Continuing on our series on ‘Consumer Protection’, we will take a look at how consumer protection has found its place within the regulatory architecture of select countries, namely Australia and South Africa. A previous post had dealt on the emergence of the twin-peaks model in Australia. In this post, we briefly describe the regulatory principles that form the basis for the Australian regulatory reform process that began with the Government’s implementation of the Wallis Inquiry recommendations.

In June 1996, the Financial System Inquiry1 (known as the Wallis Inquiry) was established to:

i. Examine the results of the deregulation of the Australian financial system

ii. Examine the forces driving further change, particularly technological; and

iii. Recommend changes to the regulatory system to ensure an ‘efficient, responsive, competitive and flexible financial system to underpin stronger economic performance, consistent with financial stability, prudence, integrity and fairness.

Chapter 5 of the Wallis Inquiry report outlines the regulatory principles that the new structure was based on. The Inquiry identifies five regulatory principles, as given below:

Competitive Neutrality

Competitive neutrality requires that the regulatory burden applying to a particular financial commitment or promise apply equally to all who make such commitments. It requires further that there be minimal barriers to entry and exit from markets and products; No undue restrictions on institutions or the products they offer; and that markets are open to the widest possible range of participants.

Cost effectiveness

A cost-effective regulatory system requires a presumption in favor of minimal regulation unless a higher level of intervention is justified; an allocation of functions among regulatory bodies which minimizes overlaps, duplication and conflicts; an explicit mandate for regulatory bodies to balance efficiency and effectiveness; a clear distinction between the objectives of financial regulation and broader social objectives; and, the allocation of regulatory costs to those enjoying the benefits.

Transparency

Transparency of regulation requires that all support/guarantees from the regulator or the government to financial institutions be made explicit and that all purchasers and providers of financial products be fully aware of their rights and responsibilities, and that financial promises (both public and private) be understood by all parties concerned.

Flexibility

The constant evolution of the financial system makes flexibility critical. The regulatory framework must have the flexibility to cope with changing institutional and product structures without losing its effectiveness.

Accountability

Regulatory agencies should operate independently of sectional interests and with appropriately skilled staff. In addition, the regulatory structure must be accountable to its stakeholders and subject to regular reviews of its efficiency and effectiveness.

The Twin-peaks model of Australia encompasses two agencies, besides the Reserve Bank of Australia: The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). ASIC is Australia’s corporate, market and financial services regulator, which includes being the regulator for consumer credit. The Australian Securities and Investments Commission Act 2001 made ASIC responsible for the following:

1. Maintain, facilitate and improve the performance of the financial system and entities in it

2. Promote confident and informed participation by investors and consumers in the financial system

3. Administer the law effectively and with minimal procedural requirements

4. Enforce and give effect to the law

5. Receive, process and store, efficiently and quickly, information that is given to it

6. Make information about companies and other bodies available to the public as soon as practicable

ASIC’s priorities therefore include ensuring that investors and financial consumers are confident and informed, promoting fair and efficient financial markets and ensuring efficient registration and licensing.

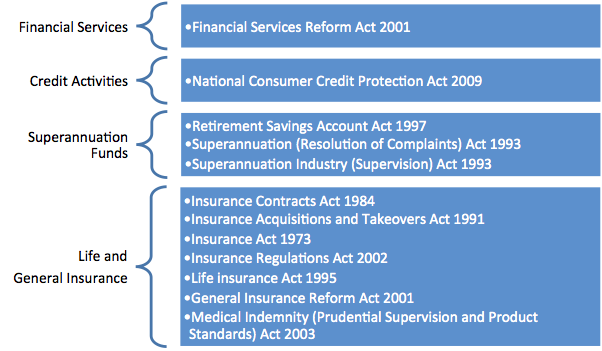

ASIC administers the following functional areas through specific legislations:

Australian Financial Services License (AFS)

ASIC administers the Financial Services Reform Act 2001 that introduced a single licensing regime for all financial services and products. This piece of legislation was later incorporated into chapter 7 of the Corporations Act 2001.This legislation requires those who carry on a business of providing financial services to hold an Australian Financial Services (AFS) licence. An AFS licence is required for entities that:

• Provide financial product2 advice3

• Deal in a financial product

• Make a market for a financial product

• Operate a registered managed investment scheme

• Provide a custodial or depository service

• Provide traditional trustee company services

The obligations of an AFS licensee, as mandated by law, include:

• Obligation to ensure that financial services offered are provided efficiently, honestly and fairly

• Obligation to meet adequate financial requirements (e.g. solvency and cash obligations) to provide financial services and to carry out supervisory arrangements

• Obligations to meet compliance and risk management requirements if the licensee is not a APRA-regulated body

• Obligation to maintain competence to provide financial services (both technological and human resources)

• Obligations of monitoring, supervising and training of authorised representatives in order that they comply with the financial services laws

• Conduct and disclosure obligations

• Obligation to manage conflicts of interest

• Obligation to establish and maintain dispute resolution (internal and external) mechanisms

• Obligation to have prescribed compensation and insurance arrangements

• Obligation to comply with requirements set out by ASIC from time to time

In the next post in this series, we will focus on the conduct and disclosure obligations that need to be met by all AFS license holders and its implications for providers and consumers of financial services.

—

– http://fsi.treasury.gov.au/content/FinalReport.asp

– As pre Corporations Act 2001, Chapter 7.1, Div 3,“For the purposes of this Chapter, a particular facility that is of a kind through which people commonly make financial investments, manage financial risks or make non cash payments is a financial product even if that facility is acquired by a particular person for some other purpose”.

– Financial product advice is a recommendation or a statement of opinion, or a report of either of those things, that is intended to influence a person or persons in making a decision in relation to a particular financial product or class of financial products, or an interest in a particular financial product or class of financial products.