A panel survey was conducted by the Social Protection Initiative at Dvara Research with 12 partner organisations to understand the coping strategies employed by low-income, borrower households during lockdown. In this post, we highlight how in the face of widespread loss of income, households relied on an informal economy, often at high costs.

The COVID-19 Impact on Daily Life (CIDL) survey was conducted in three rounds between April to June as a part of our efforts to understand the impact of lockdown on low-income, borrower households[1]. In an earlier post, we looked at the different points in the welfare delivery pipeline at which potential beneficiaries were getting excluded resulting in non-access of transfers under Pradhan Mantri Garib Kalyan Yojana (PMGKY). In this post, we look at the survey results to understand how households have been managing even with limited access to government transfers.

Widespread loss of income; Urban households continue to struggle

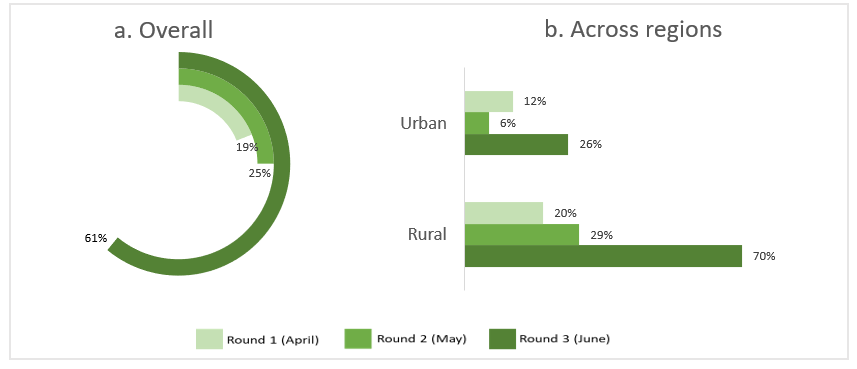

To contain the spread of COVID-19, all activities apart from those deemed essential were suspended during phase 1 (March 25- April 14) and phase 2 (April 15- May 3) of the lockdown. Zone wise restrictions continued till the end of May. Our survey found that less than a fifth of all households had at least one member working in April (Figure 1.a). With about three-fourths of low-income households engaged in no income generating activity even in May, the prolonged lockdown is seen to have heavily impacted people’s ability to work.

Figure 1: Engaged in income generating activity (Panel a: Overall; Panel b: Across regions)

Fresh guidelines announced by the Ministry of Home Affairs led to ‘Unlock 1.0’ which allowed restricted activities to restart outside Containment Zones in a phased manner. A consequent improvement was observed in the employment scenario in June (Figure 1.a). However, this spike was largely experienced in rural areas, while urban households continued to struggle (Figure 1.b). In addition to having relatively lesser number of containment zones, work generated by the sowing of seeds for kharif crop and MGNREGA are likely reasons for the employment surge seen in rural areas. For 19% of the rural households, we found MGNREGA to be at least one source of work in June.

While a larger number of people were able to return to some form of work by June, in terms of earnings, they were not much better off. About 45% of the primary earners who did work in June stated that they were earning less than before lockdown. Reduced earnings have led to other forms of stress with reduced consumption of food being one of the most serious concerns. While it reduced from 8% in April, 5% of the households continued to have at least one member skipping meals even in June.

Households turn to informal safety nets for financial support

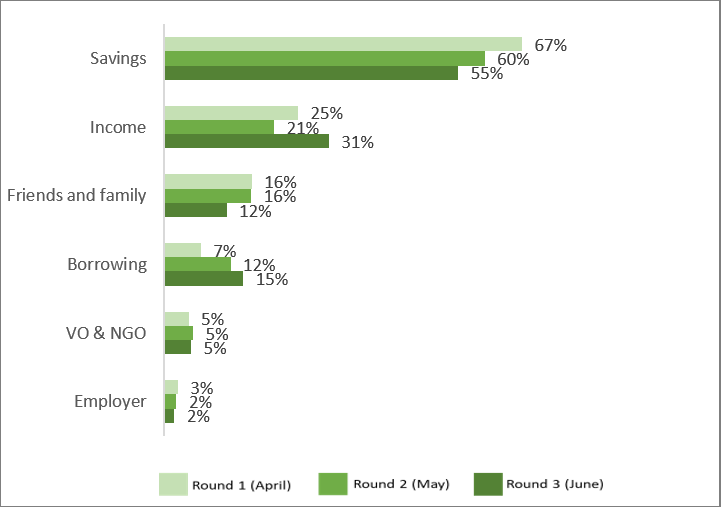

With incomes dwindling and many missing out on government transfers, low-income households turned to informal safety nets to tide them through the crisis. Respondents primarily dipped into limited savings available to make ends meet. This also includes households that were unable to source any funds during the crisis and had to do with whatever resources were available at home during the period.

Figure 2: Source of funds

Funds from family and friends are an often relied upon source of support in case of an emergency. According to the Findex report of 2017, 48% of the households relied on family and friends for generating emergency funds. However, as lockdown progressed, we found the reliance on funds from this source declining. This included both old dues being recovered as well as interest free transfers from family/friends. As the crisis had a nationwide impact, sourcing support from family and friends, who were also likely to have been impacted, became increasingly difficult. Additionally, respondents who had taken support from family/friends early in the lockdown, said that with lockdown extending, they were being pressurised to return the cash borrowed. This left them further pressed for funds.

Reliance on borrowings as a source of fund increased between April and June. These took the form of loans from financial institutions, new bank loans from Self-Help Groups (SHGs) and informal loans from a known person/ moneylender/ pawnbroker. A fifth of all households surveyed had borrowed at least once during the period, and these have predominantly been from informal sources. With financial institutions suspending lending activities, there was a larger reliance on sourcing liquidity from informal sources at interest.

Here it is important to note that the survey focused specifically on customers of Microfinance Institutions (MFIs). Hence, these are mostly households with an existing Equated Monthly Installment (EMI) burden on their loans from MFIs. While most MFIs extended a moratorium on payment of EMIs in accordance with the RBI’s announcement on March 27, this relaxation came to an end on August 31. In the face of uncertain income, borrower households are now faced with EMI payments as well. While the moratorium was provided to ease the burden of borrowers, many of whom faced a loss of income, interests continued to accumulate during the period. Hence, for a household that did opt for the moratorium, this could mean that they are looking at a higher repayment burden.

The current crisis reaffirms the observation made by the Report of Committee on Household Finance in 2017 regarding the irrelevance of formal financial institutions as a coping mechanism to smooth consumption. The current crisis reiterates the need for affordable solutions that would insure households and small enterprises against such shocks ex-ante.

[1] The COVID-19 Impact on Daily life survey is a panel telephonic survey conducted on a monthly between April to June, in partnership with 12 MFIs. The survey covers 349 households (primarily MFI customers) spread across 47 districts from 9 states. The findings may be accessed here.