This post is part of our series of posts on Long Term Debt Markets in the Indian context.

The absence of secondary markets for corporate bonds in India is arguably the single most important reason for this market not seeing the kind of growth one would expect. The public (government securities or GSecs) debt market with an outstanding issue size close to Rs. 19,74,467 crores (USD 421.35 billion), had a secondary market turnover of around Rs. 30 lakh crores (USD 640.20 billion) for the year 2009. Besides the G-Secs market, there is a market for corporate debt papers in India which trades in short term instruments such as commercial papers and certificate of deposits issued by banks and also in long term instruments such as debentures, bonds, zero coupon bonds, step up bonds etc. The outstanding issue size of listed corporate debt was Rs. 2.2 lakh crores (USD 46.95 billion) in 2009. The corporate debt turnover in the secondary market was roughly 1.5 lakh crores (USD 31.6 billion) during the year 2009. To put things in context, by the end of 2008, the Indian equity market turnover was roughly $ 1.05 trillion.

Investors have stayed away from the fixed income secondary market as the market lacks liquidity, transparency and depth. Some of the key issues that have traditionally plagued the secondary markets in long term debt in India are: 1) Absence of market makers and liquidity; 2) Preference to bank deposits, postal savings schemes, NSCs etc over bonds because of liquidity risk; 3) Lack of pricing and benchmarking-there is no yield curve at longer horizons due to thin trading volumes and poor price discovery. Although in principle, it is possible to determine a 30-year yield curve but insufficient liquidity makes it less credible; 4) Small institutional investor base; 5) Lack of adequate risk management products; 6) Higher interest rates-falling interest rates during 2000s made G-Secs attractive and trading peacked during these periods. However, the reversal of the interest rate trend since 2004 has robbed the trading in G-Secs off its sheen.

This reluctance in investor participation warrants some amount of surprise as the necessary infrastructure for an active secondary market, i.e. trading, clearing and settlement seems to be in place. It is commonly accepted that even with sufficient market infrastructure, the corporate bond market continues to operate over-the-counter (OTC). This is the case even in bigger and more developed markets like the corporate debt markets of the USA, where most trading occurs in an OTC dealer market. In the US, broker-dealers execute majority of the transactions in a principal capacity and act on behalf of their clients. In India however, the Securities and Exchange Board of India (SEBI) has mandated that all OTC trades are to be reported, settled and cleared through the authorised clearing houses. This paves the way for greater price discovery and an actual measure of the activity in the OTC bond market. To explore the steps taken by the SEBI to deepen secondary market activity, we feature here a timeline that lists the developments in trading, reporting, clearing and settlement over the years:

- In 2005, the High Powered Expert Committee (HPEC) on Corporate Bonds & Securitisation, led by Dr. R.H. Patil, mandated the creation of a corporate bonds database by the major stock exchanges that would cover credit events in addition to other information about the bonds. Also, in order to address outstanding issues on the trading, reporting, clearing and settlement of corporate bonds, HPEC also mandated that all trades be reported.

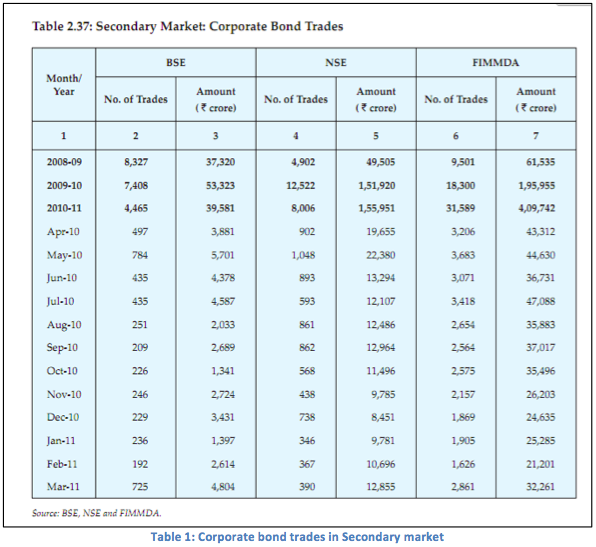

- In order to develop an exchange traded market for corporate bonds SEBI vide circulars dated December 12, 2006 and March 01, 2007 authorized the two stock exchanges- BSE and NSE, to set up and maintain corporate bond reporting platforms to capture all information related to trading in corporate bonds as accurately and as close to execution as possible. Subsequently, Fixed Income Money Market and Derivatives Association (FIMMDA) has also been permitted to operate a reporting platform. As per the circulars, all issuers, intermediaries and contracting parties are granted access to the reporting platform for the purpose and transactions shall be reported within 30 minutes of closing the deal. The data reported on the platform is disseminated on the websites of BSE, NSE and FIMMDA.

- Further, In March 2007, NSE and BSE were advised by the SEBI to provide data pertaining to corporate bonds comprising issuer name, maturity date, current coupon, last price traded, last amount traded, last yield (annualized) traded, weighted average yield price, total amount traded, rating of the bond and any other additional information as the stock exchanges think fit. In August 2007, SEBI started placing information on secondary market trades (both exchange and OTC trades) on its website on the basis of data provided by the two exchanges. Key Features:

- a. Trades executed by members of BSE/NSE shall be reported on the respective platforms of their stock exchanges. In the case of OTC trades parties can choose between any one of the 3 platforms.

- b. BSE and NSE shall coordinate amongst themselves to ensure that the information reported with BSE and NSE is aggregated, checked for redundancy and disseminated on their websites in a homogenous manner.

- c. The mandate applies to all trades in listed debt securities issued by banks, public sector undertakings, municipal corporations, bodies corporate and companies.

- d. Subsequent to the launch of the corporate bond reporting platform at NSE, reporting may be made to either platforms of BSE or NSE but not to both for the same transaction.

- As a second phase of development, SEBI vide Circular dated April 13, 2007 permitted BSE and NSE to have in place corporate bond trading platforms to enable efficient price discovery and reliable clearing and settlement in a gradual manner. To begin with, BSE and NSE have launched an order driven trade matching platform which retains essential features of OTC market where trades are executed through brokers. OTC trades however continue to be reported on the exchange reporting platforms. In order to encourage wider participation, the lot size for trading in bonds has been reduced to Rs.1 lakh. Subsequently BSE and NSE may move towards anonymous order matching with clearing and settlement.

- On October 16, 2009, SEBI mandated the clearing and settlement of corporate bond trades through clearing corporations. Key features:

- a. It was decided that all trades in corporate bonds between specified entities namely, MFs, FIIs, VCs, Foreign Venture Capital Investors, Portfolio Managers and RBI regulated entities shall necessarily be cleared and settled through the National Securities Clearing Corporation Limited (NSCCL) or the Indian Clearing Corporation Limited (ICCL). NSCCL issued a circular on November 23, 2009 facilitating a centralized clearing and settlement mechanism for enabling smooth transaction closures.

- b. The provisions of the circular apply to all corporate bonds traded OTC or on the debt segment of stock exchanges on or after Dec 01, 2009. However, the provisions are not applicable to trades in corporate bonds that are traded on the capital market or equity segment of the stock exchanges and are required to be settled through clearing houses of stock exchanges.

- On November 29, 2010 SEBI requested the Ministry of Labour to issue directions to authorities responsible for Provident Funds/Pension Funds/Pension Schemes to ensure mandatory reporting of corporate bond trades and to ensure clearing and settlement of such trades through NSCCL or ICCL. Subsequently the Pension Fund Regulatory and Development Authority (PFRDA) in a circular dated December 30, 2010 asked all Provident Funds to mandatorily report and settle the trades in corporate bonds with the Clearing Corporation.

Through these measures, the SEBI has tried to promote secondary market activity in the bond market. With the infrastructure that these measures have spawned, the Indian bond market potentially enjoys improved transparency and pre-requisites for greater activity such as an established clearing and settlement mechanism, a market-driven trading platform and smaller lot sizes for trading. For a variety of other reasons however, secondary market activity continues to be subdued.

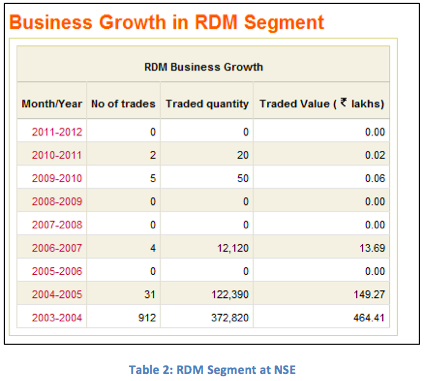

Retail Debt Market (RDM)

The retail trading in G-Secs started on January 16, 2003 in accordance with the SEBI Circular dated January 10, 2003. Both NSE and BSE introduced trading facility through which retail investors could buy and sell G-Secs. Table 2 below shows the dismal picture of volume and number of trades in the retail debt market (RDM) at NSE.

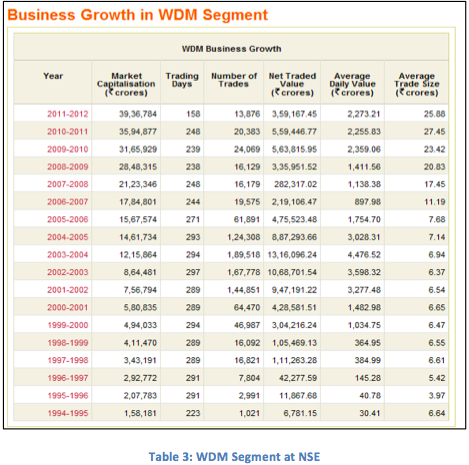

Wholesale Debt Market (WDM)

This segment provides trading facilities for a variety of debt instruments including Government Securities, Treasury Bills and Bonds issued by Public Sector Undertakings/ Corporates/ Banks like Floating Rate Bonds, Zero Coupon Bonds, Commercial Papers, Certificate of Deposits, Corporate Debentures, State Government loans, SLR and Non-SLR Bonds issued by Financial Institutions, Units of Mutual Funds and Securitized debt by banks, financial institutions, corporate bodies, trusts and others. During 2009-10, turnover in the WDM segment at NSE increased to Rs.5,63,816 crore from Rs.3,35,950 crore in 2008-09. However, during 2010-11, the turnover decreased marginally to 5,59,447 crore from 5,63,816 crore in 2009-10.

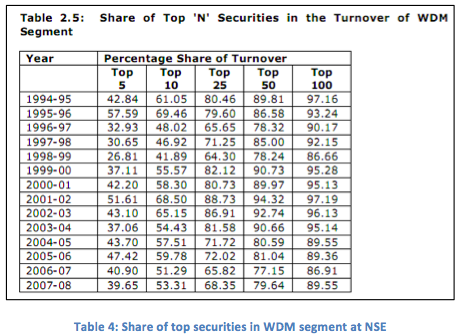

The WDM segment though, shows increasing volumes year on year but lacks the depth. Figure 4 above shows that a significant proportion of trading volumes are accounted for by the top few most active securities.

Conclusion

Thus it seems that the market regulator (in this case, SEBI) has systematically attempted to weed-out secondary market issues and tried to promote more activity, in the process of attempting to enable the corporate bond secondary market and making them more efficient. However, data suggests that secondary market activity remains subdued. Though the necessary infrastructure is in place for a conducive and active secondary market, there is one more portion of the larger issue that regulators have tried to address time and again but without much suceess– the presence of an active hedging market or the availability of adequate risk-management tools. The hedging market is fairly new and has witnessed very low levels of activity owing to it being highly complex and regulated. Our next post in this series will explore the evolution of this market and the issues it faces in greater detail.