By Biswaraj Paul Choudhury, Intern, Dvara Research[1]

Micro, Small and Medium Enterprises (MSME) are often referred to as the “backbone of the Indian economy” (Confederation of Indian Industry, 2018) and for good reason. In the year 2015-16, the sector accounted for 28.77% of the Gross Domestic Product (GDP) and contributed to a third of India’s manufacturing output (Government of India, 2018) (Confederation of Indian Industry, 2018). The MSME sector also employs upwards of 110 million people in rural and urban India (data for 2015-16 (Government of India, 2018)). This is nearly 24% of the total working population (IMA, 2017) in 2015-16. The sector is, therefore, a critical catalyst for the socio-economic transformation of the country, given its wide geographical spread, the diversity of its activities ranging from manufacturing, digital finance, trading and services as well as employing Indians from across social backgrounds. However, the sector’s potential for economic transformation is fettered by the challenges it faces like access to formal finance. Recent policy recommendations are directed at increasing the sector’s access to formal finance by encouraging digitisation of MSMEs and their use of technology-driven platforms. Digitisation is also expected to improve the governance of enterprises and reduces their costs of operation. (Government of India, 2015)

The increased policy focus on digitisation of the MSME ecosystem calls for an assessment of the ability of the sector to integrate into and benefit from the digital ecosystem. In this post, we examine the preparedness of the MSME sector to adopt digital platforms and report on the trends for adoption of Information Technology (IT) by MSMEs in 2015-16. Specifically, we use the first-ever nationwide dataset on the use of Information Technology (IT) among MSME, as captured in the 73rd National Sample Survey (NSS) data on unincorporated non-agricultural enterprises in India, to analyse:

- the use of computers and the Internet across states and explore its relationship with the telecom density of the state.

- the use of computers and the Internet across different sectors

- the use of the Internet for availing of digital financial services among large enterprises (those with more than 10 employees)

Data Analysis

Methodology

To understand the existing pattern of use of computers and the Internet among MSMEs, we use the NSS data. The 73rd round (July 2015 to June 2016) of the National Sample Survey (NSS) reports data on the use of computers and the Internet by all unincorporated, non-agricultural enterprises (estimated at 6.34 Crore) along the key economic and operational data (Government of India, 2017). This dataset on the use of information technology is the first of its kind. The 73rd round survey also incorporates a new survey block to capture the specific use of information and communication technology (ICT) for availing of digital financial services like Internet Banking and Digital Finance for enterprises with 10 or more workers. (Government of India, 2017). We use this data to analyse:

- state-wise use of internet and computers by MSMEs;

- sector-wise use of IT by MSMEs; and

- the use of Internet Banking and Digital Finance in MSME enterprises with more than 10 employees

Assumptions:

- For this analysis, we have assumed that the monthly turnover of the enterprises is uniform.

- Further, we use the turnover based MSME definition approved by the Union Cabinet in February 2018 (Government Of India, 2018)[2].

Juxtaposing this turnover-based definition on the monthly turnover data as reported in the dataset has led us to estimate that 99.896% of the enterprises are Micro enterprises, 0.104% and 0.001% are Small and Medium enterprises respectively.

Key findings:

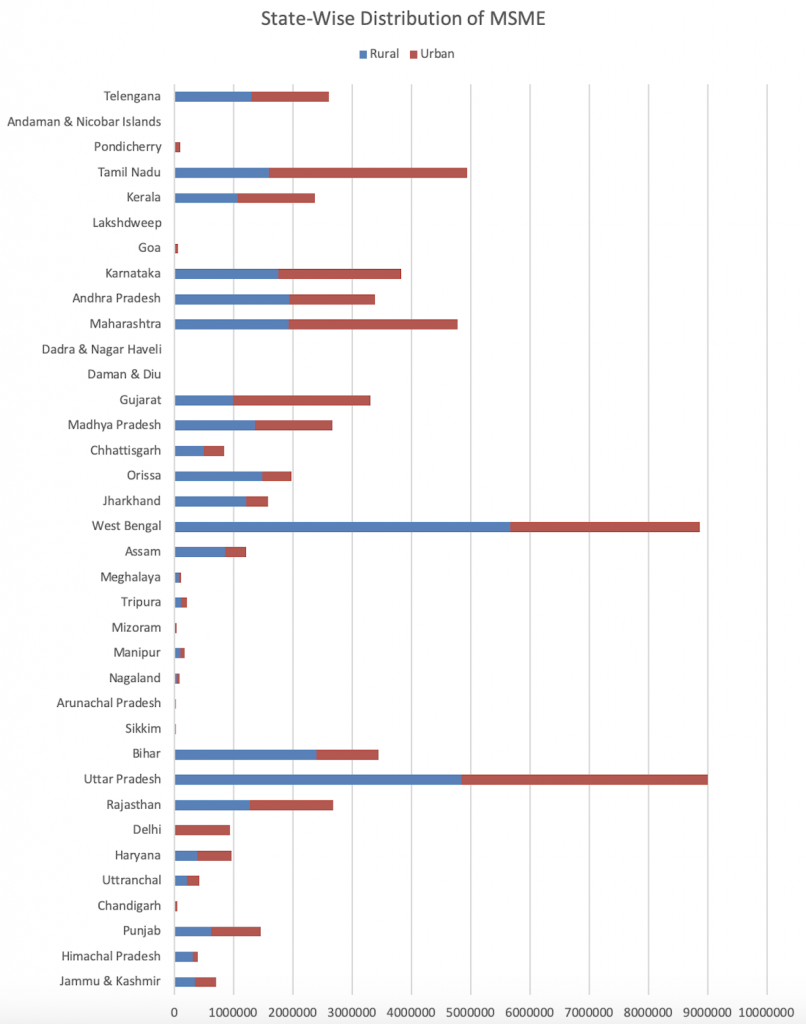

I. State-wise distribution of MSME:

The concentration of the MSME sector exhibits high geographic disparity. Uttar Pradesh accounts for nearly 14% of all MSMEs in the country. The top four states together (Uttar Pradesh, West Bengal, Tamil Nadu and Maharashtra) account for a little under 40% of all enterprises. In the two leading states of West Bengal and Uttar Pradesh rural MSMEs outnumber urban MSMEs, with the difference being very pronounced in West Bengal. The chart below presents the state-wise distribution of MSMEs.

Figure 1: Estimate of MSMEs per state: Rural and Urban

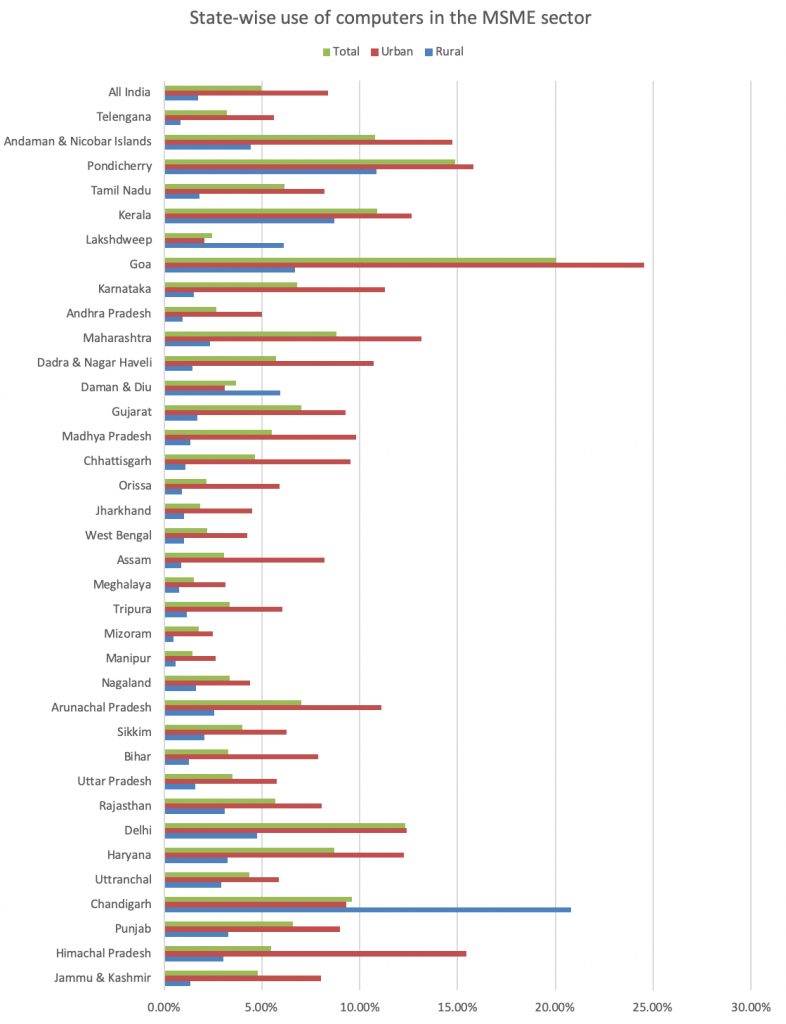

II. State-wise use of computers in the MSME sector

At the aggregate national level, only 4.96% of MSMEs report the use of computers. Disaggregation by region reveals that 8.36% of urban and 1.73% of rural MSMEs use computers at the national level. The top four states show significant disparity in MSME’s use of computers. In both Uttar Pradesh (3.51%) and West Bengal (2.19%), the use of computers is significantly lower than the national average. These states together account for nearly 28% of all enterprises. The use of computers in the other two top states i.e. Tamil Nadu (6.15%) and Maharashtra (8.79%) are well above the national numbers. The chart below presents the state-wise use of computers in the MSME sector.

Figure 2: State-wise use of computers in MSMEs: Rural, Urban and Total

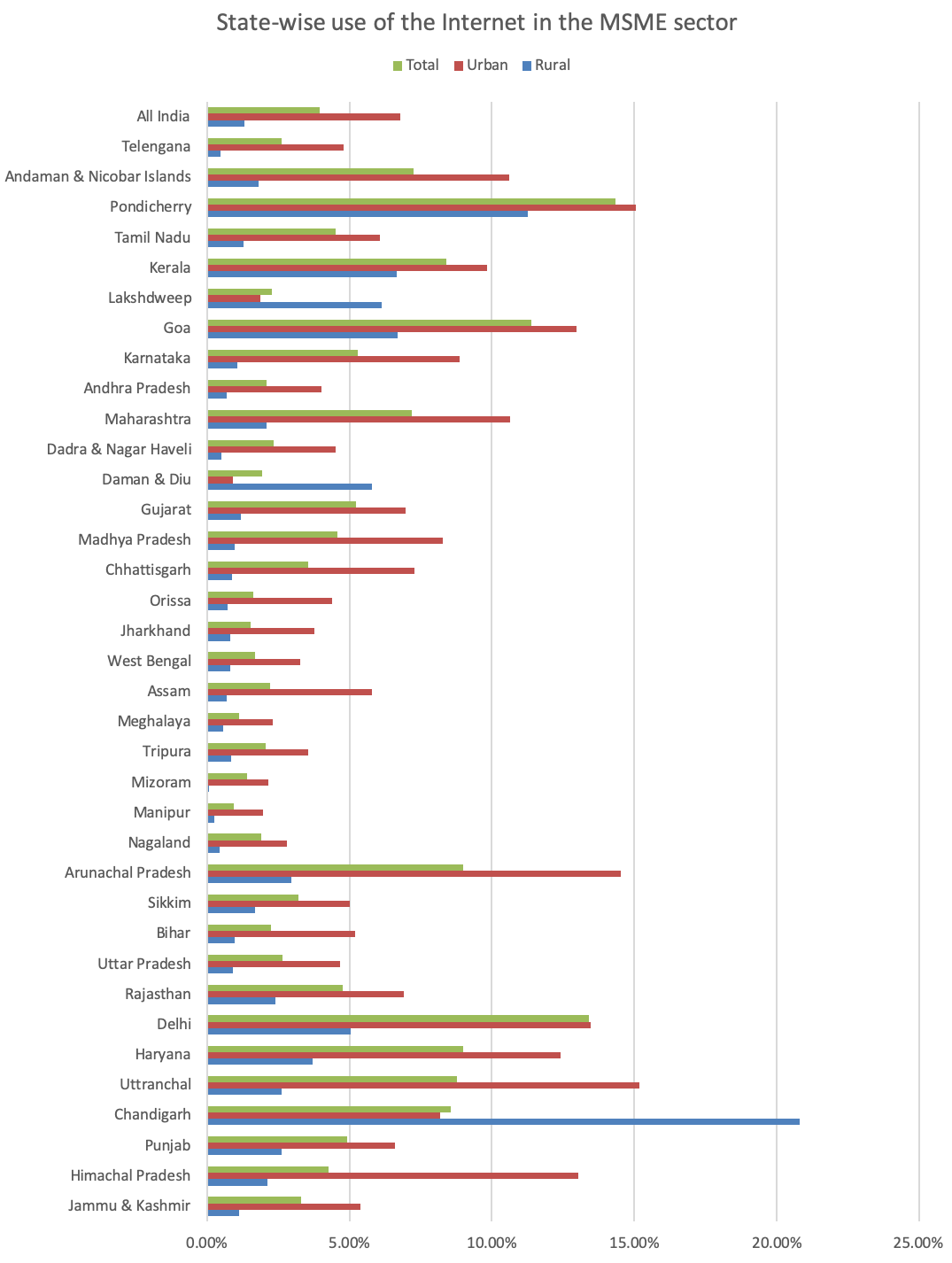

III. State-wise use of the Internet in the MSME sector:

Though the pattern of use of the Internet mimics the use of computers across states, i.e. states with higher computer usage also exhibit higher usage of internet, the percentage of MSMEs using the Internet is lower than those using computers, in most cases, including at the national level. At the national level, nearly 3.96% of all enterprises use the Internet, as compared to 4.96% of enterprises using computers. This pattern is also observed across the four leading states. In Uttar Pradesh, about 2.65% of all enterprises report using the Internet. The comparable numbers for West Bengal, Tamil Nadu and Maharashtra are 1.69%, 4.52% and 7.18% respectively. On average, it is reasonable to conclude that not every enterprise using computers also uses the Internet. However, there are a few exceptions. In Uttaranchal, the percentage of MSMEs using the Internet is nearly twice of that using computers. Similar outliers include Delhi, Haryana and Arunachal Pradesh. The features of the MSMEs in these states merit further analysis. The graph below presents the state-wise use of the Internet in the MSME sector.

Figure 3: State-wise use of the Internet in MSME sector: Rural, Urban and Total

We assessed the effect of telecom infrastructure on observed Internet adoption. We tested this by juxtaposing the NSS dataset with the state-wise tele-density data (Government Of India, 2017). Our analysis suggests that the percentage of MSMEs adopting the Internet in each state/union territory is mildly correlated to the tele-density (correlation of 0.55). While Tele-density does affect the adoption of the internet, it is not the lone driver of internet adoption. There are other factors which require further analysis.

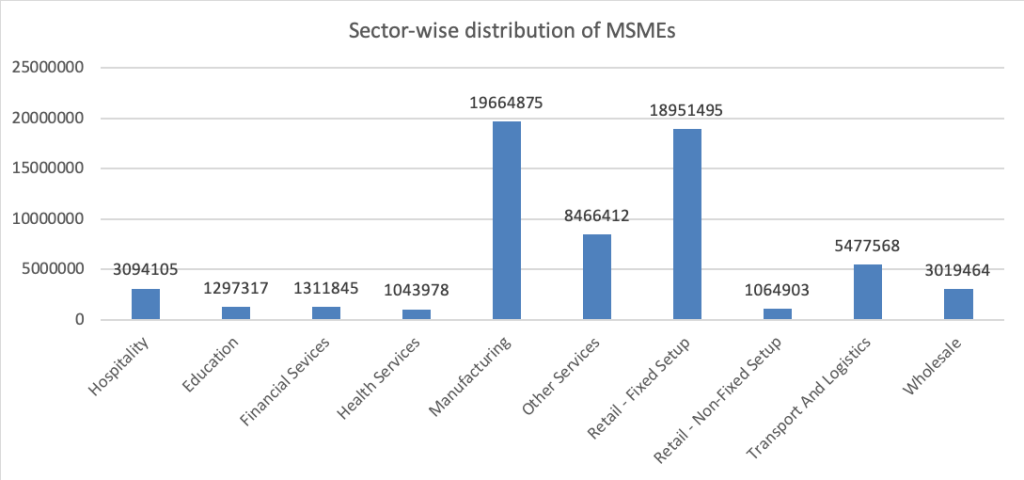

IV. Sector-wise use of computers and the Internet across MSMEs

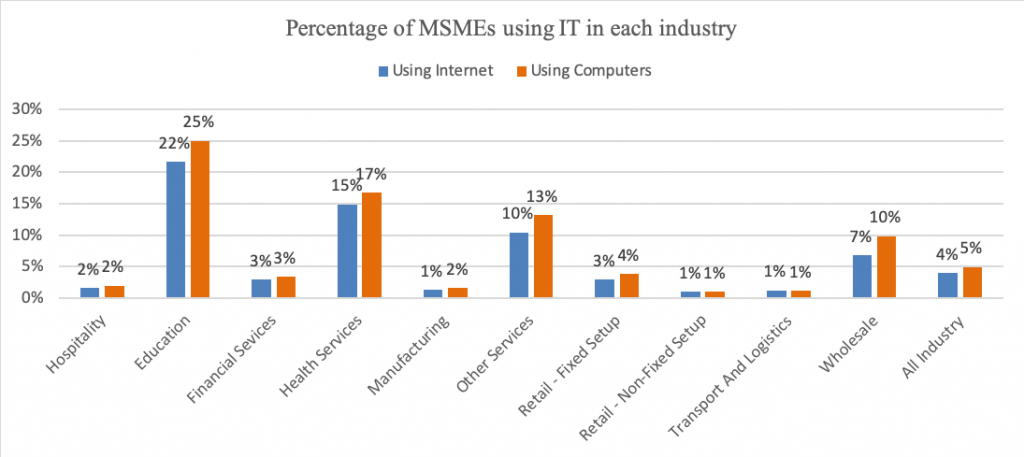

To understand the relationship between the type of activity that the MSME engages in, and the use of the Internet we have sliced the data to obtain the sectoral spread of MSMEs. The categorisation of sectors corresponds to the NIC 2008 classification and is reported in the dataset. We present our findings in the graphs below:

Figure 4: Sector-wise distribution of MSMEs.

Figure 5: Percentage of MSMEs using IT in each industry

Manufacturing and Retail-Fixed Setup have the largest share of enterprises among the industries. They, however, report poor adoption of the Internet at 1% and 3% respectively. Service sector industries like Education (22%), Health Services (15%) and Other Services (10%) report the highest adoption of the Internet. Interestingly the proportion of enterprises using computers either equals or outweighs the proportion of enterprises using the Internet across sectors. However, the use of the Internet varies significantly across sectors, and the adoption of IT for business seems to depend on the nature of the business.

The use of ICT for availing of financial services online:

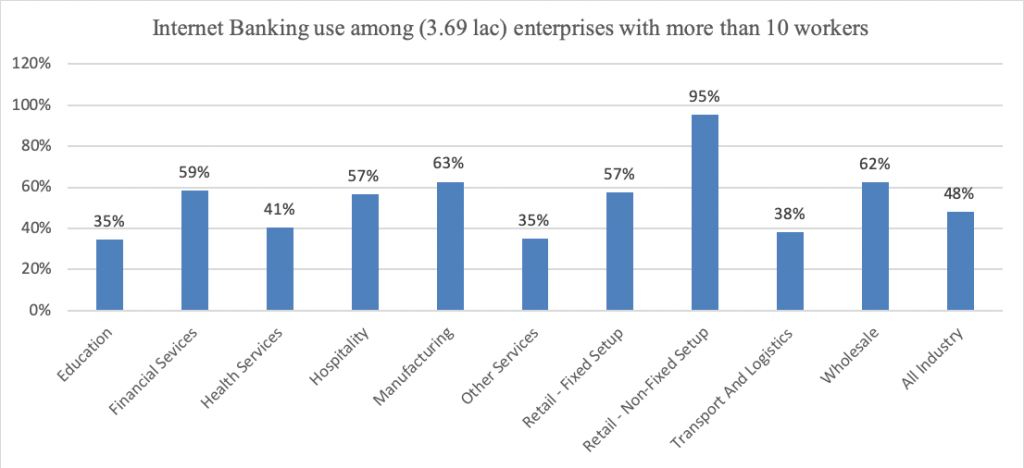

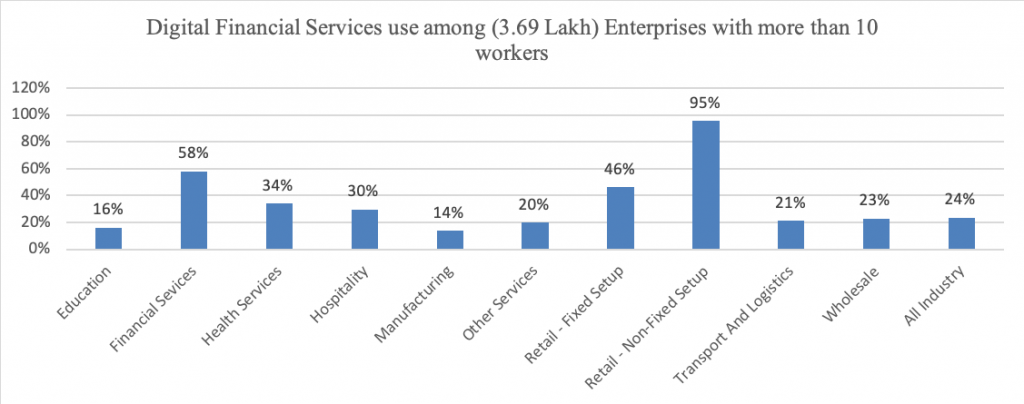

The dataset reports the use of IT to avail of financial services like Internet Banking and Digital Financial Services[3], for a sub-sample of enterprises with 10 or more employees (estimated at 3.69 lac enterprises). The analysis is presented in the graph below.

Figure 6: Internet Banking use among (3.69 Lakh) Enterprises with more than 10 workers

Almost 48% of all large MSME surveyed used Internet Banking facilities. Considering the more widespread use of Internet facilities among larger enterprises, it appears that the scale of operations is positively related to the use of the Internet in MSMEs. Roughly Internet Banking use in each industry is above or near 50% (35% – 95%) for large establishments (more than 10 workers). Strikingly, large Non-Fixed setup Retail MSME (retail sellers via collapsible stalls, etc.) had the highest adoption of internet banking at 95% while adoption of internet use for all Non-Fixed setup Retail MSME was 1%.

Figure 7: Digital Financial Services use among (3.69 Lakh) Enterprises with more than 10 workers

Moreover, almost 24% of all large scale MSME (more than 10 workers) use other digital financial services like purchasing shares (stocks), insurance and miscellaneous financial services. The use of the Internet for availing of other financial services continues to be disproportionately higher in larger MSMEs. Thus, the size of the enterprise (number of workers) appears to be an indicator of greater adoption of digital financial services.

The analysis suggests an overall low level of computer and Internet usage in the Indian MSME sector. The uptake of the Internet and computer use appears to vary with the nature of the sector, with education and health services appearing to be more Internet-intensive than others. Similarly, the size of the enterprise as captured through the number of employees appears to impact the uptake of the Internet among the enterprises. Digitisation can potentially unclog the sector’s access to formal finance by enabling capturing of data on transactions, invoices, receivables etc. This financial data can help formal lenders assess the creditworthiness of MSMEs and improve the quality of underwriting even without collateral. However, this promise of digitisation needs to account for ground realities. The low levels of digital uptake and use of the Internet not only call for policies that exponentially improve the use and uptake of ICT but also call for policies that speak to the existing non-digital nature of the sector. Any solution set to address the woes of the MSME sector in India requires a balanced approach, focusing both on improving the existing traditional channels of finance and promoting the development of digital solutions.

—

Bibliography

Confederation of Indian Industry. (2018). Micro, Medium & Small Scale Industry. Retrieved from Confederation of Indian Industry: http://www.cii.in/Sectors.aspx?enc=prvePUj2bdMtgTmvPwvisYH+5EnGjyGXO9hLECvTuNuXK6QP3tp4gPGuPr/xpT2f

Government of India . (2017). Key Indicators of Unincorporated Non-Agricultural Enterprises (Excluding Construction) in India (July 2015 – June 2016). Ministry of Statistics and Programme Implementation, National SampleSurvey Office. New Delhi: Government of India. Retrieved from http://mospi.nic.in/sites/default/files/publication_reports/NSS_KI_73_2.34.pdf

Government of India. (2015). Report of the Committee set up to examine the financial architecture of the MSME sector. Ministry of MSME. Delhi: Government of India. Retrieved from https://msme.gov.in/sites/default/files/2015_02_MSME_Committee_report_Feb_2015.pdf

Government Of India. (2017). Annual Report 2016-17 Department of Telecommunications. New Delhi: Government of India. Retrieved from http://www.dot.gov.in/sites/default/files/Annual%20Report%202016-17.pdf?download=1

Government of India. (2018). Annual Report 2017-18 Ministry of Micro, Small and Medium Enterprises. New Delhi: Government of India.

Government Of India. (2018). Turnover based MSME classification – Union Cabinet. Government Of India (pp. Ministry of Micro, Small and Medium Enterprises). New Delhi: Government Of India. Retrieved 5 8, 2018, from https://msme.gov.in/sites/default/files/Important%20event%20of%20Ministry%20for%20February%202018.pdf

IMA. (2017). The India Employment Report. Retrieved from IMA: http://www.ima-india.com/pdfs/the-india-employment-report-sample-slides.pdf

[1] The author undertook this analysis during his internship with Dvara Research. The author would like to thank Ms Malavika Raghavan, Ms Deepti George for their feedback and review, and Ms Beni Chugh and Mr Sansiddha Pani for their continuous academic support.

[2] A microenterprise will be defined as a unit where the annual turnover does not exceed Rs. 5.00 crore. A small enterprise will be defined as a unit where the annual turnover is more than Rs. 5.00 crore but does not exceed Rs. 75.00 crore. A medium enterprise will be defined as a unit where the annual turnover is more than Rs. 75.00 crore but does not exceed Rs. 250.00 crore.

[3] Includes electronic transactions via the Internet for other types of financial services such as purchasing shares (stocks), financial services and insurance.

One Response

This analysis highlights the low adoption of digital tools among India’s MSMEs, with significant regional and sectoral disparities. Larger enterprises and service-oriented sectors like education and health show higher digital usage. While telecom infrastructure is important, it alone isn’t enough to drive adoption. Policies must focus on improving both digital infrastructure and providing MSMEs with necessary training and support. Additionally, enabling digital financial services can help MSMEs access formal finance. A balanced policy approach is needed to address these challenges, promoting technology adoption while considering the diverse needs of the sector.