In this policy brief, we address the concerns of last-mile delivery of welfare benefits announced under the Pradhan Mantri Gharib Kalyan Yojana (PMGKY) on 26th March 2020. Broadly, we put forth two sets of recommendations that address the need for: (i) activation of transaction points in areas most in need of access to welfare and (ii) the relaxation of enrolment protocols (under PMGKY) to focus on the elimination of exclusion errors (i.e. benefits not being delivered to eligible/deserving citizens) rather the reduction of inclusion errors (i.e. benefits being delivered to an ineligible citizen).

The welfare measures announced as part of the Pradhan Mantri Garib Kalyan Yojana (PMGKY) announced on 26th March 2020 were motivated by the need to mitigate the loss of income for households during the ongoing COVID-19 pandemic and the resulting national lockdown. The PMGKY leverages several existing welfare schemes, to transfer benefits to those most in need of them. Among others, these primarily include the Public Distribution System (PDS) for food grains, the National Social Assistance Programme for pensions, the PM Kisan Samman Nidhi Yojana for cash transfers to land-owning farmers, and the Jan Dhan Yojana which facilitates access to bank accounts. The government’s decision of amplifying existing welfare measures during the pandemic is commendable. However, there is an immediate need to address the concerns in the last-mile delivery of these benefits that may lead to exclusion, which is as crucial as the task of allocating funds for these benefits.

In the immediate term, it is imperative to reduce exclusion errors and address any challenges to last-mile delivery of cash and in-kind benefits, as faced by both the beneficiaries and the access point operators responsible for delivering them. Previously on this post, we have noted that there are a variety of factors that could lead to exclusion errors in the delivery of welfare, especially those delivered through the Direct Benefit Transfers (DBT) mechanism. It is against this backdrop that we put forth a set of recommendations for making welfare benefits more accessible to citizens.

Firstly, in light of the increased demand for banking facilities and the immediate need to reduce over-crowding of branches, we propose immediate activation of access points and a framework to identify and prioritize districts for this exercise. Further, we note that the current structure of incentives for Business Correspondents (BCs) and other key agents does not match the types of risks undertaken by them to provide services effectively during a pandemic. In an earlier post, we have argued that without the right incentive structures, co-opting private agents for welfare delivery may lead to sub-optimal results. We propose an expansion of incentives paid out to BC agents as well as recommend a relaxation of certain conditions linked to their incentive structures.

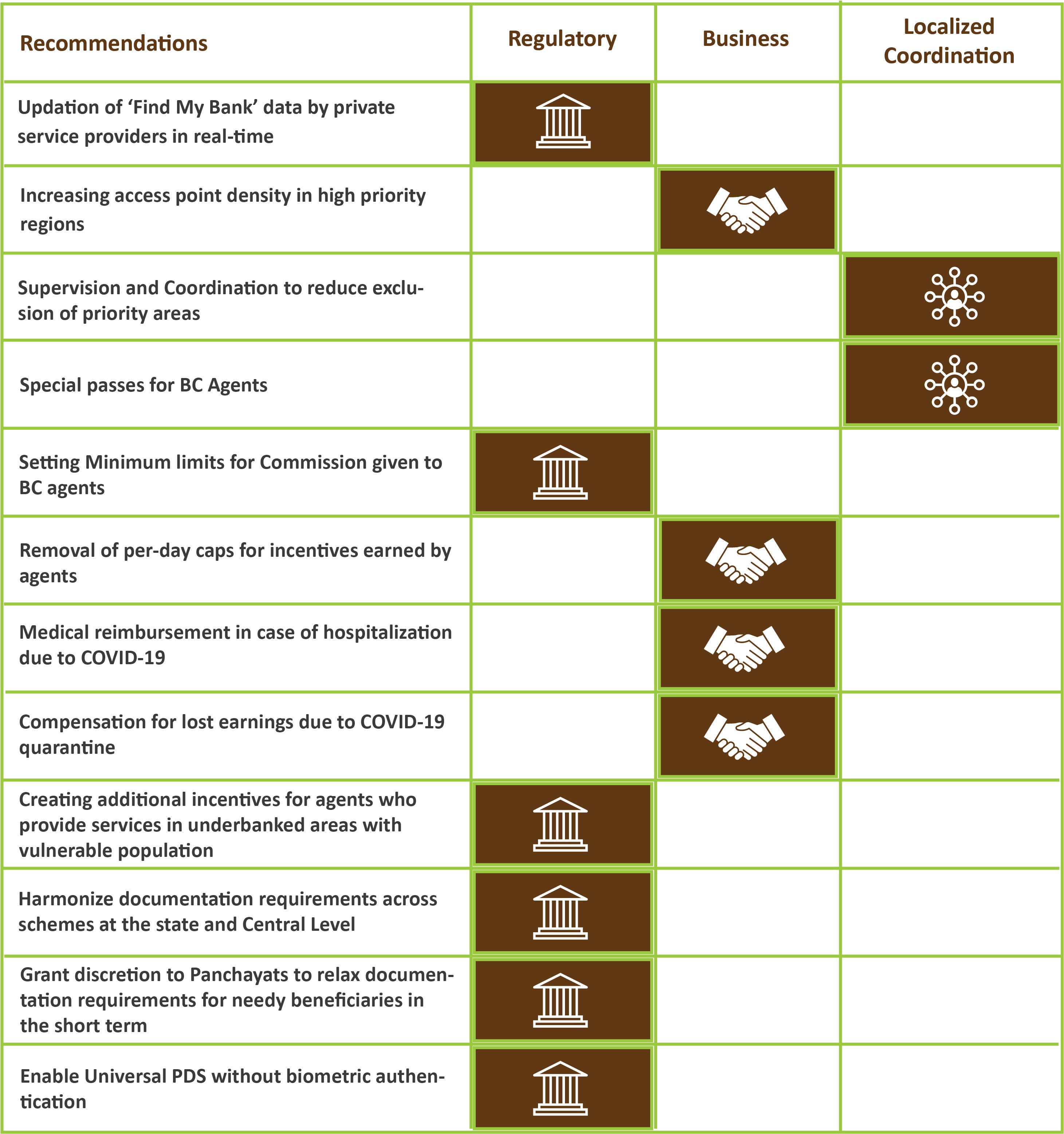

Secondly, we note that there is little clarity as to how fresh enrollments for the schemes covered under PMGKY can take place. In the current scenario, this may lead to the exclusion of some households most in need of central/state assistance. Further, many protocols for access to benefits, such as Aadhaar-linked bank accounts and biometric authentication at ration shops, were intended to address inclusion, rather than exclusion, errors. To prevent exclusion errors in the short-term, we suggest that documentation requirements be relaxed and local authorities, along with BCs and ASHA workers, be empowered to make enrollments for welfare schemes with relaxed documentation requirements. We recommend that benefits under the PDS should be made universal to all households in an area, whether permanent residents or not, and the requirement of biometric authentication be removed. Lastly, we categorize the aforesaid recommendations based on the kind of levers they require – regulatory, business, and localized coordination as enumerated in the table below.

The full policy brief is available here.

Summary of Recommendations