This blog post discusses the concept of weather-indexed insurance in India, its advantages over traditional yield-based insurance schemes and the institutional and infrastructure requirements for successful implementation of weather-indexed schemes.

Crop insurance schemes are one of the most important risk management tools available for Indian farmers, given the high degree of uncertainty and risk involved in agriculture. In India, crop insurance operates on both an area basis and on an individual basis. Yield-based insurance schemes, such as the National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS) make most of the market for crop insurance. These schemes employ techniques such as crop-cutting and aerial surveys, to gauge the amount of yield loss incurred by the farmer due to droughts, floods, or other forms of natural catastrophes. This often results in high transaction and damage assessment costs to the insurer. One alternative currently being practised are weather-indexed insurance schemes.

Weather indexed insurance schemes assume deviations in weather conditions as a proxy for yield loss and compensate for the assumed loss. They indemnify the farmer against smaller variations in weather parameters, compared to yield insurance schemes. Typically, volume of rainfall, number of rainy days, dry spell and wet spell, temperature, humidity, sunshine, and wind speed are considered. The index is usually created with a specific geographic region in mind, which results in more accurate correlations between the yield and the parameters considered. When these parameters cross their predetermined minimum and maximum thresholds pay-outs are automatically released to the farmer, resulting in almost zero damage assessment costs.

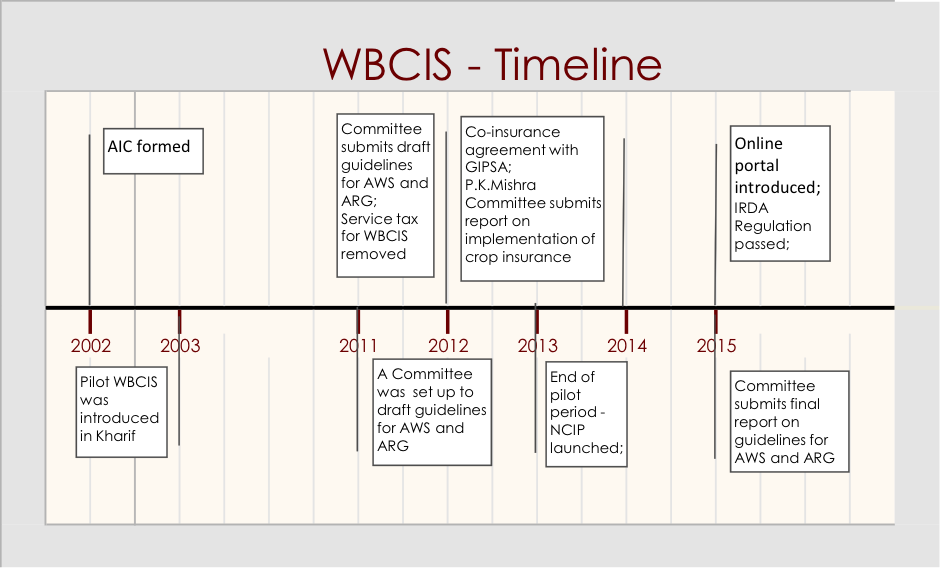

In India, the pilot for Weather-Based Crop Insurance Scheme (WBCIS) began in Kharif[i] 2007. WBCIS is a subsidised weather-indexed insurance program, in which the premium subsidies are shared equally by the State and the Centre. Since inception, it has been made compulsory for farmers who avail a loan (loanee farmers), though it is also available to other farmers (non-loanee farmers) through the same financial institutions such as banks, insurance agencies and authorised representatives of Agricultural Insurance Company of India (AIC) Limited. Over the period of last 7 years, the size of coverage under WBCIS has increased and the scheme has covered about 10 – 12% of the country’s total operational holdings in 2013-14.[ii]

WBCIS also has many distinct advantages over other yield-based insurance schemes such as the NAIS and MNAIS. Objectivity and transparency is higher compared to yield-based insurance programmes. NAIS and MNAIS would also involve significant loss-assessment costs, like for crop-cutting experiments. WBCIS entails no specific costs as there is no separate assessment for loss. Provided that the density of weather stations is improved, WBCIS also incurs a lower basis risk in comparison to NAIS and MNAIS. This is because individual differences in farming may cause individual yield outcomes to differ drastically from the average yield of the area while weather conditions remain mostly similar. Claim payments are automatic based on the weather readings and are given out within 45 days without requiring the insured farmers to make a claim, making them comparatively faster.[iii] Government liabilities for WBCIS are close-ended as they subsidise the premiums instead of the claims, as in NAIS and MNAIS.[iv]

For effective implementation of WBCIS, initial infrastructure to measure, record, and transmit weather information needs to be set up at a suitable density. These include setting up of Automatic Weather Stations (AWS) and Automatic Rain Gauges (ARG). For plains and other terrains that share a similar geography, one AWS for every 10km radius is sufficient. However, for hilly areas and areas where the terrain changes intermittently, anything more than a 5km radius increases the basis risk, as uncertainty about the weather conditions at the margins become higher. Assuming a 5km radius, about 40,000 weather stations are to be installed for WBCIS to be effective.

Guidelines to install AWS and ARG were determined by a Committee[v] in January 2015. It stipulated less stringent specifications, as compared to the existing norms imposed by the Indian Meteorology Department (IMD) or the World Meteorological Organization (WMO) for AWS siting, installation, and weather data quality management. This was primarily because of two reasons: (a) the objective of AWS installations under WBCIS are limited to monitoring and recording the weather indicators, whereas the WMO and IMD guidelines aim to collect data for research and forecasting purposes and, therefore, require more complex equipments; (b) given the remoteness of locations for these AWS, the WMO and the IMD guidelines were deemed costly and infeasible. To install the huge number of AWS demanded by the Scheme is nearly impossible in a short span if all the stringent guidelines were to be followed. WBCIS only requires collection of weather data and storage in a central repository. So, this Committee has simplified the WMO and IMD guidelines and has stipulated an AWS which can only capture weather parameters instantly and communicate with the nearest Reference Weather Station.

However, to maintain uniform quality with other weather stations set up according to the WMO guidelines, the report submitted by the Committee suggests that the data collected by the individual AWS should be monitored by a Central Receiving Station to check for missing values and accuracy. In other words, WMO guidelines for quality control of AWS data are to be adopted by these Receiving Stations. Funds to install these infrastructures are partly provided by the Centre and the rest is borne by the State. Increasingly, many private companies like Skymet are also setting up additional AWS and selling weather data to private insurance companies for areas not yet covered by the IMD. The Report of the Committee constituted to review the Implementation of Crop Insurance Schemes in India suggests that weather data ought to be treated as a public good. Public and private companies should share weather data with others and preferably collate it in a central repository, to lessen the basis risk and to ensure more uniformity in payouts.

The Agricultural Insurance Company of India (AIC) is a general insurance company started during the financial year 2002-03, which is responsible for the implementation of all crop insurance schemes. The large shareholders are General Insurance Corporation of India (which owns 35% of the total shares of the company) & National Agricultural Bank for Rural Development (NABARD, which owns 30%). The AIC receives the premium subsidies from the Central and the State governments and distributes it to the private insurance companies.

Since inception, crops and locations chosen under WBCIS are not eligible under NAIS. In Kharif 2014, WBCIS was offered along with MNAIS. During Rabi 2014-15, AIC decided to club together its yield insurance policies (i.e. NAIS and MNAIS), and WBCIS was offered alone. This separation of the WBCIS and MNAIS is necessary since it alleviates two drawbacks found earlier: one, it was chaotic for the farmers and the insurers to deal with situations where claims could be placed under one and not the other. This led to widespread dissatisfaction among the farmers. Two, the payout frequencies and magnitudes of MNAIS and WBCIS vary. With this separation, WBCIS could be tuned to cover moderate frequency and moderate severity losses as MNAIS is more suited for low frequency and extremely severe losses. However, WBCIS cannot be used as a substitute for other yield-based insurance schemes, despite its quicker payment. It can be used as a double-trigger crop insurance product for higher value crops.[vii]

The next post on this subject will discuss the challenges being faced in the effective implementation of WBCIS in India.

—

[i] Kharif crops or monsoon crops are domesticated plants cultivated and harvested during the rainy (monsoon) season in the South Asia, which lasts between April and October depending on the area. Main kharifcrops are millet and rice.

[ii] Annual Report – Agricultural Insurance Company of India Limited – Financial Year 2014-15 – http://www.aicofindia.com/AICEng/General_Documents/Annual_Report/Annual%20Report%202014-15.pdf

[iii] WBCIS – FAQ http://www.aicofindia.com/AICEng/General_Documents/Product_Profiles/WBCIS_FAQ.pdf

[iv] Ibid

[v] Report of the Committee to Draft Guidelines for Setting Up Automatic Weather Stations (AWS) and Automatic Rain Gauge (ARG) by Private Agencies and Their Accreditation, Standardization, Validation and Quality Management of Weather Data etc. Submitted to Department of Agriculture and Cooperation, Ministry of Agriculture in January 2015 http://agricoop.nic.in/imagedefault/credit/aws_gui_cre.pdf

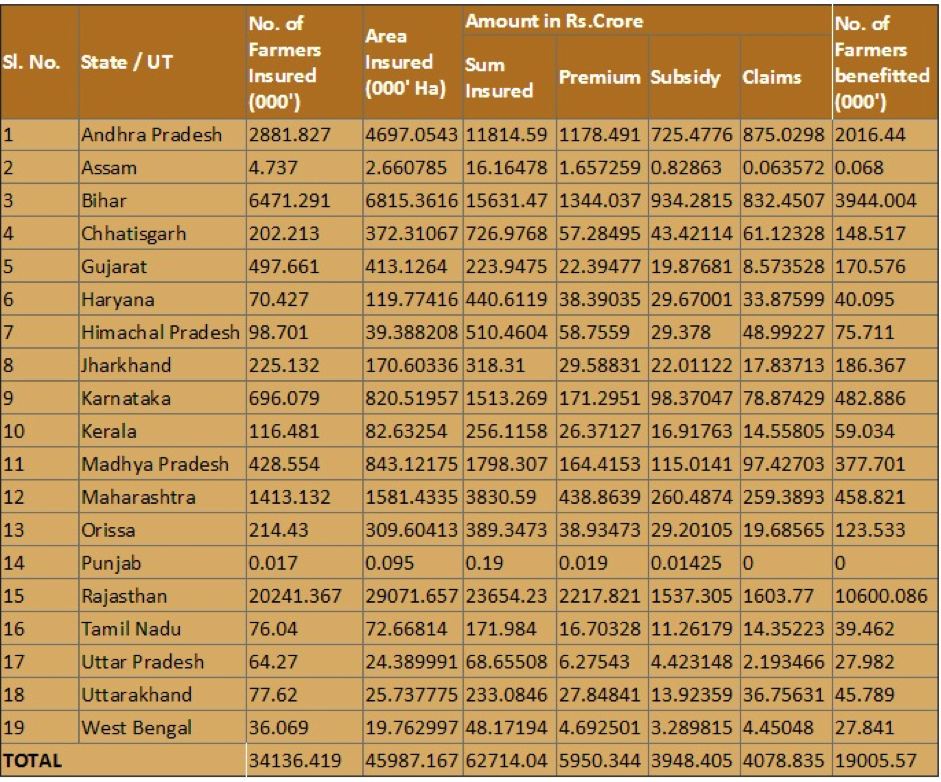

[vi] All-India Business Snapshot WBCIS – Business Statistics from Kharif 2007 to Kharif 2014 i.e. for 16 seasons(as on 1/5/2015) http://www.aicofindia.com/AICEng/Pages/Business_Profiles_Tenders/BusinessProfilesWBCIS.aspx

[vii] Report of the Committee to Review the Implementation of Crop Insurance Schemes in India http://agricoop.nic.in/imagedefault/credit/Rpt_pkm2.pdf

3 Responses

Thanks. One question relating to the table (Figure 1) for now: do you know if the “subsidy” column is government subsidy ON TOP OF the “premiums” column, or if the “premiums” column includes both farmer-paid and subsidised parts of the premiums?

Hello, The “premiums” column does not include the “subsidy”. The premium rates are calculated at different rates from the sum insured, varying with different states and crops.

Thanks for sharing this post. I have been curious about these types of topics, it’s been a pleasure to read this post. For the upcoming articles please let me know.