Continuing from an earlier post, this post highlights the CCFS recommendations around various bank and non-bank channels that will serve to deliver a ubiquitous payments network and universal access to savings.

Payments Bank

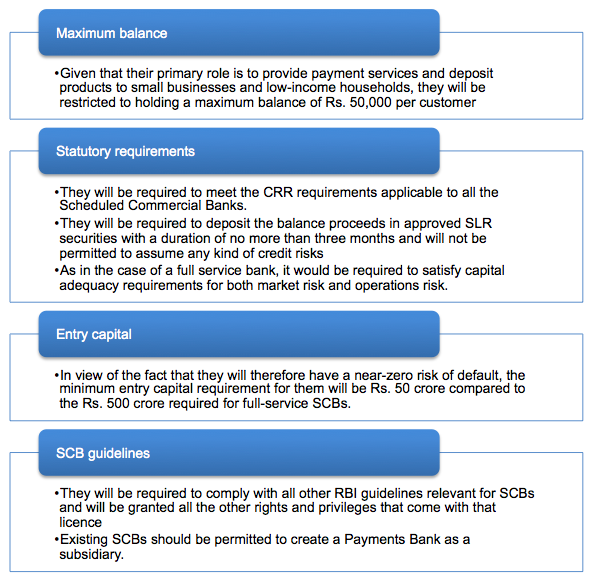

With the pressing need to provide access to payment services and deposit products to millions of households, the Committee on Comprehensive Finance Services for Small Businesses and Low Income Households (CCFS) recommends that a set of banks may be licensed under the existing Banking Regulation Act, which may be referred to as Payments Banks. These would have the following key features adhering to the Committee’s principle of regulation neutrality:

This differentiated banking design is functionally equivalent to that of the 27 currently existing pre-paid instrument operators (PPIs). While PPIs have enabled significant expansion of low-value payment services, there are several issues around them such as relaxed KYC norms, restricted cash-out facility, inability to pay interest on deposits, and the risk of contagion when partnered with a sponsor bank. Given these difficulties being faced by PPIs and the underlying prudential concerns associated with this model, the existing and new PPI applicants should instead be required to apply for a Payments Bank licence, as described below, or become Business Correspondents. No additional PPI licences should be granted.

The Payments Bank model is based on the premise that there is demonstrated customer preference for a combination of differentiated channels to access payments and credit. A customer would often access payments through a 24X7 ATM whether or not owned by her bank branch or via a credit card POS terminal at a merchant location while for credit, they would be happy to go to have their application evaluated at a more central location. Furthermore, customers often will seek payment and deposit services from one provider while borrowing from another provider.

The Committee envisions a transactions-based revenue model for Payments Banks to ensure financial viability. Payments Banks could also benefit from the shared infrastructure of their existing businesses (such as the sale of mobile airtime or postal products) and enhanced revenue from the additional loyalty induced by the payments business. Discussions with existing PPIs suggest that the market will be extremely competitive with participation from large and small players alike.

In order to address the potential conflict of interest mobile phone companies may face as independent Payments Banks while serving their partner banks, the Committee recommends that the RBI to work with Telecom Regulatory Authority of India (TRAI) to ensure that such companies, including those with Payments Bank subsidiaries, be mandated to:

- Provide USSD connectivity as per recent TRAI regulations with the price cap of Rs. 1.5 per 5 interactive sessions

- Categorise all SMSs related to banking and financial transactions as Priority SMS services with reasonable rates and to be made available to the banking system.

Business Correspondents (BCs)

This is a powerful channel that banks use to extend the reach of their branches through the use of agents, thereby increasing outreach at a low cost. However, there are specific regulatory barriers that are preventing the effective utilisation of this channel:

- ND-NBFCs as BCs: The Committee recommends the restoration of the permission of ND-NBFCs to act as BCs of a bank. The potential conflict of interest associated with NBFCs as a lending channel comingling deposits raised through its BC activity can be addressed by the adequate technology solutions available for intra-day reconciliations.

- Distance criteria between the BC and nearest branch: The Committee is of the view that the extant distance criteria (30 km for rural and 5 km for urban) between the BC and a branch of the sponsor bank be eliminated. Banks should be allowed to decide the cash management and operational oversight required.

White-Label BCs

The existing BC channel must be enabled to grow, and one way to enable this is by allowing high-quality, independent White-Label BC Network Operators to emerge which can also increase penetration of payment points in the country. This has already happened in the context of ATMs (White-Label ATMs) and there is a similar objective of loosening the tight coupling between the BC and a sponsor bank by allowing the BC greater operational flexibility as well as more degrees of freedom in determining charges to customers.

White-Label BCs should be fully inter-operable, have the ability to work with multiple banks at the back-end, and have direct access to settlements systems subject to prudential conditions to mitigate operations risk. Potential candidates for such a license could include NBFCs, existing corporate BCs, mobile phone companies, consumer goods companies, the post office system, and real sector cooperatives.

White-Label ATMs

The Committee recommends that White-Label ATMs (WL-ATMs), a recently permitted innovation of independent payment network operators, be given direct access to the payments and settlements system, subject to certain prudential conditions which mitigate operations risk. The current “nested” design, which requires a sponsor bank at the back-end, is fraught with contagion risk especially in the event that the WL-ATM grows very large compared to the sponsor bank.