On March 1, 2018, the Reserve Bank of India (RBI) extended to foreign banks with more than 20 branches[1], the sub-targets of 8% and 7.5% for Adjusted Net Bank Credit to small and marginal farmers and micro-enterprises respectively. The rationale stated by RBI was that this would level the playing field between foreign and domestic banks with regard to these targets, which it does indeed, albeit to the extent that in the short term, now foreign banks may also have to follow strategies similar to those of their domestic counterparts to build their loan books for these subcategories.

One can debate, from the principle of ensuring equity, whether directed lending is the most effective policy direction to take for the purposes of achieving the social objectives it was meant to achieve. The first-best approach may be to remove directed lending obligations placed on the banking system and to instead use direct interventions such as direct cash and benefit transfers without burdening the credit channel. However, given political economy considerations, it may be difficult to eliminate priority sector lending (PSL) altogether, given how integral it has become to the rural and agricultural economy’s dependence on the banking system for easy and inexpensive financing. Then, the second-best approach may be to consider how to achieve the goals of PSL while at the same time minimising market distortions and allowing banks to pursue the most effective strategies available to them.

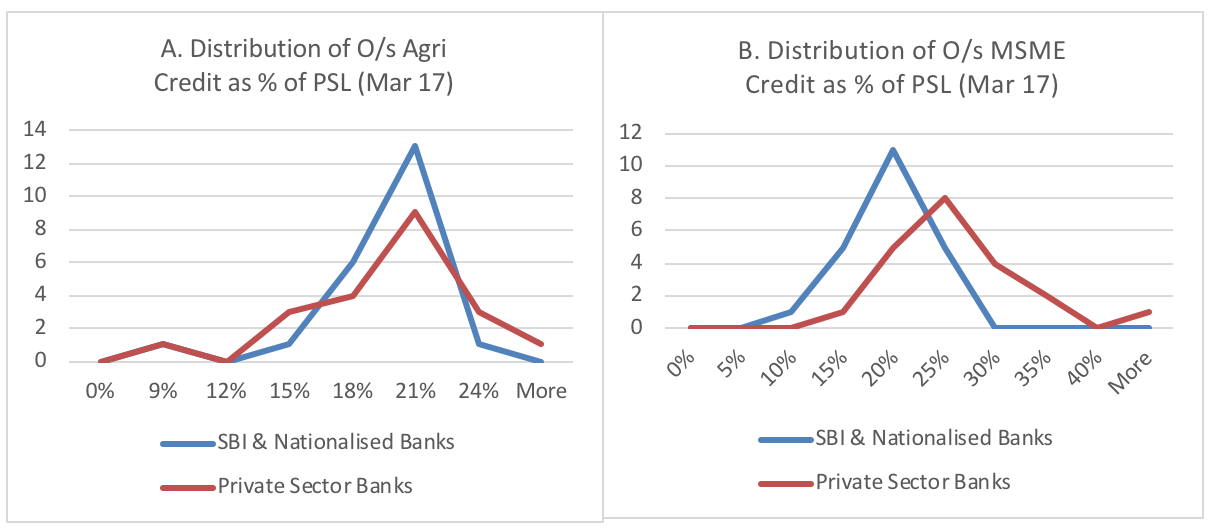

In this context, we question whether requiring foreign banks, let alone all types of domestic banks (payments banks being an exception) to build their PSL portfolios to resemble each others’ is the best way to put to use the banking system’s resources to create a vibrant and diverse loan market that is accessible to the underserved. PSL policy requires all banks to follow similar origination strategies to meet the same set of lending targets. This has led to the creation of banking businesses that are quite similar to each other. The below charts[2] indicate that whether it be the case of agri credit (Chart A) which has a target of 18% of overall PSL, or the case of MSME credit (Chart B) which does not have a target, an overwhelming 88% and 84% of banks studied[3] did not go beyond 21% for agri credit and 25% for MSME credit respectively within the overall PSL target of 40%.

Contrast India’s banking models to examples of banks with ‘specialised’ banking businesses such as MSME-focused Planter’s Development Bank of Philippines (now merged with China Bank), or the Bank Rakyat (with its micro-branch model) of Indonesia, that are examples of business-model differentiation in the banking sector.

Instead of following identical business strategies that create identical institutions with similar problems, why cannot policy, including priority sector lending policy, provide freedoms to banks to choose their specific sectors on which to build their specialised business models? This can be operationalised by giving flexibility and encouragement to banks to meet their PSL targets by employing a combination of:

- direct origination through branches and business correspondent networks

- purchase of loans through the direct assignment route from other bank or non-bank originators, as well as through investments in securitised assets representing underlying loans that qualify for PSL, and

- providing freedoms to build liquidity and tradability of the loan book.

These permissions are to be articulated clearly by the RBI and can signal to the banking system that they can indeed focus their energies on originating only those asset classes that are of interest to them and promote the evolution of sectoral specialisation by banks. This is different from the idea of business model specialisation inbuilt into certain licensing approaches of the RBI, such as those of small finance banks (loan size limits), and certain categories of NBFCs like NBFC-MFIs (qualifying assets criterion of the loan book), gold loan companies and NBFC-Factors (with atleast 50% or more of these NBFCs’ financial assets to comprise of loans against gold jewellery and factoring business respectively). The trading of PSL certificates (PSLCs) where there is no risk transfer from selling banks to buying banks, offers a fig leaf of sorts to banks by making it easier to meet their PSL targets as these don’t need equity to be kept aside for capital charges, nor is there a need to worry about credit risk or servicer risk. Indeed, the PSLC expires after March 31 of the financial year – there is no ‘true sale’ like in the options discussed above. On account of these reasons, PSLCs are less expensive for banks (anecdotally, fees may be ranging between 4-5% of loan amounts[4]) to meet their PSL shortfalls than placing deposits in RIDF with penal interest rates and lock-in features. While PSLCs may suffice for the purposes of limiting shortfalls, as has been evidenced in the recent surge in PSLC volumes in 2017 and 2018, it remains to be seen whether, a) PSLCs by itself may be adequate as a policy measure to incentivise banks to build in business model specialisations, and b) PSLCs may end up disincentivising better and/or more efficient origination (by both banks and NBFCs) if existing surpluses in PSL credit of seller banks such as SFBs, RRBs, and cooperative banks are enough to meet the shortfalls for buyer banks.

The true test of whether ‘priority’ sectors are being served, is to answer the question of whether PSL is indeed reaching those sectors and regions that are the least served, such as the eastern and north-eastern parts of the country, low-income households and SMEs. The answer to this is that there remains much to be desired from India’s directed credit story, and the manner in which PSL target achievement is measured at an overall bank balance sheet level (ANBC) rather than at the level of an under-served sector or region, has resulted in a situation where it has become entirely possible for banks to meet a significant portion of the targets without the benefits from directed lending actually reaching the most deserving. In 2017, Delhi had more agri-PSL loans outstanding than the North-East and an average agri PSL loan outstanding per account that was 60 times that for the East and North-East put together.

This is a good moment to reconsider recommendations by the RBI Committee for Comprehensive Financial Services for Small Businesses and Low-Income Households (2014) regarding an Adjusted Priority Sector Lending (APSL) mechanism in which additional weightage is given to lending to the more difficult sectors and districts. Allowing a specific bank to focus only on one or more sectors or regions of its choosing could ensure that the banking system as a whole delivers on the overall priority sector lending goals but with much greater efficiency. In such a scheme the district level multipliers could be based on the credit-GDP ratio for the district or sector, if not on the growth elasticity of credit for each district, and the sectoral weights could be based on the level of underachievement of a particular sector for the system as a whole.

—

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=11223&Mode=0

[2] Data Source: Distribution of Outstanding Advances of Scheduled Commercial Banks to Priority Sector, Statistical Tables Relating to Banks in India 2016-17

[3] State Bank of India, 21 nationalised banks, 21 private sector banks

[4] https://www.thehindubusinessline.com/money-and-banking/buying-and-selling-priority-sector-lending-certificates-can-aid-banks-margins/article8466126.ece

2 Responses

Good read and useful paper Deepti, thanks. It’ll be good if we get to see a follow up write up based on Mar’18 data to see the trend.

Thanks Amit. will do