unfair5, in which case the contract is void. However, the contract will continue to bind parties if it is capable of operating without the unfair term. Examples of unfair terms are set out in an indicative list in the law6.

The right to redress of complaints

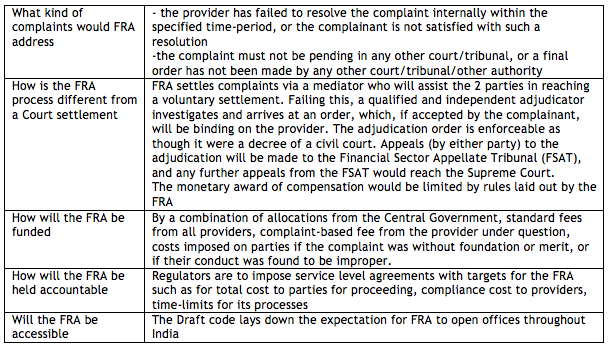

The Commission addresses this right in two steps – the first, is by placing a requirement on providers to have in place an effective mechanism to redress complaints internally, to inform consumers about their right to redress, and the process to be followed for it; and the second, is by having a statutory body external to the provider, that will be a unified grievance redressal system to redress complaints. This body termed the Financial Redress Agency (FRA), will replace sector-specific Ombudsmans currently in existence such as those for banking and insurance. Whether or not the FRA will replace the Consumer Courts (instituted by the Consumer Protection Act, 1986), will be decided later based on how well the FRA succeeds in its task.

FSLRC has also created a niche for consumer advocates to contribute to the regulator’s functions, through the creation of an Advisory Council on Consumer Protection. This body, with adequate representation from experts in the fields of personal finance and consumer rights, is expected to advice, comment on, and review the effectiveness of regulator’s policies. The regulator in turn is held accountable to respond to such proposals made by the Council, thereby bringing in an element of transparency to the regulatory decision-making process.

—

- This is not uncommon. In Australia, for instance, retail consumer includes small businesses, which are defined by s761G of Corporations Act 2001, as a business employing fewer than 100 people (if the business manufactures goods or includes manufacture of goods), or 20 people (otherwise)

- A non-negotiated contract is one in which the provider has a substantially greater bargaining power relative to the customer in determining the terms of the contract; and it is a standard form contract

- This however does not include a term that is reasonably needed to protect the legitimate interests of the provider, is a basic term such as the price of a product, or is a term required under any law or regulations

- All contracts will be presumed to be standard form contracts unless otherwise established. It is typically one that has been prepared by one party to the contract (the supplier) and is not subject to negotiation between the parties

- A contract term is considered unfair if:

- It would cause a significant imbalance in the parties’ rights and obligations arising under the contract, and

- It is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term, and

- It would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

- s25, CCA 2010. Some are given below: A term permitting one party (but not another party)

- to avoid or limit contractual performance or to terminate the contract

- to renew or not to renew the terms of the contract

- to unilaterally determine whether to determine whether the contract has been breached

- a term limiting one party’s vicarious liability for its agents

2 Responses

It would be meaningful if the Consumer Protection system recorded the Financial Services Provider’s record (FSP) – viz., – if they’ve recommended a set of products with reasonably expected outcomes, let the agent write this on the consumer’s consent/app form. Let this be evaluated on actual outcomes at future dates (where it is appropriate). Just like you have credit rating for borrowers, you then have a databank built up of “FSP credibility” on what they actually say. This will also prevent “overselling” by reps, that normally happens to meet targets, as they will be bound to record it. The last bit is what seduces those who know less about such things and may be gullible. Accountability then becomes meaningfully implementable.

All the other aspects are extremely relevant too, but the key is to ensure that the small guys aren’t sucked into things on hearsay. That’s my suggestion

@google-ececca0512775748dea679787f008417:disqus

Thanks for sharing your thoughts on building a ‘FSP credibility’ database, through possibly crowd-sourcing, or perhaps as a more formal regulator-led supervisory measure. Giving a documented record of recommendations has been a practice in other jurisdictions too. However, the important question would be that the provider cannot be held responsible for outcomes (such as markets and economic performance) but rather for the advice being suitable in the context of the needs, objectives and financial situation of the consumer, as analysed by the expert judgement of the provider based on information collected from the consumer.