Happy Birthday Pudhuaaru KGFS, and if we may say so as an objective evaluation team: Many happy returns (in every sense of the word)! Today marks the 8th anniversary of Pudhuaaru KGFS and it is laudable that it not only set itself a social purpose on top of business goals but also allowed the results towards this purpose being scrutinized independently and scientifically, almost from the start of its lifetime. As the initial results emerge from the large, randomized control trial that has been following the serviced areas and households over several years (KGFS: Impact Evaluation [IE]), there are clear indications that Pudhuaaru KGFS has more impact on its clients’ life than just any business might.

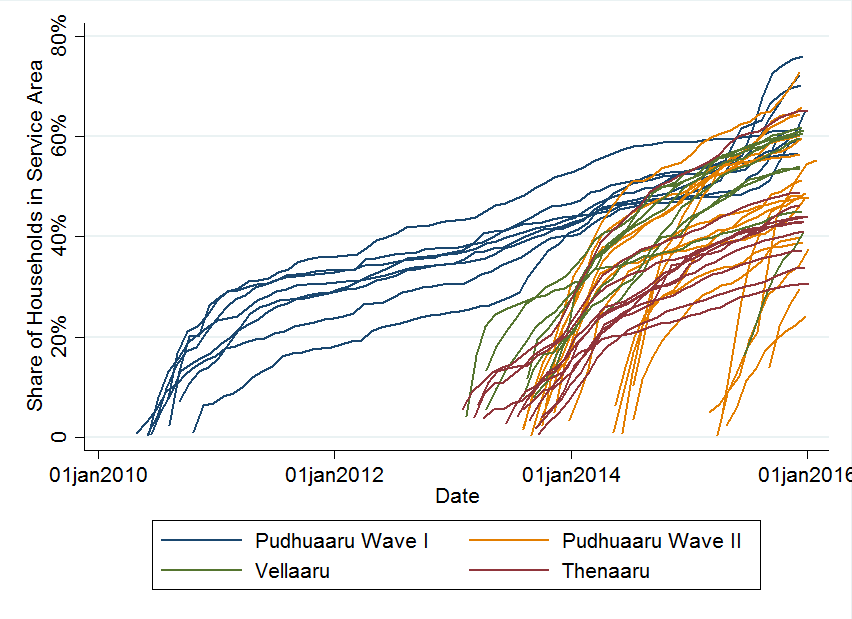

Over the last eight years, microfinance itself has grown up and evolved, not without many developmental setbacks. Rapid expansion of MFIs in the early 2000s with the view that “all humans are born entrepreneurs” (Muhammad Yunus) and universal access to microloans would move people out of poverty via self-employment, gave way to the 2010 microfinance crisis of Andhra Pradesh with over-indebted farmers taking their lives over the desperation of not being able to pay back their unsustainably large debts. The shock to the industry is evident in the stagnant take-up rates in initial branches around the same time (see figure 2 below). Confidence in the channels and magnitudes of impact was battered further by several evaluations with no detectable or very modest results (see e.g. Banerjee et al, 2013, and 2015) and finally, the concept re-emerged as a more wholesome “financial inclusion” to once again raise hopes for a multitude of social outcomes.

Pudhuaaru KGFS has waited out the storm with confidence in its model and the flexibility to react to the demands of the market and offer a broader product portfolio than most MFIs, has made it stand out from the others in the sector. The KGFS:Impact Evaluation study is researching the impacts of a business model much more resembling banks as we know them for middle class customers than traditional MFIs, including a broad range of loan products, insurance and savings products as well as wealth management advise.

The evaluation is based on the randomized roll-out of branches which ensured that we have comparable “control areas” with no branches and any significant difference we can find between the areas with and without bank branch can be traced back to the opening of a bank, discounting any intervening factors. From 2010 onwards, we have repeatedly interviewed nearly 19,000 households in three districts (3,300 for a large household survey and 15,300 for an additional, shorter social network mapping), including a majority of Pudhuaaru KGFS branch service areas.

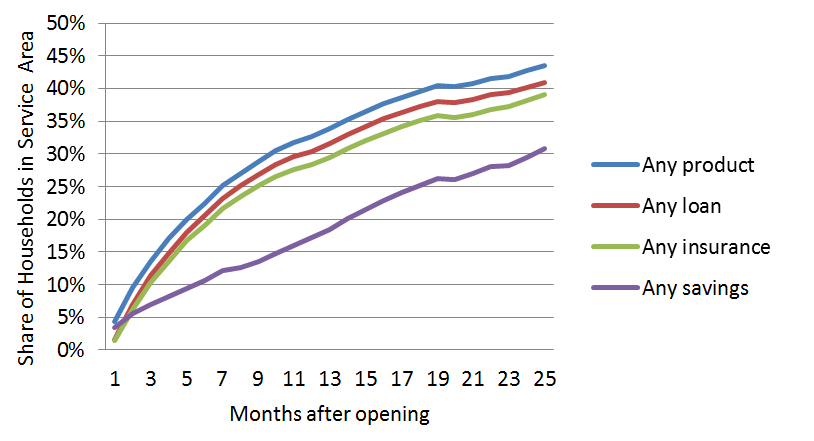

The first thing to note is that the engagement with the products is reasonably high. KGFS customer data and census data from the area show that 44% of households in the service area (defined as a five km radius area around the branch) have taken up at least one product at this point. Many have taken multiple products – on average eight – in the first three years of branch operation1.

Second, the take-up of insurance products is equally high as of loans products, with only savings products lagging behind somewhat. This sets this evaluation apart from other similar evaluations that have suffered from low-uptake of the product they are trying to evaluate in an Intent-To-Treat model (i.e. the impact is assessed over all of the possible clients, not just the ones that did indeed take products. Low take-up might lead to difficulty in getting precise estimates of the observed changes).

Figure 1: Product take-up in study branches by month of opening and product type

We can also observe that KGFS has improved its model with experience: take-up is more rapid in the waves of branches that opened later, reaching an average of 32% of village households with at least one product one year after opening (vs. 23% in the initial branches).

Figure 2: Product take-up in study branches over time

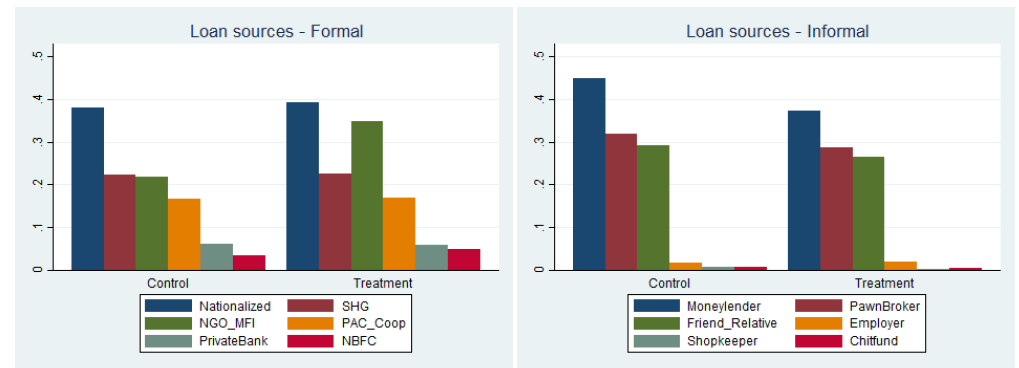

We have so far collected only two thirds of the final data set, and thus we are cautious to make definite statements, however, it is very clear that KGFS is taking away business from the informal sector and moneylenders in particular. While the share of population with formal loans is 65% in treatment areas, it is only 60% in control areas and additionally, informal borrowing is 4 percentage points higher in control areas. Especially moneylender borrowing is affected, which is 8 percentage point lower in treatment areas; this is a 20% decrease compared to the matched areas without a branch. From our survey of informal financiers servicing the same regions, we know that they are charging much higher interest rates for loan products, nearing 60% annual rate, while KGFS is at 25% for its products. Based on this, we are hopeful to see some further changes in the structure of employment, investment or consumption. Overall indebtedness is only slightly higher, at 89% of households in treatment vs. 86% in control areas with outstanding loans. A social network map of the study area also shows that people might have to rely less on far away friends and family when borrowing for emergencies and hence reduce their borrowing from them. We will substantiate these first indications in the months to come until the end of the evaluation period at the close of this calendar year.

Figure 3: Sources of outstanding loans in the KGFS treatment and control areas

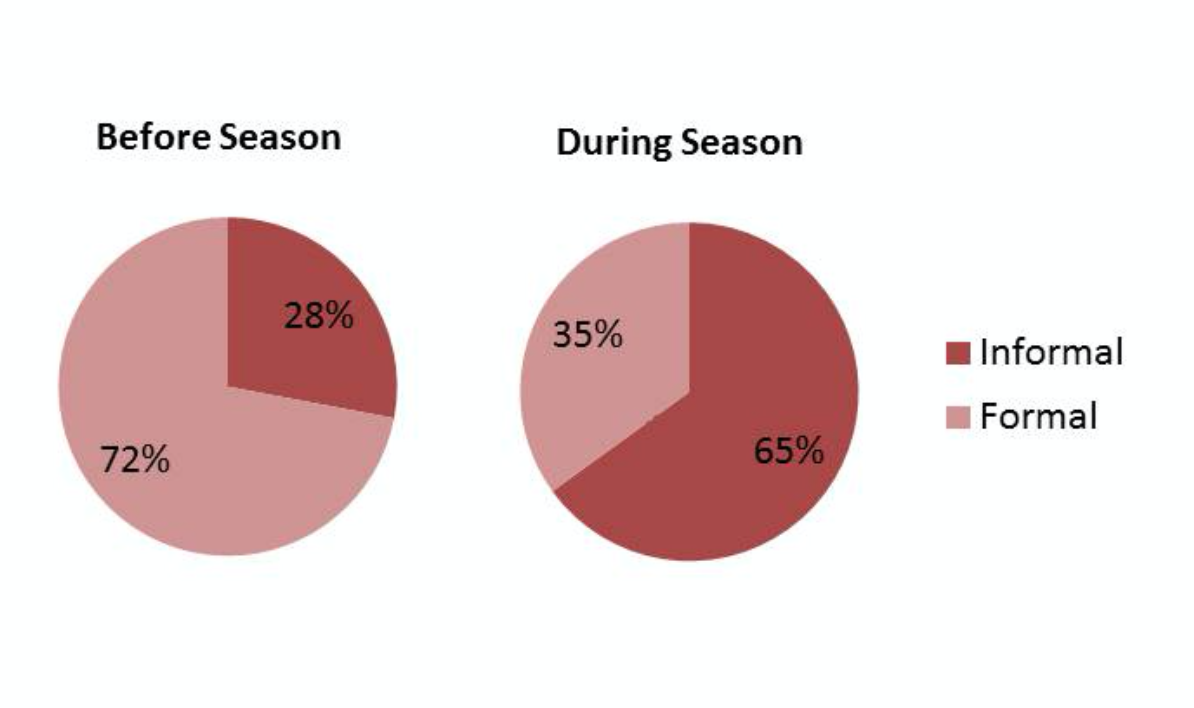

The evaluation also shows up the limits of Pudhuaaru KGFS’s model as it currently stands. In a dedicated agricultural component (as part of the global Agricultural Technology Adaption Initiative), we are seeing that, while formal loans make up a large share of loans before the beginning of the season, they are not deemed to be flexible enough to still be of relevance once the season starts (see figure 4, more information here).

This insight gets reinforced by the survey of informal financiers who quote turnaround times and flexibility in loan payback frequencies that might not be replicable for KGFS. Some of the changes in product design were already implemented by KGFS, for example door step collection of repayments has by now become a common feature even of branch banking. One can see from this survey that customers are willing to pay extra for the service of flexible repayment windows and absence of formal documentation.

Figure 4: Farmers use formal loans mostly at the start of season

It is not the case that only financially excluded people resort to moneylender loans: in fact around two-thirds of moneylender customers have loans with formal institutions. Providers like KGFS will have to be creative and innovative in their product design and use of technology to match some of these features. This will determine whether they will be able to reach out and affect the life of the customers in their areas even more widely than has happened in the last eight years.

—-

1 – This data is from the 36 branches that opened in the last three years, which makes them more comparable than the earlier 8 branches.

Sources:

Banerjee, Abhijit V., et al. “The miracle of microfinance? Evidence from a randomized evaluation.” (2013).

Banerjee, Abhijit, Dean Karlan, and Jonathan Zinman. “Six randomized evaluations of microcredit: introduction and further steps.” American Economic Journal: Applied Economics 7.1 (2015): 1-21.