Productive investments in infrastructure development are paramount to the attainment of economic growth, job creation, and poverty reduction (World Bank, 2018). In 2017, consulting firm McKinsey estimated that an increase in infrastructure investment equivalent to one percent of GDP would translate into an additional 3.4 million direct and indirect jobs in India. But the infrastructure gap that exists in India is undeniable (Woetzel, et al. 2016). Recently, the (Economic Survey 2017-18, Government of India n.d.) forecasted that around USD 4.5 trillion worth of investments is required by India till 2040 to develop infrastructure and improve economic growth and community well-being. The country can, however, manage to supply only USD 3.9 trillion worth of investments given current trends. This leaves a massive financing gap of half a trillion dollars, that has the potential to hamper economic growth, service provisioning, and community well-being.

Infrastructure Financing in India

Infrastructure financing is fraught with credit and market risks associated with the long investment tenures for these projects, making commercial banks rather unsuitable for financing these projects, given the much lesser asset-liability and liquidity mismatches they can be comfortable with. Development Finance Institutions (DFIs) such as IFCI, IDBI and ICICI were set up after independence to finance long term projects with low-cost funds to ensure that the spread on their lending operations does not come under pressure. But with the reforms of the 1990s, as the state retreated from controlling markets, the allocated funds for dedicated DFIs began to reduce and eventually run dry. As a result, reliance on DFIs decreased and was compensated by increased reliance on private participation in infrastructure financing[1]. These DFIs metamorphosed into ‘universal banks’ (Joseph and Mazumdar 2019), accepting retail and short-term deposits from private individuals and entities to maintain a healthy supply of capital from the market while continuing to fulfil the mandate of economic development by attempting to invest in and finance infrastructure projects (Nayyar 2015).

Most recently, rising NPAs for the banking system and a liquidity squeeze faced by Non-Banking Financial Companies (NBFCs) have raised concerns around how infrastructure financing can be supported by the banking system. RBI has been exploring the concept of differentiated banks and of setting up new licenses for Wholesale and Long-Term Finance (WLTF) Banks (Reserve Bank of India 2017). But the Indian system is still largely bank-centric, allowing no easy solutions to the challenge in short to medium term.

In our search for answers, we looked at banking models that have funded long-term infrastructure projects in other jurisdictions, with a special focus on development banks. In this post, we write about one such institution, the Brazilian Economic and Social Development Bank or BNDES.

BNDES

1) Ownership: Since its foundation in 1952, BNDES, owned and controlled exclusively by Brazil’s federal government[2], has been the country’s key financing agency for long-term infrastructure investment policies, and is solely responsible for about one fifth of Brazil’s total investment capacity (Harneit-Sievers, et al. 2015) with disbursements of USD 18 billion in 2017 (BNDES 2018). Disallowing private sector participation in the ownership structure has allowed the bank to pursue objectives that go beyond the standpoint of economic profitability, to include social development goals and allowed alignment of government policies with the management of the institution. While the privatisation wave of the 1990s diluted the role of Development Banks in India, in Brazil, the mandate of BNDES policy shifted in favor of Brazilian private sector (with increased capital disbursements for both domestic and foreign infrastructure projects), with the ownership pattern of BNDES remaining unchanged and state-backed funds continuing to finance the bank’s investments (Carvalho 2013).

2) Resource Mobilisation: Acting as one of the largest financing and investment stimulating agencies in fulfilling its policy mandates, the bank has mobilised unusual sources of finance including resources from multilateral organizations and public debt bond issues, compulsory budgetary allocations, transfers from treasury, and resources generated from special taxes and cesses, levies on insurance and investment companies, etc.(Harneit-Sievers, et al. 2015). The Government instituted Social Integration Programme (PIS), and Public Employment Savings Programme (PASEP), and subsequently Workers Assistance Fund (FAT), which are financed with payroll taxes imposed on company profits (similar to provident and pension funds in India), whose administration was transferred to BNDES. The Constitution was further amended to route 40% of FAT accruals to BNDES mandatorily.

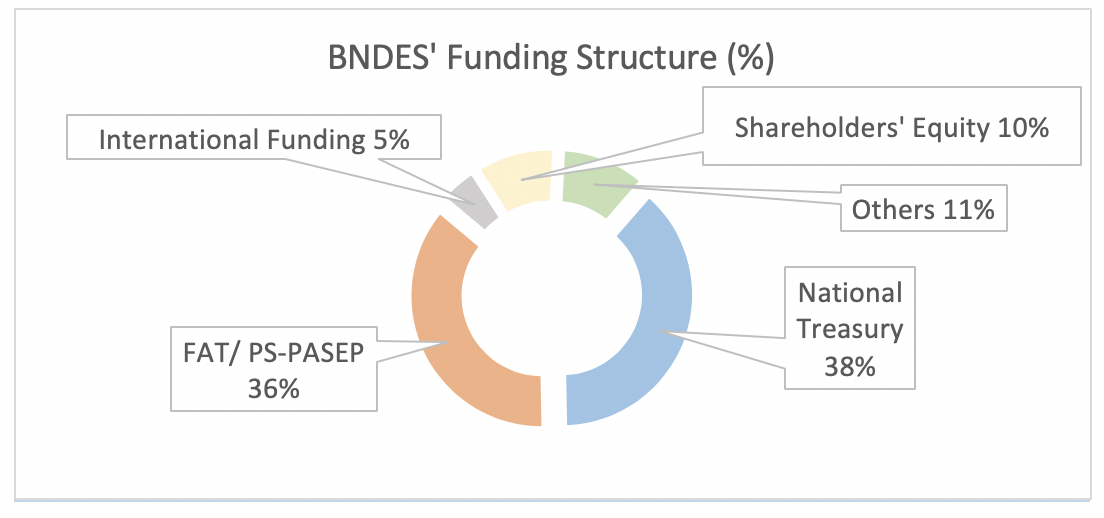

Figure 1: Sources of funding that comprise BNDES’ total liabilities (BNDES 2018); (Author’s Calculations)

Shareholders’ equity (from the federal government), forms 10% of total liabilities. Over 38% is from obligatory investments from the National Treasury and 36% from mandatorily routed FAT funds (BNDES 2018). Thus, long-term funds have been mobilised compulsorily by the federal government for investment in infrastructure.

3) Functioning and Governance: In reality, the bank has assumed roles larger than financing, by extending technical and bureaucratic expertise, and qualified access to information on economic factors and agents to shape development in real-time (Harneit-Sievers, et al. 2015). This privileged access[3] to information further attracts investment in infrastructure development, and the government is attempting reforms to equalise the lending rate with market rates to prevent crowding out of private investments in the sector (World Bank 2018). According to BNDES’ statute, financial or investment collaborations must fulfil a set of rules that include: 1. Technical and financial assessment of the venture, including social and environmental implications; 2. Verification of collateral or legal security; and 3. Evaluation of the entrepreneur’s morality on bank’s own criteria (The Brazilian Development Bank 2002). These profoundly impact the bank’s ability to operate programs from proposal to implementation. It can also offer financing for programs related to education and research, scientific or technological nature and in social projects that promote job creation, urban services, health, education, sports, justice, housing, the environment, rural development, culture, among other areas, even if they offer no return or are ’non-fundable applications’.

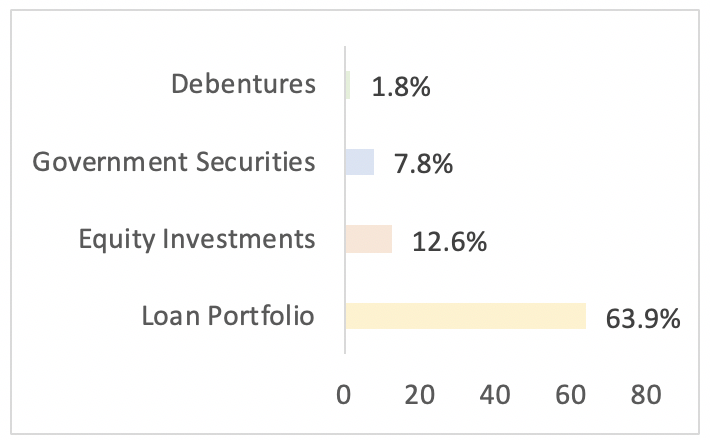

4) Capital Deployments: BNDES mobilises resources for both state programs and private ventures and operates through a network of second-tier accredited financial institutions (over 42% of its loan portfolio as of 2016), with most Brazilian banks offering BNDES products (on-lending or indirect operations). Most of the capital has been deployed towards loan portfolio of BNDES (63.9%), out of which 38% of disbursements went towards infrastructure (BNDES 2018). A major chunk of the remaining capital has been invested in equity investments (12.6%), government securities (7.8%), and debentures (1.8%) (BNDES 2018).

Figure 2: Key Capital Deployments by BNDES in FY17 (BNDES 2018); (Author’s Calculations)

Further, most of the loan book is low risk, with 94.6% being of AA to C (high quality to good quality) rating. Along with this, the bank had a very low percentage of NPAs at 1.38% of the loan portfolio in 2016 (BNDES 2018).

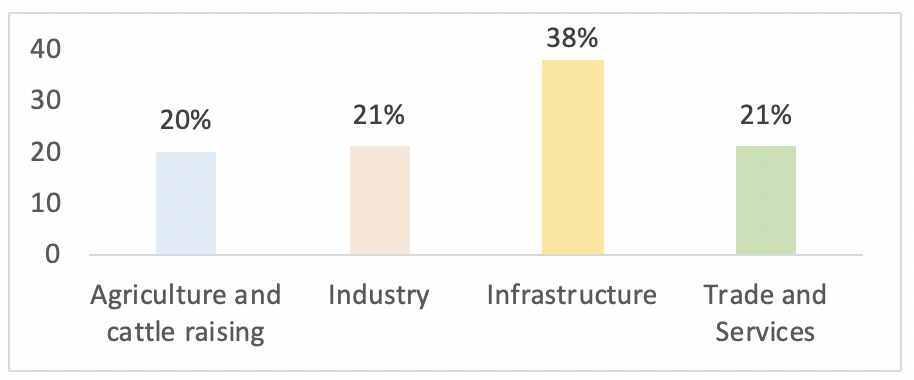

Within the loan portfolio of BNDES, the largest lending has been towards infrastructure development (transportation and related sectors), followed by industry, trade and services, and agriculture[4].

Figure 3: Sector-wise Loan Deployments by BNDES in FY17 (BNDES 2018); (Author’s Calculations)

The bank is profitable and reported net income of Brazilian Real 6711 million reported in December 2018 and return on equity of 12.8% (BNDES 2018), even in the wake of financial difficulties looming large on the Brazilian economy. BNDES can be termed as an unusual state institution that has successfully survived through the decades.

Conclusion and Key Takeaways

Long term funds (like pension funds, provident funds, insurance funds, and other social security programs) are an important untapped resource that can potentially be utilised to finance long term projects, as exemplified by BNDES in Brazil. This can tackle the challenge of liquidity and asset-liability mismatches that arise when short-term, retail deposits are mobilised by commercial banks to finance long-tenor, high-risk infrastructure projects. Channelling of constitutionally mandated obligatory savings, multilateral investment funds, and other state-backed financing options can be considered to provide long-term finance. This carefully curated, obligatory matching of funds parked in long-term public resources (pension and provident funds) with long-tenor loans can provide some respite from the asset-liability mismatch and the dearth of resources needed for deploying in long term investments.

—

References

Ananthakrishnan, G., 2017. “INDIAN INSTITUTE OF BANKING & FINANCE.” http://www.iibf.org.in. April. Accessed June 2019. http://www.iibf.org.in/documents/BankQuest/Apr-June2017/Bank%20Quest%20Apr%20-%20June%20%202017.pdf.

BNDES. 2018. “Annual Integrated Report.” www.bndes.gov.br. April. Accessed June 2019. https://www.bndes.gov.br/SiteBNDES/bndes/bndes_pt/Hotsites/Relatorio_Anual_2017/pdf-eng/BNDES_RA2017_OurPerformance.pdf.

—. 2016. “www.bndes.gov.br.” Relatorio_Anual_2016_en. Accessed 2019. https://www.bndes.gov.br/SiteBNDES/bndes/bndes_pt/Hotsites/Relatorio_Anual_2016_en/assets/bndes_ra2016_web_02-1_thebraziliandevelopmentbank.pdf.

Carvalho, Fernando J. Cardim de. 2013. Development and Cooperation. Accessed 2019. https://www.dandc.eu/en/article/brazils-state-owned-development-bank-bndes-probably-more-powerful-many-countrys-federal.

Economic Survey 2017-18, Government of India. n.d. Chapter 8, pg.131. https://mofapp.nic.in/economicsurvey/economicsurvey/pdf/120-150_Chapter_08_Economic_Survey_2017-18.pdf.

George, Deepti, and Madhu Srinivas. 2018. Livemint. October 25. Accessed June 2019. https://www.livemint.com/Opinion/CRtbv6vPwppPpmXsM6VKrK/Opinion–Is-it-time-to-introduce-wholesale-banks-in-India.html.

Government of India, Ministry of Finance, DEA. 2018. Economic Survey of India 2017-18. New Delhi: Oxford University Press.

Harneit-Sievers, Mark Grimsditch, Yu Yin, C. P. Chandrasekhar, Mzukisi Qobo, Carlos Tautz, João Roberto Lopes Pinto, and Fabricia de Andrade Ramos. 2015. “Development Finance in BRICS Countries.” Heinrich Boll Foundation. September. Accessed June 2019. https://in.boell.org/2015/09/09/development-finance-brics-countries.

Joseph, Samuel, and Rahul Mazumdar. 2019. The Hindu Business Line. June 5. Accessed June 28, 2019. https://www.thehindubusinessline.com/opinion/caution-infra-financing-by-banks-is-rising-again/article27526608.ece.

Lall, Rajiv B., and Ritu Anand. 2009. “White Paper, IDFC Occasional Paper Series.” www.idfc.com. January. Accessed May 2019. http://www.idfc.com/pdf/white_papers/Financing_Infrastructure.pdf.

Moslener, Ulf, Matthias Thiemann, and Peter Volberding. 2017. “National Development Banks as Active Financiers.” http://policydialogue.org. May. Accessed June 2019. http://policydialogue.org/files/events/background-materials/Future_of_National_Development_Banks_-_Germany.pdf.

Nayyar, Deepak. 2015. “Birth, Life, and Death of Development Finance Institutions in India.” Economic and Political Weekly, August 15: 51-60.

Reserve Bank of India. 2017. www.rbi.org.in. April 7. Accessed June 28, 2019. https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=866.

The Brazilian Development Bank. 2002. Legislation. October 11. Accessed June 2019. https://www.bndes.gov.br/SiteBNDES/bndes/bndes_en/Institucional/The_BNDES/legislation_bndes.html.

Woetzel, Jonathan, Nicklas Garemo, Jan Mischke, Martin Hjerpe, and Robert Palter. 2016. Bridging Global Infrastructure Gaps. Research Report, Shanghai, Abu Dhabi, Zurich, Stockholm, & Toronto: Mckinsey Global Institute, Mckinsey & Company.

World Bank. 2018. Infrastructure Finance. February. Accessed June 2019. https://www.worldbank.org/en/topic/financialsector/brief/infrastructure-finance.

[1] India has embarked on an infrastructure financing model that recognises that public savings are not sufficient to meet huge infrastructure requirements (Lall and Anand 2009). Private participation in infrastructure financing is greatly relied on (be it through greater emphasis on Public-Private Partnership models or raising investment by the private sector in infrastructure).

[2] BNDES is a wholly-owned federal government company linked to the Ministry of Planning, Development and Management, and has been the main instrument of the government for long-term financing and investment in the Brazilian economy (BNDES 2016).

[3] BNDES, national promotional banks and other development banks represent unique entities that occupy a space between the private market and the government, allowing them privileged access to both policymakers and the commercial market. This access allows them to go beyond the limitations faced by the government in its engagement to macroeconomic policy and regulatory sphere, and those of private capital that seek purely commercial profits. Rather, DBs are able to further pursuance of national priorities by engaging as modified market participants, financing policy priorities that are underserved by the private market by not being forced to behave entirely with commercial motivations (Moslener, Thiemann and Volberding 2017).

[4] We could not come across data on maturity profiles of liabilities and assets of BNDES

One Response

A very thought provoking article. Kudos to Dvara for promoting such interesting kind of work.