ICRA and CRISIL have upgraded the ratings assigned to the Senior Pass Through Certificates (PTCs) and Assignee Payouts pertaining to three transactions backed by micro loan pool receivables originated by Grama Vidiyal Microfinance Limited (GVMFL) and two transactions backed by micro loan pool receivables – one originated by Satin Creditcare Network Ltd. and one by Janalakshmi Financial Services Private Limited respectively.

ICRA upgrades micro loan pool receivables originated by Grama Vidiyal Microfinance Limited (GVMFL)

The ratings upgrade reflects the good collection performance on the underlying pools so far, and enhanced credit enhancement cover for the rated instruments / payouts over the balance tenure.

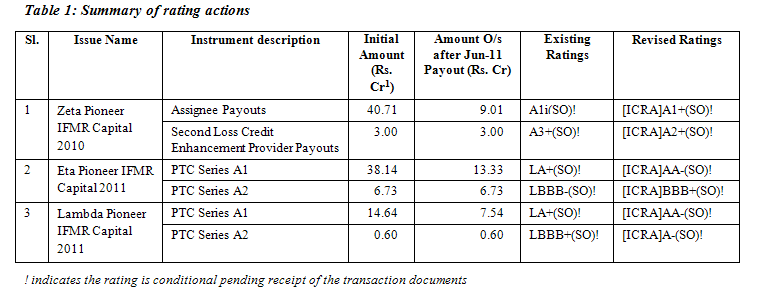

The summary of the rating actions taken by ICRA is given below.

In case of all the three aforementioned transactions, the selected pool comprised of unsecured micro loans (less than or equal to Rs. 20,000 each), with low initial tenure of contracts (50 weeks), moderately high initial seasoning and no overdue. Moreover, the pools comprised of General Loans[2] only.

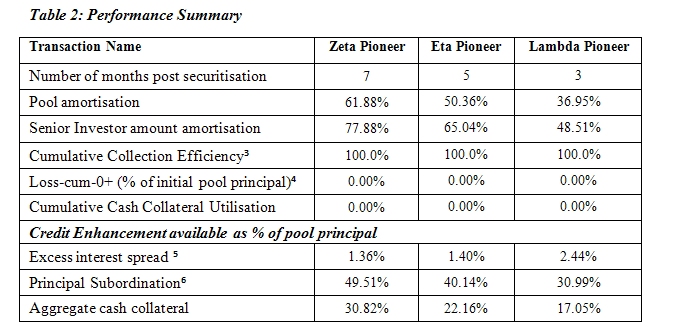

A brief performance summary for these pools is given below

As can be seen from the table above, the cumulative collection efficiency for all the above-mentioned transactions has been 100% and no delinquencies have been reported in these transactions so far. As a result, no cash collateral has been utilised in these transactions till date. The credit enhancement available in the transactions is sufficient to support the revised rating level.

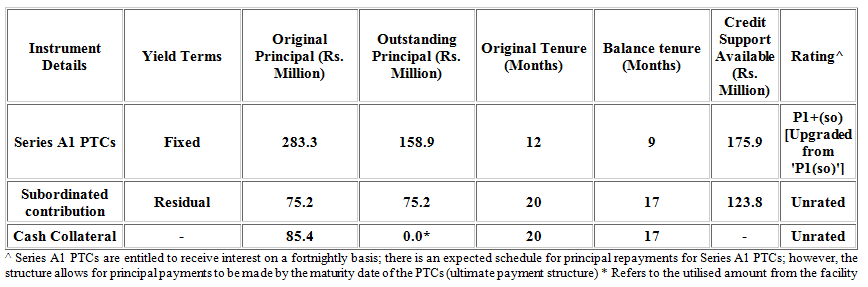

CRISIL Upgrades micro loan pool receivables originated by Satin Creditcare Network Ltd

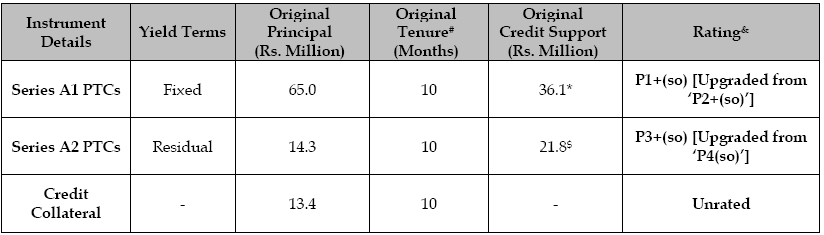

# Indicates door-to-door tenure between the issuance date and legal final maturity date; actual tenure will depend on the level of prepayments in the pool, exercise of clean-up call option, and extent of shortfalls

& The Series A1 PTCs are entitled to receive interest on a fortnightly basis. There is an expected schedule for principal repayments for the Series A1 PTCs; however the structure allows for principal payments to be made by the maturity date of the PTCs (ultimate payment structure)

* Credit support for the Series A1 PTCs includes Rs.22.7 million in the form of subordination of cash flows over and above the scheduled payouts promised to the Series A1 PTCs

$ Credit support for the principal repayment on the Series A2 PTCs includes Rs. 8.4 million of subordinated cash flows

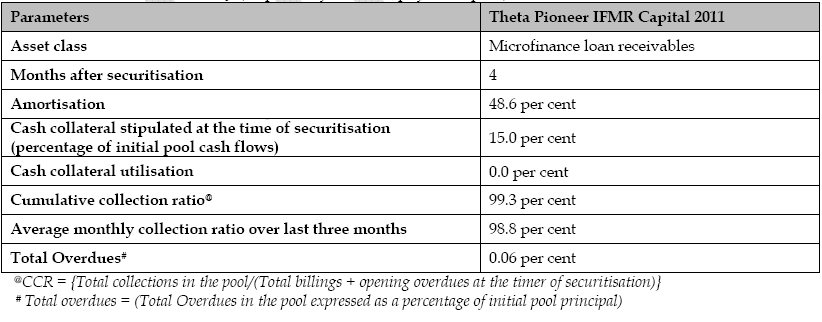

CRISIL has upgraded its ratings on the Series A1 and Series A2 PTCs issued by Theta Pioneer IFMR Capital 2011 to ‘P1+(so)’ from ‘P2+(so)’, and to ‘P3+(so)’ from ‘P4(so)’ respectively. The PTCs are backed by microfinance loan receivables originated by Satin Creditcare Network Ltd. The upgrade is driven by strong collection performance together with low overdue level of the pool, which has led to an increase in the cover provided for the PTC payouts by the available credit collateral.

Pool Performance Summary (as per May 23, 2011 payout report)

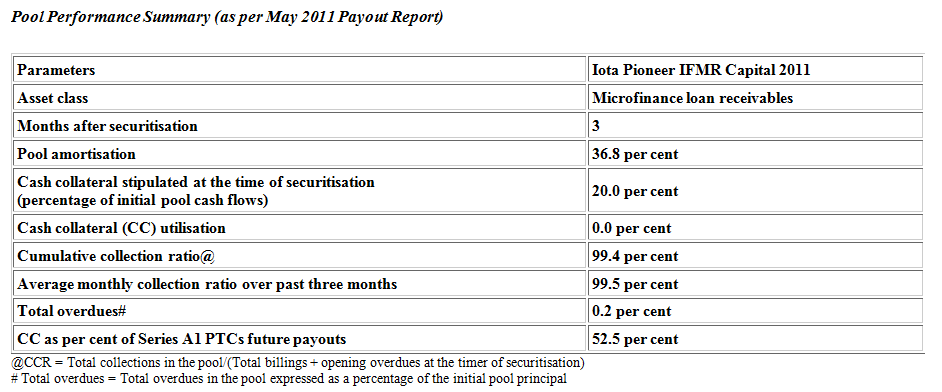

CRISIL Upgrades micro loan pool receivables originated by Janalakshmi Financial Services Private Limited

CRISIL has upgraded its rating on Series A1 pass-through certificates (PTCs) issued by Iota Pioneer IFMR Capital 2011 to ‘P1+(so)’ from ‘P1(so)’. The PTCs are backed by microfinance loan receivables originated by Janalakshmi Financial Services Pvt Ltd (JFSPL; rated ‘BB+/Stable’ by CRISIL).

The upgrade has been driven by the underlying pool’s strong collection performance and current amortisation level, which has led to an increase in the cover available for the PTC payouts. Available cash collateral covers 52.5 per cent of the Series A1 PTCs’ payouts.

[1] 100 lakh = 1 crore = 10 million

[2] These are Group Loans given to borrowers who are organised in groups of five, where each group member is responsible for repayment by the other group members.

[3] Cumulative collections / (Cumulative billings + opening overdue at the time of securitization) There are no opening overdue in case of any of the GVMFL pools

[4] POS on contracts aged 0+ dpd / POS on the pool at the time of securitisation

[5] (Pool Cashflows – Cashflows to Senior Investor – Junior Investor principal – originator’s residual share)/ Pool Principal outstanding

[6] (Pool principal outstanding – Senior investor principal outstanding) / Pool principal outstanding