Digital currencies have generated substantial curiosity over the last year, particularly post the favourable1 hearing that Bitcoin, a prominent digital currency2, received at the US Capitol hill in November 2013. There is growing interest in trying to understand what digital currencies really are but they are much confused because of the difficulty in placing them squarely in the current monetary setup of ‘fiat’ paper currencies. This leads to most dismissing digital currencies as another ‘geeky innovation’ which will fade post the initial curiosity is over, while some confuse it with an online payment system. This can be quite misleading as digital currencies pose important political economy questions on the control of money supply in a society and are deeply connected to a growing3 school of right wing economic thought called ‘libertarianism.’4 Given the increasing usage of digital currencies and the ideological support5 for them in certain section of economic thought, it would be prudent for monetary authorities and regulators to not dismiss such currencies and meaningfully discuss their implication. In this post, we attempt to provide a context for such a discussion by giving a brief overview on the evolution of money and the ideological support for digital currencies.

Are digital currencies ‘money’ as we commonly understand?

Are digital currencies even ‘money’ in the first place? Money is defined as anything that serves as a general medium of exchange. Digital currencies can be used to discharge all the three purpose of money viz., medium of exchange (growing number of establishments accept digital currencies in trade for goods and service), standard of value (the value of other goods and services and can be expressed in digital currencies) and store of value (digital currencies can be stored and used in the future). Digital currencies should not be confused with an online ‘currency’ which is convertible to a fixed pre-determined value of government legal tender. For instance, the digital currency Bitcoin is not an online architecture for transferring government legal tender from one place to another. Bitcoin is an alternative medium of exchange with its own value which fluctuates with other currencies.

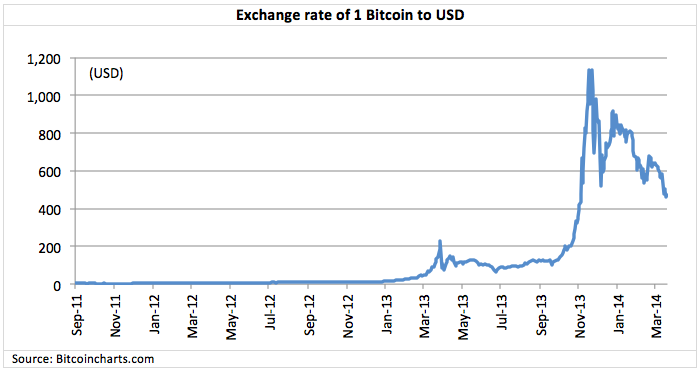

As can be seen in the graph above, the exchange rate of Bitcoins to USD has gyrated wildly since the digital currency gained prominence. The recent volatility in the value of Bitcoins can be traded to events surrounding the shutting of Mt. Gox, a popular Tokyo based Bitcoin exchange6. Thus, even though digital currencies like Bitcoin serve all the three purpose of money, they can emerge as a general medium of exchange only if such currencies gain stability.

Evolution of Money

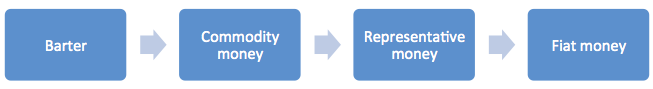

Money was invented to counter the limitations of the double co-incidence of wants in a barter economy. Over the years, different commodities have been used as money, such as seashells, tea, fur, cattle and even tobacco. The use of metal coins as money can be traced back to Lydians in 700 BC from where it was passed on to the Western civilization through Greeks and Romans. Coins served several useful purposes like being durable, portable and having an intrinsic metal value. As trading grew, coins became popular throughout Europe during the 18th century. These coins, which contained metals, were examples of ‘commodity money’ – where a commodity which had precious value was used as a medium of exchange. Commodity money had both intrinsic as well as exchange value.

The use of paper money can be traced back to the Chinese T’ang Dynasty (618-907 A.D.). Initially paper money could be exchanged for certain commodities like gold, silver or even tobacco7. Such paper money convertible to fixed quantity of certain commodities was termed as ‘representative money’. Again, representative money had both intrinsic value (as they could be converted to certain commodities) as well as exchange value.

The final evolution of money is ‘fiat money’8. Fiat money is similar to representative money except it can’t be redeemed for a commodity. The Reserve Bank of India (RBI) notes we use today are an example of fiat money9. Fiat money has only exchange value (which is derived from a government ‘fiat’ or order) and no intrinsic value.

From the above discussion, it is clear that digital currencies are similar to fiat paper money in the sense that they only have exchange value and no intrinsic value. However, the exchange value of digital currencies is completely market determined and is not derived from decree of the government. This is the single most important reason why such currencies are lauded by supporters of the free market, particularly libertarians, who are distrustful of the government’s monopoly role in controlling the money supply10.

Exchange Value of Digital Currencies

Digital currencies derive their exchange value from several characteristics. Such currencies represent a completely decentralized anonymous peer-to-peer medium of exchange. They bypass any regulatory restrictions for cross border transfers as digital currencies do not depend on conventional payment platforms (like Visa, MasterCard) or clearing houses and are transferred electronically. For instance, Bitcoins are electronically transferred from one e-wallet to another e-wallet hosted on personal computers scattered throughout the world. These features make the architecture of digital currencies the most cost-efficient and anonymous way to transfer money from one place to another11. The downside is that this anonymity, regulatory bypass and lack of KYC make them extremely vulnerable to use by anti-social agents. Bitcoins have been used extensively in trading for illegal drugs through an online platform called ‘Silk Road’. The anonymous nature of Bitcoins can also lend itself to financing terrorist activities. There have also been concerns on the security architecture of digital currencies with reports of several heists from Bitcoin e-wallets12.

The fact that digital currencies only have exchange value and no intrinsic value has led many people to say that such currencies represent a bubble, much like the ‘tulip mania.’ This argument however overlooks the fact that by this reasoning, all money are always in a bubble as money (by definition) will always have exchange value over and above its intrinsic value, and in this sense, its value is always inflated compared to its intrinsic value. The caveat here is that while fiat paper currencies are backed by government legal tender laws, there is no corresponding backing for digital currencies from any monetary authority.

Ideological support for Digital Currencies

Digital currencies have several similarities with the classical gold standard system of 1815-1914 when national currencies were convertible to a fixed quantity of gold. Libertarians consider the classical gold standard as the “Golden Age” of unadulterated monetary system13. Prominent libertarians like US Senator Ron Paul, who leads the ‘Audit the Fed’14 campaign in the US and supports a return to the gold standard15, look favourably at digital currencies like Bitcoins because of the similarities. In fact the similarity of the Bitcoin economy to the classical gold standard system has led many libertarians to hail Bitcoin as the free market solution to private currency16. The similarity with gold standard can be clubbed under three broad heads:

Market selection of the medium of exchange

Sympathizers of the gold standard support digital currencies as they derive their exchange value endogenously without any backing by a government or central bank monetary authority. This is much like the emergence of gold as a medium of exchange in competition to other commodities like tobacco, sugar, cattle, tea, shells among others. Among various alternatives, gold was established as the preferred medium of exchange for its acceptability, durability, portability, homogeneity and scarcity. In April 1933, the US went off the gold standard where US citizens could no longer redeem dollars in gold but the foreign central banks could still convert their dollar holdings to gold at the Federal Reserve. In August 1971, President Nixon took US completely off the gold standard by revoking the foreign convertibility of the dollar to gold. For a supporter of the gold standard, the next best bet would be to support a digital currency which mirrors certain gold standard characteristics.

Market determined supply

The supply of money in a gold standard was market determined. The supply of gold would increase as long as the marginal cost of mining gold is less than the value of goods and services which an incremental unit of gold can buy. Thus, a gold mining company would produce gold till arbitrage opportunities have been exhausted through the forces of perfect competition.

The money supply process is similar for digital currencies. For instance, participants in the Bitcoin economy mine the digital currency by solving complex computational algorithms till the time the marginal cost of undertaking this activity exceeds the incremental value of the goods and services which a Bitcoin can buy. The maximum supply of Bitcoin is by design fixed at 21 million coins17, which is similar to a gold standard economy where the stock of gold is fixed.

It should also be noted that the monetary operation of a Bitcoin economy would be exactly the same as under the gold standard where a fixed stock of the money supply finances growing global exchange through divisibility of the unit of currency18. Also, the stock of money supply is immaterial as divisibility ensures adjustment in nominal denominations without changes in real values19.

Competition to Government Legal Tender

As an alternative currency without backing of any legal tender laws, digital currencies circulate in competition to fiat currencies as a medium of exchange. This is along the lines of the libertarian demand for open competition in currencies20.

Regulatory Oversight

The regulatory oversight for digital currencies has not fully developed with monetary authorities around the world adopting a strategy of wait-and-watch. The limited regulatory actions that have been promulgated till now has been sporadic and based on two primary concerns – financing of anti-social activities and evasion of capital controls. In the case of Bitcoins, given its anonymous character, it has been used extensively in trading for illegal drugs through the online platform Silk Road. In October 2013, the FBI seized 144,000 Bitcoins from Ross Ulbricht, the alleged owner of the online platform. At today’s exchange rate, the value of the seized Bitcoins is in excess of USD 70 mn21. By August 2013, the U.S. Department of Homeland Security had seized bank accounts worth USD 5 mn of Mt. Gox as it had failed to register itself as a money transmitting business and was in violation of U.S. anti-money laundering regulations22. More recently, China’s central bank prohibited financial institutions from handling Bitcoin transactions on concerns such digital currency pose on bypassing capital controls23. This was after China had become the world’s largest trader in Bitcoins.

India’s central bank, the Reserve Bank of India (RBI), issued an advisory warning against the risks of dealing in digital currencies like Bitcoins24 on December 24, 2013. Days later, Enforcement Directorate (ED) officials at Ahmedabad raided two companies engaged in Bitcoin transactions25. The concerns highlighted by RBI were susceptibility to hacking26, no dispute settlement mechanism as Bitcoins bypass any authorized central agency, speculative value, unknown legal status of Bitcoin exchange platforms, use in illegal/illicit activities, breach of anti-money laundering (AML) and combating the financing of terrorism (CFT) laws.

Thus, the regulatory oversight for digital currencies has primarily been inspired by concerns on their end-usage and capital controls. None of the regulatory actions taken so far can be explicitly linked to concerns that digital currencies pose on the control over an economy’s money supply by a central bank. This can be justified as the volume of digital currencies is small compared to central bank issued money. However, if the usage of digital currencies grows to materially alter the dynamics of money supply in an economy, central banks around the world will have to think hard on the regulatory landscape for such currencies.

Conclusion

Digital currencies have introduced, albeit small, a competition to government backed legal tender. Though the architecture of digital currencies is still unstable and receives ideological support from only non-mainstream sources, it would not be prudent to underestimate them. Given the important questions that the evolution of digital currencies raise (and Bitcoin is just one among the several27), there is a need to understand this new medium in the context of our regulatory framework in a much more holistic manner.

—

- Mythili Raman, the acting assistant attorney general for the US Department of Justice’s criminal division, said in testimony before the Senate Homeland Security and Government Affairs Committee that, “The Department of Justice recognizes that many virtual currency systems offer legitimate financial services and have the potential to promote more efficient global commerce.”

- There are now in excess of 12 million Bitcoins in circulation with a total market value of close to USD 8 billion

- An example would be the rise in prominence of the Tea Party movement in the US. In their study titled ‘Libertarian Roots of the Tea Party’, David Kirby and Emily Ekins argue that “The tea party has strong libertarian roots and is a functionally libertarian influence on the Republican Party”.

- David Friedman, in his book ‘The Machinery of Freedom’, says, “The central idea of libertarianism is that people should be permitted to run their own lives as they wish.”

- This Washington Post article argues that Bitcoin received “overwhelmingly positive” hearing at the US Congressional meeting due to “months of careful diplomacy by Bitcoin advocates.”

- http://www.forbes.com/sites/cameronkeng/2014/02/25/bitcoins-mt-gox-shuts-down-loses-409200000-dollars-recovery-steps-and-taking-your-tax-losses/

- For e.g., in 1715 Maryland, North Carolina and Virginia issued tobacco notes which could be converted to fixed quantity of tobacco

- Fiat is defined as “an official order given by someone who has power.” Paper money is used as a medium of exchange on the ‘fiat’ (order) of the government

- For e.g., a Rs 20 note (or for that matter any other rupee denomination note) is signed by the RBI Governor as “I promise to pay the bearer the sum of twenty rupees”

- Thomas Woods, a prominent contemporary libertarian writes in detail about this in his paper titled ‘Why The Greenbackers are Wrong’ at http://tomwoods.com/blog/why-the-greenbackers-are-wrong/

- The recent Department of Justice hearing on Bitcoin in the US emphasized that virtual currencies like Bitcoins “have the potential to promote more efficient global commerce.” http://www.theguardian.com/technology/2013/nov/18/bitcoin-risks-rewards-senate-hearing-virtual-currency

- http://www.technologyreview.com/news/522411/bitcoins-rise-constrained-by-heists-and-lost-fortunes/

- See Rothbard, Murray (1963), ‘What has Government Done to our Money’, Section IV, Ch. 1, p86

- The Federal Reserve Transparency Act, a bill to audit the Federal Reserve, was introduced by Ron Paul in February 2009

- Ron Paul has been a strong advocate of the gold standard. See Paul, Ron (1981), “Gold, Peace and Prosperity: The Birth of a New Currency”, Mises Institute

- For e.g., the Libertarian Party in the US accepts contribution in Bitcoins on its website http://www.lp.org/make-a-bitcoin-contribution

- For an exhaustive FAQ on Bitcoins, see http://bitcoin.org/en/faq

- While Bitcoins are divisible to 0.00000001 units, paper receipts backed by gold (which were the predominant operational system for the gold standard) were also divisible to small denominations.

- The easiest way to think about this under a fiat money economy would be to assume that one morning you are told that an extra ‘zero’ has been added to all monetary denominations. So Rs 10 is now Rs 100. What used to cost Rs 10 before will now cost Rs 100. Similarly, if you were earning Rs 10 before, you will now earn Rs 100. In real terms, nothing changes. By adding an extra zero, we have increased the monetary base in an economy ten times without any change in real values. Thus, neither does the initial stock of money nor the total money stock has any bearing on a Bitcoin or gold standard economy.

- US Senator Ron Paul, a prominent libertarian, is the sponsor of the Free Competition in Currency Act of 2011, which seeks to repeal legal tender laws backing government issued currencies

- http://www.forbes.com/sites/andygreenberg/2013/10/25/fbi-says-its-seized-20-million-in-bitcoins-from-ross-ulbricht-alleged-owner-of-silk-road/

- http://techcrunch.com/2013/08/23/feds-seize-another-2-1-million-from-mt-gox-adding-up-to-5-million/

- http://www.bloomberg.com/news/2013-12-05/china-s-pboc-bans-financial-companies-from-bitcoin-transactions.html

- http://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=30247

- http://articles.economictimes.indiatimes.com/2013-12-27/news/45626789_1_one-bitcoin-bitcoin-transactions-peer-to-peer-payment-network

- There have been several media reports of hackers breaking into electronic wallets and wiping out balances of digital currencies like Bitcoins and Dodgecoin

- Some others are Litecoin, Namecoin, Peercoin, etc. For a full list, see http://www.theguardian.com/technology/2013/nov/28/bitcoin-alternatives-future-currency-investments

2 Responses

Dear Ravi, thanks a lot for this excellent article. It clears up many myths about digital currencies and lucidly explains how they work and derive value. I have a question around the section on the ideological foundations of digital currency. It is my understanding that it is fairly well established in modern macro economics that the gold standard was and remains a bad idea. For example, in a recent poll (http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_cw1nNUYOXSAKwrq), economists overwhelmingly disagreed with the idea of the US employing the gold standard.

Among many reasons for this disagreement, the most compelling one perhaps is that gold standard limits the ability of the central bank to increase money supply during times of economic downturn. Economists like Barry Eichengreen (http://emlab.berkeley.edu/~eichengr/fetters_gold_paper.pdf) even argue that loyalty to the gold standard was the key reason in extending the length of the great depression. I was wondering what you thought of these arguments-do you think it weakens the ideological argument for digital money?- and your views on how monetary policy response, in an environment of competing currencies, would play out. Thanks.

Dear Vishnu

Thank you for your comment and I am glad you liked the article. You have raised very pertinent points and I would be glad to share my views.

It is not surprising that “economists overwhelmingly disagreed with the idea of the US employing the gold standard” since we live in a Keynesian world and Keynes himself had denounced the gold standard as a “barbarous relic.” However, there are supporters of the gold standard, primarily from the libertarian school of economic thought, who disagree with the mainstream economists’ criticisms of the gold standard. For a typical response to the criticism regarding the gold standard, may I suggest this article (https://mises.org/daily/5379/The-Gold-Standard-Myths-and-Lies ) by a prominent libertarian writer. Though few, there are mainstream economists also who view the gold standard favourably. Alan Greenspan, the longest serving Chairman of the Federal Reserve, in this dated article (http://www.constitution.org/mon/greenspan_gold.htm ), systematically puts forward his view on why the gold standard was not responsible for the Great Depression. More recently, this Forbes article (http://www.forbes.com/sites/nathanlewis/2013/03/14/if-alan-greenspan-wants-to-end-the-fed-times-must-be-changing/ ) carries an interview quote by Alan Greenspan to Fox Business in which he says, “some mechanism has got to be in place that restricts the amount of money which is produced, either a gold standard or a currency board”, further quoting from the same interview, “There are numbers of us, myself included, who strongly believe that we did very well in the 1870 to 1914 period with an international gold standard.” Robert Zoellick, the eleventh president of the World Bank, in this article (http://www.ft.com/intl/cms/s/0/5bb39488-ea99-11df-b28d-00144feab49a.html?siteedition=intl#axzz14dKEeR16 ) in Financial Times, makes a case for a larger role for gold in monetary systems, “The system should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values. Although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today.” Milton Friedman, who won the Nobel Memorial Prize in Economic Sciences in 1976, shares a completely different point of view (http://www.fee.org/the_freeman/detail/the-great-depression-according-to-milton-friedman ) on the causes of the Great Depression, much in contrast to a part of the mainstream explanation that gold standard hindered the ability of the Federal Reserve to expand money supply and give a monetary push to the US economy. In fact, in his research ( ‘A Monetary History of the Unites States’, co-authored with Anna Schwartz), he lays the blame for the Great Depression on the Federal Reserves’s contraction of money supply at the trough of the economic slowdown (rather than any limit imposed by the gold standard on expansion in money supply). Thus, it appears that the Federal Reserve was unilaterally contracting money supply during the early phases of the Great Depression, unwarranted by any fall in gold reserves. Ben Bernanke, the previous Federal Reserve Chairman, accepted Friedman’s analysis (laying the blame at Fed’s contractionary policies rather than any limits imposed by gold standard for monetary expansion) in a speech in honor of Friedman’s 90th birthday, “I would like to say to Milton and Anna: Regarding the Great Depression, you’re right. We did it. We’re very sorry.”

The limited point I am trying to make is not to get into a gold standard debate, but to highlight that there does exist strong ideological support for the gold standard, not only from libertarians, but also mainstream economists and the view that the gold standard propagated or lengthened the Great Depression is an unfinished debate. Hence, in my view, the mainstream explanation for the role of the gold standard during the Great Depression does not diminish the ideological argument for digital currencies.

Regarding your point on monetary policy response, increased usage of digital currencies will weaken the ability of a central bank to control money supply. While mainstream view will hold this as a drawback of digital currencies, alternative opinion in certain school of economic thought would consider this an advantage as no less than Milton Friedman himself was very critical of central bankers being able to influence monetary supply on a discretionary basis.