There is consensus about the importance of financial inclusion. This has translated into efforts to increase the level of financial access from the financial sector firms as well as through policy initiatives. Among the financial sector initiatives, the most visible has been the growth of the FinTech platforms. Technology has been seen as a disruptive instrument in the domain of finance over the last three decades, with digital lending being a very visible and pervasive element. It is useful and important to ask about the impact that it has had. In India, the government has led several policy efforts towards accelerating financial inclusion. Some of the prominent policies include making bank account ownership universal through the Pradhan Mantri Jan Dhan Yojana (PMJDY), expanding the outreach of social security through the ‘Jan-Dhan se Jan-Suraksha’ program, strengthening the digital public infrastructure based on its three pillars of digital identification (through Aadhaar), payments infrastructure (through Unified Payments Interface), data-exchange solutions (through the account aggregator framework), and enhancing last mile service delivery through agent networks and Business Correspondent Sakhis. In all this, the aim has been to increase access to formal finance for low-income households.

However, there is not a similar consensus on what financial inclusion means, or how it is to be measured. For example, the UN defines an inclusive financial sector as one providing financial access, across deposits, credit, and insurance. In India, the RBI emphasized the delivery of ‘appropriate financial products and services.’ In implementation, financial inclusion measures tend to report access to banking, typically as the fraction of the population with bank accounts (an example is the Global Findex database on financial inclusion of the World Bank). But there is a growing recognition that financial inclusion is broader than access to banking alone and should cover access to a larger base of financial products and services (Gupta & Sharma, 2021; Palta et al., 2022). Recently, the UN has proposed adopting the concept of financial well-being (often used interchangeably with the term financial health) as a part of what financial inclusion means, where the outcome of financial access should be the ability to sustain the needs of an individual, through normal times and through shocks. This definition has become part of the development agenda of the United Nations Capital Development Fund (UNCDF) and the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA).

The Dvara-xKDR financial inclusion measurement system was created incorporating the three-part ‘input-output-outcome’ framework of measuring the impact of an intervention (an example is what Banerji et al., 2013 implemented in the domain of education). The measurement of financial inputs is similar to the financial access measurement implementations in other efforts. What is novel is the explicit attempt at measuring financial output or how financial products and services are being used once they have been purchased thereby measuring the outcome for the buyer. Further, there is an explicit focus on the household as the unit of observation for the outcome. This is because the financial product or service is purchased by an individual, but the impact is best seen by the household. This can be implicitly the case for deposits or mutual funds, but explicitly so in the case of insurance. What the Dvara-xKDR financial inclusion measure thus captures is the access of the household to all available products, how these are being used, and the impact that they have on the well-being of the household, whose members access the formal financial system (Ghosh & Thomas, 2022). The method used for this measure is implemented through a household-level survey.

Impact assessment of digital lending in collaboration with FACE

Fintech Association for Consumer Empowerment, or FACE, is a self-regulatory industry body of fintech lenders in India. Its membership accounts for 80% of digital lending business volumes and is therefore a crucial player in the growing digital lending industry serving the credit requirements of retail customers. The pace of expansion that unsecured retail credit is witnessing can be perceived as positive in terms of expanding access to and reach of collateral-free formal credit to millions of Indians. At the same time, there is a prevailing sentiment of the need to tread with care due to the dual nature of credit and potential customer harm that can arise from overuse of credit resulting in financial distress and over-indebtedness.

The Dvara Research-xKDR Forum method is applied to customers associated with digital lending member companies of FACE to gauge the level of financial inclusion and perception of financial well-being at the household level. The information provided through this tool can provide useful communication to both the policy and the investor communities about how Financial Service Providers can improve the financial well-being of their customers.

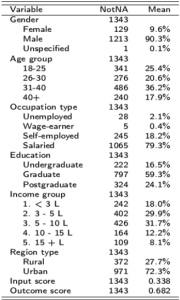

FACE members surveyed customers representing 1300 households from thirty geographies within India post-COVID. The sample surveyed largely comprises salaried, urban male graduates earning forty thousand per month, on average. The features of the sample are summarized in Table 1.

Table 1: Summary statistics

Results of the Dvara-xKDR Financial Inclusion measurement survey

The sample surveyed had an inputs score of 0.338 on average, and outcomes score of 0.682 on average. In comparison, the financial inclusion score reported in (Ghosh & Thomas, 2022) based on the in-house data collected for validation of the framework was 0.22 (inputs), 0.21 (outputs), and 0.54 (outcomes). When we apply the World Bank’s Global Findex data to the Dvara-xKDR method, we find the input, output, and outcome scores to be 0.78, 0.19, and 0.30, respectively (Ghosh & Thomas, 2022). Therefore, when comparing the scores from the FACE survey to the benchmarks listed above, we find that FACE customer households appear to be at higher levels of financial well-being. This suggests that often they are able to meet their current financial obligations and are confident about their financial future. Moreover, the sample households with greater ownership of financial instruments (inputs) reported higher levels of financial well-being (outcomes).

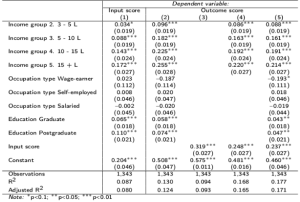

Financial inclusion also correlates with certain household features in this sample. There is an income effect: sample households who earn more tend to have a higher number of financial instruments and are at a commensurately higher level of financial well-being. Similarly, households with more educated members have higher participation in finance as well as feel more financially healthy when compared to households with less educated members. On the other hand, financial inclusion does not appear to have a strong link with the type of occupation of the individual who was surveyed. This suggests that financial access has positive implications regardless of where and how the individual is earning income. These results are presented in Table 2.

Table 2: Regression results

Way forward

The Dvara-xKDR financial inclusion measurement survey is designed to capture the journey of a household’s interaction with formal finance. This survey, of the financial customers of a set of Digital Lending firms associated with FACE, provides policymakers and practitioners an independent tool to assess households’ participation in and usage of formal finance, along with households’ perception of financial well-being. The objective of conducting this exercise in collaboration with FACE has been to bring in an element of independent enquiry towards addressing the question of access to digital lending and its implications on the financial well-being of households.

FACE has played an instrumental role in persuading its member companies to contribute to the discourse of financial inclusion and its links with financial well-being, through this survey. This also aligns with FACE’s roles and responsibilities of identifying customer harms and promoting customer protection, as laid out in RBI’s draft framework for fintech self-regulatory bodies. This serves to demonstrate that such a data collection effort regularly can help to identify changes in the financial well-being of households who engage with financial products of different kinds. Such a tool also establishes benchmarks that can help to compare the evolution of financial access and well-being over time, and across different types of financial models (such as micro-credit, self-help group-based financing, digital lending, or other new forms of lending) that can emerge in the industry. This requires that more FSPs administer this survey on a regular basis at periodic intervals such that the efforts can become more systematic and standardized. The information emerging from this exercise can, in turn, be a valuable input into communication by these firms with the wider ecosystem of their customers, as well as with their investors and their regulators.

References

Banerji, R., Bhattacharjea, S., & Wadhwa, W. (2013). The annual status of education report (ASER). Research in Comparative and International Education, 8(3), 387–396. https://doi.org/10.2304/rcie.2013.8.3.387

Ghosh, I., Thomas, S. (2022). Financial Inclusion Measurement: Deepening the Evidence. Inclusive Finance India Report, 9, 117-125. Inclusive-Finance-India-Summit-Report-2022.pdf (inclusivefinanceindia.org)

Gupta, S., & Sharma, M. (2021, July). A Demand-Side Approach to Measuring Financial Inclusion: Going Beyond Bank Account Ownership. Dvara Research. https://dvararesearch.com/wp-content/uploads/2024/01/A-Demand-Side-Approach-to-Measuring-Financial-Inclusion-Going-Beyond-Bank-Account-Ownership.pdf

Palta, G., Sarah, M. A., & Thomas, S. (2022, July 3). Measuring Financial Inclusion: How much do households participate in the formal financial system?. The Leap Blog. https://blog.theleapjournal.org/2022/07/measuring-financial-inclusion-how-much.html#gsc.tab=0