The future regulatory environment for microfinance is being shaped by the recommendations of RBI’s Malegam Committee, set up to study issues and concerns in the microfinance sector. The report stresses the importance of protecting the interests of low income households, who by virtue of their economic position, are in a weak bargaining position when compared to the provider of financial services. Although, there is perfect agreement among all concerned that microfinance institutions (MFIs) are an important plank in the agenda for financial inclusion, many of the recommendations of the committee may indeed lead to financial exclusion for a vast majority of low income households in India. The committee recommends that effective interest rates charged by microfinance institutions be subject to a floating ceiling of 10 to 12% over cost of funds, and a fixed ceiling of 24%. This article seeks to analyse the impact of the interest rate cap on the microfinance sector, serving more than 20 million clients today.

Valuing a Ceiling on Interest Rates

How can we ascribe a value to a ceiling on interest rates? An interest rate cap can be compared to a series of European call options which exist for each period the cap is in existence.

In mathematical terms, a cap payoff on a rate L struck at K is

Where,

N is the notional amount, in this case, the amount of debt funding raised by the MFI

α is the day count fraction corresponding to each period for which the cap is in existence

K is the strike price, or in this case, the effective cap on the funding rate of an MFI

Using an absolute cap of 24% on the interest rates to be charged on micro-loans, and operating costs of 9%, this implies a ceiling of 15% on the funding rate of an MFI at 0% return on equity.

If we consider a 15% return on equity, this adds 3.39% to the overall costs, thus implying a ceiling on the funding rate of an MFI at 11.61%[1]. In order to hedge itself against the risk of an increase in funding rates, an MFI would periodically need to purchase an interest rate cap corresponding to the tenor of its debt. While interest rate options are often embedded in bond issuances with put or call options, these are not traded independently or on the exchange. The above interest rate cap can be priced using the Black Derman Toy model with the required inputs of the yield curve and the term structure of volatility. Given long term interest rate volatility has been estimated at approximately 18 %[2], the pricing of such an option is likely to be in excess of 1%[3] per annum.

Over the past three years, debt funding costs for MFIs have ranged from 11% to 16%; however, the recent events in Andhra Pradesh have precipitated a liquidity crunch for many microfinance institutions, with borrowing rates now at the higher end of this range.

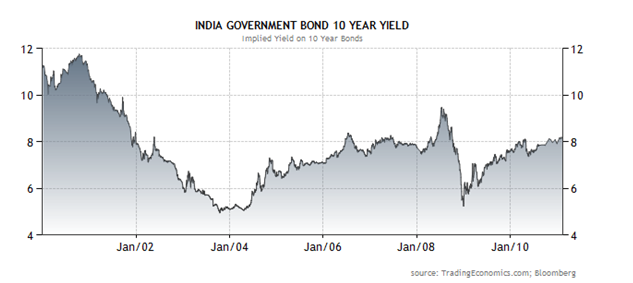

An analysis of government bond yields over the last ten years show that 10 year yields have ranged from 6 to 12%. Over the last five years, however, the range has been narrower from 6 to 9.5%[4]. AAA and AA corporate bond spreads have been around 200[5] bps in the last five years, this implies that the benchmark funding rate for AAA and AA corporate and financial institutions would have ranged from 8 to 11.5%.

As the credit rating for MFIs is at best in the investment grade range, 200 bps can be estimated as the approximate premium demanded by the market for a bond issuance by a MFI[6], therefore, in the last five years MFI debt issuances would have ranged from 10 to 13.5%. The implicit interest rate cap at 11.6% therefore lies in the middle of the estimated range at which MFI debt issuances would have been priced in the market. The value of an interest rate cap is lower when a call option is “out of the money”, i.e., the strike price or the cap interest rate is much above current spot interest rates.

However, in this case as the implied cap interest rate of 11.6% is actually lower than the actual cost of debt funding raised by most MFIs, it can be inferred that this cap is very expensive for the microfinance institution. In short, the MFI would have effectively sold an interest rate cap and received zero premium for it. It is not clear whether the interest rate ceiling is subject to review, if so, on what basis, and at what frequency? The longer the interest rate ceiling applies, again, the more expensive the price of the call option, as the option seller must be compensated more for committing to a fixed-rate for a longer period of time.

Assessing the Potential Impact of Interest Rate Ceilings on MFIs

In light of this, a majority of MFIs will need to make significant strategic changes to their business model, enabling either a sharp reduction in operating costs or a sharp reduction in funding costs or both. Evidence from other countries shows that pricing caps have historically hurt the poor as they incentivise originators to expand only to easily serviceable geographies and ignore remote areas and lower income clients[7].

Even in countries with deep, well-developed credit markets such as the UK, US and Western Europe, research shows that interest rate ceilings have not impacted the cost of credit to low income borrowers. It has been proved not to be an effective means of addressing exploitative lending and indeed has had severe negative repercussions on the availability of credit for those on low incomes and the credit impaired[8]. A more detailed analysis of the impact of interest rate controls in these countries with a long history of credit markets, will give us a clearer understanding of the likely impact of the introduction of any rate ceilings in India.

The Experience in Developed Credit Markets

Research in European, US and UK credit markets show that markets with rate ceilings exhibit less diversity in the credit products available in the market and the range of credit models offered to low income households is sharply narrower. Tailored credit products for low income households, which tend to feature high rates are either unable to develop, in the case of established ceilings or forced out of the market, where ceilings are imposed. For instance, the UK and US have well-developed and segmented products for low income households such as payday loans[9], rent to own[10], auto title loans[11] and secured credit cards[12], whereas neither France nor Germany (with rate ceilings in place) have a distinct low income finance sector.

The absolute exclusion of the low income population in France and Germany has created the conditions for illegal lending. It is estimated that 10 to 12% of low income households in France and Germany have used unlicensed lenders as compared to 4% in the UK, due to the lack of legitimate credit options. In India, informal money lenders charging “triple digit” interest rates will thrive given that the rate ceiling may choke off the supply of credit to low income households from the formal financial sector. As money lenders do not fall within the ambit of the RBI, it will be impossible to enforce codes of practice and ensure “fair” treatment to those on low incomes.

Germany provides a good example of how a rate ceiling, particularly when combined with disincentives to default, can result in a highly risk averse lender set. Credit scoring thresholds and criteria have been set at levels that would tend to exclude potentially higher risk groups, such as those who are self employed or short term contract labourers. Comprehensive documentary evidence, including signed statements by employers and long term employment contracts are required to support credit applications, with this condition rigorously enforced.

Lenders have also withdrawn from markets where ceilings are newly imposed. In Florida, a rate ceiling for auto title loans was imposed at the end of 2000; this led to the reduction in the number of auto title lenders from 600 to 58 in one year. Similarly in the state of Alabama, Georgia and North Dakota, after the imposition of rate ceilings on pay day loans, a majority of lenders discontinued this product offering. Evidence over a thirty year period in the US credit markets also suggests that competition rather than rate ceilings determine the price for mainstream credit.

Are There Lessons We Can Learn?

Given the effects on product innovation and market withdrawal, the consumers most likely to be impacted are those operating outside the financial mainstream, the unbanked low income households. The outcome in India of such a regulation may be devastating for low income households if it results in the cutting off of their only access to formal financial service providers.

In the banking sector, historically, the prime lending rate set by banks has served as an effective interest rate ceiling for small loans below the size of Rs. 200,000, this has been one of the reasons for the abysmally low penetration of bank credit in low income households, both in rural as well as urban areas. In September last year, interest rates were substantially deregulated by replacing the PLR with the base rate, a floor rate. The introduction of the base rate could pave the way for the entry of mainstream commercial banks into the microfinance sector, as this represents a huge untapped market opportunity. Such competition from banks as well as regionally focussed financial institutions, in the absence of a rate ceiling, may catalyse the development of credit products for the diverse requirements of low income households.

Low income households require access to not just unsecured group loans, but also other types of credit, both for liquidity, consumption and production, such as pre-harvest finance, agricultural commodity backed loans, gold loans, two wheeler loans, cattle loans and tractor finance. Regulation on interest rates that intends to protect the interests of low income households must apply not just to a single narrowly defined credit product, but the entire gamut of credit products that a low income household requires and uses. For instance, interest rates on gold loans, a fully secured credit product popular with low income households during an emergency, range from 12 to 28%, well above the proposed interest rate ceiling prescribed by the Malegam Committee. The median interest rates charged, however, are now in the range of 12 to 18%, this sharp reduction has been made possible by transparency and competition among the players. In particular, the entry of commercial banks in the gold loan market increased competitive pressure, forcing existing players to reduce their rates.

The Reserve Bank of India must carefully consider the impact of interest rate ceilings before introducing such a fundamental shift in policy. We must learn from the experiences of others that competition, innovation and transparency can be the only permanent ways of bringing affordable access to credit for all. “Quick-Fix” solutions like interest rate ceilings may be tempting in their simplicity, however in reality may actually create credit exclusion.

[1] For ease of comparison, all numbers and assumptions have been taken from the Malegam committee report

[2] Bond Valuation and the Pricing of Interest Rate Options in India, Jayanth R. Varma, Indian Institute of Management, Ahmedabad

[3] Source: Kumar, Anand: “Valuation of Caps on Debt Funding Rates”, Draft

[4] Source: Bloomberg

[5] Source: FIMMDA Corporate Bond Database

[7] CGAP Occasional Paper No. 9

[8] “The Effect of Interest Rate Controls on Other Countries”, Department of Trade and Industry (UK)

[9] Payday loans are small loans to tide over short term liquidity needs between one payday and the next.

[10] Rent to own is a rental contract in which title to goods(typically white goods or electronics) remains with the store until the end of the contract, usually 12-24 months

[11] Auto title loans are high cost short term credit secured on the borrower’s vehicle to largely unbanked car owners

[12] Secured credit cards are those that are partly or fully secured by cash deposits

One Response