This post is a continuation of IFMR Finance Foundation’s blog series on the different aspects of the Report of the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households.

By Anand Sahasranaman, IFMR Finance Foundation

In view of the rigid sectoral targets and the absence of an active trading market for PSL assets, current PSL requirements force identical strategies from all banks, with little scope for specialisation.

The sectors qualifying for PSL have been updated by the RBI from time to time. Within the overall sectoral definitions prevalent currently, there are also sub-targets for some sectors: for instance, there is a target of 13.5% of Adjusted Net Bank Credit (ANBC) to Direct Agriculture, 4.5% of ANBC to Indirect Agriculture, and a target of 10% of ANBC for credit to Weaker Sections. Analysing the performance of banks in meeting these sub-targets reveals that meeting the Direct Agriculture sub-target has consistently proven to be a challenge for the banking system, with a 25% shortfall in achievement against the stipulated target. Additionally, the banking system overall also falls 10% short of achieving the Weaker Sections target.

In addition to the sectoral dimension, there is also significant regional disparity in the disbursement of PSL credit. Southern and western states have traditionally benefitted from PSL disbursements, while the central, eastern and north-eastern states have been neglected. During the 11th Five Year Plan, 37.6% of agricultural credit was disbursed in Southern India, which accounts only for 18.7% of India’s gross cropped area. On the other hand, Eastern India received only 7.3% of agricultural credit with 14.7% of gross cropped area and Central India received only 13.2% of agricultural credit with 27.2% of gross cropped area.

In view of the challenges banks face in achieving PSL targets in some sectors and regions, and in order to ensure that banks have the incentive to specialise while achieving these targets, the CCFS has recommended the Adjusted PSL (APSL) mechanism. Under this mechanism, while there is no change in the underlying sectors eligible for PSL, there is additional weightage given to lending to the more difficult sectors and districts. The target for banks is to reach an APSL of 50% by lending to any combination of PSL sectors and districts they choose.

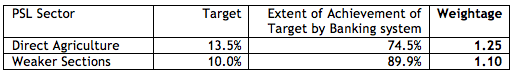

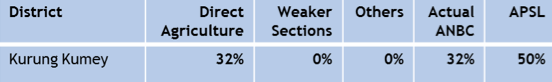

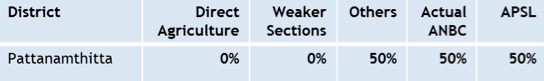

As discussed earlier, Direct Agriculture and Weaker Sections are two PSL sectors that have seen shortfalls in lending, and based on the historical extent of shortfalls, there is additional weightage now provided under the APSL mechanism, as follows:

As the table indicates, Rs.1 lent by a bank for direct agriculture would be multiplied by a factor of 1.25, and the Adjusted PSL achievement would be equal to Rs.1.25

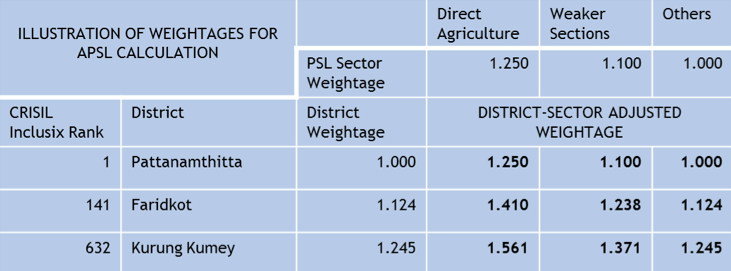

In addition to PSL sectoral weightages, regional discrepancies have been addressed through district-level weightages which are based on the extent of financial inclusion in each district, as per the Crisil Inclusix Index. Scores in the index range from 96.2 for Pattanamthitta district in Kerala to a low of 5.5 for Kurung Kumey district in Arunachal Pradesh. A raw district weightage for each district is calculated based on the distance of the score for that district from that of the best performing district, i.e., the worst performing district would have the highest weightage. However, in order to ensure that the district weightages do not become too high, they need to be damped down by a factor which is calculated such that the district with a CRISIL Inclusix score of 50 gets an APSL of 50% for achieving 40% ANBC with the current sub-targets within PSL.

The combination of district and sector weightages will determine the overall APSL applicable for each bank’s PSL portfolio.

As the table illustrates, each district-sector combination has a weightage attached to it which is based on the individual weights of that district and that sector. For instance, Rs.1 lent by a bank for direct agriculture in Faridkot district would be multiplied by a factor of 1.41, to get an APSL achievement of Rs.1.41. It is also apparent that the APSL mechanism does not in any situation result in weightages of below 1, meaning that Rs.1 invested by a bank in any PSL asset in any district would at least yield an APSL of Rs.1.

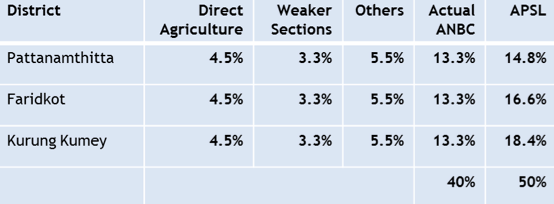

Overall, the implication of the APSL mechanism is that it will be the strategies of individual banks that will determine the fraction of ANBC they will need to lend as PSL – the only stipulation being that each bank will need to achieve a target APSL of 50%.

This is clarified through the following illustrations of 3 banks following distinct PSL strategies to reach an APSL target of 50%:

1. BANK 1 lends equally across 3 districts – the most financially included district, the least financially included district, and the district with the middle score in the Crisil Inclusix index. Its PSL portfolio follows all the sub-target norms as per current PSL requirements. This bank will need to lend 40% of ANBC to reach the APSL target of 50%.

2. BANK 2 lends only for Direct Agriculture in the least financially included district, and will need to lend only 32% of ANBC to reach the 50% APSL target.

3. BANK 3 lends only for SME Export in the most financially included district, therefore needing to lend 50% of ANBC to reach 50% APSL.

In conclusion, the APSL mechanism is designed with the intent of promoting increased specialisation among banks by incentivising lending to the more difficult regions and sectors and by enabling banks to follow distinct strategies in reaching the APSL target.

11 Responses

I would say that this

is Priority Sector redefined and more realistic in approach. While the tendency

presently across banks is somehow achieve the PSL target at the year end and banks

have been treading the path which is easy & hence lend in areas wherein it is

easy to lend/disburse. So neglected areas would continue to remain neglected. The

suggested approach is incentivising banks to lend in difficult areas and

thereby removing the existing regional disparity. When the policy stipulates

13.5% credit as direct agriculture lending and banks can conform to this, I am sure

the suggested approach would ensure that banks proactively remove this inequality.

Thank you sir for your comment.

Comments on the Priority Sector targets

Upfront a key issue seems to be the rigidity of the targets by sectors/sub-sectors. Also implied through the note is the inappropriateness of fitting a single distribution sub-target for different sectors to all districts and sectors within all districts.

1. Rigidity of targets

The priority sectors cross a hybrid of two aspects

a. Sectors deemed important by govt

b. People from weaker sections of society

Sub-sectors are completely place dependent. For example, you can’t have high agricultural lending targets in Garwal , Uttarakhan. Farm land doesn’t exist in scale! Its too fragmented. Commercial farming is minimal. What is a bank going to lend to?

2. The flaw of “targets” for debt disbursements and the need for capital

Debt implies the existence of a viable enterprise or individual. The debt is a derived instrument. Banks do not have the onus, as per this policy, too seed enterprises that can avail debt once they find their feet. Poorer people and sections lack capital to fund the risks (even good risks) of running or expanding enterprise. There is nothing in the policy that qualifies non-loan disbursements as “priority”.

The debt targets system is a throw back to the old system of economy:

a. Govt handed out loans (this is now a prudent one courtesy RBI/ Basel etc) in loan melas

b. Govt controlled economic activity through licenseing and price controls, so knew quite well who could be making money and who couldnt’

These are totally inappropriate to current context.

3. Adding quasi-equity and innovative debt products to qualify as priority sector funding (not just lending).

Venture funds established earlier (TDICI and others) offered hybrid debt instruments that were linekd to turnover / profits of enterprises funded. Higher returns were part of the package for the extra risks taken. Why shouldn’t any avenues like this be included? Its after all providing funds towards priority sectors – people without jobs or income.

4. All lending within a target community aids “priorities”

Why shouldn’t consumer lending in the nature of :

i) Education and personal loans

ii) consumer credit tied to asset acquisition (these can be limited to prevent abuse and expanded gradually on annual reviews).

Both will entail credit risk evaluation by the bank on repayment ability – that will only come from incomes generated. If the loan is to “the weaker” section, why isn’t it also priority?

5. Complicating matters with further weightages

If a district weightage is 1.25 – its simply saying achieving 80% of stipulated target is enough. Why not just call it that – 80% is the target? instead of adding some more number work.

Same could hold for a sector.

Both the above weightages will involve a lot a bargaining at district and sector level. Add 600 districts x 6 sectors, that’s 3600 weightages that banks (primary stakeholders) would love to jig in their favor in terms of achieving and looking good. None of these weightages can hold over a long term – for example, once a critical mass of enterprise is acheived – Tirupur export cluster – lending is easy. RBI will be facilitating banks to expand their “easy” work rather than doing the difficult ones. Plus adding further monitoring and audit work at a micro-level that isn’t practically handleable. Even if outside independent audit is done to review these matters, it’ll add the cost of business to already marginal areas.

My suggestion is :

Stick to 40% (or whatever number)

List a broad swatch of sectors as indicative in the various geographies

Stick to simple numbers and review

6. Govt’s financial inclusion iniative is to widen the spread of “access” to bank funding.

Critical aspects are

Opening a bank account so that a person’s credit history develops

Relationship paves the way for other financial products including lending

Why not set targets for account opening to new customers? and then lending to eligible ones?

Many details may still need to be worked out.

7. The govt has accepted the principle of focussed efforts in difficult areas in telecom through the USO fund. What prevents doing the same for banking? All banks pool in target funds (in some common fund). The fund manager’s job is to hassle banks into acheiving sales targets for funds disbursements. This way we don’t duplicate efforts by have someone who’s sole job is pushing the agenda. Non-pushing is the sole reason why the small account opening hasn’t been happening despite RBI’s excellent initiative to make life simple!

Hope this provokes some discussions!

Dear Pras, thank you very much for your detailed comment. Please

find my response below:

1. Rigidity of targets

The APSL mechanism is designed to allow banks to focus on their

inherent strengths and capabilities, and local economic conditions while

lending. The APSL mechanism does not mandate high agricultural lending targets

in Garhwal; banks in the area may choose to lend only to SMEs or weaker

sections in the district and still achieve their PSL targets. However, since

the agriculture is the most credit strapped sector, lending to direct

agriculture in Garhwal will be accorded more weightages than lending to other

sectors.

2. The flaw of “targets” for debt disbursements and the need for

capital

The report is in general agreement with the point you make. For

instance, the report recommends that government interventions like interest

rate subventions and waivers be offered directly to beneficiaries by the

governments using DBT. This allows “banks

and financial institutions to act strictly according to market principles so as

not to introduce strong moral hazard and make it difficult for financial institutions

to enforce contracts” (Page 92). The report cites the example of EU and the US,

where subsidises offered ensure that there are minimal distortions in the

market prices and production decisions of farmers.

3. Adding quasi-equity and innovative debt products to qualify

as priority sector funding (not just lending).

Although not mentioned in the post, the report has argued that equity

investments by banks in complementary infrastructure within the purview of PSL guidelines, such as rural warehouses, market yards, godowns, silos, and NBFCs in low financial depth districts be made eligible for contribution to the

overall priority sector lending targets. The report recommends that this be

permitted where debt already qualifies for PSL but with a multiplier of four,

to reflect the higher risk and the illiquid character of these investments. This

benefit must accrue as long as the equity investment is held by the Bank. Further, this list of eligible equity investments may be varied from time-to-time. (Page

121)

4. All lending within a target community aids “priorities”

The Report recognises several inconsistencies within the current PSL

framework. For instance, “the logic for higher education loans being reckoned

as PSL and primary education loans not being eligible is not clear…Another

concern is the bias towards ownership housing and not rental housing by making home loans up to a specific amount eligible for PSL” (Pg. 128). The report recommends that “each ‘significant’ sector or sub-sector (with more than a 1 per cent contribution to the GDP) of the economy should achieve at least a 50 per cent credit to GDP ratio (financial depth) in order to ensure that the absence of finance is not retarding its growth”. Further, the difference between observed financial depth and the 50 per cent goal should define the weight assigned to it. The report recommends that a similar methodology be used for calculating district weightages as well.

However, it was not recommended that the RBI shift to using this

methodology immediately due to the paucity of data regarding current levels of

district and sectoral financial depth. The report recommends that the RBI

eventually shift to such a transparent mechanism where all sectors or districts

that haven’t achieved minimum levels of financial depth be considered as

‘priority’.

5. Complicating matters with further weightages

The district weightage proposed by the report should not be seen as

a target. For instance, there is no target for a bank to lend in Kurung Kumey.

However, if it chooses to lend in the district, it could benefit from the

additional weightage accorded for lending in a more financially excluded

district. It is up to the bank to design its optimal district-sector matrix

based on its inherent strengths and efficiencies. Further, the district and

sectoral weightages are envisaged as dynamic multipliers that mirror the level

of inclusion achieved on the ground. For instance, as Tirupur or Kurung Kumey

become more financially included, we expect their respective district

weightages to reflect this.

6. Govt’s financial inclusion iniative is to widen the spread of

“access” to bank funding.

One of key visions of the report is that every Indian resident above

the age of 18 years, would have an individual, full-service, safe, and secure

electronic bank account by January 1, 2016. The report believes that the

underlying momentum of Aadhaar issuance across the country can be leveraged to

achieve this vision and recommends that every resident should be issued a

Universal Electronic Bank Account (UEBA) automatically at the time of receiving

their Aadhaar number by a high quality, national, full-service bank. Further,

the report also recommends universal reporting to credit bureaus of all loans,

both individual and SME and in particular SHG loans, Kisan Credit Card, and

General Credit Card. The report sees this process as being a part of a broader

Customer Data Architecture (Pg. 132) that uses alternative data (like utility

bills, rentals etc.), big data (transactional data such as mobile minutes,

top-ups, and Voice and SMS usage) to create credit histories for ‘thin-file’

customers.

Dear Vishnu, Thanks for your detailed response. Clarifies many things. I should have put the caveat in my comments that I may have alluded to matters addressed elsewhere in the report…can only plead typing fatigue for omitting to do that!

Couple of additional thoughts though :

i) Why not have additional bank accounts in unbanked areas as a target? With “active” defined as minimum once a month usage or something? All bank lending etc will accelerate with that. Why not weight that metric in PSL? Its a developmental goal.

ii) What prevents a banking equivalent of a USO fund (used in telecom) for focused efforts on lending? Lending in difficult rural contexts is a specialized business much the way say, lending to bio-tech firms is. This expertise alone won’t translate to “career” progress for individual executives as loan quanta will be small. This will combine residing expertize and catering to individual career progress motives (lets not pretend we’re all social workers!). Some aspects that can be woven into this :

a. CSR money, that banks have to spend, can be spent towards running the new outfit, which will still work on lending to earn profits.

b. CSR and Govt programme funds plus Social VEnture Capital could be parked and routed through the new entity with additional bank loans. This way the entity drives enterprise development (pro active) rather than wait and hand out loans (a longer process and one which a bank realistically can’t do under current rules).

c. This could be through alternative framework such as Trusts, etc – so all participating banks derive the benefits on the target acheivements plus we don’t create a new “corporate” structure that will thrive on treasury as opposed to lending (common glitch with long lead time ventures).

d. If the GOvt/RBI thinks this a new venture that needs to be tested why not select 20 districts to run this initially? Lead banks can run it within their overall structure (so no complicated laws may be needed).

Again, just thinking aloud. The suggestions are intended to be towards a. making life a little easier and b. more proactive ; without sacrificing financial prudence. So I’d request you to consider them accordingly and not as a criticism of the report. Of course, some of the above suggestions may be garbage!

Dear Anand

The need for directed lending in the form of PSL in banking system arose out of two factors viz., socialization of credit and nationalization of banks for financial inclusion of unbanked people and financial deepening in rural areas . While the former aimed at distributive justice and the latter focused on professional approach to bank credit operation on national priority areas. Bur subsequent changes in the direction the high valued directed lending has become value less misdirected lending after various changes made since introduction 1774 . Still 51.4% of farmers HHs remain excluded( Report on FI Dr C.Rengarajan)

In this context of prevailing already damaged PSL values, I opine that the Mor’s report could have prudently skipped PSL sector. However, while probing the suggested APSL my comments follow.

First, it is felt that it would hardly facilitate for candid inclusion of the excluded. Further, mere incentivizing in terms of weight age , scoring and indexing (CRISIL) will help only in producing statistics for monitoring for the institutions without candid inclusion.. Arguably the regional disparity in distribution of PSL credit is due to poor regional economic development in terms of physical infrastructure in some eastern regions. This factor is mainly responsible for poor outreach and persistent low CD ratios of the banks for several decades. (Ref FI report Dr C.Rengarajan page 106 ) consequently witnessing with more exclusion in these areas. . Unless physical assets are improved adequately for enhanced credit absorbing capacity wherever necessary in backward regions, , neither the stated incentives nor the digitalized delivery services . conceived in the report would be useful for said purposes.

Second, in the regional disparity in distribution of PSL including for agricultural credit also suggests inadequate absorbing capacity or near saturation point with the given physical assets in the said region. Further, reported calculation of demand for agricultural credit in proportion with total gross cropped area without reckoning owned funds for the said purposes ( District Credit Plan guidelines of RBI) is incorrect.

Another debatable suggestion is ‘The target for banks is to reach an APSL of 50% by lending to any combination of PSL sectors and district they choose.” As it defeats the very purposes of sub sector allocation. Already prevailing criticism on classification and monitoring PSL of the banks is on treating jewel loan(JL) irrespective of the purposes putting under agricultural purposes as PSL . This system gives a cushion to the banks preferring for this kind of high values collateral based JL and enable reaching target under Agricultural sub sector as well total Logically those poor without any jewel would remain excluded.

Last, coming back to incentives, instead of weightage and indexing , the staff at branch level need to motivated with incentives like cash or promotions, for more inclusion of new members from excluded cohort , minimum number of inoperative accounts/defunct/c, more linkages with SHGs without subsequent drop outs/push outs , group mortality , appropriate integrated financial products ( credit plus), suitable delivery means, adoption of CPP etc.

Thank you for sharing my views

Dr Rengarajan

Dear Dr. Rengarajan, thank you very much for your thoughtful and detailed response to the post. Please find my response below:

1. The regional disparity in distribution of PSL credit is due to poor regional economic development

It is not clear that this argument is supported by literature. In fact, a case could be made that the poor regional economic development is a result of limited access to financial services. For instance, the works of McKinnon (1973) and Shaw (1973) have established the “supply-leading” nature of finance i.e. the level of banking development and stock market liquidity each exerts an independent, positive influence on economic growth. Later studies like King & Levine (1993) and Levine & Zervos (1998) argue that financial depth (i.e. the size of the intermediary sector) as a measure of financial development has a statistically significant and economically large relationship with long-run real per capita growth, capital accumulation, and productivity growth and that the initial levels of stock market liquidity and banking development (as measured by bank credit) are positively and significantly correlated with future rates of economic growth, capital accumulation, and productivity growth.

The report also documents that against an overall bank credit to GDP ratio of 52%, the agricultural sector has a modest sector credit to GDP ratio of 36% (Page 36). Further, the report estimates that the total demand for credit from small and marginal farmers alone could be as much as Rs. 4.8 lakh crore. This is roughly equivalent to the total amount of credit that the agricultural sector receives (both direct and indirect) (Page 118). This helps illustrate the problem might not be one of deficient demand and lack of absorption capacity and that there is sufficient room for growth of credit and a fairly severe incidence of under-penetration for important sectors of the economy. The design of the APSL mechanism encourages financial institutions to serve traditionally under-served areas by providing additional weightages.

2. APSL defeats the very purposes of sub sector allocation

The report argues that “current PSL strategies require each bank to originate assets in exactly the same manner as every other bank. While such an approach could be entirely feasible for banks with universal banking aspirations, it is not well-suited to benefit from the unique capabilities of more regionally or sectorally specialised banks. For example, rural cooperative banks or National Banks with a large rural branch network may be better suited to focus their entire attention on direct agricultural lending while their urban counterpart would do well to concentrate only on lending to small businesses. This has meant that not only are the banks as a whole not achieving their PSL targets, particularly to key sectors such as agriculture but are also experiencing a very high incidence of loan losses” (Page 125). The APSL mechanism will allow banks to achieve their APSL requirement either by concentrated origination in a sector of their choice or through market purchases of qualified assets. Such a mechanism along with a market for sale and purchase of PSL credit will also enable differentiated banks with different foci and strategies such as Wholesale Investment Banks and Wholesale Consumer Banks mentioned in the report to contribute actively to supporting the priority sectors.

3. Instead of weightage and indexing, the staff at branch level need to motivated with incentives like cash or promotions.

Provision of incentives that rely on quantitative targets could exacerbate the problem of mis-sale to customers. Previous committees like the Damodaran Committee (2011) have noted this. The report envisages that customers have convenient access to ‘suitable’ credit products (Page 26). Further, the report recommends that “the firm‘s internal rules relating to compensation packages of staff should not create incentives or otherwise promote inappropriate behaviour. In addition, requirements relating to Suitability and appropriateness should be embedded into compensation packages. Accordingly, the compensation packages and incentive structures should not be based solely on numerical targets but should include qualitative aspects such as offering appropriate products and services to customers and complying with requirements of the internal policy relating to Suitability etc” (Page 188).

Dear Mr Anand. Thank you for your kind response . I wish to share some of my points pertaining to your observations.

1. Reg the point on regional economic disparity and its implication on financial expansion in eastern regions in particular, committee report of financial inclusion by Dr C,Rangrajan has prudently highlighted the fact. Pages 106 to 112 of the report merit your attention for better understanding demand side causes and solutions for financial inclusion. I am surprised to note that the citation of the most relevant literature on financial inclusion and financial deepening in my comment in two places has gone unnoticed by you

2. Reg. agricultural credit I have not referred to the % to GDP but my contention is on the reported calculation of demand for agricultural credit in proportion with total gross cropped area without reckoning owned funds for the said purposes ( District Credit Plan guidelines of RBI) is incorrect. To wit total demand for crop loans for instance may be calculated in relationship with gross cropped area. But while arriving demand for institutional credit , the % of owned funds and the resources other than the banks need to be reckoned( as RBI’s guidelines for preparation of district credit plan)

3. Reg. APSL , my argument is that combination of sector they choose may facilitate the banks to concentrate viable sector although potentially available other sectors in the given area and prefer jewel loans regardless of the purposes ( treated as PSL although directed specifically for agricultural purposes but not strictly followed) to reach the PSL target even without weight ages. On similar vein, the indirect financing to EB , MFI,SHG ,KVIC enjoying the status of PSL, and permitting investment in RIDF (% of shortfall in PSL target) would not help in sector wise , scheme wise, block wise, bank wise deployment of credit in the given district ( under RBI guidelines DCP/AAP/service area credit plan ) . This apart, so long the end use of credit and the extent of nascent inclusion of hither to excluded remain nontransparent , the above factors may help neither candid inclusion of excluded nor financial deepening in hither too unbanked area despite glittering achievement of APSL target.

4. Reg incentives, I reiterate for your convenience the suggested ones are for more inclusion of new members from excluded cohort ,( Dr CR report on FI page 4) minimum number of in-operative accounts/defunct/c, more linkages with SHGs without subsequent drop outs/push outs , group mortality , appropriate integrated financial products ( credit plus), suitable delivery means, adoption of CPP etc. reflect quality dimension from candid financial inclusion and deepening and also helpful for effective monitoring with measurable indicators the extent of new inclusion from the excluded cohort. I wonder how mere weightage and indexing would serve the said purposes

5. Basically, when the main focus of the study is on financial inclusion and deepening , more demand side insights need to be discerned wisely for understanding the profile of excluded , being the prospective target group for the inclusion mission. In India we have enough reports pertaining to Institutional design, structure and strategies in supply side for the said purposes ( to quote lead bank scheme, district credit plan , branch expansion, Non public business working day , service area credit planning , SLBC,DCC,BLBC, village adoption, specialized branches etc) . For the benefit of gaining acumen on the dynamics of demand side in rural financial arena in general and financial inclusion & deepening in particular, it would be useful to you Mr Anand and your team members to kindly have a perusal over the relevant literatures including the reports of Dr CR(2008),),A.M.Kushro(1989) B.Sivaraman(1981), which I have already referred to in my earlier response to you. In this context, I wish to bring to your kind attention also to my book “Microfinance Principles and approaches: Ten commandments for responsible financing to the poor” (Amazon.com) which among others includes a chapter on anatomy on demand side perspectives of micro financing .

Thank you for sharing my views

Dr Rengarajan

Sir,

The APL mechanism is without any logic. The PSL targets are at present bank wise and not region wise. Accordingly, the weights for district are automatically built in. If the idea of the commitee is to compensate the banks for non-achivement of direct agriculture target, then the committee should have reduced the target to say 13 or 14%. The recommendations are just a number game. Even the state wise data are published by RBI after a lag of year. How then it is possible to capture district wise data. If the aim of PSL is those who are not getting the credit why credit given to supporting infrastrcture should be considered under PSL?.

Thanks for your comment Mr. Prabhakar Rao.

You are right in saying that the current targets are bank-wise. The objective of the APSL mechanism is to ensure that banks have the incentive to lend to the more difficult sectors and regions. While the target still remains at the bank-level, the expectation is that banks have an incentive to choose to lend in region-sector combinations that give them higher weightages, and therefore enable fulfillment of priority sector lending policy goals at a national level. The weightages have been designed in a way that balances the twin requirements of: (i) incentivising equity in credit distribution; and (ii) maintaining overall quantum of PSL lending in the banking system. This design is in fact meant to provide a fillip in lending to agriculture and weaker sections, and the expectation is that far from reducing the flow to these sectors, there will greater incentive now for banks to specialise in these sectors to both gain greater weightage for their own PSL book but also create assets that will have tremendous value in the PSL trading market.

We propose that the data used for calculating the district weightage is the CRISIL index of district level financial inclusion. This is updated on a regular basis and is available in the public domain as a neutral source for data on the extent of financial inclusion. In order to transition to using district wide credit and GDP numbers, there is a need, as you say, to ensure that we have the data series published in a transparent and regular manner. The Planning Commission should take the lead in putting out reliable time-series on District level GDP.

Supporting infrastructure such as credit bureaus, weather stations, warehouse infrastructure and land registries are critical bottlenecks to the flow of credit, especially in priority sectors. This is discussed in detail in Chapter 4.9 of the report. Enabling the creation of these infrastructures could have a significant impact on long term credit flows and therefore the recommendation that investment in these infrastructures be considered under PSL.

Dear Sir

Your argument that the commitee’s recommedation will give fillip to agriculture and weaker section is not correct. The conversion factors itself is so designed that with the present level of achievement , banks will be able to achieve the stipulated targets by applying the conversion factors instead of lending.

The banks, which have not achived the PSL targets are those which do not have Pan-India presence or not having wide network. In that case, how the region-wise weightage will give a level playing field for all banks. CRISIL Index is not a measure of credit flow. In that case how it can be used as weighing factor. A very simple measure of credit flow i.e. credit deposit ratio is already used by banks for measuring location wise distribution of credit. Across the globe processes are becoming simpler, whereas the Committee’s recommendations are in the other direction.

If the infrastrcture is so critical why the investments made by banks in RIDF, which you may appreciate, are mainly used for creation of minor irrigation, etc. are not part of PSL.