This is the second in the series of posts under the topic “Understanding the KGFS Customer”. The author, Sowmya Vedula, of IFMR Rural Finance, presents data regarding KYC documents (both ID and address proof documents) furnished by potential customers when they enrol with KGFS. The author also presents data of existing financial services that customers were already availing at the time of visiting KGFS. The information is as declared by the customer at the time of enrolment or at the time of any periodic data updation.

This blog post displays data of all enrolled members of the three KGFSs, Pudhuaaru (Tamil Nadu), Dhanei (Orissa) and Sahastradhara (Uttarakhand), obtained from the datasets of the Customer Management System (CMS).

Note:

• Data considered for this post is as of September 20th 2011

• The enrolment statistics for the three KGFSs is: Pudhuaaru – 126,082; Dhanei – 24,793; Sahastradhara – 18,404; Total=169,279

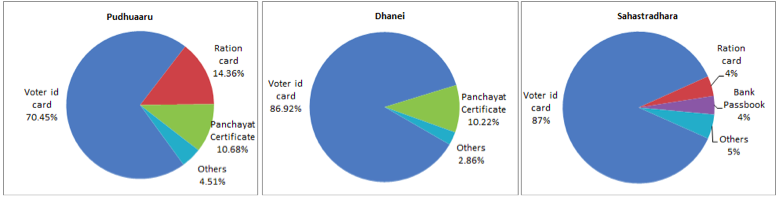

ID Proof Documents

ID proof documents are collected from customers during enrolment with KGFS. Voter ID is the most commonly submitted ID proof document across the three geographies. The major document in the ‘Others’ category for Pudhuaaru and Dhanei are driving licence, bank passbook, PAN card and passport, while for Sahastradhara it is driving licence, PAN Card and passport.

The ‘Panchayat Certificate’ category comprises of letters obtained from a gazetted officer or the Panchayat Head or the Village Admin officer (VAO). Slightly more than 10% of all enrolments in Pudhuaaru and Dhanei used this category of ID proof. In Pudhuaaru, 72% of these enrolments were by females while in Dhanei, females in this category formed only 41%. A major portion of these enrolled customers were labourers or housewives.

PAN Card

PAN card (Permanent Account Number issued by the Income Tax Department) applications had been facilitated by the KGFS branches for its customers up to March 2010.

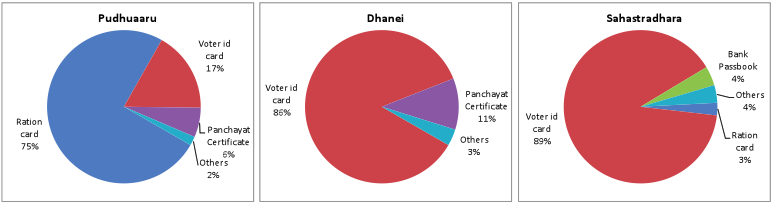

Address Proof Documents

The break-up of the document types collected as address proof are given above. The major document types in the ‘Others’ category for Pudhuaaru and Dhanei are driving licence, bank passbook and passport, while for Sahastradhara it is driving licence and passport.

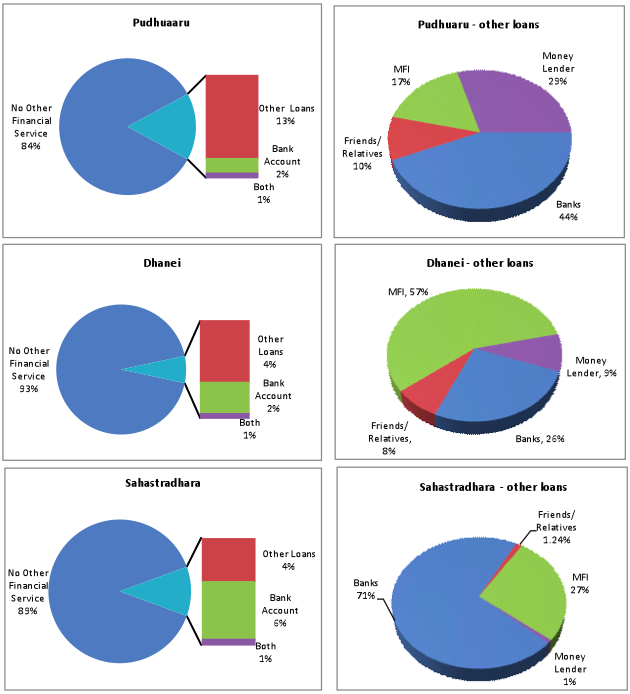

Other financial services

The above charts give information about other financial services being availed by the KGFS Customer – bank account and other loans. The breakup of the source of the loans is given in the panel on the right.

2 Responses

Nice analysis Sowmya. I think focusing on one aspect at a time is really good since it keeps things simple. I have couple of suggestions though:

– Along with analysis it would be good if you could add some inferences from the analysis. Some insights which may have to be probed further but sharing those would be good for the readers.

– Given the density of MFIs in state like Orissa, I thought the “Other Financial Services” or Other Loans category would be significant in case of Dhanei. It could be due to two reasons: 1) Customers are not sharing information about their loans with other institutions or 2) Only those customers who are not able to get loans from MFIs are coming to KGFS… It is worth probing…

Rohit

Thanks Rohit, for your valuable suggestions. This is the first time we are presenting CMS data in this forum. As a first step we deliberately wanted to present the data as is, without making any comments. You might have noticed that the subsequent posts under the same theme where we have our comments too to supplement to the data.