A training exercise was undertaken recently for the wealth managers (WMs) of Sahastradhara KGFS (from 18th to 20th March) and Dhanei KGFS (from 25th to 27th March). The training involved the wealth managers who had joined recently; and also the WMs who had completed 6 months tenure in KGFS allowing them to refresh their skill-sets.

The trainees were first exposed to assets, liabilities, income and expenditure, and cash-flow of a household and what are the initiatives a household could take in order to improve income, reduce expenses, pay-off high interest borrowings and build assets.

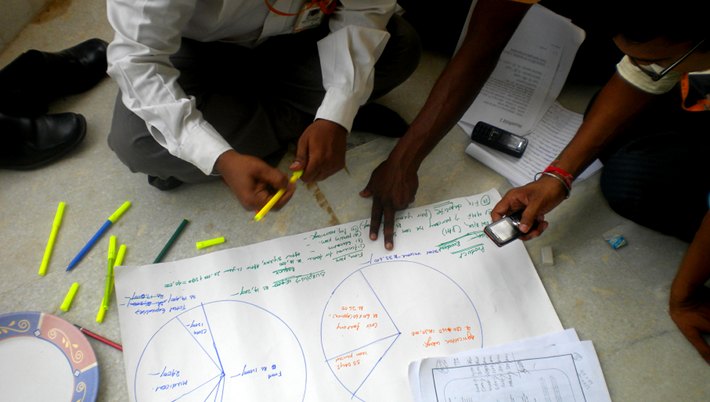

New Inductees during training at Dhanei KGFS

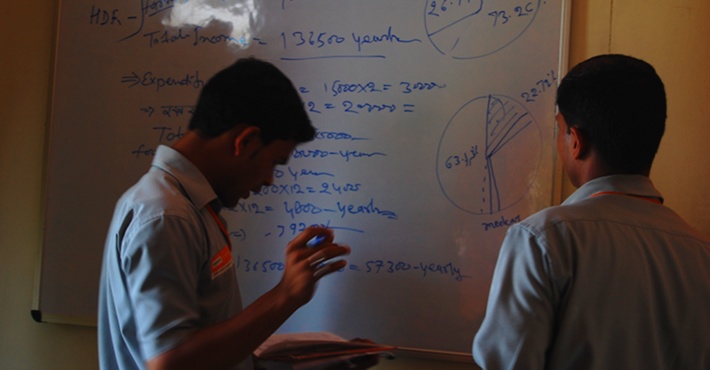

Our focus was mainly on the Wealth Management module for both the new inductees and the refreshers. Discussions were held as to the fears, goals and aspirations of households, and how a Household Diagnostic Report (HDR) is generated out of Customer Management System (CMS). Participants were shown a demo on Life Wealth Envelope (LIWE), showing the comparison of best and worst cases that a household might face and how the worst cases could improve by availing insurance products.

WMs explaining the HDR during the training at Sahastradhara KGFS

A sample Branch Index was also shown to them that helped understand the importance of:

- Collecting comprehensive and accurate data in CMS

- Based on HDR what products need to be prescribed to the household

- Quality of internal controls (Audit)

For the WMs to understand the concept well, an exercise was conducted involving three teams. Each team was given a household data to analyze the financial position and asked to come out with their Household Diagnostic Report (HDR) by drawing pie charts and make recommendations on suitable insurance and investment plans. The teams discussed the entire financial position of the household and as to how the surplus money could be deployed to achieve their goals and aspirations.

We also introduced modules related to Post office products, Public Provident Fund (PPF), National savings certificate (NSC), Kisan Vikas Patra, Time deposits, Recurring deposits, Monthly income scheme, RBI bonds to create awareness on products that are safe, liquid and give a reasonable return. A special module on Mutual Funds was introduced for the trainees to understand the concept of mutual funds and the various categories of it.

An absorbing game was also introduced to emphasize how teamwork plays a very vital role in an organization’s success. The participation was total with everyone realizing the essence of team spirit and togetherness.

Game in progress at Dhanei KGFS

Finally the training ended with an open house where WMs were given space to share their suggestions/feedback.

—

Chandrachudan V, Seethalakshmi, Deepti George, Rajesh E of IFMR Rural Finance (presently known as Dvara KGFS) training team contributed to this post.

9 Responses

Fantastic! One comment on products like KVP, Postal Savings etc – the product team must carefully evaluate these products from a wealth management angle and if found appropriate, we should find ways to make these accessible proactively to the customer. I am not sure how awareness per se would be helpful.

Thanks. I was articulating this in our concall as well that till such time we roll out appropriate products from our shelf, they should not be denied access to such products.

Along with awareness, the appropirate products from outside our scope can be mixed to offer customised propositions to the household.

The other side is voluntary disclosure of benefits in other products for the customer to choose from, of course within the reach and needs of rural customer.

Ravi, nothing is "outside our scope" so long as it makes sense for the customer. We can work with any product provider (public or private) if we think the underlying proposition (design, pricing) is good.

I agree with Bindu. This is a fantastic effort. And, I do believe that any product should be rolled out carefully just as we have rolled out the products thus far so that we look at all the implications, pricing, servicing issues, fit into the wealth management framework, etc. before we roll them out. We should really resist the temptation to do ad-hoc rollouts and I am not sure what we mean by "outside our scope". All products that exist and those we can create are within our scope and the only thing that matters to us is the well-being of the customer.

There are three perspectives:

I think we will all agree that we should carefully scrutinize every assertion/advise that we make to the customer. If there are any products that we feel will fit into the framework that we are creating for customer wellbeing, our effort will be to urgently make those available to the customer through KGFS.

As pointed out already there are no products outside our scope. Consumers choose products with functionalities that satiate their requirements/preferences. As financial engineers we have the ability/responsibility to build these functionalities using various financial instruments.

Also the vision is that the wealth manager will have a sense of accountability for any advise he/she would offer to customers. By discussion of features/details of products in the market that have either not been evaluated by us carefully or configured to be offered through KGFS, we may end up doing something that is contrary to this vision.

on the point of how the awareness per se helps..here is my view…

given the network of post offices, several of our households would have exposure to these products in terms of familiarity and some could have even subscribed to them. so during their discussions with our WMs they may compare / ask for clarification on these products. Awareness of these products can enable our WMs to handle these conversations.

Agreed Anil, but then we need to be able to explain how a post office savings compares relative to say, MMMF. If a person already has postal savings, should they also save in MMMF? If the postal savings product is better design and returns-wise, shouldn't we just facilitate that?

To add on – during the refresher training a session on Dhan chakra is taught to the refreshers which will talk in detail about the post office savings products. This is to make them aware of the post office products.

We are in the process of rolling out a seperate module on Mutual fund which will showcase comparison of Mutual fund Vs other investments such as Bank deposits, PPF, NSC, Life insurance. The comparison is made in terms of returns, safety, liquidity, tax benefit.

The module is almost complete and Chandrachudan sir is reviewing the same. We will roll it out shortly.