IFMR Capital strives to build small business loans as a mainstream asset class in the capital markets and therefore partner with innovative financial institutions that extend financing to this financially excluded segment. We believe we can leverage our expertise, credibility and investor franchise to systematically build this asset class backed by a strong underwriting framework.

IFMR Capital identifies the small business loans asset class as loans of ticket sizes ranging from INR 50, 000 to INR 20 lakhs which are provided to individual entrepreneurs (and not to a corporate entity, partnership firm, sole proprietorship or any other legal person) for the purpose of financing working capital or capital investment. Such loans may either be unsecured or secured with property or hypothecation of stock or machinery.

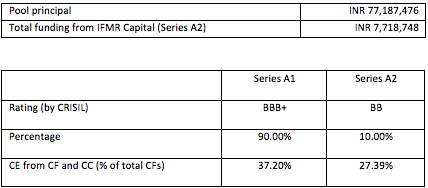

As a first, IFMR Capital has recently closed an INR 77.2 million rated PTC securitisation transaction (called Abeona SBL IFMR Capital 2012) with its partner; the Bangalore based NBFC, Vistaar Financial Services Private Limited. The transaction was IFMR Capital’s first securitisation of an exclusive SME loan pool and one among very few similar transactions in the past. IFMR Capital’s transaction is unique as this was the first transaction with a new and small originator in a space that is dominated by larger NBFCs having significant vintage.

Vistaar operates in Tamil Nadu and Karnataka and has developed a robust lending model for the small business loan segment despite being a fairly new organisation. As a product offering to its customers, it has both a lower sized loan (up to INR 70 thousand) backed by hypothecation of stock as well as a higher ticket size product backed by mortgage of property (upto INR 15 lakhs).

While traditional bank lending has depended almost entirely on credit appraisal through analysis of financial statements and business documentation, financial institutions such as Vistaar recognise that they will not have the luxury of such resources and hence they depend heavily on estimation of real cash flows in the business which is often not reflected in financial statements or paper documentation.

One of the important requirements for this kind of lending is also a deep understanding of the nature of businesses and local socio-cultural aspects of a particular geographical region, for which it is often required that the loan officers are from the local area. These financial institutions lend with ticket sizes ranging from INR 50,000 to INR 20 lakhs depending on the comfort of the institution, with higher ticket sizes (more than a lakh) often being secured with mortgage over personal property of the entrepreneur, in order to minimise risks related to moral hazard/willingness to pay. Here is an illustration of the typical origination model of a small business lender such as Vistaar.

The pool was broken up into two tranches with the senior tranche receiving credit enhancement support from subordination of the junior tranche as well as cash collateral placed by the originator and significant EIS which is to act as additional cushion for the senior investor. The Senior A1 tranche was rated BBB+ (SO) by CRISIL and the junior Series A2 tranche was rated BB (SO) considering the protection from EIS and cash collateral that it enjoyed. IFMR Capital invested in the junior tranche while a large NBFC invested in the senior tranche.

Over the last one year, there have been three transactions (including the Vistaar transaction) with a similar underlying pool. The other two were, however, rated direct assignment transactions. All these three represent the first occasion when each of these originating entities have securitised pools with a significant proportion of the small business loans as the underlying asset class. Given here are some of the key numbers.

The rating of BBB+ for the senior tranche is constrained on account of the relatively weak entity rating of Vistaar – the originator and the servicer in the transaction, on account of its limited vintage. With time and observed performance of more and more rated pools, the rating is expected to improve significantly.

IFMR Capital plans to follow-up this transaction with several more in this asset class, and we are currently in the process of building a pipeline of SME lenders. The next step would be to replicate the multi-originator securitisation structure for small business lenders, just as IFMR Capital has done successfully for microfinance institutions. Such a transaction would enable small business lenders to access capital markets at a reasonable cost.

3 Responses

The fact that the senior tranche was purchased by another NBFC seems to suggest this approach may not be replicable on a large-scale? What do you think?

The investor in this transaction is a very large NBFC and we

have seen that there is a lot of interest amongst the larger NBFCs to

invest in new avenues in the less explored market segments such as SME

finance.

Having said that, the transaction structure is suitable for any form of

capital market investor. In our previous experience with the

microfinance asset class, we have seen mutual funds, banks, large NBFCs

and even private wealth investors making investments in our

transactions. We are trying to build a similar market for the SME

finance space as well. Other potential investors include insurance

companies and pension funds. Off course, there are strict guidelines

that need to be followed. The listing of PTCs could further open up

avenues for offshore investors to invest in such transactions.

However, the market is still evolving. Our efforts are in making such

structures available in the market and generating investor awareness.

It seems that the retail investors are not interested for this PTCs …?