Sahastradhara KGFS started its operations in the year 2008 with a mission “to maximise the financial wellbeing of every individual and every enterprise by providing complete financial services in remote rural Garhwal”. Currently, we have thirty one branches serving the districts of Uttrakashi, Chamoli, Rudraprayag, Tehri, Dehradun.

While Sahastradhara KGFS has gone where no private financial institution has gone before and proven its commercial case, we continue to think there is enormous untapped potential and room for improvement in the customer experience. This can be seen in terms of low activation rates, time delays between customer enrolment and activation and relatively low wealth manager productivity. Against this context, Sahastradhara KGFS commissioned an exercise which was internally dubbed as “Mission Deep Dive Sahastradhara” to uncover the root causes for this and suggest strategies for improvement.

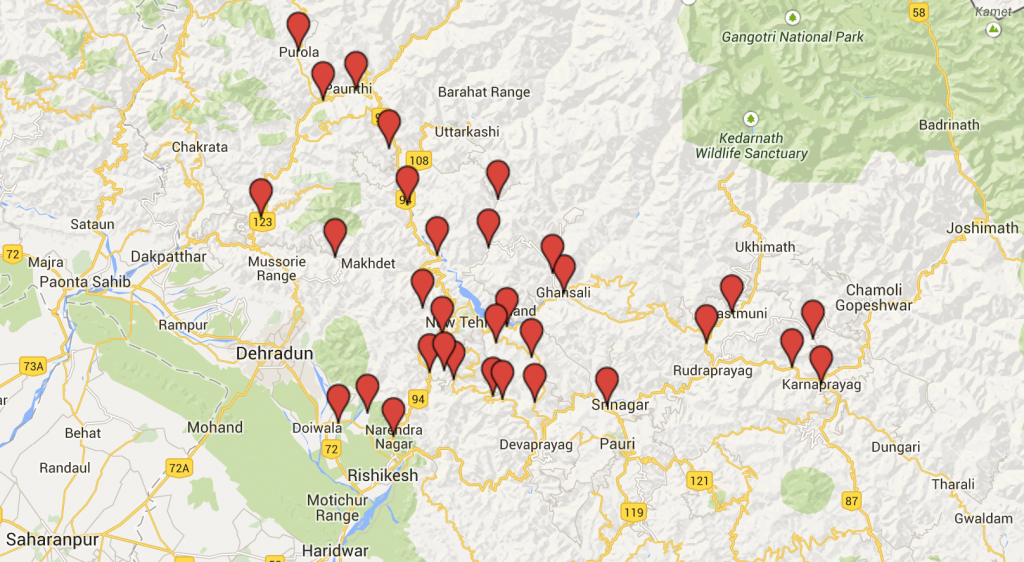

Sahastradhara KGFS Branch locations

In the extensive field engagement that followed, a cross functional team involving members from diverse roles dwelt deeper into the operations of the entity. Out of this extensive study three themes emerged as the ones that needed most attention immediately:

- Data Integrity – How well do we know our customers and how is this being leveraged for business decision making?

- Process improvements – How efficiently are we able to provide service to our customers?

- Organisation development and training – How well trained and empowered is the field staff to carry on branch operations smoothly?

The team came up with following suggestions and tools to address these gaps:

i) Beat plan for the Wealth Managers – The service area of a branch can go up to 25 kilometres from the branch location. Owing to the hilly terrain, the hamlets and habitations are not always accessible by road; they have to be accessed on foot. For a Wealth Manager to reach up to these villages a mix of options have to be chosen i.e. public or private transport and foot. Field visit to such villages[1] not only demand a significant investment of daily time but also physical effort. To plan the daily schedule of Wealth Managers and to maintain regular interface with the customers, a beat plan for each branch was proposed. As per the beat, Wealth Managers are expected to visit a particular village or set of villages on a pre-defined date.

ii) Prioritisation matrix – As part of the beat, once the Wealth Manager has reached a village, the prioritisation matrix[2] would suggest which customers have to be met and for what activity? The rules that govern the prioritisation matrix tool are flexible and can be defined/ altered on the basis of changing business priorities. As a starting point, we added the following rules:

- customers whose data needs to be updated (re-enrolment),

- high priority insurance customers (human capital, shop and livestock),

- customers who have goals coming up in this year (lead for credit products) and

- customers who have high surpluses and long term goals (lead for investment products)

iii) Focus on Tier 1 areas – Tier 1 areas, are the areas that are located within a range of 10 kms from the branch by road and where the Wealth Manager does not have to cover more than 3 kms on foot. In order to increase the business numbers, Tier 1 areas or the areas that are easily accessible by road or foot from the branch were shortlisted. The target was set at achieving a minimum of 50% household level activation for asset, insurance and investment products.

iv) Re-enrolment and data update of households – We defined metrics that measure the quality of enrolment data based on completeness, validations and vintage. Households that did not satisfy this data quality metric were to be re-enrolled/ data was to be updated for them in the systems. Priority was accorded to households based on their engagement with us – re-enrol active and overdue households first, then dropout households and then never active households. Having quality information about the financial lives of these households would enable the Wealth Manager to offer high quality wealth management advice and hence, the right financial products suited to the household profile.

v) Credit process improvement strategies –

- Introduction of Cash flow appraisal template – The existing loan appraisal template used to capture data about a business at a point in time i.e. on the day of appraisal. Due to this, we had limited understanding on the seasonality of cash flows of the customers. Appraisal sheet that will capture the month on month cash flows of the business was introduced with an objective to understand the seasonality of cash flows of the customers, eventually leading to us designing customized products.

- De-centralisation of loan approvals – Loan sanction up to a certain amount was decentralised to the branch staff. This would lead to an increase in ownership of loan underwriting at the branch level and reduce the loan processing time.

The deep dive exercise at Sahastradhara KGFS gave us valuable insights into the running of a KGFS. It allowed us to reassess some of the contours of the KGFS model and align it to our larger mission. Some of the key insights are:

- Importance of having recent, triangulated and complete enrolment-appraisal data about our customers: In order to offer suitable financial products to the households it is important to understand their financial profile fully – income, expense, goals, assets and liabilities. We are working to make the KGFS enrolment process a work-flow based data collection system which will ask a limited set of key questions to the customer to understand their financial lives completely. To make the best use of finite customer interaction time, the data declared by the customer will be validated and triangulated at the backend using external data sources and our own historical data.

- Importance of understanding month on month cash flows of the households before product sale: Any credit product being given to a household is based on a thorough appraisal of the loan purpose and the asset being created from the loan. This deep dive exercise taught us that while it is important to do that, it is equally important to assess the current cash flows of the household which will support regular repayments. Given the rural markets we operate in, it is also important to be cognizant of the seasonality associated with these incomes. We are working to build this knowledge about income generating assets and the cash flows from that asset into the enrolment-appraisal process.

- Better use of the Wealth Manager time and improved customer experience: We are also building predictive models that would assign a score to a customer at every stage of his/ her interaction with us. This would provide better targeting strategies and specific engagement paths based on customer type, thereby improving activation rates, predicting delinquencies and customer attrition over time.

- Assessing the quality of enrolment data in other KGFSs: Data quality as a topic has garnered a lot of interest and we are working to come up with a standard set of data quality metrics which will then be published thereby incentivising the branch to collect good data. The branch staffs are also being trained on the importance of having quality data and some methods by which they can prompt the same from the customers at the time of enrolment.

- Significance of a process audit: The audit process is a key tool in identifying two things: if the process that has been prescribed is being followed on the ground (voice of process) and if there are any gaps in the process that hinder the customer experience (voice of customer). After the Sahastradhara exercise, we are trying out a couple of methods by which any prescribed process can be audited. This is being tried out in multiple KGFSs and a refined audit process is expected to be launched pan India.

- Learning about the roles of the frontend staff: The Sahastradhara deep dive reiterated the role that our field staffs play in the customer experience. It is absolutely crucial that the frontend of the organisation be empowered and owns the success of each of their branches. Decentralising certain amount of decision making will go a long way in bringing about that cultural shift.

- Leveraging existing technology: The backbone of the KGFS model is the initial investment we make in technology and how we leverage it to provide quality service to the customers. In this regard, we pushed the branches to use the mobile platform to make on-the-spot product sales and other transactions at the customers’ homes. This coupled with real time biometric authentication, thermal receipts and IVR messages provide a secure way to move product sales closer to the customers.

—

[1] Village Sangrola under the service area of Lambgaon branch is 25 kms from the branch. It takes 2 hours to cover 23 kms by road and an additional 30 minutes to walk 2 kms uphill, to reach the village. A to and fro journey to the village will consume 5 hours. Customer interaction and transaction time will take additional time. The time and distance were mapped during a field visit in May 2014.

[2] A prioritisation matrix is a demand chart equivalent in an MFI. But unlike MFIs, our Wealth Managers perform a multitude of tasks ranging from enrolment to product sale to appraisal. The prioritisation matrix helps the Wealth Manager keep track of the tasks to be completed while the tasks themselves and the priorities can be dictated from a central level.

4 Responses

This is a very good analysis and discussion. Some very good ideas here. But I feel that the “deep dive” needs to go “deeper” and start from a different “dive-spot” perhaps closer to middle of the ocean (the village / customer) and further away from the shore (the branch and its targets).

What is most worrying to me is that the language in the entire post is very much a “push-sales” language of traditional bankers — there is no mention of customer well-being in the entire post and no reference to it in any of the strategies proposed by the authors. The focus seems to be on, “the sales process”, “leveraging data for business”, “lead generation”, “activation rates”, “customer attrition”, and “preventing default” and not as much on assessing what the customer truly needs — a positive current cash-flow customer does not actually need a loan for example unless she has a growth goal (unlike what is suggested in the blog-post, the purpose of credit is not merely to facilitate smoothing for near term goals but also to meet growth needs – in fact is my sense that it is this exclusive focus on near-term goals of customers that is a significant problem — there is need to look at business customers and their working capital finance needs and long-term asset finance needs much more carefully). The purpose of computing month-on-month or even daily or weekly cash-flows where necessary, is not merely to prevent default on a badly designed product but to offer a product-design to the customer that is better suited to her situation.

I would have loved to see the deep-dive start with the customer and not with the branch and for it to have tried to independently and fully assess a set of households and understood how (and if) and the extent to which the true plan-grow-protect-diversify needs of a select group of customers of various types are being met. I feel that such an exercise would have also generated a set of specific issues that the Wealth Managers appear to be missing and some clues into how to asses the true business potential of a branch which is tightly linked to the well-being of the customer.

I feel that in banking (whether for the rich or the poor), as in most other businesses, unless there is a tight and exclusive focus on customer well-being; unless the business lives and breathes it every minute; and unless all of its language is truly about that, I feel that the business will neither achieve customer well-being nor build a sustainable high growth business.

Dear Sir,

Thank you for your comment on the blog post.

We completely agree with you that the core focus of the KGFS has to be the customer and her financial well-being and all business strategies derive from that and the language of our post could have reflected that better. In the specific case of Sahastradhara, we are still struggling with fairly basic operational issues (distance from branch, wealth manager span of control, role of middle management, quality of customer data) that severely challenge our ability to understand and service customer needs. The deep dive exercise of IFMR Rural Finance was aimed at identifying and addressing root operational causes for these as well as rolling out quality & training interventions so that the branch and the wealth manager can truly focus on core customer related processes.

While we concentrated on fixing branch level issues, we did pay attention to some crucial customer centric questions and tried out a set of different strategies to shift the

focus of the branch from product conversations to Wealth Management conversations.

Some of them are mentioned below:

1. Reducing the time between enrolment and appraisal – The enrolment process was redefined to one that not only looked at KYC, annual cash flows and balance sheet of the Household but also paid diligence to collecting information on goals and month on month cash flows in one interaction. Information from the FWR (overlaid with product rules like DSC and Human Capital) coupled with the Wealth Mangers’ Wealth management conversation would facilitate the relationship with the end customer to be a more meaningful one.

2. Decentralization of loan approvals – It was found that the loan approval processes were heavily centralized in Sahastradhara KGFS i.e. any loan between INR 5000 to INR 150,000 was approved at the HO (people who were physically far away from the customer and were appraising the customer on the basis of excel templates and no personal interaction). This process was decentralized leading to a lot of autonomy in

the hands of the Wealth Manager, resources closest to the customer. Another process that was changed was the number of times a customer was required to visit the branch for a credit product – we changed the process so that this effectively falls from 4 to 2 i.e. enrolment and disbursement

3. Beat plan – To increase face time of the Wealth Manager with the customer and build expectancy in the mind of the customers operating out of the market or residing in the villages.

4. Re-enrolment and training – Creating a buy in of the staff for good data was important and this is something we aimed to do at the deep dive. We trained the staff on the importance of collecting good data from the customers in order to understand their financial lives and hence offer suitable products.

I hope the above explains it well on how we decided to tackle one issue at a time i.e. fixing the internal processes first, to improve the reach – width and depth of services in the service area.

A good analysis keeping growth of the organisation in center of mind. I believe the mission of Sahastradhara kgfs is “to maximise the financial wellbeing of every individual and every enterprise by providing complete financial services in remote rural Garhwal” is the core of doing business there. I have worked there for 3.5 Years and trust me I have not seen as hardworking and deligent resources any where else in entire career of 14 years. I am taking this an opportunity to share some of the facts which could be helpful for the organisation in achieving its mission of doing financial wellbeing of each and every household of Sahastradhara kgfs (Restricting the views only to Sahastradhara Kgfs as it is unique geography for doing business)

1. Choose right Spot : Unlike rural or urban geography, hills have sparse population density. Having customer is prime thing to do any kind of business. Cost of delivery increases if the target segment is small. Choosing or setting up point of customer facilation (Branch) is key for this geography. This can be witnessed by comparing growth of old set of branches Vs New set of Branches.

2. Choose right product: Product designed for other geographies may or may not work in the hills considering culture, tradition or local business requirement. Jwell loan or JLG will not work in hills as taking jwell loan there is considered a very bad thing in society where as there is little say of women’s in financial matter in the geography in question. Group disiplene and group cohesion is very difficult to me maintained in JLG considering terrain and distance of household in between.

This is evident if we do the portfolio analysis of the entity. The major occupation in the geography is small retailing, having cabs, doing farming of selected fruits and beans in selected part, engagement with hotel industry and vegetable farming in certain cluster. We must have bouquet of products to cater customer need.

3. Minimising cost of operation: As population is sparse hence cost of delivery will high. To neutralize this summation of activities are required at each customer interaction. Here comes the role of beat plan. Before any customer interaction, wealth manager must have complete knowledge of requirement of customer as per wealth management principal and he must be able to offer all solution same at the time of interaction only. Technology can play a vital role here. We can leaverage the technology to minimise the cost of delivery.

4. Tight monitoring mechanism : In order to avoid any unpleasant surprise, Monitoring mechanism should be developed which must be able to throw early warning signals in each area of operation.

Summing up my suggestion…Long live Sahastradhara kgfs…

Pratap Kumar

Ex Head operation Sahastradharakgfs KGFS.

Pratap, it is very good to hear from you and thanks for your valuable comments. We are working on all of these and the Sahastradhara team has been very diligent and resilient!