In the wake of recent reports of dramatic decline in the availability of capital, microfinance service providers struggling to keep afloat, and the recent proposal by the finance minister to create a dedicated fund for providing equity to smaller MFIs, means of financing and capital for players in the inclusive finance space is yet again an italicised topic. Players in the microfinance sector can capitalise on emerging innovative financial structures and an ever-expanding market. A whole gamut of funding options are available for microfinance service providers ranging from traditional debt funding and mezzanine debt to foreign institutional investments, private equity investments and portfolio buy-outs that enable capital market access. This is the first installment in a series of blog-posts exploring funding options for microfinance service providers.

In this post we discuss the several debt financing options available for players in the microfinance sector with special focus on debt-funding options suitable for microfinance service providers established as non-banking finance companies (NBFCs) that do not accept deposits. At a recent Spark session, Badrinarayanan from IFMR Rural Finance walked us through these modes of financing.

The types of debt funding available can be split two ways – by Term (Short term and Long term) and by Source (Domestic and Foreign). Term loans, unsecured loans (subordinated debt), securitisation/portfolio buyout, private equity, certificates of deposit, inter corporate deposits, commercial papers, non-convertible debentures and external commercial borrowings are the sources of funding that are currently available in the market. Badri focussed on commercial papers, non-convertible debentures and external commercial borrowings as good funding options that the NBFCs that do not accept deposits can explore for augmenting their growth plans.

I. Commercial papers

Commercial Papers (CPs) are privately placed, unsecured, money market instruments and are issued as promissory notes. CPs can be issued by corporates, primary dealers and approved financial institutions. The eligible corporate must have a tangible networth of atleast Rs 4 crore, have sanctioned working capital limits and its borrowal account needs to be classified as standard assets. CPs have to be rated by any one of the four SEBI-approved rating agencies in India viz. CRISIL, ICRA, CARE and FITCH. All CPs must have a minimum credit rating of P-2 of CRISIL or an equivalent rating. The limit on the amount of issue is determined by the Board of Directors of the issuing company/credit rating agency. It is mandated that the funds are to be raised in two weeks from the date the subscription is thrown open. Once the indicative ratings are obtained the process of execution for the issuance of CPs will typically take one week.

II. Non-convertible debentures

Non-convertible debentures (NCDs) can be issued with original or initial maturity of up to one year and these are privately placed debt instruments. The eligibility conditions for issue of NCDs up to one year by corporates are same as that of CPs except for sanctioned working capital limits. Just like CPs, NCDs have to be rated by a SEBI-approved credit rating agency and should carry a minimum rating of P-2 or equivalent. NCDs can be issued in denominations of Rs 5 lakh and in multiples of Rs 1 lakh. According to Companies Act, 1956 and Companies (Acceptance of Deposit) Rules, 1975 an NBFC can secure any asset, movable or immovable, to issue NCDs. Further, an NBFC which is a private limited company can issue only those debentures to non-members/non-shareholders which is either secured by the mortgage of immovable property of the company (and not any other assets) or convertible into shares of the company.

III. External Commercial Borrowings

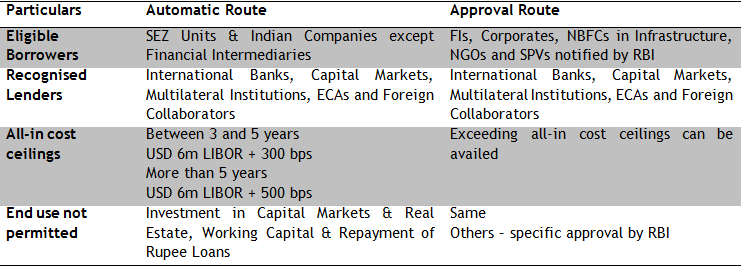

External Commercial Borrowings (ECBs) are commercial loans in the form of bank loans, supplier’s credit or buyer’s credit availed from non-resident lenders with a minimum average maturity of three years. ECBs are allowed under either the automatic route or the approval route.

The following table summarises the requirements and eligibility for raising funds through ECBs via the automatic route and the approval route.

ECB Borrowings by microfinance institutions / players in the microfinance space

NGOs engaged in microfinance activities are eligible to avail of ECB funding for up to USD 5 Mio in a year under the approval route. Such NGOs must have a 3-year borrowing relationship with a Bank authorised to deal in foreign exchange and must get a certificate of due diligence on fit and proper from the Bank. Funds raised through ECBs should be used for lending to SHGs or other microfinance activities including capacity building. It may be noted that on 31-Oct-2008, RBI had allowed NBFCs, temporarily, to raise short term Foreign Currency loans. But the same was withdrawn on 3-Feb-2010.

Which of these methods then, is the ideal way to raise funds?

Badri says that “the choice of tapping any of the aforementioned funding options by NBFCs that do not accept deposits depends on satisfactory compliance with statutory & regulatory requirements, the cost of funds, the liquidity position of the entity, the movement in capital markets and the time involved.”

Entities in the microfinance space can raise funds through the option that is best suited to their needs, with these parameters significantly influencing such a choice – cost of funds, liquidity, favourable capital markets and time.