Recently, CRISIL has revised the rating of the senior and subordinated securities issued by Pioneer III – a pool securitised by Grameen Financial Services – to AAA(so) and A(so) respectively. This is the third such upgrade of a microloan securitisation and reflects a trend in this asset class. Microloan securitisation has come a long way since the first such transaction structured by IFMR Capital in March 2009. Consistent upgrades across multiple transactions implies not only excellent pool performance, but also that the confidence that the investors and the rating agency had in the performance of the asset class and the originators was not misplaced.

A brief update on the three upgraded transactions.

IFMR Trust Pioneer I Transaction

India’s first rated microloan securitisation transaction was completed with Chennai based microfinance institution (MFI) Equitas Micro Finance India Private Limited (Equitas) in March 2009. This INR 157 million transaction was structured and arranged by IFMR Capital, a Chennai-based inclusive-finance company that also invested in the subordinated tranche.

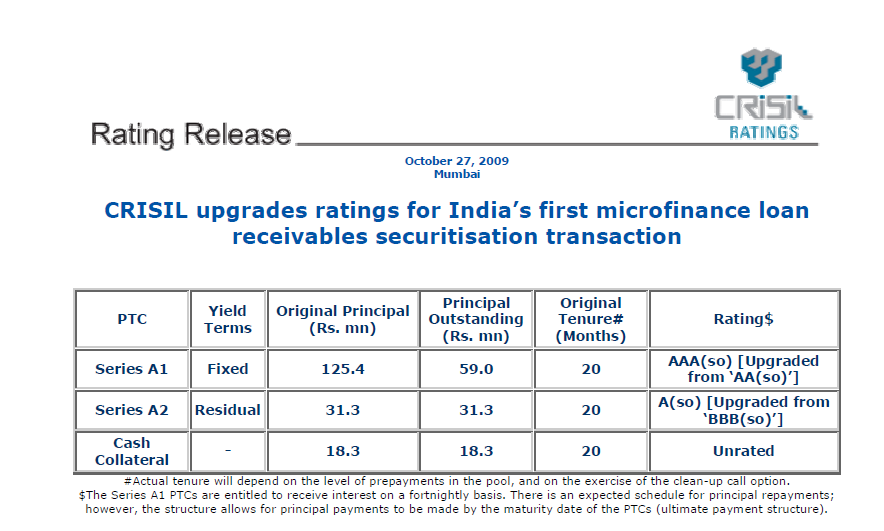

Since this was the first transaction with securitisation of receivables of a hitherto untested sector, CRISIL, India’s foremost rating agency, assigned a AA(so) rating to the senior tranche and BBB(so) rating to the subordinated tranche and mandated a cash collateral of 11.7% of the pool principal along with the credit enhancement provided through subordination in the structure.

Within six months post the securitisation, based on the observed high collection efficiency – a cumulative collection ratio of 99.8% – and the increased cover that the credit enhancement now provided to the outstanding payouts to investors – cash collateral itself now covered 20% of the pool principal – the ratings were upgraded by three notches with the senior tranche receiving an AAA(so) rating and the junior tranche’s rating being upgraded from BBB(so) to A(so). This transaction has now amortised completely with the investors (including IFMR Capital) receiving payouts as scheduled.

The rating upgrade release by CRISIL is shown below:

IFMR Trust Pioneer II Transaction

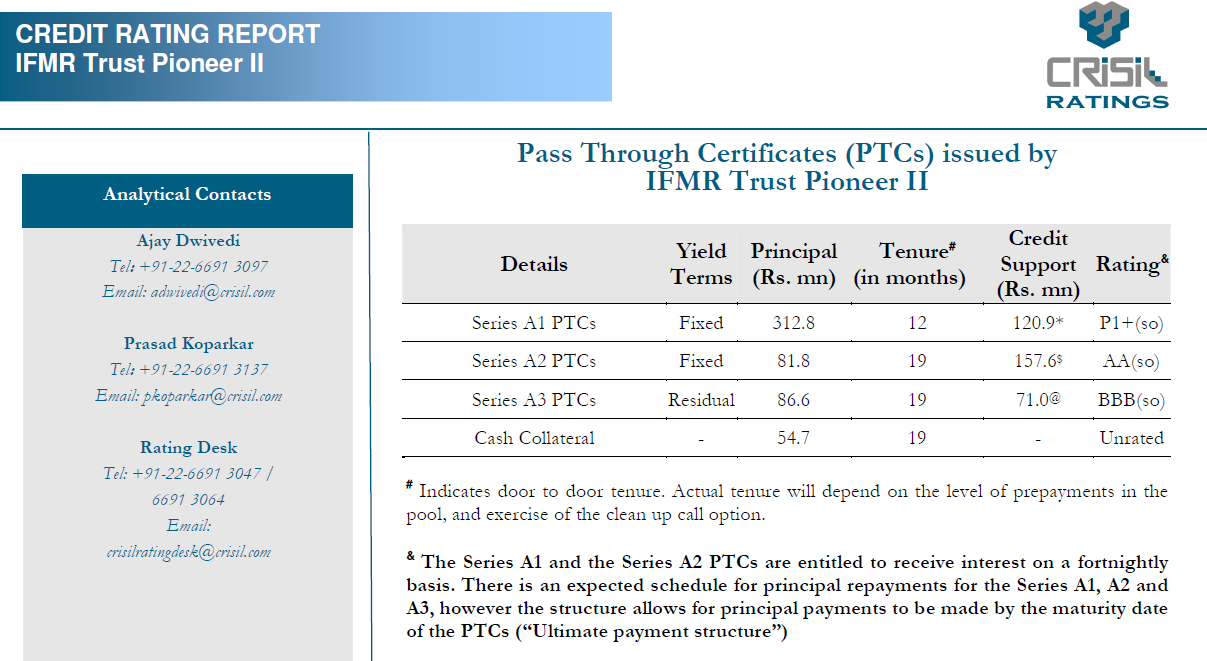

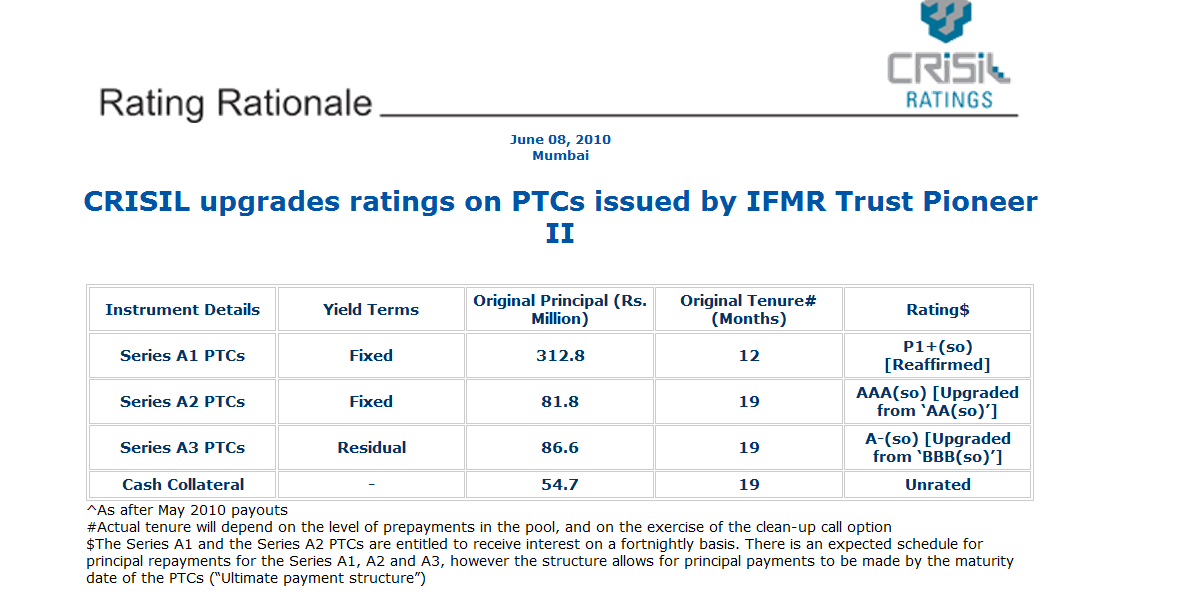

For the second rated microloan structured by IFMR Capital with Equitas, the highest short-term rating of P1+(so) was assigned to the senior tranche at the outset itself, reflecting the rating agency’s increased confidence with the sector and the ability of high-quality MFIs to deliver excellent pool performance. There were two senior tranches in the structure, with the other, longer term senior tranche receiving a AA(so) rating and the subordinated tranche receiving a BBB(so).

Again, within seven months after the transaction closing (November 2009), in the second review of the structure and pool performance, CRISIL upgraded the ratings assigned to the longer term tranches while reaffirming the P1+(so) assigned to the shorter term senior tranche. The second senior tranche was now rated AAA(so) and the subordinated tranche received an A-(so) rating. The upward revision was due to the strong collection efficiency as reflected in the 99.9% cumulative collection ratio.

IFMR Capital Pioneer III

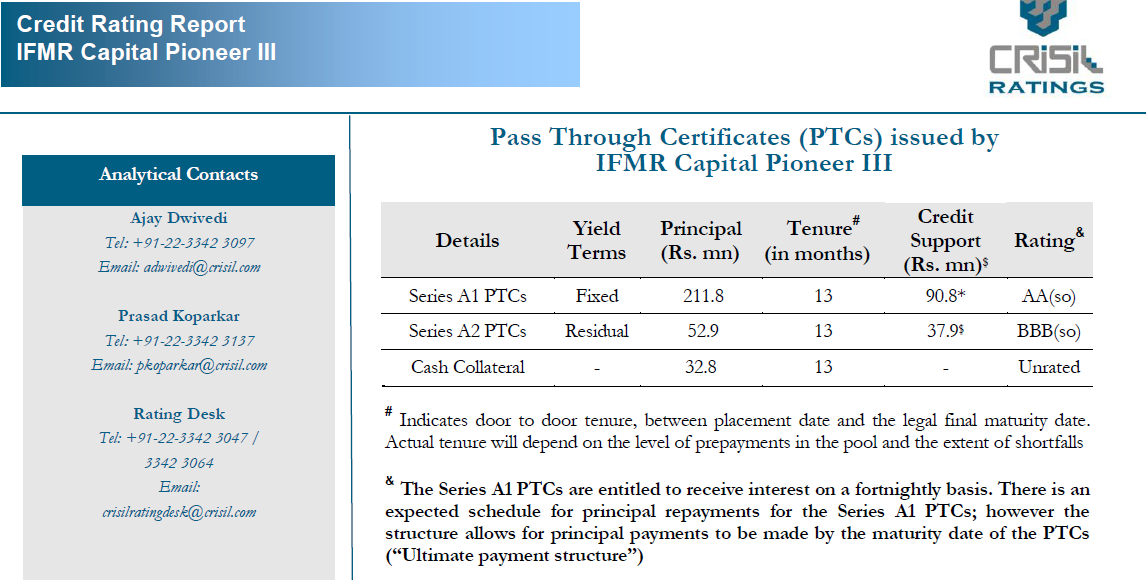

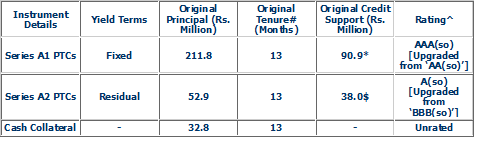

Recently, CRISIL revised ratings assigned to IFMR Capital Pioneer III, microloan securitisation of receivables of reputed Bangalore-based MFI Grameen Financial Services Private Limited (Grameen Koota). This transaction closed on March 25, 2010 this year and IFMR Capital structured and invested in the securitisation. As can be seen in the extract from the transaction rating rationale below:

the senior tranche in this transaction was assigned a AA(so) rating while the subordinated tranche received a BBB(so) rating from CRISIL. Based on 5 months of observed collections and payments to investors, the rating agency has revised the rating of the senior tranche to the highest long-term rating of AAA(so) and that of the subordinated tranche to A(so).

Collection efficiency numbers have been 99.8%. Strong collection efficiency implies zero or low utilisation of the credit enhancement (protection available to investors in the form of cash collateral and subordination of cashflows) that in turn means the cover available to investors for outstanding amounts is higher than before. Along with the increased confidence in the structure and the underlying originator based on the observed payout performance, the rating upgrade thus reflects a clear increase in the protection available to investors.

Also see:

CRISIL upgrades PTC ratings for IFMR Trust Pioneer II

CRISIL upgrades ratings for India’s first microloan securitisation transaction

CRISIL upgrades ratings on PTCs issued by IFMR Capital Pioneer III