In an earlier post on this blog, we mentioned that ‘Mobility’ was going to play an important role in enabling access to KGFS’ products and services in remote rural locations.

In the district of Tehri Garhwal in Uttarakhand where Sahastradhara KGFS operates, physical access to KGFS branches is made challenging by an inhospitable terrain. With much of the district located at and between the foothills of the Himalayas, access by road is limited. For many villages access is restricted to un-motorable roads which are often sealed by landslides caused by torrential downpours – a frequent occurrence during the monsoons. The monsoons are particularly fierce in these hills and continue from June until late September. Winter doesn’t make things easier. Snow in the more northern areas often brings life to a standstill – Villages are cutoff from power, communications and access to basic supplies.

It’s no doubt then that Sahastradhara makes an ideal case for mobility solutions that tackle many of these access restrictions.

Where would we start?

Enrolling a significant number of potential customers is a fundamental step in delivering services. Enrolments are necessary in building the critical mass of customers that is needed to effect change and create real access to the benefits that KGFS could bring to an area.

Most Sahastradhara branches cover a service area with a population of around 7000 inhabitants. Branches are typically centrally located near a market place making them accessible when people visit the market.

Since its start, at every place that Sahastradhara opened a branch, local store owners were quick to realize its benefits. Store owners were often the first customers of the branch. Thereafter frequent visitors to the market would approach KGFS to inquire about its services and would usually signup as well. This process would continue for a few months until a certain level of enrolment equilibrium had been reached at that branch.

After a few months activity would slow down. New customers would become scattered. New enrolments would no longer be proactive. New enrollees would visit KGFS to address a specific need – a sudden loan requirement – rather than as a planned financial initiative. Also many of these had family members that were already KGFS customers – and had already experienced the benefits that Sahastrasdhara KGFS had to offer. Unfortunately new (financially excluded) families were still keeping away. Sahastradhara recognized this. There was a need to “reach-out” to more people. Enrolling more people into the Sahastradhara network was one way of spreading the message and creating awareness.

The Challenge of Enrolment

The enrolment process at the branch was straight forward. Unlike signing up for common utility or government services, it was easy (customers only needed proof of their identification and home address) and it was free.

KGFS had incorporated a comprehensive customer registration system. This was done to create a unique customer profile that would allow easy access to all services that KGFS had to offer. In addition to basic demographic information, the system was capable of capturing details about the family, its lifestyle, its assets and liabilities and importantly digital copies of the customer’s photo, fingerprints, and even scanned images of identification documents. A high degree of branch automation using computers, technology peripherals and internet connectivity made all this possible.

And therein lay the challenge.

How was branch automation going to be made portable enough to allow Sahastradhara to ‘reach out’ further?

Early trials with laptops that replicated the branch setup were encouraging. The premise was that field staff would be able to take the branch setup (in a portable form using laptops) to the customer’s doorstep.

While theoretically feasible, in practice this setup did create an interesting set of challenges:

- Portability/Weight: A Laptop computer + a flat bed scanner + an optical fingerprint reader + camera + necessary charging and connectivity cables suddenly meant that field staff needed to carry a few kilos in a backpack while climbing up and down steep inclines to get to villages in their territories. Reports from the field suggested this was difficult particularly during harsher weather.

- Power: Even with extended capability batteries – peripherals that drew current from the laptop ensured a typical battery life of only 3-4 hours. With access to power still a challenge in some villages frequent trips back to the branch were necessary.

- Cost: The multiple peripherals required meant more fixed costs per branch – sometimes in excess of 10% of existing fixed branch costs.

- Human Angle: While technology in the form of television, satellite tv, and telephone was common place in these areas – computers and the peripherals necessary for enrolment were still alien. Field staff would often face puzzled looks and hesitation as they went about setting up the equipment before starting an enrolment. Customers were uncomfortable with the elaborate technology layout for what they felt should have been no more strenuous than a paper based survey – the type other agencies in the area often used. Allaying people’s reservations and fears was necessary.

All these challenges pointed toward a need for mobility that was ultraportable, efficient, and easy to use.

Enter the Mobile Phone

Mobile phones seemed like a reasonable alternative. They were ultraportable, easy to use, easily available, affordable, rugged and a familiar technology in rural India. But were they a possible replacement for the laptop system?

To replicate the laptop system (and the branch) the mobile phone would need to be an all-in-one data entry/capture device; it would need to be the camera it replaced; also the flat-bed scanner, and the biometric authentication device.

Could this be done?

To make the system viable, hardware costs needed to be kept to a minimum. But fingerprint biometrics built-in to phones were rare and did not always meet regulatory requirements. Thus the fingerprint scanner had to be an external device capable of interfacing with the phone. This was an added cost. The cost of the phone therefore needed to be minimal – necessitating a very simple phone with a basic feature set.

The Beginning of the End Result

Sahastradhara KGFS has recently successfully run a proof-of-concept field pilot for mobile phone powered enrolments that addresses a number of these feasibility questions.

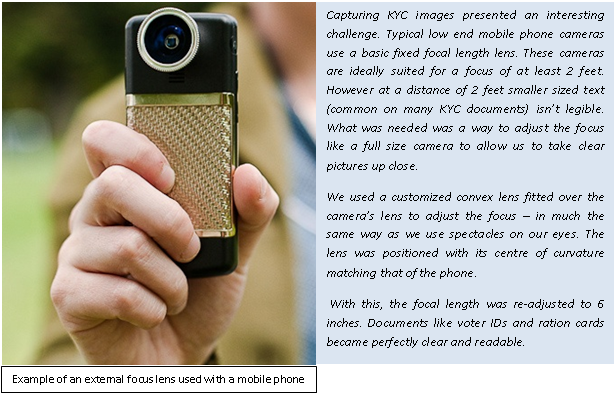

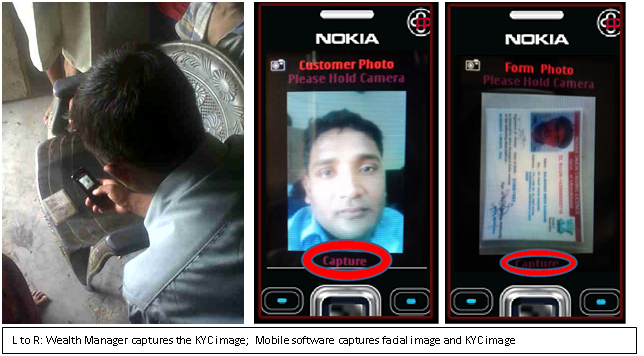

Using a basic camera enabled mobile phone with special software, field staff were able to capture photographs of new customers. The images were clear and distinguishable with a resolution comparable with the branch based system. Know your customer (KYC) document images were also captured using the same camera.

A wireless and portable finger print scanner was used to capture customer finger prints and automatically transfer them to the phone’s memory. Customer demographic and other details were (for the time being) captured using a standard paper based customer registration form – in the future this too could be entirely phone based making the paper form obsolete.

At the branch new customer data was entered into the system manually, and the corresponding images and finger prints were uploaded to a remote server through the local computer and internet connection.

Going forward

Still at an early stage in its development cycle the system has already been well received by field staff. At the pilot branch where the system was tested, month on month enrolments nearly doubled. If these numbers are indicative, the system shows great promise going forward.

This is a first, yet important, step as we make mobility an important element in our mission to provide financial access in even the remotest of places.

9 Responses

seems like you are there, Adi. solution's looking good.

vishwa

Hi Advait and Anupama, This is really great work. Throws up some interesting possibilities for us in the NEs…

Keep up the good work!

Awesome innovation..this is the way forward..proud to be part of NE

Rahul Anand

Well done, Anupama. This is truly innovating in the face of necessity. Very pleased to learn of this experiment.

This is the kind of cutting edge and continous (product and technology) innovation we need coming out of the IFMR Rural Finance system. Great work. Could be quite transformational.

This is pretty exciting! Well thought out and implemented!

Superb Anupama. And congratulations to Advait. Using Mobile is really innovative and cost efficient. We may have to support this with some hand held device for capturing household info and that will complete the task. And customer enrolment doubling is a clear indication of the acceptability. Kudos to the entire team who have made this possible. I am sure you will come out with many more such innovative solutions.

Thank you all for the positive feedback!

Simplifying and reducing the costs of biometric authentication is an area of focus that will be critical in scaling up. While fingerprints are the preferred form of biometric today – other technologies could be better suited for such applications in the future.

Thank You all for your valuable comments, while we take technology to remote areas we are learning some interesting aspects from feild too,

after our wealth managers had managed to do considerable enrollment at one of the villages , there was group of men who landed up at our branch saying your people came and took pictures of the women with a MOBILE PHONE , how can you ensure it will be not missused,they had HEARD that pictures from mobile can be sent all over the world.Lot of explanation put them to rest as they were shown our CMS, while few were our customers but still felt that on laptop its OK but MOBILE had other connotation for them. So much for goinig forward , so when we take two step forward we have to take one back … rather tread carefully . We have to take the community along… … Technology and culture both will take a while…