The informal sector households in India are more likely to incur catastrophic health expenditure (CHE)[1] due to low-income levels and the lack of a safety net. Excluded from the government social insurance programs and unable to afford the private insurance packages, community-based health insurance (CBHI) has evolved to cover them against such health shocks. VimoSEWA is one such model in India, which shows the strength of community-level intervention and support.

National Insurance VimoSEWA Cooperatives Ltd.

VimoSEWA is the microinsurance intermediary under the trade union SEWA targeting informal workers from SEWA[2] and other MFIs and NGOs associated with the union. It became a cooperative in 2009 and has 84000 members as of 2019. SEWA’s long-standing work of decades has built trust among its members, which extends to the insurance products of VimoSEWA. This social capital encourages pooling of resources and has hence been recognised as an important factor in the success of CBHI entities like VimoSEWA.

Functions

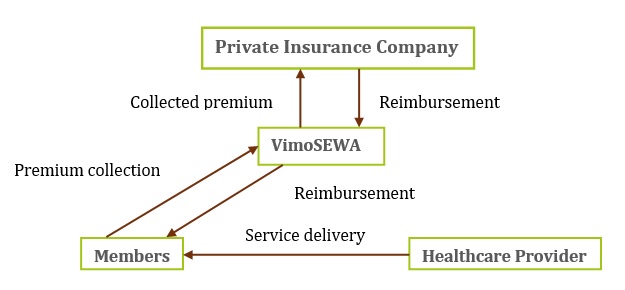

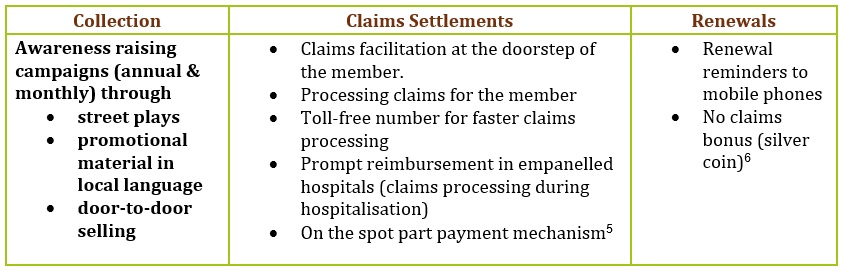

VimoSEWA acts as a microinsurance agent for insurance companies like Life Insurance Corporation of India (LIC), Larsen & Toubro (L&T), New India Assurance etc. The strength of the cooperative is in its understanding of the informal sector market and its frontline staff, which is tasked with awareness generation, premium collection, and claims settlements (Table 1). Its coordination with SEWA Health and SEWA Bank has helped in its functioning and in addressing issues of fraud, affordability, and awareness. It has primarily helped in transferring the burden of filing claims and selecting good quality inpatient facilities from the members to the VimoSEWA staff. The model provides performance-based incentives to the frontline agents (VimoAagewans[3] and VimoSaathis[4]) to promote uptake and renewals rather than sales.

Figure 1: Mechanism of Operation

Table-1: Functions of VimoSEWA

Most microinsurance agents perform the function of collecting proposals, premiums and settling claims. VimoSEWA goes beyond this minimum mandate and takes steps to increase uptake and facilitate easier claims settlement. The awareness generating campaigns help to increase enrolments and collections while the in-house claims department[7] facilitates early settlements (Table 1). The primary reason for their success in community participation is the trust built through SEWA’s work. The union initially provides support and solutions to the most pressing challenges of the community and invests in skill-building of the youth who become Aagewans. These frontline workers, being a part of the community, can then play a vital role in creating awareness of the importance and need of insurance.

VimoSEWA acts as the microinsurance agent for a range of products, most of which is through its partner insurance companies. For its health insurance products, it currently has partnered with L&T and New India Assurance. In such cases, it carries out all the functions associated with insurance except carrying the risk. One product, namely the Saral Suraksha Yojana, is manufactured by the cooperative itself. This is the only product where the cooperative carries the risk and it was made complementary to the RSBY[8] scheme by providing add on benefits of wage cover during hospitalisation. Although the Microinsurance Regulations 2015 prohibit microinsurance agents from producing and marketing their own products, the regulator has probably taken a lenient view here since they serve an underserved market. The cooperative has plans of growing into an insurance company itself to be able to provide more tailor-made packages to the informal sector.

Addressing the issues of moral hazard and adverse selection

The issues of fraud and adverse selection plague VimoSEWA’s schemes as well. They have addressed the former through blacklisting hospitals that inflated claims. However, the latter was a major issue since the claims ratios had exceeded the premium collections consistently. Although the membership is through the women of SEWA, the entire family is covered by the schemes. This has helped from a risk management perspective as a safeguard against adverse selection.

The cooperative has created a network of hospitals through tie-ups with those run by trusts or even private hospitals that have a social service agenda. VimoSEWA directs its members to these hospitals by providing incentives such as full cover in the network hospitals. These two measures have helped reduce the tendency of moral hazard on the part of the providers.

Sustainability concerns

In 1999, VimoSEWA started providing a bundled insurance product covering accidents, hospitalisation, disabilities and life. However, 90% of the claims were related to health insurance. The claims ratio had exceeded 100% despite hikes in premium amounts. To counter this tendency, the sales mix was readjusted to increase the share of life insurance products which have lower claims incidence.

The board also restructured the remuneration of the staff to incentivise higher premium collection rather than membership to bring the gross margin in line with the acquisition cost. The consequence of this trade-off was evident in the decrease in membership following the increase in premium. This has now, however, stagnated to an equilibrium level. VimoSEWA has moved from a greater percentage of full-service models to a more balanced portfolio with mutual and partner-agent products. This helps in decreasing the servicing cost, which is essential for the sustainability of a microinsurance institution.

The incidence of a natural calamity (Bhuj earthquake in 2001) and communal violence (Gujarat riots in 2002) increased consumers’ understanding of the necessity of insurance due to its risk-mitigating benefits[9]. At the same time, VimoSEWA realised the importance of reinsurance to account for such covariant risks. However, despite these challenges, VimoSEWA is one of the more successful models in India and has been sustainable since 2013-14 and has recently become profitable.

Conclusion

VimoSEWA’s model of community-based health insurance has played a significant role in providing insurance cover to the informal population engaged with SEWA. For India’s informal non-poor, who are largely left out of both government and commercially provided insurance schemes, models such as that of VimoSEWA’s provide a pathway to distribute insurance. Their strength lies in the social capital they enjoy, the deeper understanding of local requirements and the ground level presence of its staff, which provides product awareness and claims support where required. Such efficient CBHI entities should have a pathway to become full-service insurance companies to cater to the informal segments in India, which would then allow them to use their local knowledge to design suitable products. The current regulations, which require a capital requirement of 100crores to become an insurance company is a critical barrier to this. To this extent, the Committee on Standalone Microinsurance Company’s recommendation to reduce this capital requirement to 20 crores would be a key step forward. Additionally, to ensure protection against large claims payout, the regulator could also facilitate reinsurance. The larger commercial players for whom entities such as VimoSEWA act as agents, can then take the role of a reinsurer. These measures would help CBHIs like VimoSEWA become viable alternatives to serve the underserved market of informal workers.

The author would like to thank Mr. Shree Kant Kumar (CEO, VimoSEWA) for his inputs which helped refine this post.

[1]CHE is defined as out of pocket spending on healthcare that exceeds a certain proportion of a household’s income. WHO proposes considering more than 40% of the household’s non-subsistence income as CHE.

[2]SEWA is a trade union of women workers in the informal labour market (home-based workers, producers, vendors, manual labourers, and agricultural workers).

[3]VimoAgewans are frontline staff, paid a monthly fixed moratorium along with a variable component which is a function of the amount of premium collected.

[4]VimoSaathis are part-time employees who earn a commission only on the premium they collect.

[5]Local representative reimburses member during the first visit for expenses made till then and the rest is reimbursed at the time of discharge.

[6]Beneficiaries get a silver coin at the end of three years if they had no claims but got their insurance renewed for the fourth year.

[7]Unlike other intermediaries, the claims department goes beyond mere documentation assistance and provides door-step delivery, conducts investigations and scrutiny of claims as well as claims settlement.

[8]The Rashtriya Swasthya Bima Yojana (RSBY) is a government-run health insurance program that started in 2008. It was subsumed by PM-JAY in 2018.

[9]The enrolment increased dramatically from 30,000 to 92,000 following the earthquake.

Acharya, A.,&Ranson, M.K. (2005). Health Care Financing for the Poor: Community-based Health Insurance Schemes in Gujarat. Economic and Political Weekly, 40(38), 4141-4150. https://www.jstor.org/stable/4417170

Benni, N.,&Barkataky, R. (2018). The Role of the Self Employed Women’s Association (SEWA) in Providing Financial Services to Rural Women. Rome. Food and Agriculture Organization of the United Nations (FAO). http://www.fao.org/3/CA2707EN/ca2707en.pdf

Donfuet, H.O., & Mahieu, PA. (2012). Community-based health insurance and social capital: a review. Health Economics Review, 2(5). https://healtheconomicsreview.biomedcentral.com/articles/10.1186/2191-1991-2-5#citeas

Garand, D. (2005). VimoSEWA, India- Good and bad practices in Microinsurance. CGAP Working Group on Microinsurance Good and Bad Practices- Case Study No. 16. https://www.ilo.org/employment/Whatwedo/Publications/WCMS_122472/lang–en/index.htm

Inamdar, T. (2017). VimoSEWA: A capability assessment of the company’s aspiration to build a scalable, sustainable micro-insurer. https://sewainsurance.org/wp-content/uploads/2020/09/Report-3.pdf

Xu, K., Evans, D.B., Carrin, G.,& Aguilar-Rivera, A.M. (2005). Designing Health Financing Systems to Reduce Catastrophic Health Expenditure. (Technical Briefs fro Policy Makers Number 2). World Health Organisation. https://www.who.int/health_financing/documents/pb_e_05_2-cata_sys.pdf

IRDAI (Micro-Insurance) Regulations’ 2005. https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo109&flag=1&mid=Insurance%20Laws%20etc.%20%3E%3E%20Regulations

IRDAI. (2020). Report of the Committee on Standalone Microinsurance Company. https://sewabharat.org/wp-content/uploads/2020/11/Report-of-the-SAMI-Committee-19.8.20.pdf

Oza, A., Dalal, A., & Holtz, J. (2013). VimoSEWA’s Resurgence: Increasing Outreach and Managing Costs in a Voluntary Stand-alone Microinsurance Programme. Microinsurance Paper No. 25. International Labour Organization. https://sewainsurance.org/wp-content/uploads/2020/09/Report-1.pdf

Ranson, M. K., Sinha, T., Gandhi, F., Jayswal, R. & Mills, A.J. (2006). Helping members of a community-based health insurance scheme access quality inpatient care through development of a preferred provider system in rural Gujarat. National Medical Journal of India, 19(5), 274-282. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1847540/

Sinha,T. (2017). VimoSEWA – An Insurance Cooperative for, with and by Women. In Miles,K., Wiedmaier-Pfister, M., & Dankmeyer, MC. (Eds.), Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons. Federal Ministry for Economic Cooperation and Development (BMZ). https://www.ifc.org/wps/wcm/connect/4dbd983e-2ecd-4cde-b63e-191ffb2d48e6/Full+Women+%26+Inclusive+Insurance+BMZ_Web.pdf?MOD=AJPERES&CVID=lK1xhtq

One Response

Great Post