It is not often that the Supreme Court of India becomes disgruntled by the death of a buffalo. In September 2012, the highest court of the land found itself in just this situation following the death of an insured animal. How did a simple insurance pay-out claimed for the death of a buffalo in 2001 result in proceedings before the Supreme Court eleven years later?

These and other strange questions arose during our exploratory review of cases filed at various forums regarding retail financial products. This blog post is the first in a series presenting vignettes from the review.

The long and winding road

The case of Gurgaon Gramin Bank Vs. Smt. Khazani and Anr.[1] related to events arising after the purchase of a buffalo with a loan from a regional rural bank, and insured by New India Assurance Company Ltd. The animal died within the period of insurance and a claim was filed by the complainant through the bank to be passed on the insurer. Three years passed without any response from the bank or the insurer despite notices being sent to both entities.

Eventually, a consumer complaint was filed in a district consumer forum. The district forum ordered the insurance pay-out to be made, together with interest and costs to the complainant as recompense for litigation expenses and harassment. The bank appealed to the State Commission (the appellate body under the Consumer Protection Act, 1986 (CPA)), which rejected the appeal. The bank moved to the penultimate appellate body under the CPA, National Consumer Disputes Redressal Commission (NCDRC), seeking a review of the State Commission’s decision. The NCDRC dismissed the bank’s petition. A special leave petition was then filed to the Supreme Court by the bank against the NCDRC’s order.

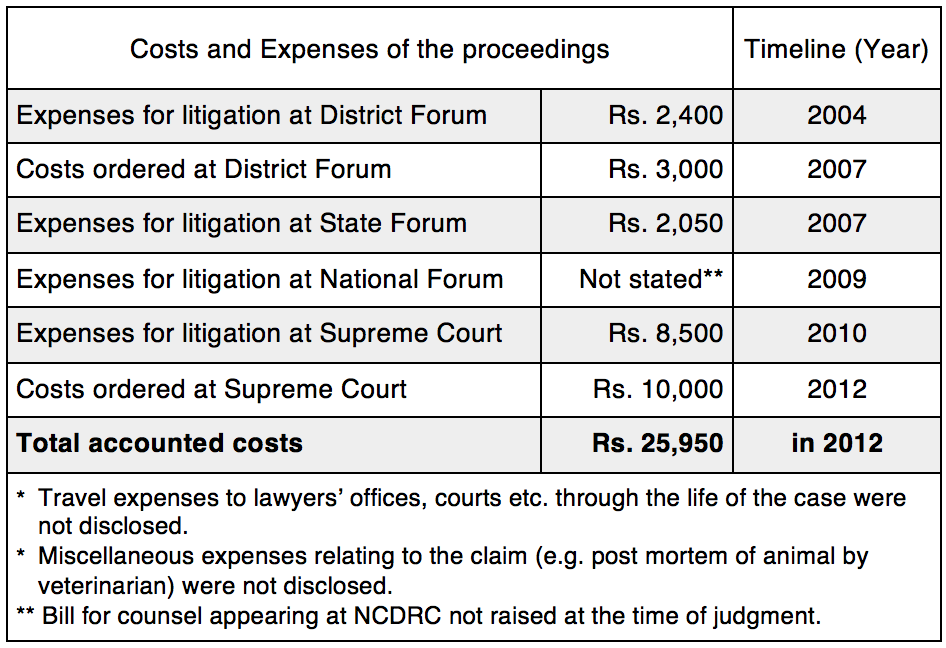

The two judges seized of the matter at the Supreme Court were not impressed by this sequence of events. In a scathing judgment, they condemned the practice of relentlessly pursuing various litigative forums especially where poor rural farmers were involved. Noting that the bank’s conduct was not appropriate, especially since the matter related to questions of fact examined by three other forums, the court ordered substantial costs and dismissed the case. A snapshot of the costs disclosed in the judgment give us an idea of the time and money costs of resolving this case. Remember, the case related to an insurance claim made in 2001 for Rs. 15,000.

We highlight this particular case because of the open-and-shut facts and the consistent rulings made at various levels of the judicial system. In more complex cases of fact and law, despite having valid claims consumers are often left to strategise with their lawyers as to which cause of action to pursue or which forum to approach.

Strategy over substance?

Although complaints regarding deficiency of services or unfair trade practices relating to financial services can be filed at consumer forums established under the CPA, these forums often dismiss cases involving complex questions of facts and law and direct complainants to civil courts as a more appropriate forum.

Several examples of such dismissals exist. A case seeking compensation from the complainant’s bank for allowing opening of a fictitious account (which allowed the other partner in the complainant’s partnership to siphon away money) was dismissed on grounds of complexity and the complainant was directed to the civil courts.[2] Where a complainant claimed that his bank had indulged in unfair trade practices by charging an increased rate of interest without any notice and consent from him, the case was dismissed stating that the determination of whether excess interest was charged on a term loan in existence for several years would require recording of voluminous evidence which was more appropriately done by the civil courts.[3]

However uncertainty persists because higher forums have also overturned such dismissals. For instance, the NCDRC set aside one such dismissal by a State Commission in a case where the cheques linked to a Unit Linked Insurance Plan (ULIP) were sent in the post but not received by the complainant but encashed by someone else.[4] While the State Commission had held that the determination of facts would prove too onerous, the NCDRC refuted this and noted that it was a simple case of principal-agent liability that did not require a civil court to resolve it.

Meanwhile, complainants are also approaching courts other than the consumer forums to varying degrees of success. Our case review revealed direct approaches to the High Court where PSU banks were involved, for instance on grounds that a public entity had infringed constitutional rights by improper sale of ULIPs.[5] Another case filed with the Competition Commission of India alleged that a bank was abusing its dominant positions through unfair and onerous clauses in credit card agreements.[6] Cases in Debt Recovery Tribunals, investor grievances lodged through the SEBI system and complaints with the Banking Ombudsman are just some of the other channels dealing with complaints regarding financial products.

With this multiplicity of forums, one would assume a quick resolution of disputes relating to financial products. However, as the Gurgaon Gramin Bank case revealed, even straightforward cases can face labyrinthine routes to resolution, worsened in situations where the forum has been incorrectly chosen by complainants. The fragmented regulatory landscape can create multiple possibilities—each of which bear the threat of lengthy proceedings.

These (and other) cases in our review indicate that two different questions remain open for further discussion and research: Are courts already discussing what constitutes “suitable” advice and conduct on the part of financial institutions? How can the regulatory architecture evolve a signalling system that will direct case traffic in the direction of the right forum? Subsequent posts in this blog series will seek to tease out responses to these questions by taking stock of existing case law, regulations and policy proposals.

[1] AIR 2012 SC 2881

[2] Jayachandra Kumar Vs. Chairman, State Bank of India, 1992(2) CPR 699 (NC)

[3] M/s. Ganesh Mahal Vs. The Manager, Karnataka Bank Ltd. & Anr, CPR(3) 1995 126

[4] Raghubir Singh Vs. Unit Trust of India, NCDRC, Revision Petition No. 553 of 2002 (10.10. 2002), MANU/CF/0362/2002

[5] Virendra Pal Kapoor Vs.Union of India, 2014 (8) ADJ 602

[6] Shri Pravahan Mohanty Vs. HDFC Bank Limited and Card Services Division of the HDFC Bank, Competition Commission of India, Case No. 17/2010 (23.05.2011), MANU/CO/0020/2011

4 Responses

But why do the banks spend so much on open and shut cases?What would be their take on the courts’ conclusions?

Thanks for your question Dr. Madhusudan! The idea is definitely not to make any sweeping generalisations – banks do act with due process on insurance claims no doubt. In the Gurgaon Gramin Bank case, the Insurer disputed receipt of one particular piece of documentary evidence which the complainant had evidence to show he had sent to the bank. Despite this disputed piece of evidence, the fact remains that (1) there was a valid post mortem that the animal was dead (!) and (2) eventually the amount spent defending the point was far in excess of the full insurance pay-out amount. To quote the SC verdict “Assuming that the bank is right…once an authority like District Forum takes a view, the bank should graciously accept it rather than going in for further litigation and even to the level of Supreme Court”. I am tempted to remark (tongue in cheek) that the law is not an ass :).

This is a very interesting vignette. I think it is important to separate ‘suitability” from “process delay”. The boundaries of what constitutes a suitable product should ideally be drawn ex ante, and any transgression of these boundaries is something that the judicial system can address. Delay in settlement (as in the example above) would be ex post facto, and would possibly be better addressed by the ‘signalling’ system you suggest.

Completely agree with you Jayshree. The two questions we pose are distinct – and should be so. However, they are also two sides of the customer protection coin for retail financial products. The direction of travel should be one towards a balance where (1) financial service providers have a clear ex-ante understanding of the impact of their products and avoid conduct that is unsuitable, and (2) customers have clear channels to redress any harm done through such conduct. Separately, this ex-ante conception of suitability will no doubt have a relationship with ex-post assessments by the Courts as they build-out the concept through practical application.