This post is in response to an article, “Loan Defaults Versus Over-indebtedness in Rural Tamil Nadu”, published on the CGAP blog on June 10th, 2013. The article asserts that microfinance institutions (‘MFIs’) in the state of Tamil Nadu (‘TN’) in India are facing repayment problems. The article further states that repayment problems are due to the increasing indebtedness of the rural households, which in turn is caused by the availability of various funding options to households and increasing expense due to changing lifestyles, and further mentions that there are willful defaults by the borrowers. The assertion of repayment problems in TN and the reasons and assumptions put forth by the author do not corroborate with our experience and data. The article also ignores the recent development in regulation and the implementation of Credit Information Bureaus (CIBs) processes in the microfinance sector in India. The original article can be accessed at: http://www.cgap.org/blog/loan-defaults-versus-over-indebtedness-rural-tamil-nadu

Microfinance is typically availed by section of society that is financially vulnerable and politically sensitive. Any opinion on the sector, particularly expressed through a public portal, should be supported by reliable data and in-depth research. We feel that a comprehensive response to the article is required to adequately address the questions raised by the author.

IFMR Capital is a registered non-banking finance company (‘NBFC’) based in Chennai, Tamil Nadu, India. IFMR Capital had microfinance exposure across 23 states and 296 districts in India. This includes the state of Tamil Nadu. It tracks the loan-by-loan data on repayment of pools structured, arranged and invested in by it. IFMR Capital has so far conducted monitoring and field surveillance visits to MFI operations in 192 districts, 440 branches and 1181 centers across India and has deep on-the-ground insights into microfinance operations and risks in the country.

Are microfinance repayments suffering in Tamil Nadu?

IFMR Capital’s monitoring team visits centres and branch operations regularly as detailed above. During the financial year 2012-13 a total of 15 monitoring visits were conducted in Tamil Nadu covering 7 Microfinance Institutions, 18 districts, 49 branches, and 99 centre/group meetings. All these visits showed high percentage of collections (close to 100%). The few instances where instalments were missed were usually due to the borrower being unwell or traveling. In such cases, the joint liability was intact and other members contributed for the absent member. This continued even through the four months of near drought situation during which parts of Tamil Nadu struggled with low and erratic rainfall. Even during these difficult conditions the repayment by microfinance clients was not under stress. As of March 31st , 2013 the average PAR 30 across our six partner MFIs in Tamil Nadu is less than 0.09% for the preceding two quarters.

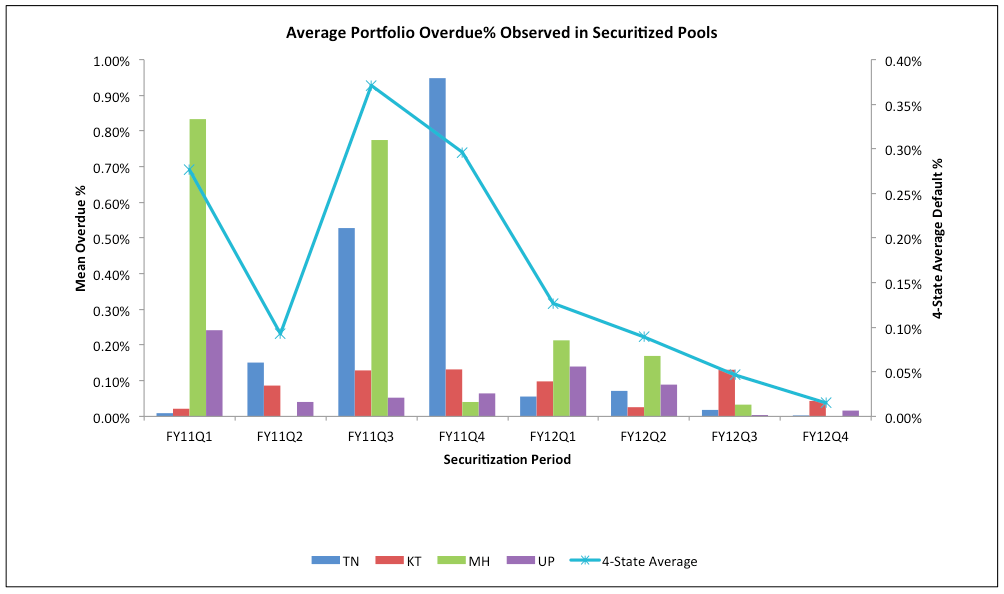

Collection efficiency of IFMR Capital’s securitized microloan pools has consistently been high. As on March 31st 2013, the average collection efficiency on 33 live securitized transactions, with pools originated from Tamil Nadu, was 99.82%. 24 of these pools had collections efficiency of 100%. Further, there is a decreasing trend in the observed default in the securitized pools from Tamil Nadu and other states.

The above chart shows that as of March-2013, there is a decrease in the observed portfolio overdue since the end of FY2010-11 based on the 55 microcredit pools securitized by IFMR Capital between March-2010 to March-2012 across the four states of Tamil Nadu (TN), Karnataka (KT), Maharashtra (MH) and Uttar Pradesh (UP).

Are rural households over-indebted?

The article mentions that rural households are chronically indebted and ‘are caught in a spiral of debt’ which effects their ability to repay microfinance loans. The article further asserts that microloans are rigid and force households to borrow more. There is evidence to show that low income households often borrow and repay frequently to finance the timing mismatch between cash inflows and outflows. It has also been documented that low income households depend on multiple, often informal, sources of finance (Portfolios of the Poor). There is however no evidence to conclude that these households would borrow from these sources beyond their repayment capabilities. Further, under the new regulatory regime for microfinance, all MFIs are required to enrol with credit bureaus. They contribute credit information to these bureaus and use credit bureau information to check for indebtedness of the borrower. By regulation, an MFI cannot be the third lender to a client. This has resulted in both responsible lending by the MFI and disciplined credit behaviour by the client.

MFIs now follow a stringent code of conduct and customer protection procedures. The collection mechanisms of MFIs are now well regulated and are designed to protect the borrower. Further, regulation has ensured that the MFI product details and terms are well documented, standardized and transparent. Transparency, documentation and standardization should not be confused with rigidity. Some MFIs have expanded their product suite to offer emergency loans, festival loans, water loans, sanitary loans and education loans to existing customers who have a good repayment track record.

The author’s assumptions that rural households are increasingly indebted and that lifestyle changes and needs are driving expenses faster than the real income need to rigorously tested. There is no substantive evidence to assume or conclude that:

- Rural households have increasing demand for consumer durables regardless of affordability

- Households continue to spend more on rituals even if the expenses are higher than wages

- Urbanized lifestyle, which also includes use of electricity, gas stoves, mobile phones and better transport, necessarily means that expenses are increasing more than income.

- Households will borrow more to meet increasing expenses rather than looking for alternate source of income or reallocating expenses.

Is microfinance forcing households to borrow more?

The article mentions microcredit as one of the many reasons for over-indebtedness. It would be wrong to assume in the first place that the mere availability of microcredit, or any source of funding for that matter, could cause over-indebtedness. It would directly imply that borrowers do not understand financial management and are ready to ‘consume’ loans thoughtlessly because loans are readily available and further that microfinance lenders are oblivious to the real consequences of such indiscriminate lending.

Microcredit is an alternative source of finance to poor households. It is unclear why the author has concluded that households only use microcredit for additional consumption and do not use microcredit to substitute informal debt. Microcredit is cheaper, standardized and transparent whereas informal credit is often very costly, unreliable and riddled with coercive collection mechanisms. In our experience MFIs actively encourage clients to borrow for income generation activities including for micro-enterprises. This is further verified through loan utilization checks. Many MFIs also pursue the complementary objective of livelihood promotion among their borrower base.

Are multiple borrowing options tempting microloan borrowers to default?

The Reserve Bank of India has significantly strengthened the regulatory framework for microfinance lending and also brought in comprehensive measures for customer protection. The Joint Liability Group (‘JLG’) model has acted as a deterrent against willful defaults. as the underwriting is done by the group. With the advent of credit bureau usage, willful defaults have decreased. Borrowers are aware that their credit history is being recorded and preserved by the bureaus and is being used by other MFIs to assess their credit worthiness. The author’s assumption that borrowers have little incentive to repay MFIs is not substantiated by observed behavior and is weak particularly in the new operating environment for MFIs.

Informal finance and social inequality

The question about the potential risks due to informal finance sources raised by the author is based on the assumption that ‘perhaps informal financing is high in south India’. It is unreasonable to state without any supporting data that informal sources of funds are higher or lower in a certain part of India.

Another question that the article raises is the possible link between the social inequalities and mass defaults in microfinance. We have not observed any localized or mass defaults on our portfolio of exposure to MFI partners in or outside Tamil Nadu.

Conclusion

Our portfolio exposure, loan performance data and on-the-field monitoring findings do not lead us to believe that there is a problem of over-indebtedness in Tamil Nadu. Neither do we have reasons to believe that there is any loss of legitimacy or trust that may cause client non-repayment and localized or mass strategic defaults.

6 Responses

Very focussed observations rebutting the conclusions made by Isabelle Guerin. Not sure if this has been forwarded to her for her comments. Yes, with institutional arrangements such as credit bureau, RBI’s norms for lending by MFIs, things have improved considerably and MFI financing has become client friendly. But, fact remains that MF per-se cannot be panacea for all the financial problems of the low-income-households be it in TN or elsewhere. It is just a supplementary in nature. Studies are needed to know if the clients of MFIs have grown in financial terms in proportion to the growth of the MFI promotors and if so, what proportion of them have grown, if not why? Sooner it is done, better for the secotr. Will IFMR take the lead?

Dear Santhanam, thanks for your comment. You have rightly mentioned that there has been significant progress towards ensuring customer protection, transparent pricing and information sharing through credit bureaus. I agree that microcredit may not be an absolute remedy for all the financial problems. There is a need to provide a wider range of services to the financially excluded. Institutions such as KGFS are working in this direction and have taken some commendable result oriented initiatives.

There are some studies conducted to assess the impact of microfinance on customer welfare and poverty reduction. But most of these studies have looked at a small time frame of 1-5 years. Social welfare and poverty reduction may not be achieved directly as a result of access to finance alone, but through access to better opportunities (like education, health services) which in turn become affordable when the household has access to finance. But this takes time and a study should take a far more comprehensive view (both in temporal and spatial coordinates) to effectively capture this impact.

TN will soon go the AP way. Just wait and see

The repayment data from MFIs is very useful to put the default claims of the CGAP blog in perspective. However, I wonder if , in the absence of efficient ways to measure and document cash-flows and returns on assets and activities of borrowers,

ad-hoc restrictions on borrowing and lending may be actually limiting the

financial leverage an economy (say a village in which the MFI is operating) is

capable of bearing ,i.e; a low debt/GDP ratio. This could explain high overall

repayment rates while at a JLG or individual level, there could still be

borrowers that are over-indebted and borrowers who are operating below their

‘optimal’ levels.

On the points related to MFIs being cheaper than informal credit and the merit in encouraging clients to borrow for income-generating purposes, it may be useful to compare some recent literature. Updated data from the Portfolios of the Poor households shows that informal sources can be cheaper when financing costs are compared as a part of a complex household portfolio over time rather than on an APR basis (http://www.cgap.org/blog/benefits-and-costs-financial-products-poor).

Poor Economics ( a recent book by Abhijit Banerjee and Esther Duflo) offers some interesting explanations on why there is an inherent limit in the amount of borrowing that can take place for ‘income-generating’ activities, despite MFI encouragement. The authors state that the local nature of most small businesses means that the return curves flatten out quickly and generating income beyond a point requires either larger amounts of capital, specialized skill or knowledge or access to missing infrastructure or markets which MFIs alone may not always be able to provide. ‘Consumption’ loans, as they are currently classified, will continue to occupy larger portions of a household’s loan portfolio until better products, both credit and non-credit are developed to address the needs that these loan satisfy.

Thank you

for your detailed response to my post. This gives me an opportunity to develop

in more details my arguments.

Method

First, let me give more details about the method. As you say, “Any opinion on

the sector,particularly expressed through a public portal, should be supported

by reliable data and in-depth research”. You are perfectly right. All the arguments of my

post draw on intensive research done over the last 10 years in Tamilnadu by an Indo-french research team based in Pondicherry and part of it has been published in various

journals. We use a large range of methods, including household surveys, but also qualitative tools such as semi-structured interviews, informal discussions, observation, immersion in the villages, repeated visits in the same villages and to the same households.

Repayment defaults

There are probably MFIs who are doing better than others and I was not talking

about all MFIs in Tamilnadu, I should have said this. What is true however is

that in some cases, and too often unfortunately, regular rescheduling practices

from MFIs allow them to show good repayment performances and hide repayment

problems.

Are rural households over-indebted?

You are perfectly right to point out that rural households are patching

together various sources loans. I may point out that it is exactly what I am

saying in the post. Contrary to what you say, I also argue that microcredit is

not the solely cause of over-indebtedness: it is an additional factor among

others. I have elaborated on this in a working paper

(http://www.rume-rural-microfinance.org/IMG/pdf_WP_14.pdf)

forthcoming soon as chapter in a book which deals exclusively with

over-indebtedness (Microfinance, debt and over-indebtedness, Routledge,

forthcoming next September). Even if microcredit is not the only factor, it may

contribute actively to over-indebtedness because of its rigidity. This has been

highly documented (including in the book Portfolio of the poor that you quote),

and most MFIs in Tamilnadu (maybe not all) are no exception to this: households

have to repay monthly while their incomes are highly irregular and sometime

unpredictable. This is developed in another working paper

(http://www.rume-rural-microfinance.org/IMG/pdf_Working_Paper_9.pdf).

I also strongly believe that for part of rural households, expenses are

increasing more quickly than real wages. I have documented this for manual

migrant workers (http://digitalcommons.mcmaster.ca/globallabour/vol3/iss1/6/).

Microfinance is part of the broader financialisation process that is currently

taking place in Tamilnadu and the very fact that consumption credit is

mushrooming everywhere is indicative of this.

Credit bureaus

Yes, I know that there is now a credit bureau in Tamilnadu and this is very

good news. Credit bureaus are a necessary but not a sufficient condition to

prevent multiple

borrowing and over-indebtedness, for various reasons:

– Informal debt is not taken into account; yet in rural Tamilnadu, informal

finance still represents the major part of outstanding debt (80 to 90% on average according to our estimates)

– Some borrowers may find ways to escape from it, for instance by using the

name of friends or relatives

you say: “Microcredit is cheaper, standardized and transparent whereas

informal credit is often very costly, unreliable and riddled with coercive collection

mechanisms”.

In all the places where I have been working, this is wrong.

– Although some microfinance institutions are likely to be transparent, many

are not. Informal finance neither has the monopoly nor exclusivity of social

pressure, intimidation or harassment. It is now well established that group lending,

which is still prevalent in Tamilnadu, implicates high social and opportunity costs. Neither is individual lending an exception to this. As I argue in the post, microfinance is often embeddeded into local networks of influence, with powerful leaders in charge of recruiting clients and enforcing repayments. This has also been documented in detail by Ramesh Arunachalam in various parts of south-India (http://microfinance-in-india.blogspot.fr)

– As for informal sources, they are not necessarily more expensive (especially

when taking into account opportunity and transaction costs). Moreover, in order

to really understand how and why people juggle with various sources, we have to

take into account the diversity of criteria people use (with are both financial

and social). We have documented this in detail in a paper, using a combination

of quantitative and qualitative data (Guérin I. Roesch M. Venkatasubramanian G.

D’Espallier B. (2011) Credit from whom and for what? Diversity of borrowing

sources and uses in rural South-India, Journal of International Development,

(24): S122-S137

– Of course these informal financial arrangements are both shaped by and

constitutive of local hierarchies (such as caste, class and gender). Many

informal lenders are from upper castes and deliberately use debt to tie down

labour, restrict land access or build political allegiances. So I am not saying

that informal finance is better than microfinance. However, insofar as many

informal lenders play a fundamental role of protection and acts as brokers for

a large number of resources, they are not likely to disappear. We have also

documented this in another paper, here too using a combination of quantitative

and qualitative data. (Guérin I. D’Espallier B. Venkatasubramanian G. (2012)

Debt in Rural South India: Fragmentation, Social Regulation and Discrimination,

Journal of Development Studies, DOI:10.1080/00220388.2012.720365 [early view].

You say: ‘In our experience MFIs actively encourage clients to borrow for income generation activities including for micro-enterprises’.

Over the last 10 years, with my colleagues we have done a number of household

surveys and collected data on microloans uses. The share devoted to income generating activities hardly exceeds 20%. And the reasons for this are quite clear: the

rural poor are rarely interested in starting a business, as they are very much

aware of the risks. Local demand is rather low and most markets are already

saturated. Market segmentation along caste, class and gender lines is an

additional limiting factor. We have documented this in detail a working paper

(forthcoming soon on www-microfinance-in-crisis.org), here again drawing on a

combination of qualitative and quantitative data.

With regard to borrowing patterns in various parts of India, NSSO data clearly

show that debt, whether formal or informal, is on average much higher in

south-India.

My post aimed at bringing attention to some weaknesses of the microfinance industry

in Tamilnadu. For the well-being of the population and the sustainability of the

whole industry, I think it is fundamental not to turn a blind eye to this.

With 3 decades of filed exposure in rural and micro financing in Tamilnadu, I share my views on Isabelle’s posting and V. Anand’s response

Regarding repayment I agree with Isabella’s assertion “ too often unfortunately, regular rescheduling practices from MFIs allow them to show good repayment performances and hide repayment problems” This glittering performance at MFI/SHG level is to get good rating and avail further funds. Here sources of funds for repayment matter seriously often ignored by researchers and the lending institutions. “All that glitters is not gold “ ( more details discussion in CGAP blog – Richard Rosenberg posting on Over indebtedness” and my responses) Sources for repayment is mostly from informal money lenders . It is also reported along the growth of MFIs , money lenders also grew .

In regard to use of micro credit , non supervised lending with no credit planning facilitated the poor for using Micro credit more for consumption and low share went for IG activity (20% as reported by Isabella) It is also true in the context of market saturation with excess of micro credit ventures in a given area relative to its potential and too many lending institutions besides informal ones competing unethically.

Regarding the end question ( posted in CGAP Blog by Isabella ) on inclusion of informal finance, I consider it is a must for prudent micro credit planning and rural credit planning as well . From time immemorial , prevailing adage on rural debt, “ Indian farmers is born in debt, lives in debt, dies in debt and bequeaths the debt” ( now suicide in debt) indicates how debt has become historically part and parcel of rural life system. Therefore, from the client’s perspectives at household level, the functioning of credit (money) and its implication on their livelihood in terms of debt burden and financial stress would be the same regardless of the type of sources of credit be it formal or non formal or informal. The inclusion of informal finance would therefore facilitate for assessing the level of debt absorbing capacity and repaying capability of the individual households and exercising caution for avoiding overheating the household economy while further advancing.. In view of this informal finance remaining as an integral part of household economy or financial portfolio , inclusion of the finance would become essential for making meaningful analysis on the subject. But data asymmetry poses a major problem.

In this regard regulation and credit bureau as you referred to can do little and also could cover debt scenario only partially . Perhaps for this exercise, the ways and means may have to be explored for capturing data on informal finance in a given area deploying social anthropological tools, ethnographic approach , discussion with FGD, SHG, Local VIPs etc .

The second question on integration of MF with local social capital and local value system, assumes importance as it helps for responsible lending without inequality implication among the rural in general and poverty segment in particular.. The social engineering process for such integration need to involve activities such as Participatory planning right from identification, prioritization ( for the bottom poor) , designing products, sequencing them, close monitoring and counseling , client protection, accountability to all the stake holders, through local social network . BRAC –CGAP graduation model is worthy emulation. We have rural banks but no rural bankers. (Lessons from RRB in India) It needs further probe.

In the last in the context of persisting over indebtedness and default problem over a long period, the regulation , supervision and credit monitoring and nascent Credit bureau are necessary but not adequate for challenging the said problem effectively. In the context of political galvanization of SHG and micro credit in Tamilnadu state , I agree the need to understand the loan default complexities in socio political and cultural context adding ethical dimension also in the demand side instead of confining to economic and institutional perspectives at surface level in rural financial landscape.

Thank you for sharing my views

Dr Rengarajan.