In the second post of our two-part series on Monetary Policy Transmission, we take a closer look at the impediments to policy transmission in India and also list the recent measures taken by RBI/Government to overcome these impediments. In addition we look at what recent empirical evidence has to say on effectiveness of policy transmission in India

Impediments to Transmission in India –

- Sustained fiscal dominance – RBI, being the merchant banker for the Government, has the responsibility to raise money, in this case through Government bonds, as and when needed by the Government. These Government borrowings tend to crowd out non-food credit in bank finance[1] and thereby reduce policy transmission. Though it is to be noted that steps have been taken to separate RBI from its public debt management responsibilities.[2] How effective these measures are and when they will reach their logical conclusion, however, remain uncertain. In contrast, many Emerging Market Economies (EME) such as Brazil, Poland, Hungary and South Africa have a separate debt management office to management government debt. Also, even among those EMEs where the central bank is involved in public debt management, their role is quite limited and they only act as a facilitator[3].

- Statutory pre-emption through Statutory Liquidity Ratio (SLR) – The SLR prescription provides a captive market for government securities and helps to artificially suppress the cost of borrowing for the Government, dampening the transmission of interest rate changes across the term structure. It was also observed that till 2014, the Government was borrowing at a negative real interest rate[4]. This was because the estimated average cost of public debt was above the average CPI inflation.

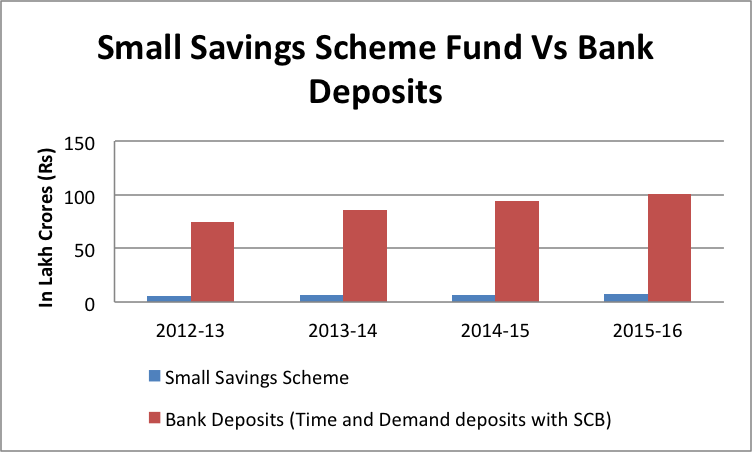

- Small savings scheme – Besides market borrowings, the other main source of funding government deficits in India is small savings mobilised through, inter alia, post office deposits, saving certificates and the public provident fund, such channels are characterised by administered interest rates and tax concessions. The substitution from bank deposits (both time and demand deposits) to small savings erodes the effectiveness of the monetary transmission mechanism, especially through the bank lending channel.

Source: Indian Budget 2017-18 and RBI’s Statistical tables relating to Banks of India : Table No. 10

As can be seen from the above graph, the funds in the small savings scheme are substantial compared to the bank deposits in the Scheduled Commercial Banks (SCB).

- Subventions – The Government also influences monetary transmission through its directives to banks. Keeping some economically and socially important objectives in mind, both the Central and State Governments offer interest rate subventions to certain sectors including agriculture[5] instead of considering direct subsidies, distorting the transmission mechanism.

- Informal Economy – India has a large informal sector workforce[6] and significant presence of informal finance as a significant source of credit for the real economy[7]. These are outside the influence of transmission measures.

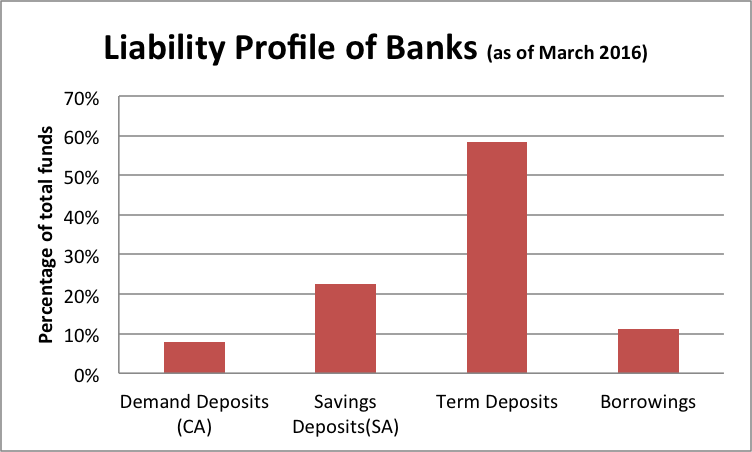

- Liability Profile – The policy repo rate does not directly affect the determination of base rate of banks. The pass-through mainly hinges on the policy rate influencing the interbank rate, which in turn, influences the deposit and lending rates[8]. This pass-through is greatly diminished, since wholesale borrowings (including borrowing from the RBI and interbank borrowings) constitute barely 10 per cent of the total funds raised by banks[9].

Source: RBI’s Statistical tables relating to Banks of India : Table No. 2 ; As of March 2016

As can be seen from the above graph, the non-deposit borrowings of banks (which include borrowings from RBI and other wholesale funding) though significant, are quite small when compared to deposit liabilities. Thus their power to influence the lending rates is low. Added to this is the limited ability of banks to reduce their deposit rates in response to lowering of the policy rate. It is quite hard for banks to lower their term deposit rates (term deposits form almost 60% of all funds) in response to lowering of the policy rate by RBI. This constraint in lowering of deposit rates imparts rigidity to the liability term structure and to that extent impedes policy transmission.

Recent measures taken by RBI/Government that helps to overcome impediments to transmission

- The Government, through an executive order, has set up a Public Debt Management Cell (PDMC) under the Ministry of Finance. The PDMC takes over the front office and the middle office functions of public debt management from RBI, while RBI will continue to handle the back office operations. The PDMC is to become a full-fledged body and completely take over the debt management functions from RBI in about 2 years[10].

- Effective from 1st April 2016, RBI has mandated all banks to move to a Marginal Cost of Lending Rate (MCLR) based regime. This rate is to be calculated taking into account –

- Marginal cost of funds

- Negative carry on account of Cash Reserve Ratio CRR

- Operating Costs

- Tenor Premium

This is set to improve the monetary policy transmission on the lending side. While early signals from the market suggest that this move would indeed increase the effectiveness of policy transmission[11], it is still too early (less than 4 quarters since the measure came into effect) to comment on the impact of this change with any certainty. Most empirical studies suggest that monetary policy transmission happens with a lag, and depending on the variable to influence, of about 2-3 quarters.

- With the Government resetting the interest rates for Small Saving Schemes every quarter[12], there is some scope for these interest rates to be aligned with the policy rate and thereby help transmission.

- There is some indication from the Finance Ministry (April 2016)[13] that it may consider replacing interest rate subvention schemes with interest subsidies paid directly into borrower accounts. However action on this is still awaited.

Effectiveness of Policy Transmission

Recent empirical research in the Indian context suggests that the bank lending rates respond asymmetrically to monetary policy, i.e lending rates respond more quickly and positively to monetary tightening than to monetary loosening[14][15][16]. Also there seems to be some evidence of pass-through in the first leg of policy transmission – Policy rates to Bank Lending rates. However, with regard to the second leg of policy transmission – Bank Lending/Financial Market rates to economic output/demand, the evidence seems to suggest little or no pass-through[17]. One reason for this could be the low level of penetration of formal financial intermediation in our economy. Put differently what it means is that the interest rate decided by RBI seems to significantly influence the bank lending rates in the right direction, especially when RBI raises the rate. But this does not seem to impact the output or price of goods and services in any substantial way. One reason for this is that large sections of our population still do not save in or borrow from banks or other formal financial institutions. However, with the current thrust on financial inclusion and the consequent spread of the formal financial system, the transmission in this leg is likely to get strengthened over time.

[1] Urjit Patel Committee Report (2014), Chart IV.2

[2] The Hindu Businessline – Debt management office to gradually-end; Oct 2016

[3] Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chair: Dr. Urijit Patel, 2014)

[4] Ibid, Chart IV.3

[5] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=10540&Mode=0

[6]http://www.ilo.org/wcmsp5/groups/public/—asia/—ro-bangkok/—sro-new_delhi/documents/publication/wcms_496510.pdf

[7] http://www.mospi.gov.in/sites/default/files/publication_reports/KI_70_18.2_19dec14.pdf

[8]Sonali Das , IMF working paper WP/15/129 – Monetary Policy in India : Transmission to Bank Interest Rates

[9] Urjit Patel Committee Report (2014)

[10] The Hindu Businessline – Debt management office to gradually-end ; Oct 2016

[11] Indian Express – Private Sector capex ; Oct 2016

[12] Press Information Bureau release ; March 2016

[13] The Hindu Businessline – Govt. to pay interest subsidy directly to borrowers ; April 2016

[14] Mishra, Montiel and Sengupta (2016) , “Monetary Transmission in Developing Countries – Evidence from India”

[15]Bhupal Singh (RBI 2011) , “ How asymmetric is the monetary policy transmission to Financial markets in India”

[16]Sonali Das , IMF working paper WP/15/129 – Monetary Policy in India : Transmission to Bank Interest Rates

[17]Mishra, Montiel and Sengupta (2016), “Monetary Transmission in Developing Countries – Evidence from India”