This post is the first post in a new blog series that would delve and deliberate on different aspects of designing a framework that would enable a credit institution to identify the exposure to extreme events and to estimate the potential losses due to such events.

Risk premium is one of the components of the cost of providing credit. It is important to understand the nature of underlying risk for estimating the real cost of credit. Historical repayment behaviour may provide significant insights to enable reasonable estimation of credit risk; however, the estimates may be limited to losses experienced in the past. For example, it is possible for a credit institution based in North-West India to have never experienced losses due to a devastating earthquake in its ten year long vintage. But it is not prudent to rule out the potential losses due to an earthquake in future; particularly when the geography is prone to experience devastating earthquakes. The key is to assess the potential risk of events which may have low probability of occurrence, in fact may not have occurred in last 20-30 years at all, but have potential for high impact.

Natural disasters come to mind immediately but these are not the only ones that should be reckoned with to estimate the real risk. Man-made disasters such as industrial accidents, terrorist attacks, and riots are some obvious examples of non-natural disasters. However, other man-made activities such as deforestation, mining, and construction may also lead to seemingly natural disasters. An article in The Hindu daily provides an interesting discussion on this causal relationship.

The focus of this blog series is not to delve into the reasons of such extreme events but rather to initiate a discussion on the design of a framework which would enable a credit institution to identify the exposure to extreme events and to estimate the potential losses due to such events. However, before designing a framework it is important to identify events the framework should address.

Extreme Events

The extreme events discussed here typically have following characteristics:

- Uncertainty on the time of occurrence: There is usually a reasonable uncertainty on when the event could occur. For example it may be known 72 hours before a cyclone could hit the eastern coast but there may not be any inkling of the cyclone, say, a week in advance. Scientific advances have made it possible to predict some of these events but the time frame between the warning and the occurrence is usually very small.

- Nature of Impact: Impact is almost always disastrous in nature. However, an unexpected technological innovation could effectively throw an established technology giant out of business, hence a disastrous event for the company, but nevertheless a positive event in a broader frame of reference! But, in this blog we are not focussing on such good-bad or bad-good events.

- Large scale of impact: The event has to have an impact on a very large scale. A land slide impacting a couple of houses, though tragic and disastrous for the families, may not qualify as an extreme event.

However, the impact need not be instantaneously realised. For example, droughts qualify as extreme events but usually make the impact over a longer period of time, unlike earthquakes.

Also, an event, disastrous in nature on a large scale, may occur periodically, e.g. floods in certain rivers may impact the geography almost every year. Such events, though classified as extreme events, will need different approach for risk measurement. Residents and institutions in geographies regularly affected by periodic events develop, over the time, various mitigation strategies to minimize economic losses. We plan to discuss in some detail such cases in a later post in this series.

Framework

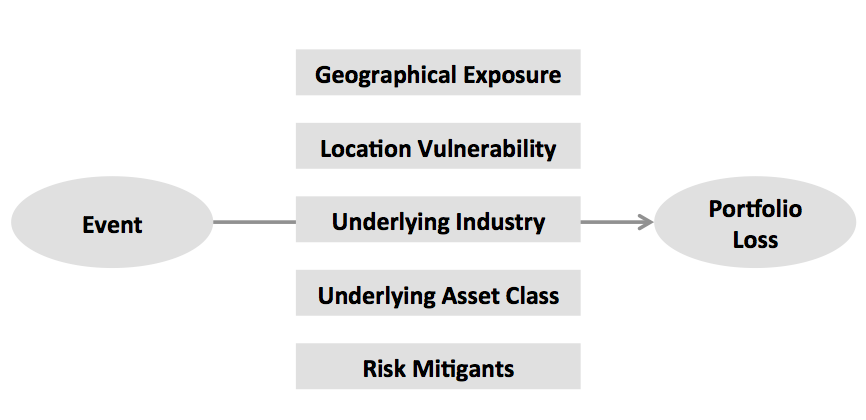

The framework should enable a credit institution to measure its portfolio exposure to extreme events and to estimate the expected and unexpected losses due to such events. Ideally it should mimic the linkages between the occurrence of the event and the eventual losses in the portfolio.

Figure 1: Linkages between the event and the eventual losses

The key components of such a framework should include:

- Mapping Module: To standardize and map the exposure and risk factors like location vulnerability and industry clusters to geographies at a granular level. This is a data intensive module and forms the backbone of the framework.

- Impact Module: To estimate the loss if an event actually occurs. This, in our opinion, is the trickiest bit to put in place; partly because the loss data is not available always and partly because the nature of impact and the eventual response depend on various factors such as asset class, underlying industry, credit policies, relief activities, past experience, and risk mitigation tools available to borrowers and institutions.

- Simulation Module: To simulate! Based on the probability and severity assumptions, the module can use the Monte Carlo simulations to generate various extreme event scenarios and estimate the eventual loss distribution.

In the subsequent blog posts we plan to discuss in detail each of the above modules.

—

As part of our blog series on the recently held Spark sessions, Vaibhav presented his thoughts on the framework at one of the talks. You can view the video & the presentation from his session below:

Presentation:

Video: